By P.V. Balasubramaniam, Former Director & CEO, York Transport Equipment (Asia) Pte. Ltd., Singapore

The Indian economy is facing an overall slowdown which is very visible from the monthly sales data in the automotive sector. Growth in the manufacturing sector is critical for India, both to keep GDP above 7% per annum as well as for job creation. Niti Ayog’s document published in September 2018 on Strategy for ‘New India @ 75’ states the following objectives: to double the growth rate of the manufacturing sector by 2022 and increase its contribution to 25% of GDP. During the last seven years, from 2011-12 to 2017-18, the manufacturing share as percentage of GDP has just moved from 16.1% to 16.6%. And so, expecting this to jump to 25% in the next three years seems unrealistic.

The automotive industry can potentially contribute to an increasing share of the manufacturing sector and to job creation. Accordingly, the Government has prepared the Automotive Mission Plan (AMP) 2026. The objectives of the plan are:

- Auto industry contribution to GDP to increase from 7.1% to over 12% by 2026.

- Generate additional employment of 65 million. Currently about 32 million are employed directly and indirectly. During 2006-16, 25 million secured employment in the sector.

These objectives are achievable provided there is massive investment in the sector, to the extent of maybe $40-50 billion in the next seven years. During 2006-16, investment in the automotive sector was about $22.5 billion.

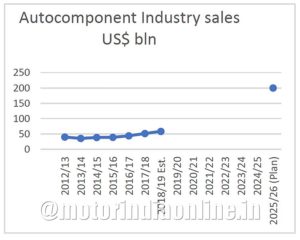

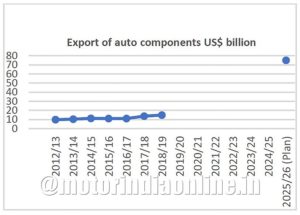

The auto component industry is expected to contribute substantially to meeting the AMP 2026 target, and that is the focus of my analysis. The ‘Strategy @ 75’ makes it clear that domestic demand is inadequate for sustained high value manufacturing in this industry, and so export driven growth is necessary. AMP 2026 plans the following for the auto component sector:

These seem to be over ambitious targets, unlikely to be met considering that we are already in the third year of the plan and we have not seen much investment. On the contrary, we are experiencing a pronounced slowdown in the industry not only in India but globally. AMP 2026 does not outline any actionable plans that could bring in investments or export business.

Auto component production grew from $39.7 billion in 2012-13 to $58.3 billion in 2018-19, a CAGR of just 6.6%. To achieve the AMP 2026 plan, CAGR must be about 20%, which is impossible.

Auto component exports stood at $9.7 billion in 2012-13, increasing to $14.8 billion in 2018-19, a CAGR of 9.7% per annum. To achieve the AMP 2026 target, exports must grow @ CAGR of 26% which is also highly impossible.

Now that the Government is starting its second innings with its focus on growth in manufacturing and new jobs, it is better to be realistic on what is achievable. During the last two years since AMP 2026 was developed much has changed in the international trade and automotive sector.

The US-China trade relationship is under strain, but it has not yet affected the automotive sector since levying tariff on Chinese auto parts would impact the US as much as it affects China. Even if tariffs are levied on China’s auto parts, it will not help India much. India does not make the types of parts that are mostly exported from China to the US. China’s export to the US was worth $20 billion in 2018 vs. $1.8 billion from India. Further, even after the 25% customs duty levied by the US on China parts, it’s unlikely for India to match China in terms of cost, capacity / volume and quality.

Of the $13.5 billion of auto components exported from India, only $5.1 billion is auto parts (classified under the HS code 5708) which could be considered as finished auto parts used for both OEM and the aftermarket. The major portion of India’s exports are intermediate components such as castings, forgings, and machined & fabricated items that are manufactured to customer’s drawings and specifications. India’s exports of finished parts designed and developed within the country are limited. Unlike Chinese exports which include substantially electrical and electronic parts that are proprietary items developed within the country, and so not easily replaceable, Indian exports could be replaced by supply from other countries.

India is not price competitive in most auto parts. China could be cheaper by over 25-30% in many items! This is huge and is as a result of lower economy of scale of operation, lower productivity and cost inefficiency. This is an area to be addressed immediately to increase our share of export.

India’s auto component industry is fragmented with many family-run small and medium size suppliers who do not have the capacity to supply large volumes as required by the export market. The World Bank report on Automotive in South Asia of October 2016 says the following on the Indian automotive sector: “In effect, large productivity gaps persist in the sector, with most OEMs (together with their suppliers) having subscale / fragmented operations with low capacity utilization, quality levels and investments in skills below international benchmarks.”

Import of auto parts has increased over the years. Reasons for import are lack of technology, inadequate quality and being uncompetitive. China is having an increasing share of India’s imports, and most electronic parts are imported from China. Use of electronics in India is still lower compared to developed countries. As we move to BS 6, we can expect more electronics in the vehicles and further increase in import from China.

McKinsey, in its report “The auto component industry in India- Preparing for the future, Sept 2018”, states: “The world is seeing electronics permeate all areas. The automotive industry is likely to be no different. The current penetration of electronics in the automotive market is low in India – due to limited scale, imports address around 65 to 70 per cent of OEM demand in the country. But by 2030, the auto electronics content is expected to contribute nearly 45 per cent of the total automobile cost in India.”

With the increasing thrust on electric vehicles (EVs), India’s import would further increase. With no manufacturing base for EV components, India is importing batteries, all drive, transmission and steering components from China and other countries. The industry is moving towards assembly of EVs in India based on imported components with the Government facilitating lower customs duties. Thus, with the trend in automotive technology leaning towards electrical and electronic components, India will have a massive import bill.

(To be continued…)