Through the scrapping of vehicles we see a business opportunity of USD 1.5 billion annually. In the first five years of implementation of the policy alone, we expect a business opportunity of USD 6 billion from steel and aluminium recycling, points out Dr. Deb Mukherji, MD, Omega Seiki Mobility

Under India’s forthcoming voluntary vehicle scrappage policy, private vehicles – which are over 20 years old – will have to undergo fitness tests. Commercial vehicles that are over 15 years old will also have to face these tests. Fully automated fitness test facilities will be set up on a public-private partnership (PPP) basis involving private firms and state governments. The automated tests will allow no scope for human intervention or fudging of results. Those who choose to drive a vehicle that has failed the automated test are likely to face substantial penalties, and such vehicles could also be impounded.

Additionally, even vehicles older than eight years that pass the automated tests will be subjected to a ‘green tax’, which will see owners shell out an additional 10% to 25% of road tax at the time of the renewal of the vehicle’s fitness certificate. Those who opt for the voluntary scrappage scheme and have their old vehicle scrapped will be eligible for benefits and incentives as part of the policy when they purchase a new vehicle. The vehicle scrappage policy has been devised to promote sales of new vehicles with improved fuel efficiency and low pollution levels, as well as to slash India’s expenditure of Rs 10 lakh crore on crude import. Around 1 crore ageing vehicles are set to be scrapped once the policy is implemented, according to Nitin Gadkari, Minister of Road Transport and Highways.

The ministry expects the new policy will boost the Indian automotive industry’s turnover by 30% to Rs 10 lakh crore in the coming years. As a direct result of the policy being put in place, up to 50,000 jobs and investments of around Rs 10,000 crore are expected to be generated. To scrap an old car, a car owner will need to visit an authorised car scrapping dealer who will inspect and evaluate the vehicle for scrapping. As the notification of the policy gets underway, more clarity on the procedures and authorised scrapping centres will emerge. The scrapping of old automobiles presents a huge business opportunity in the recycling business.

The Recycling Process Flow

Vehicle scrapping is a specialised process. An automobile consists of a huge number of parts made of steel, aluminium and several other nonferrous metal parts. Then there are plastic, rubber, electrical, electronics and glass parts. The recycling centres need to have special facilities to dismantle and reclaim as much as possible of the used car. In the recycling centres the parts are taken out and stored category-wise for sale and reuse. The car body, mainly consisting of cold and hot rolled steel, is then pressed and crushed into bails using heavy-duty machinery. These bailed metals go to a foundry for re-melting and are further put into a component manufacturing cycle.

At present there is only one authorised recycling centre in India. MMTC, a Government of India enterprise, has forayed into the recycling sector with an equal partnership joint venture with Mahindra and Mahindra. A JVC named MMRPL is one of the first organised automotive shredding plants in India for recycling vehicles and other white goods by converting these into shredded scrap, which is a vital raw material for the secondary steel plants. A collection and dismantling centre with state-of-the-art technology has been set up in Greater Noida and Chennai. The metals recovered through the process above go to the foundry markets for recycling.

