The corona virus-triggered pandemic has had a devastating impact on the commercial vehicle (CV) industry. To understand this impact up close, Leaptrucks, one of the largest marketplaces for buying and selling used trucks and buses, conducted a detailed survey of goods transport operators. This article by Kaushik Narayan, CEO and Founder, Leaptrucks summarises the issues and challenges operators have had to face and highlights their expectation of a quick economic rebound

The commercial vehicle industry has been one of the worst hit sectors in the ongoing pandemic. The lockdown imposed in March crippled the industry when only essential goods were allowed to be transported until early May. While subsequent lockdowns provided some allowances to transportation, state level restrictions continued to hamper free movement of goods and further extended its misery. Leaptrucks recently conducted a regional survey to understand the sentiment among goods transporters.

The survey captures the major roadblocks they have faced since the beginning of the pandemic. It also analyses the impact of demand and freight rates on the industry. And most importantly, it captures their expectation of market recovery. While the survey was limited to three states in South India, most of the learnings are applicable to goods transporters across the country. The conclusions are summarised under six key takeaways from the Leaptrucks Goods Transporter Sentiment Survey.

Respondents Surveyed

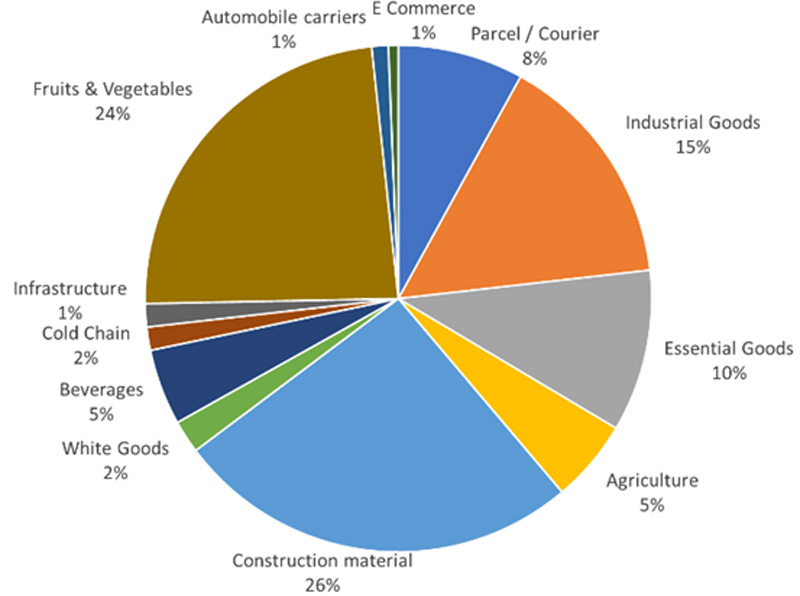

Over 450 goods transporters across Kerala, Karnataka and Tamil Nadu were interviewed for this survey. They include single truck operators, lower and upper retail and large fleet operators. They own small, medium or heavy commercial vehicles and hail from both urban and rural locations. The market segments interviewed include:

Agriculture | Beverages | Cold chain transportation | Construction material | E-commerce | Essential goods | Fruits and vegetables | Industrial goods | Infrastructure | Parcel and courier | White goods | Automobile carriers

Over 26% of respondents belonged to the construction material segment and 24% from the fruits and vegetables segment. Automobile carriers and e-commerce segments had relatively lower representation of 1% of respondents. The segmental selection also varied across states. This survey excluded passenger transportation.

