MOTORINDIA’s first-in-series LIVE webinar panel saw experts from the CV value chain discoursing on what needs to be done to emerge from the clouds of ‘uncertainties’ plaguing the industry for quite some time, complicated further by the on-going pandemic. The panelists spoke in unison that a new normal is in place and stakeholders ought to be the change catalysts they wish for, by bringing dramatic cost cuts and innovative solutions, while also preparing themselves to be more agile, collaborative, and competitive, reports Dhiyanesh Ravichandran.

India is one of the top-five manufacturing and consumption hot spots for commercial vehicles in the world. With the domestic CV industry facing an unprecedented crisis out of the COVID-19 pandemic that has crippled the entire economy, it is pertinent to note that the industry was already witnessing a steady growth decline since the last quarter of 2018, compounded by a plethora of structural and cyclical uncertainties for quite a while. Subdued demand, under-utilization of fleets, driver shortage, financing and insolvency issues, and regulatory challenges are the state of affairs of this industry in recent years, whose cumulative impacts are more pronounced at vulnerable and distress periods like that of today.

In a bid to bring together various segments of the CV industry value chain and take the dialogues forward at this critical juncture, MOTORINDIA organized its first-ever LIVE webinar panel to make an assessment of the enduring uncertainties and identify key focus areas to address the short- to mid-term challenges in the trucking industry. The webinar that took place on June 3, 2020, brought familiar faces from four integral segments of the value chain – OEM, supplier, logistics, and dealers – to get their perspectives on the uncertainties and key enablers for recovery. Sponsored by Belmaks and Tata AutoComp Hendrickson Suspensions, the LIVE panel discussion was moderated by Jinal Shah, Regional Director (South Asia) – Power Systems Research.

In his opening remarks, Shah began with a market prediction of a 45-50 percent drop in CV sales in the current year over 2019 figures, necessarily taking the industry back by a decade in terms of progress. While touching upon a clutch of challenges plaguing the CV industry, he claimed the scenario as ‘VUCA’ (short for volatility, uncertainty, complexity, and ambiguity) in nature – a new normal that we have to accustom to. “The world is no different. The global CV industry will also see lower demand and output in the short to medium term, which makes it all the more imperative for the domestic industry to become more competitive and grab as much as opportunities”, he opined, while adding that change and uncertainties have always been part of the CV landscape, yet the time frame available for stakeholders to adapt and thrive is shortening in recent times. “Times like that of COVID-19 have exposed numerous susceptibilities across the value chain that warrants a 360-degree overhaul”, he expressed.

While acknowledging that the CV industry is facing unprecedented challenges like never before, Anuj Kathuria, Chief Operating Officer, Ashok Leyland, said that the bigger concern than negative growth (for this year) is that the demand is unlikely to revive anytime soon. “We have to seriously think on ways and means to revive demand”. He reiterated that an early scrappage policy and reduction in GST rates are some short-term measures to boost some demand that automakers are pushing for, while hopes are on infrastructure projects across the country by governments. “We need to brace ourselves and help each other to bring in more operational efficiency and identify all fallacies in our system. Our ecosystem has to work in a coordinated manner to bring out a lean pipeline across our value chain, rightly address wastage at different stages, and work on the demand side to survive the interim period”, he opined.

Speaking on the need for entrepreneurial spirit at times like this, Jayant Davar, Founder, Co-Chairman and MD, Sandhar Technologies, asked, “What is that we as commercial establishments need to do to tide over the crisis period, rather than expecting something to be done by the government”? Sharing from his company’s experiences of undergoing downturn caused by subjugational demand for over three instances in the last three decades, he said that a vibrant comeback ensued each time with a better growth graph than the period before the crises. “These are the times we need to consolidate, do different things in completely different ways, with status-quo being catapulted for rapid changes”. He stressed on the need for organizations to conserve cash and cut down capital expenditure dramatically while spending more on R&D and localization and grasp every little opportunity. Davar continued, “From now on, any changes in trucking technology and business models will be much faster than before. It’s time to think bigger… things will never go back to ‘normal’, we need to brace ourselves for dramatic changes”.