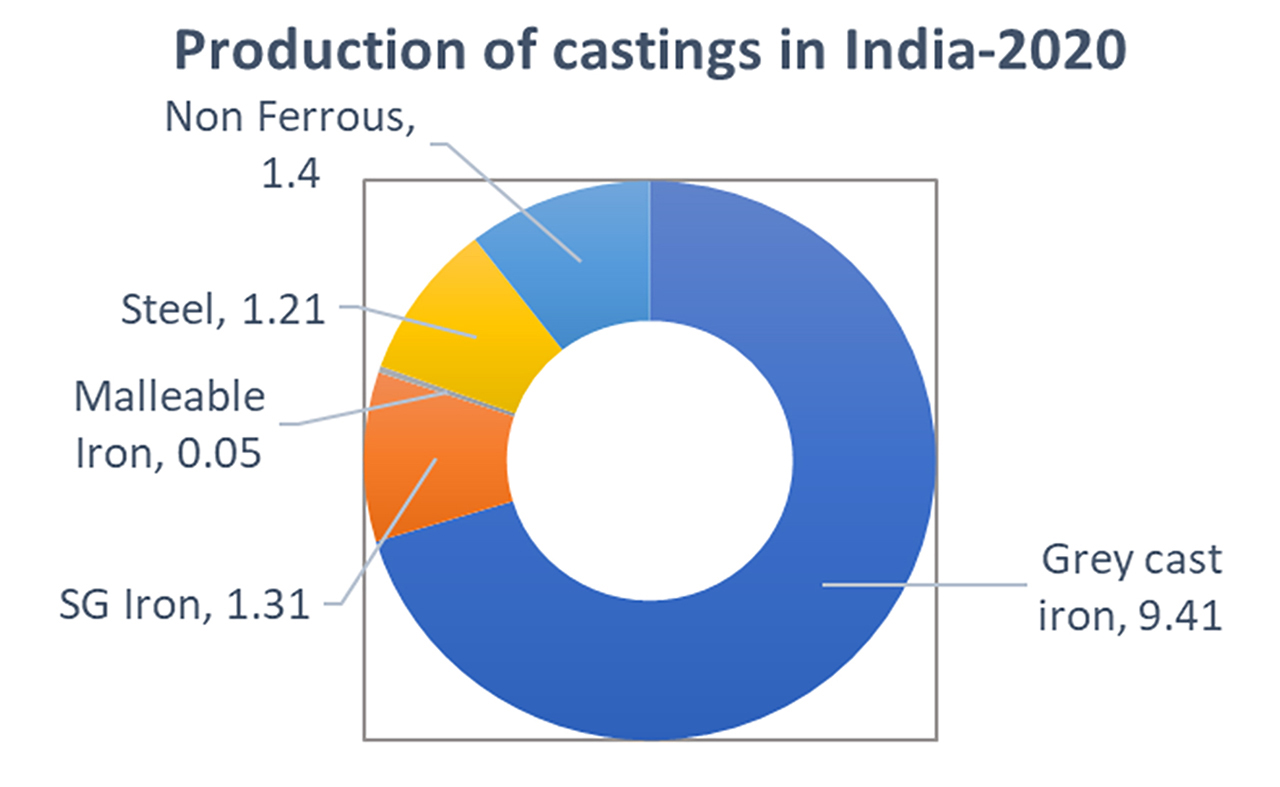

Foundry Market in India

The total casting market in India is around USD 19 billion. This market is fragmented with several small and medium companies occupying the market share. There are several players in the unorganised sector too. Due to environmental and energy concerns, the industry has largely been disorganised. However, due to a large number of businesses shifting from Europe and USA to India there is a consistent growth in the industry. Almost 46% of the market belongs to the automotive industry which buys iron, aluminium and other nonferrous metal castings. A focus on technology upgrades and export opportunities will drive the industry in the next decade or so.

The market growth is projected to accelerate to CAGR of 10%+ by USD 13 billion from 2020-2024. The market is characterised by the presence of well-diversified local vendors, mainly in five industrial clusters – Belgaum, Batala and Jalandhar, Coimbatore, Kolhapur and Rajkot. Mahindra CIE Automotive Ltd., Nelcast Ltd., Sanmar Group, Tata Metaliks Ltd., and Tata Motors Ltd. are some of the major market participants. These prominent players are investing in research and development and focusing on strategies to carry out further research to develop better products.

