Government policies, transition towards alternative fuels and the OEMs yearning to make the driving experience better will help the commercial vehicle market to get back on the road to normalcy, states Abhik Mukherjee of Counterpoint Research

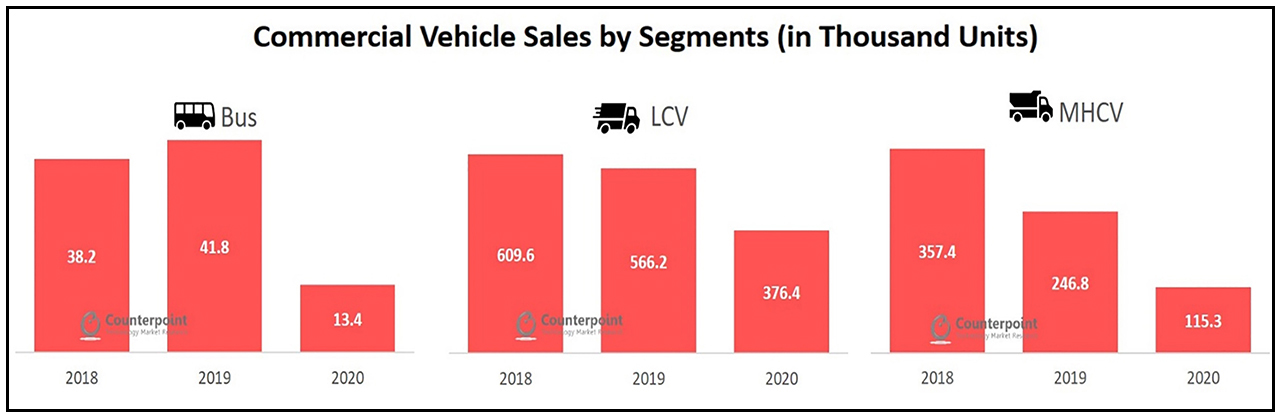

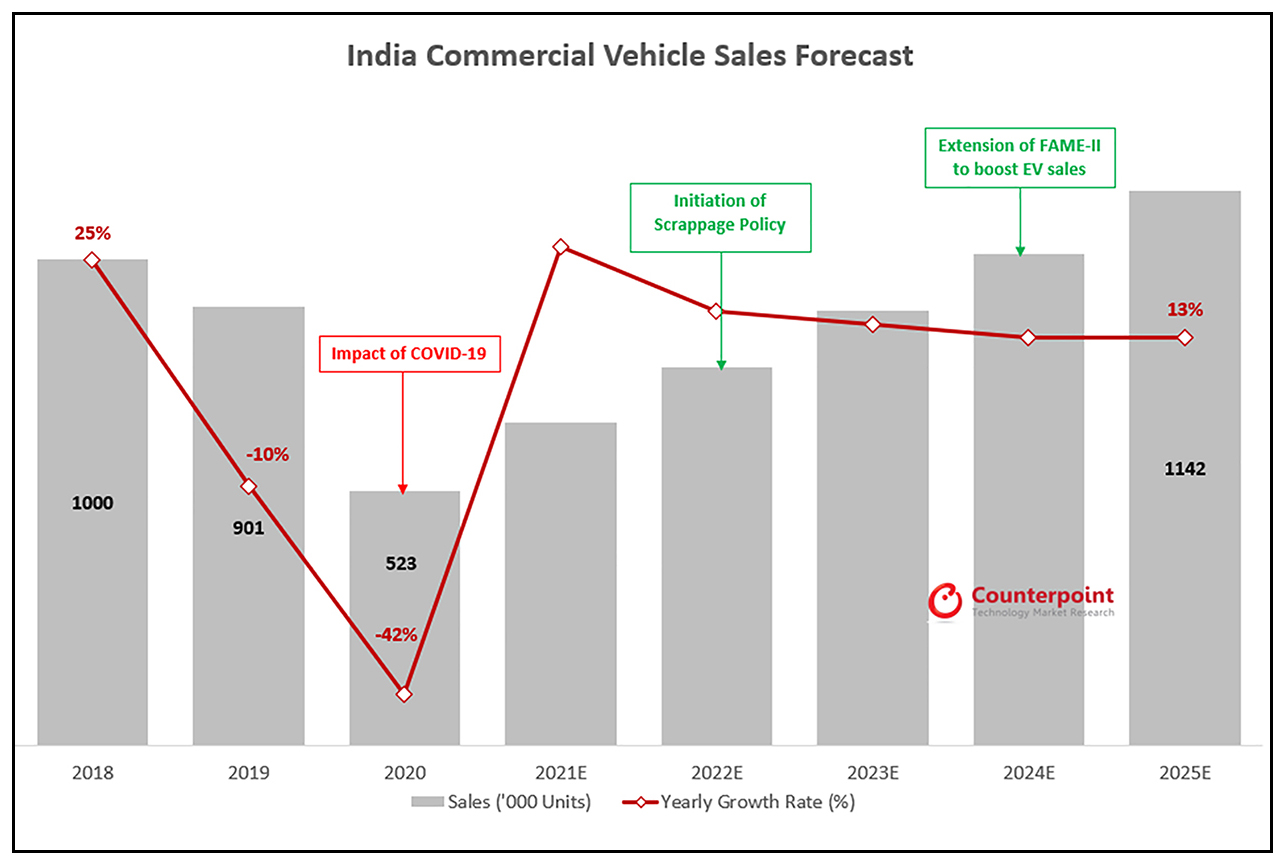

When the corona virus pandemic took roots in India last year, the country’s automobile market was already going through a rough patch that started in 2019. The long-term effects of demonetization, moderate economic growth, new axle load norms, transition to BS-VI norms and liquidity crunch combined to slow down the market. But the pandemic almost knocked down the market during Q2 and Q3 of 2020, especially the commercial vehicle (CV) segment. With factories closed under a countrywide lockdown, the demand for CVs hit a new low and their sales declined 42% YoY in 2020. The demand for buses and medium and heavy CVs (MHCVs) was hit the hardest, with their sales decreasing by 68% YoY and 53% YoY, respectively.

The market started recovering after Q3 2020 as the demand for light commercial vehicles (LCVs) and intermediate commercial vehicles (ICVs) increased due to the booming e-commerce segment and last-mile delivery. Recovery was also visible in the MHCV segment due to investments in infrastructure and construction projects by the government and private players. A V-shaped recovery was happening. With the decrease in virus cases during Q4 2020, the automakers expected educational institutions would soon open and take pending delivery of buses, while the state transport departments and the tourism sector would also boost the sales for buses. But the nightmare was yet to end.

