Kaushik Narayan, CEO, Leaptrucks picks out six key commercial vehicle (CV) industry trends and analyses the sales of CVs in February 2021

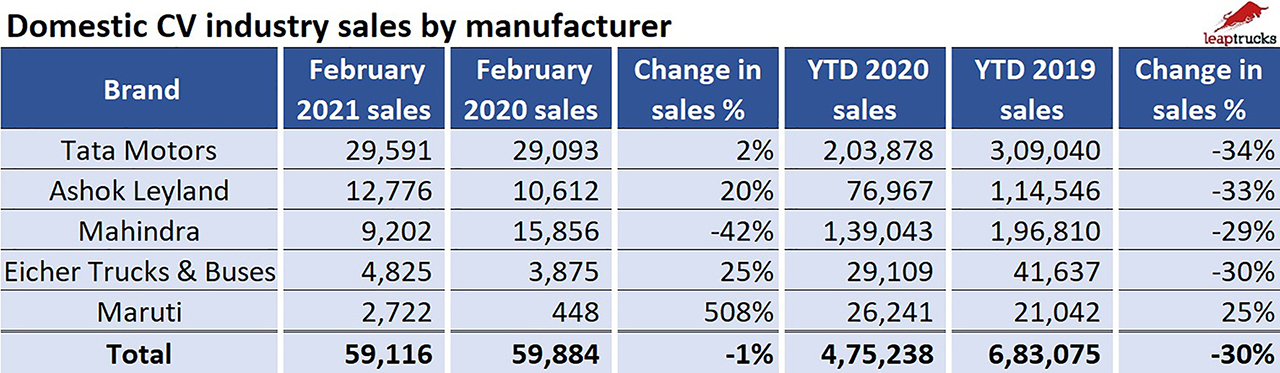

February was a challenging month for the automotive industry with the top five manufacturers showing a modest de-growth of 1% in February 2021 as compared to February 2020. Year-to-date, the industry continues to be down by over 30%.