Business Opportunity

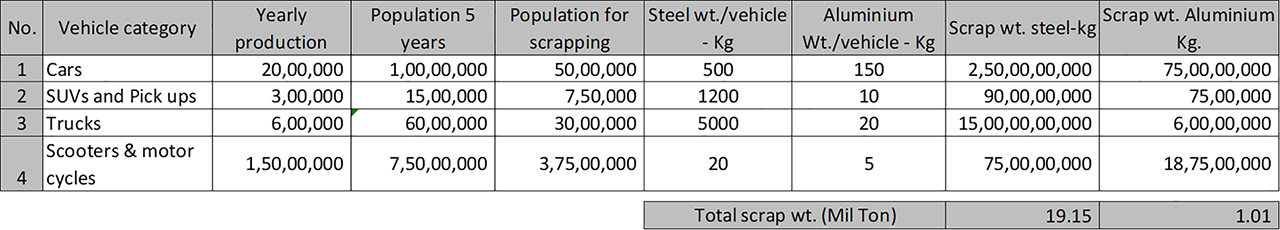

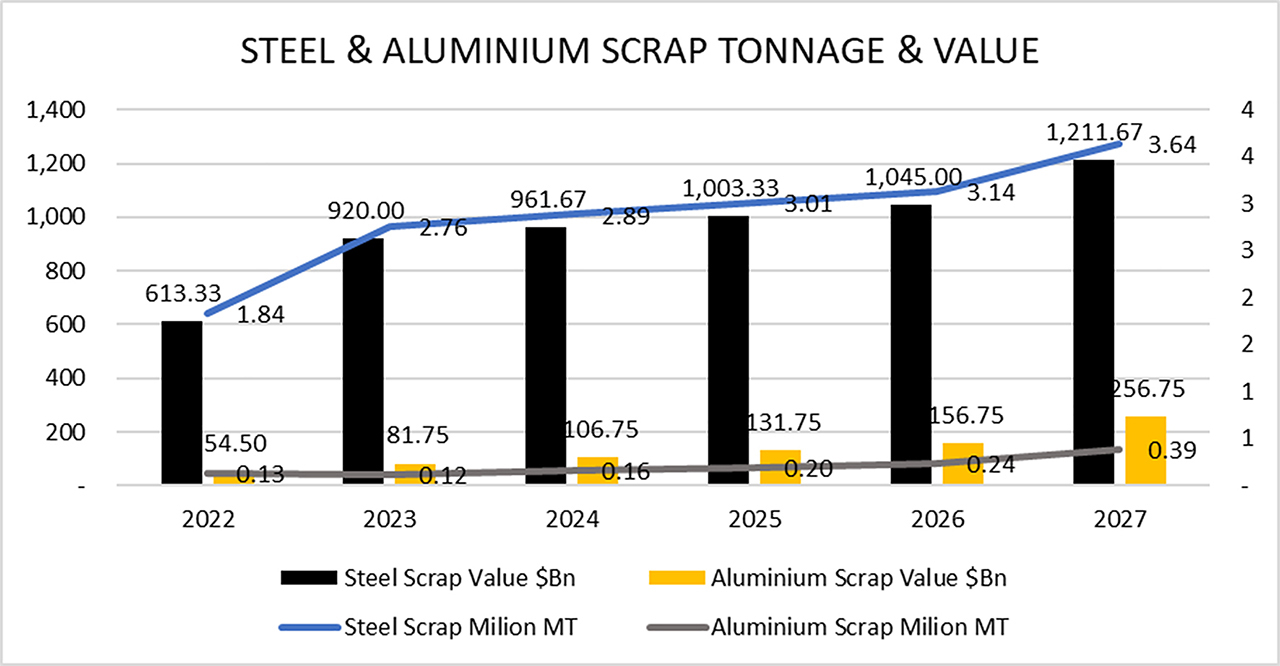

We have plotted the data based on the average annual vehicle production in India. A median of 50% vehicle population has been assumed for scrapping. This will be achieved in the first five years starting with 10% in the first year and reaching 35% by the end of five years. The next five years are likely to see an increase in vehicle scrapping as the norms get tightened as well as recycling centres’ capacities increase. Through the scrapping of vehicles we see a business opportunity of USD 1.5 billion annually.

In the first five years of implementation of the policy we expect a business opportunity of USD 6 billion from steel and aluminium recycling. Other than these, there would be other recovery items like plastics, rubber, electrical wiring, etc. which would add to the business potential. Exotic materials like titanium, palladium etc., which are part of catalytic convertors, would need to be recovered with a special recycling process and add to this business opportunity. Once the scrapping and recycling starts, this business is expected to grow to USD 2 billion annually.

Conclusion

With the new vehicle scrapping policy coming in, the entire ecosystem consisting of automobiles, metal foundries and component manufacturing will benefit. Almost the entire steel and aluminium remaining fit for recycling can be reclaimed, as per experts. In fact, car recycling is an established business in other countries. It benefits the entire supply chain. With around 20 million MT of steel coming into the secondary market every year, the market quantity will increase by 20%. India imports around 9 million tons of steel melting scrap annually.

This would not be required, thereby saving precious foreign exchange. Also, the pressure on steel and nonferrous metals like aluminium will ease up as component makers can buy the materials directly from smelters. On the demand side the scrapped number of vehicles will be replaced by new vehicles, thereby creating a demand in the automobile industry. To make the scrappage policy successful, it is extremely important to set the complete recycling chain in place. Vehicle scrapping is not the only intent; we need to recycle and reclaim as much as possible from the end-of-life vehicle to ease pressure on the entire ecosystem.