The rising cases of the corona virus from mid-March 2021 marked the beginning of the second wave which affected automobile market recovery. However, the market did not suffer as it did in April 2020. With full or partial lockdowns in most major states, the OEMs voluntarily reduced production due to a rise in infection among factory workers, lack of consumer demand and shortage of semiconductor components. Most of the major OEMs halted CV production during May. The country also witnessed an acute shortage of medical oxygen as the virus cases increased during April 2021.

As a result, the industrial supply of oxygen was diverted for hospital use. This hindered the production of steel, a major component in CV production. All these factors pushed down CV retail sales by 66% MoM in May 2021, according to the Federation of Automobile Dealers Associations (FADA). The automobile dealers were also hit hard by the second wave. In 2020, both the government and OEMs had announced survival packages for the dealers, but this was not the case during the second wave. Only a handful of OEMs announced financial packages for their dealers. The second wave has made a big dent in the dealers’ finances. Repayment is due for the inventory funding taken by the dealers before the lockdown.

With negligible sales, the revenue is almost zero for most dealers, but their working capital has depleted a lot due to fixed costs. In automobile retail, banks and NBFCs provide inventory funding as loans to dealers which they need to repay in a 30-45 days period. With the lockdowns going on for more than two months, the dealers have no ways to repay the money. The second wave did not spare the rural and semi-urban market. The spread of the virus in rural and semi-urban areas forced the population to prioritize safety and hold liquidity over other requirements. Therefore, the demand for tractors in rural and semi-urban areas is also not expected to see a positive movement despite the prediction of a good monsoon. Taking the current situation into account, we expect the CV sales to grow 25-27% in 2021 instead of the initial expectation of 40%.