Survey Results

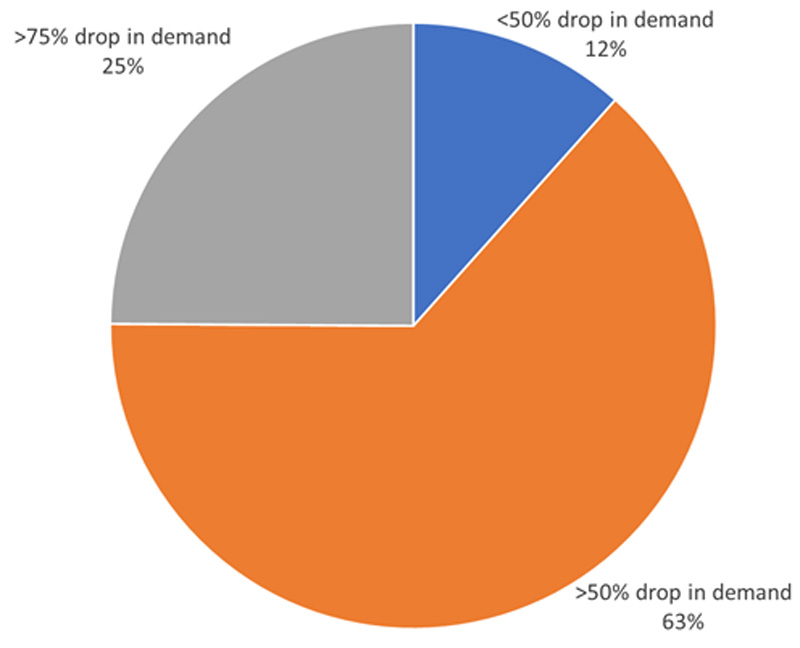

Impact on Market Demand

The pandemic has crippled the market demand for commercial vehicles. At the time of the survey, only 12% of respondents were witnessing demand of even 50% or more in comparison with the pre-pandemic levels. On the other hand, 25% were witnessing a demand drop of over 75%. Most segments surveyed have been impacted negatively by market demand. Outliers include the essential goods, e-commerce, agriculture and fruits and vegetables segments.

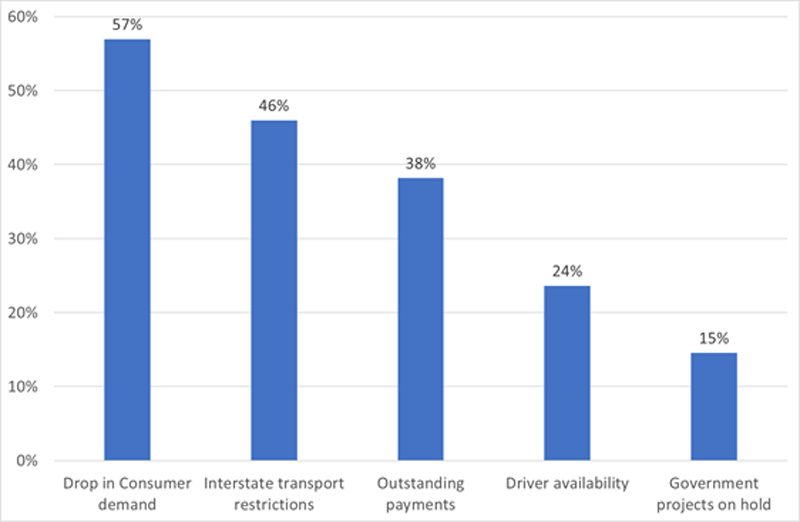

Major Factors Impacting Market Demand

Over 57% respondents pointed to an overall drop in consumer demand due to the pandemic. The challenges faced due to interstate transport restrictions prior to Unlock 4.0 came a close second. Respondents also pointed to large outstanding payments from the market which was negatively impacting their cash flows. Fear of contracting the virus had also reduced driver availability which impacted their ability to operate trucks despite having active demand. Transporters operating in the infrastructure segment pointed to government projects being put on hold, thus reducing their fleet utilisation.