Segment Level Performance

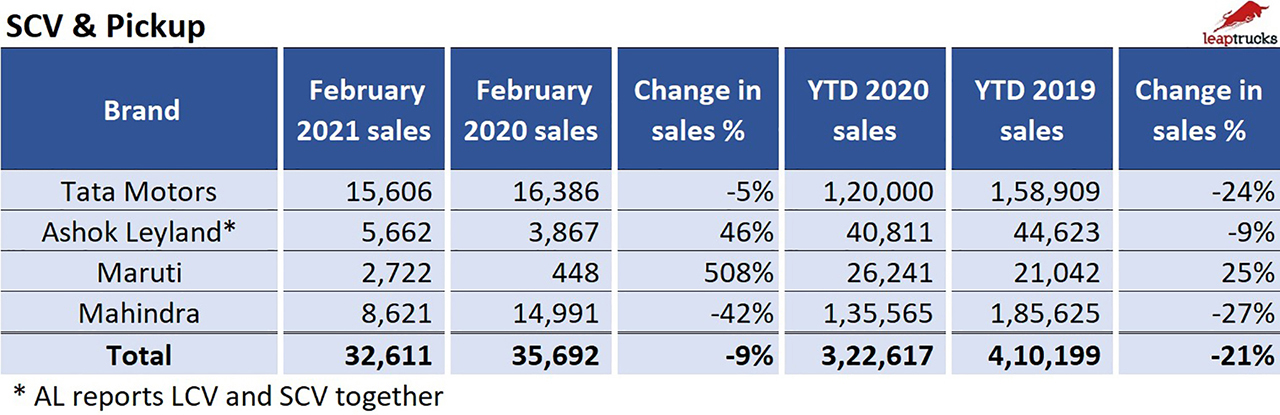

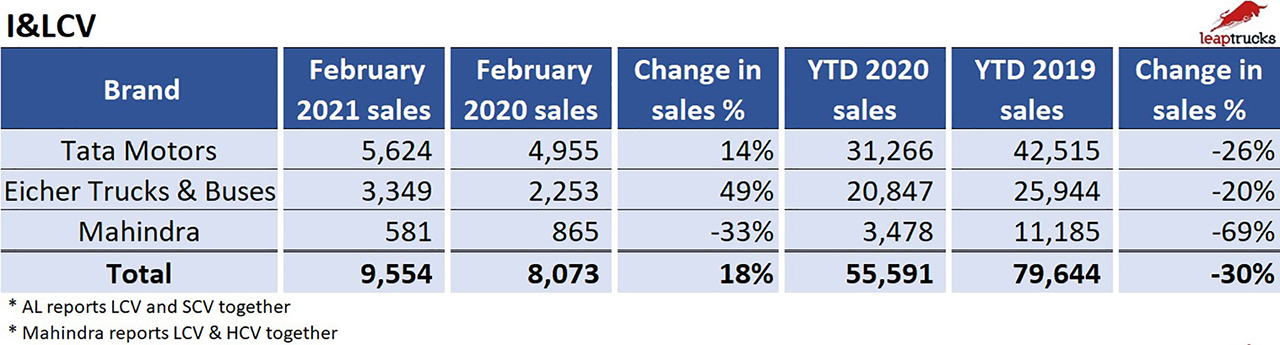

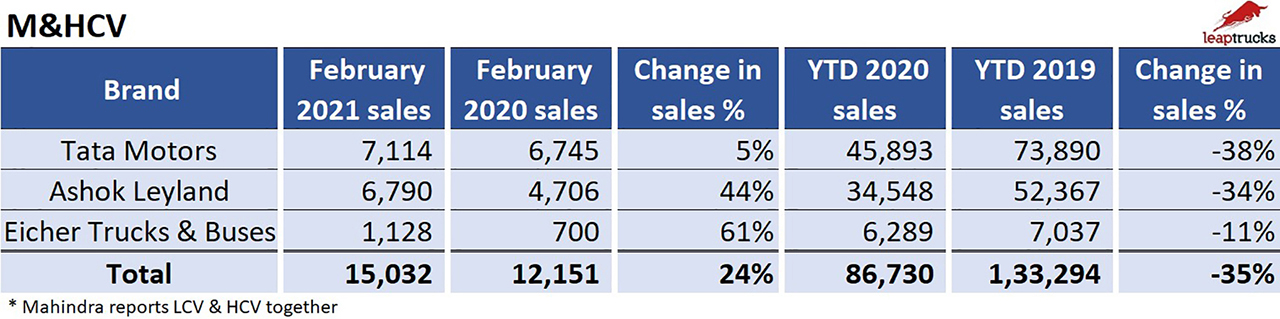

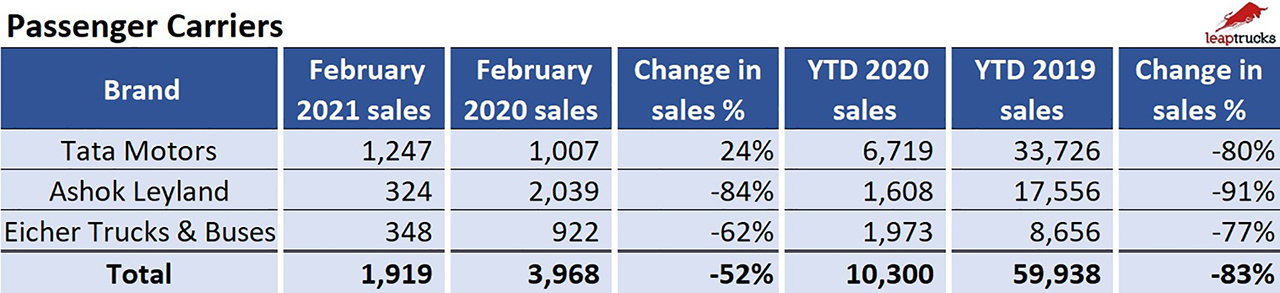

The medium and heavy commercial vehicle segment and the intermediate and light commercial vehicle segment showed strong growth of 24% and 18%, respectively. The small commercial vehicle (SCV) segment continued to be plagued by supply issues, de-growing by 9%. While the passenger segment continued to de-grow, it had its best monthly performance in a challenging year with a lower de-growth of 52%.

Manufacturer Level Performance

Maruti Suzuki Limited continued to perform strongly over a low base volume last year. Eicher Trucks and Buses and Ashok Leyland followed with a strong performance of 25% and 20%, respectively. Tata Motors grew by 2% while Mahindra and Mahindra was the only manufacturer to de-grow by 42% over significant supply challenges.

Key CV Industry Trends

The industry continues to face many short-term challenges, such as:

Strong Recovery: The CV industry is down by 30% year-to-date. To put things in perspective, the industry was down over 85% at the end of Q12020. To add to this, the bus industry, which comprised about 9% of the CV industry volumes last year, was severely impacted by the pandemic, down by over 83%. Considering the impact of the pandemic and the related challenges, the turnaround has been pretty remarkable.

Impact of BS VI Transition: All motor vehicles in India transitioned from BS IV to BS VI emission norms by March 31, 2020. Consequently, the sales from February 2020 were lower than the year prior to the preparation of the transition. Despite a lower base, volumes still de-grew by 1% in February 2021. This clearly indicates that the industry continues to be in the process of recovery. We anticipate significant growth in March 2021 since the sales in March 2020 were even lower than the sales in February 2020.

Rising Fuel Prices: Diesel prices in India have grown at an average of 30% over the past year – Rs 66.29 on March 1, 2020 as compared to Rs 86.37 on March 1, 2021 in Bangalore. At a time when demand was stabilising to the pre-pandemic levels, rising fuel prices continue to dampen logistics operations.

Lagging Freight Rates: It is largely estimated that less than 20% of freight is moved under long-term contracts that are linked to fuel rates. Large operators with long-term contracts linked are able to manage these fuel price increases better with a lower impact to profitability. However, smaller operators with short-term or no contracts continue to struggle as fuel and other input costs continue to grow. It will be challenging for freight rates to also continue to rise indefinitely because this will have a negative impact on the prices of commodities and essential supplies.

Component Supply Challenges: Supply issues continue to plague OEMs as indicated by Mahindra and Mahindra in a recent press release. New vehicle deliveries will continue to pose a challenge due to the delay in delivery of semi-conductors and other critical components anticipated over the the next four months.

Rise of CNG: With the advent of the BS VI era, customers are now left with a wider choice of engines and fuel for their trucks. Petrol and CNG are now competing with diesel for customers, especially in last mile transportation. As the number of CNG pumps increases, it is now becoming an attractive choice as both a cleaner and environment-friendly fuel for companies as well as a significantly cheaper option for operators. Offering similar mileage, 1 kg of CNG is 40% cheaper than 1litre of diesel (CNG at Rs 51.50 as compared to diesel at Rs 86.37 in Bangalore). If you are worried about availability, rest assured that the penetration of CNG is significantly more than you think as seen in this map from Maruti Suzuki that shows all the CNG pumps in and around your city.

Leaptrucks is a marketplace for buying and selling used trucks, buses and construction machinery. You can see all our listings at www.leaptrucks.com/listings/. If you are from the industry and would like to contribute to our blog, please contact us at hello@leaptrucks.com.