Exide Industries Ltd. has reported a net profit of Rs. 104 crores on a net turnover of Rs. 1,462 crores for the third quarter ended December 31, 2012. Compared to the corresponding quarter of the previous financial year, this translates into a 17 per cent growth in turnover. However, net profit for the quarter remains at the same level of the previous year.

For the nine months ended December 31, 2012, net profit is Rs. 376 crores, including Rs. 0.95 crore as dividends from subsidiaries against Rs. 319 crores in same period last year, which included Rs. 24.88 crores as dividends from subsidiaries. Excluding the dividend income from subsidiaries, the growth in net sales and net profit for the nine months is 24 per cent and 28 per cent respectively.

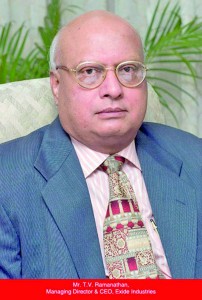

Commenting on the quarter’s performance, the Managing Director and CEO, Mr. T.V. Ramanathan, said: “The quarter witnessed a continuous upward move in the prices of lead which, combined with rupee depreciation vis-à-vis the US dollar, resulted in significant cost push and consequent pressure on the margins, which to some extent was compensated by the positive impact on the margins arising from the robust volume growth in the replacement segment”.

During the quarter under review the replacement market for automotive batteries saw a volume growth of 25 per cent as against the same quarter of the previous financial year. However, due to the de-growth in the OE market, overall growth was only 13 per cent.

In the two-wheeler replacement market, the company witnessed a 53 per cent volume growth. But here too growth in the OE segment was subdued, though in line with the two-wheeler vehicle industry.

Consequent upon the early onset of winter in most parts of the country, the home inverter battery market was not buoyant in the quarter. However, the business for solar batteries witnessed almost 100 per cent growth.

Demand for UPS batteries remained low due to the poor growth of the economy, with majority of bulk customers like banks and other major players in the service sector going slow on their investments. In the home UPS systems, the company has further consolidated its market share.

Exide Industries’ capital expenditure for the current financial year is estimated to be Rs. 190 crores.