Adding a new perspective on the significance of logistics costs, Sushil Rathi, COO (Transport and Procurement), Mahindra Logistics, averred that the operational costs of trucking fleets are undesirably higher. “There are too many people in the chain, with resources getting wasted at all levels. We need to collaborate with our fellow trucking and 3PL companies and aggregation platforms to address the twin issues of lack of proper demand especially backhaul loads and driver shortages”, he said. The industry should immediately address the issue of severe driver shortages complicated by the mass exodus of labourers to their home towns during the lockdown, by instilling confidence in the driver community and ensuring their hygiene and welfare, he added.

Moving on, re-calibrating the economics for dealers was yet another point of discussion at the webinar. In response to the speakers’ comments on digital sales channels, Siddharth Bhandari, Chairman of Federation of Automobile Dealers Association (FADA) – Bengal Region, and CEO, Bhandari Automobiles, agreed that digitization is the way ahead. “The pandemic lockdown has turned out to be a great opportunity for the digital platforms to take over all walks of our lives, for instance, SCV customers using e-wallets for payments, rising popularity of online platforms for used trucks, and operators resorting to online aggregators”. Adding that the CV space has opportunities for digital sales in the supply side, he opined that both the brick-mortar and online sales models have to coexist, as it would be difficult to move the entire dealer ecosystem online at this point.

Speakers commented that dealerships have to provide more to customers than just CV sales. Bhandari noted, “MHCV dealers are already offering leasing options, on-site support, comprehensive service packages, buyback guarantees, and so on in their contracts; it’s time they expand their reach with customers even further”. Extending the argument further, Anuj Kathuria stressed on the idea of associating with the customers throughout the product life-cycle, wherein we consider the lifetime operational costs of trucks incurred by them. “This means, we are looking at beyond sales and service revenue. We are Ashok Leyland are bringing a lot of customization through modularity to offer the right products by understanding our customers’ requirements, thereby shifting from transactional to partnership mode of engagement”, he observed. Kathuria also suggested that a ‘click and mortar’ model of sales for CVs, MHCVs in particular, will make more sense in the coming times.

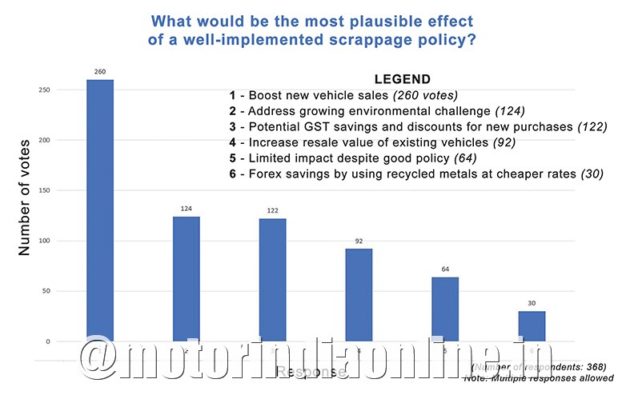

The webinar also saw enlightened dialogue on the relevance of the much-awaited scrappage policy, in the light of boosting new vehicle sales. While speakers ruled out that a mandatory scrappage policy will not trigger demand in uncertain times like the current period owing to under-utilization of vehicles, they acceded that lucrative short- and medium-term incentives – including lower GST and insurance premiums, road and registration tax concessions for new trucks, and so on – are the only way make the policy effective. “The TCO advantages of new trucks as against the old ones can also be a persuasive factor in giving a push to the buyers”, opined Kathuria. A poll among the viewers on the plausible impacts of scrappage policy was also carried out during the webinar.

Jinal Shah, in his closing remarks, surmised that all stakeholders should become a change catalyst themselves, and not necessarily wait for the external demand drivers to turn in favour. Becoming competitive and collaborative is paramount, he observed, thereby focusing more on solutions for the challenges. “Our businesses have to move from build-to-print models to innovation and R&D-driven enterprises. Since the traditional demand drivers are not promising, we need to do a lot internally as an industry to move beyond the uncertainties to make a winning strategy”. This is neither the first nor the last crisis for this industry, he said, but a crisis of this kind cannot be wasted without gaining good experiences and key learning. “We have to stop playing individually, but join others to perform a symphony to make the difference”, he added.

Watch the full panel discussion in MOTORINDIA’s YouTube channel – www.youtube.com/motorindiamagazine