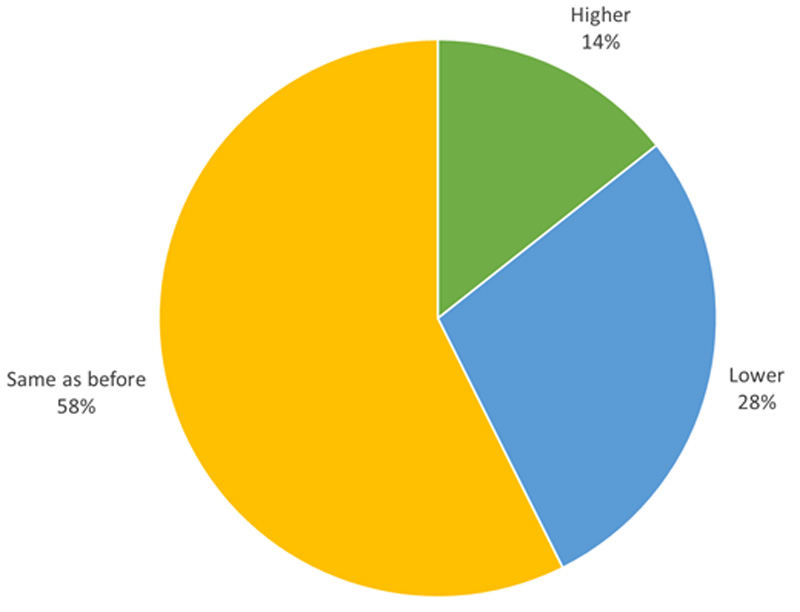

Impact on Freight Rates

The implementation of the lockdown coincided with an increase in diesel prices which make up the largest component of transportation costs. Diesel prices have increased by over 21% since the end of March. Only 14% of the respondents are operating at rates higher than the pre-pandemic levels to offset diesel price increases. On an average, their rates have grown by a meagre 3-5%. However, over 58% of them were operating at rates similar to those of the pre-pandemic levels. Over 28% were operating at rates lower than the pre-pandemic levels. These rates range between 5-15% below the pre-pandemic levels. This is primarily due to the drop in demand in the market. Respondents have largely not been able to pass on diesel price increases to end users. Freight rates continue to be under pressure.

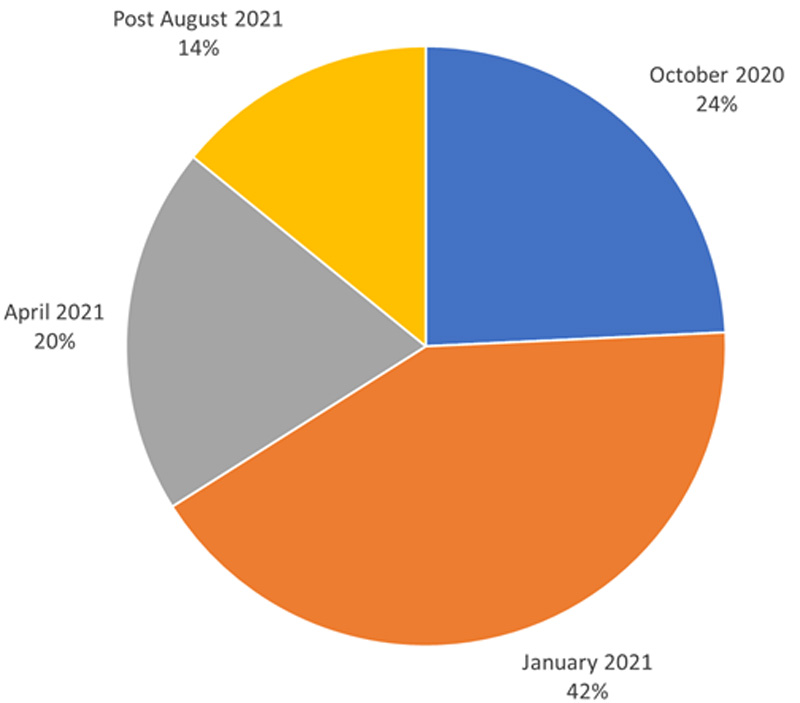

Anticipated Date of Market Recovery

We found that our respondents were largely optimistic despite the challenges thrown at them by the pandemic. Over 66% of the respondents anticipated a recovery by January 2021. Only 14% anticipated a long drawn out recovery going well into August 2021. Respondents operating in rural locations were more optimistic about a quicker recovery. Steady demand for agricultural products has helped stabilise the rural economy in the face of the pandemic. The impact of lockdowns has been paralysing in urban locations. This has in turn impacted the confidence level of urban goods transporters.