Market Outlook

Automakers cannot do much unless a demand-side recovery happens, but the crisis faced by automobile dealers can be resolved if the Reserve Bank of India (RBI) and the Ministry of Finance extend the loan repayment period from 30-45 days to 90-120 days. However, with the government policies, transition towards alternative fuels and the OEMs yearning to make the driving experience better, the CV market is expected to witness a strong recovery in the coming days. The sales are expected to cross 1.1 million by the end of 2025.

Apart from generating new sales for the OEMs, the scrappage policy can mark the initiation of a new circular economy. The value of the components in the ‘end of life’ vehicle can be captured by recovery, recycling, and reuse.

All these policies can work in favour of building a strong recovery of the automotive sector, especially the CV market. The increase in momentum of the vaccination drive and decrease in vaccine shortage is also a good sign for economic revival.

—

Keys to Recovery

• The PLI scheme initiated in March 2020 will be helpful for the OEMs, particularly at this hour. With the transition to BS-VI norms, the OEMs can cater to the need for automotive components in different markets by making minor spec changes to suit requirements. This will not only increase domestic dependency but also allow Indian industries to grow. However, in the near term, this scheme will have no direct impact on CV sales. But it will provide some cushioning to the OEMs from the damage done by the pandemic.

• The government’s initiative to invest in the mining and construction sectors is expected to pick up during the latter half of 2021. According to credit rating agency ICRA, the mining and construction industry may grow 15-20% in 2021. Investment in construction activities like ports, metros and airports could aid the demand for CVs, especially the MHCVs. The growth in the sector is expected to sustain till 2023 before declining during the general election in 2024.

• The e-commerce sector boomed during the pandemic. Now, people are dependent on delivery services more than ever. The ongoing good sales for LCVs and ICVs will continue thanks to the booming e-commerce sector and good agricultural output. In Q4 2020, the sector saw 36% YoY growth in the volume of orders. The overall sector is projected to grow by 84% till 2024.

• The movement of OEMs towards alternative fuel systems for sustainable mobility is also expected to boost CV sales. Apart from biodiesel and CNG, hydrogen fuel cell and electric vehicles (EVs) are slowly gaining traction. Though EV penetration in the CV market is very low – 0.5% of total CV sales in 2020 – the segment is expected to gain volumes steadily over time with e-buses constituting a major chunk. State governments are keen on electrifying public transport to reduce emissions. Low operational and maintenance expenditure per unit kilometre and overall ownership costs are major advantages backing e-buses. Moreover, the revised subsidies under FAME II will further reduce the upfront cost for purchasing electric CVs. The penetration of telematics and superior in-vehicle experience in the newer models will also attract CV sales.

• The scrappage policy to be effective from April 2022 will be one of the major factors that will boost automobile demand, especially the demand for CVs. Under the scrappage policy, CVs older than 15 years and passenger vehicles older than 20 years will be deregistered. Vehicles that fail the fitness test or vehicles whose owners fail to renew the registration certificate will be removed from roads. The scrappage policy also offers some possible incentives:

a) The scrap value of the old vehicle to be decided by the scrapping centre will be 4-6% of the ex-showroom price of a new vehicle.

b) A discount of 5% will be offered by the government to the OEMs for a new purchase against a valid scrap certificate.

c) The registration fees could be waived for new vehicles.

d) State governments are encouraged to offer up to a 15% rebate on road tax for CVs.

—

About the author

Abhik is a Research Associate at Counterpoint Technology Market Research based out of Kolkata. He is part of the Automotive team at Counterpoint and is also interested in tracking the growth of emerging technologies. His core area of research is EVs. Prior to joining Counterpoint, he was an Academic Associate, and holds a M.Phil. degree in Economics from Visva-Bharati Central University.