Voith Turbo, part of the Euro 4.2 billion Voith Group of Germany, offers a number of highly-advanced products and technology solutions for a wide range of industries and applications in the Indian market. The company is known for its hydrodynamic retarders and automatic transmissions for commercial vehicles, while it also offers air compressors for the auto sector and dampers for farm equipment.

With the Indian CV industry making rapid progress in terms of technology adoption, improved fuel efficiency, enhanced safety and more stringent emission norms, Voith sees multiple avenues for growth in the country and is gearing up to be future-ready.

In an exclusive interaction, Mr. Kuntal Dasgupta, Managing Director, Voith Turbo India, tells us about Voith’s current position in the Indian market, its strategy to make it big, areas in which it is gunning for growth, and more.

Excerpts:

What is Voith’s current status in the Indian market? Since when have you been present in India and what products do you offer for customers here?

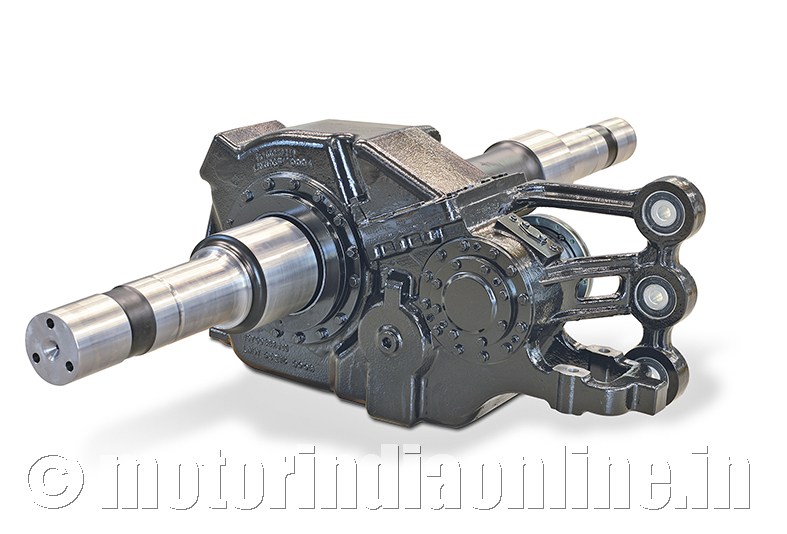

Voith India started its operations in 1987. We celebrated 30 years of our successful journey in July. Currently we have two manufacturing units along with the Engineering Centre located in Hyderabad. We cater to the Industrial, Rail, Commercial Vehicles and Marine segments in India. We are offering the entire range of Voith products for India. Some of the products are manufactured at our Hyderabad facility. We do export a few products to other countries from our facility in India. In the commercial vehicle segment, we offer products like hydrodynamic retarders (in-line, off-line and remote mount), automatic transmissions called DIWA, air compressors for the M&HCV segments and dampers for the farm sector.

Voith is globally-renowned when it comes to providing automatic transmission (AT) solutions for commercial vehicles. While on the one hand the Indian market is still not too matured for using ATs on trucks and buses, some of your competitors offering ATs have been quite successful and continue to make inroads in the market. What are your plans for ATs in India and when can we see Voith taking on competitors in the Indian market?

Yes, Voith AT is the most ideal for city bus applications, and we have a good market share in EMEA. The key driver for AT or AMT is scarcity of skilled drivers, passenger comfort (no jerks with AT) and no fatigue for drivers (no clutch pressing, no gear change manually). When it comes to the Indian CV market, AMT and AT is going to grow over a period of time as scarcity of skilled drivers is so acute. When it comes into trucks, as of now no visibility in India for AT, but in buses, city bus applications are increasing with AT. A few OEMs are even making the coaches with AT. We are working with our customers in new projects with AT which would be productionized next year. We also have plans to bring a new version which is under development into the Indian market.

How successful have you been with retarders?

The retarder is an endurance brake system which provides safety to passengers and cost benefits to the end-customer. We have started manufacturing retarders in India since 2012 and 90% of parts are localized. We cater to domestic as well as export markets. We have presence with our CV products with most of the M&HCV manufacturers in India. Initially there was a perception among end customers that the retarder involves additional cost.

But when we explained with real time data the cost benefits through fuel saving, increased brake liners’ life, longer tyre life and higher average speed of the vehicle, the customers got convinced and made the retarder mandatory in their tenders / orders to OEMs. Apart from this we are expecting an endurance braking legislation by 2020, and the OEMs are working towards this goal in all new projects which would be the key driver for our business growth.

How much importance do you think Indian fleet operators attach to turnaround time, fuel efficiency, comfort and safety (of drivers/goods/passengers) and the total cost of ownership? Do you think the market is heading in the right direction and at the required pace?

Yes, now the focus of the end customer is on TCO and greater safety. To meet this demand the best product we offer is the hydrodynamic retarder which reduces pressure on service brake and leads to safety. The end-user is able to realise the increase in cost benefits through brake liners, tyres and the fuel economy as explained earlier. The break-even point for retarders is within 1½ years of operation by considering 500 km/day over and above the savings goes to end customer pocket, we say from our experience the savings with retarder is Re. 1 per km.

How different and challenging do you think the Indian market is for European brands to come in, engineer a product suitable for the local market and emerge successful amidst all the cost pressures and other potential hurdles? How has Voith addressed these challenges (for the products you have been successfully selling in India) and how do you plan to address the challenges (for products you are yet to successfully sell)?

Three key parameters for MNCs /European brands to be successful in the Indian market are technology, being cost competitive with local players and quick application engineering response with respect to OEM requirements. Of course, Voith is the brand for Technology and Reliability, and the rest is addressed through localization of products with an established vendor base. We have a strong engineering centre in the Hyderabad office functioning since last six years, and all the application engineering support to customers is being catered from India and also our team support for global engineering projects. We leverages on these facilities for the next products to be introduced in India.

China and India being the two major global growth markets for the automotive & transport industry, what kind of focus is Voith placing on these two key regions?

The Voith Management Board is very much focussed on India and China under the growth regions in APAC. For example, our Mobility business CEO travelled twice in three months to India to meet our esteemed customers as a part of business discussions, and we have a very aggressive strategic business plan to meet local demand in keeping with the changing market trends / requirements. We have put in big investments for footprints in China and India which would be the next in line in terms of capacity expansion.

As an economy and as an evolving commercial vehicle market and given all the megatrends and macro-economic changes, what are your comments on the evolution of the Indian market? Over the medium- to long-term, how important would the Indian market be for Voith?

The Indian CV market is changing very fast with, for example, the mandate of emission norms from BS4 to BS6 in a short span, ABS mandatory for a safety, new Bus Body Code, the expected endurance brake legislation, etc. It’s a little pressure on OEMs with respect to available time lines but good for safety and reduction of pollution levels. As a citizen of India, I welcome all the above norms which facilitate road safety and cleaner environment. As a technology product manufacturer, we are also welcoming the above trends to promote our products. We have aligned with our customers to meet the above requirements both in the existing new programs, and are working towards that common goal. India is very important growth market for Voith in CV and Rail and, with modern infrastructure in India, demand for high speed and long coaches would raise the demand for Voith range of products.