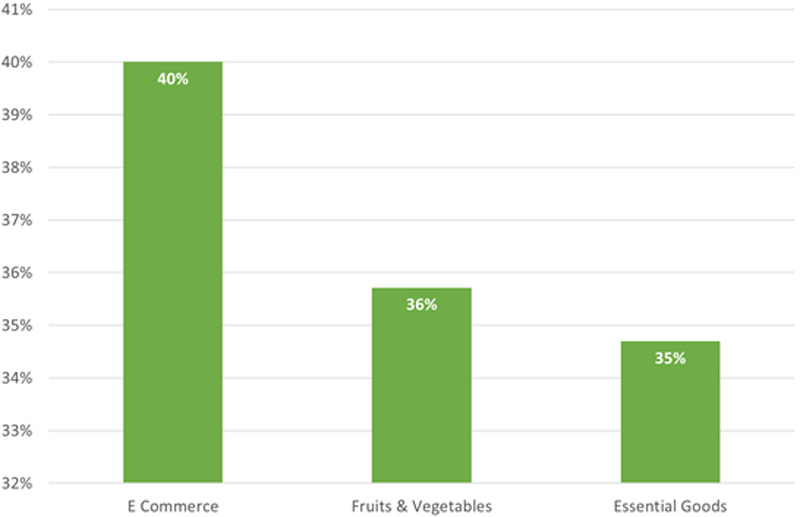

Segments Leading the Recovery

A few segments were already showing early signs of recovery. Respondents in these segments were actively looking to add to their fleet to meet growing market demand:

- E-Commerce: 40% of survey participants were looking to purchase new vehicles in the next three months. The pandemic has increased home ordering which e-commerce companies have benefited from.

- Fruits and Vegetables: The demand for farm produce has been healthy since the beginning of the pandemic. Farmers have also been able to realise good prices for their produce. Over 36% of transporters in this segment expected to buy again in the next three months.

- Essential Goods: Operators transporting FMCG and essential goods have also had a lower impact due to the pandemic. Over 35% of them anticipated that they would have to expand their fleet in the next three months.

The Six Key Takeaways

Goods transporters have had to deal with a significant drop in market demand amid the pandemic. In conjunction with an increase in diesel prices, this has put freight rates under tremendous pressure. Only a few segments like agriculture, fruits and vegetables, e-commerce and essential goods have bucked this trend. Our detailed interviews uncovered the following six key takeaways for optimism among goods transporters:

1) Robust rural demand: Rural demand has been growing at a faster pace than urban demand. The demand for vegetables and essential goods including pulses across the country will help sustain and grow this demand.

2) Rising urban demand: Urban demand is also rising, albeit a bit slowly. While e-commerce, fruits and vegetables and essential good segments continue to lead the recovery, most other segments are also joining the fray.

3) Easing of interstate restrictions: Unlock 4.0 has been a blessing to the CV segment. This has addressed one of the primary concerns cited by over 57% of respondents as their tallest hurdle. This will also help drive demand in the industry.

4) Timely EMI moratorium: The EMI moratorium was both timely and necessary. It has provided goods transporters with valuable time until demand has picked up to stay solvent. The Reserve Bank of India has proven once again that a stitch in time saves nine and all banks and NBFCs will also attest to the same.

5) Improving freight rates: All the factors mentioned above have also led to a gradual increase in freight rates. The upcoming festival season will further provide operators with an opportunity to further consolidate freight rates and completely offset the diesel price hike.

6) Regional variances: Respondents from Kerala were highly optimistic (81% expecting a recovery by January 2021). They were followed by Karnataka with 63% and Tamil Nadu with 49% expecting a recovery by January 2021. The virus cases being well under control in Kerala in comparison to other states was a clear differentiator. The frequent lockdowns and restriction in movements both within and outside the state contributed to lower optimism in Tamil Nadu.

Conclusion

At the time of the survey, respondents were already beginning to see green shoots of recovery. Increasing market demand, easing up of interstate movement restrictions and an improvement in flow of cash to lower outstanding payments were slowly providing them much needed confidence. This has also set the stage for a faster turnaround in the CV segments as the economy gets back to normalcy post Unlock 4.0. It also bodes well for the industry and the financiers who have been worried about the prospects of higher repossessions from lenders in the CV industry.