Transport Solutions of India Pvt. Ltd. (TSI) was established in January 2006 with a vision of becoming a truly global, complete road transportation solutions provider, by bringing innovative, safe and quality solutions to the country. Currently in its eighth year running, TSI has already forged alliance with world-renowned brands such as Lohr, Mosolf and HLM, which has given the company a wide range of capabilities in different segments, in addition to its own extensive range of tippers, trailers and other applications. We find out more from the TSI team on the company’s journey towards delivering global transport solutions in the Indian market.

The company was initially formed as a joint venture with Belgian trailer manufacturer Stokota, which subsequently became a 100 per cent TSI venture in 2008. TSI has two wholly-owned business units, namely, TSI Trailers and TSI Tippers, apart from a trading division called All For India (AFI) which offers imported products such as tankers and other special applications. Through its tipper and trailer divisions, TSI offers a wide range of products and solutions which have been designed and developed in-house to meet the exact requirements of its customers.

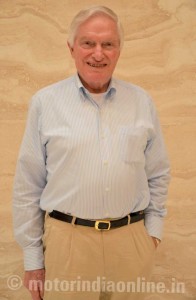

Mr. Jack Vaandrager, Founder of the reputed Hyva brand in 1979, is the current Chairman of TSI. Mr. Vaandrager who hails from the Netherlands, is a pioneer when it comes to commercial vehicles and truck applications with decades of experience in the field. He had started studying the Indian market in the 1980s and had little doubts about its potential back then. Today, Mr. Vaandrager is working with his associates at TSI, with a vision of improving the country’s road transportation system by adopting globally successful practices in a suitable way for the Indian market.

Mr. V.K. Singh, a veteran in the Indian commercial vehicle industry, is the Managing Director of TSI. Says Mr. Singh: “We want to be a truly global company and a complete transport solutions provider in the country. We give a lot of emphasis on core areas such as engineering, design and development with our design approvals and validations taking place in Europe, so that they are of global standard.”

Mr. Singh has the full backing of his twin sons, Mr. Anand Singh and Mr. Amit Singh, who are the CEOs of TSI and Mosolf India respectively. The company’s vastly experienced and technically sound top management is supported by a dedicated workforce of over 1,000 people across the country, which includes a strong R&D team comprising a good balance of youth and experience.

TSI has also joined hands with leading global names in different segments such as car and truck carriers, finished vehicle logistics and reefer vans, thus providing the most comprehensive range of transport solutions in the country today.

Says Mr. Anand Singh: “One thing which we have done well is to bring Western technology to India. We will not reinvent the wheel. We will bring the best available European brands and technologies to India but as per the local requirements. From an OEM perspective, we offer them a complete range of products, technologies and customized solutions, which is one-of-its-kind in the Indian market today.”

TSI has a state-of-the-art manufacturing facility spread across five acres at Chakan near Pune where it manufacturers its range of tippers, trailers and other products. The facility also has two bays for manufacturing the Lohr range of car and truck carriers. Currently, only half of the available land is being utilized for manufacturing while the expansion to the other half is expected to happen in the near future, as market demand picks up.

TSI Trailers focuses on the manufacture of all types of semi-trailers for the Indian market, including flatbeds, skeleton, semi-low beds, low beds, tipping trailers, etc. The company had sold around 1,200 trailers annually for the last few years, and though the Indian trailer industry is going through a very tough phase currently, with falling numbers, once the situation stabilizes the segment is expected to grow at a healthy rate of 20 per cent annually. Apart from the headquarters in Pune, the trailer business unit has branches in Mumbai, Kolkata and Nagpur focusing on the western, eastern and central regions of India respectively. It also offers strong support to its customers through a network of over 60 distribution, sales and service centers across the country.

TSI Tippers is involved in the manufacture of all types of tippers – front end, underbody, box body and rock body for the Indian market. The company supplies to almost all leading vehicle manufacturers, including MAN, Mahindra Navistar, Hino Motors and dealers of Tata Motors and Ashok Leyland. TSI’s annual tipper sales hover around the 1,800-mark for the last few years. It projects a 15 per cent annual growth, which is likely to happen once the market projects improve, especially in the mining segment. The company is gearing up to start supplies of high-end tippers for multinational vehicle OEMs that have entered the Indian market. The Tipper Division has a mounting capability at Pithampur catering to MAN’s requirements, in addition to the company’s main facility at Chakan.

The Lohr way

Lohr India Automotive is a 51:49 JV between Lohr France and TSI. Established in 2008, Lohr is the world leader in the manufacture of car and truck carriers, with operations in France, Russia, Serbia, the US, Mexico, China and Turkey, with annual revenue of around Euro 480 million. The Indian car market is growing from 1.5 million cars in the last decade to nearly four million cars in the next few years with a similar growth pattern seen in the truck segment as well. The Lohr-TSI JV is targeting this rapidly growing market by manufacturing car and truck transporters of world-class quality, tailor-made to suit the Indian requirements and, most importantly, at competitive costs.

Lohr offers the lowest cost of operation when it comes to transporting cars and trucks. The company, along with TSI’s Indian expertise, has built a strong reputation for its brand in the Indian market, with a growing list of customers realizing the long-term benefits offered by its products. “If a customer owning 500 car and truck carriers of other brand decides to replace his fleet, he could do it with just 400 Lohrs, because owing to the higher carrying capacity, the total cost of ownership comes down with the transportation efficiency improving a lot. We have delivered car and truck carriers to many transporters in the country, including NYK, KMT, Kishore Transport, IVC, TVS and SVLL, among others. We also did a study for a leading CV manufacturer by transporting vehicles from one of its plants using the Lohr carriers. The test results projected an annual saving of Rs. 75 crores for the OEM from just a single plant”, says Mr. Anand Singh.

The Mosolf mastery

Mosolf India Logistics Pvt. Ltd. was formed as a 51:49 JV between Mosolf GmbH, Germany, and TSI. Mosolf is a world leader in the finished vehicle logistics industry with operations all over the world, including markets like Europe, Russia, China, Brazil and India, with annual revenue of about Euro 500 million. The company works with the top global automotive brands such as Volkswagen, Daimler, BMW, Opel, Porsche and many others.

In India, when Volkswagen (VW) started manufacturing cars in 2009. It was looking for an expert to handle its vehicle logistics and yard management operations. Globally, the finished vehicle logistics at VW’s Mosel facility in Germany is taken care by Mosolf. So, with a view to keeping the global practice intact, VW had called for Mosolf’s support in India as well. Interestingly, Mosolf is a Lohr customer for car and truck carriers globally, and when the former wanted to enter the Indian market, Lohr already had the JV with TSI. This made TSI the unanimous choice as partner for Mosolf to enter India, which it did in May 2009.

Having started with VW, Mosolf India has bagged contracts from several other customers in vehicle transportation, yard management and other operations. As part of the contract, operations such as quality checks at the end-of-production line, yard management, and pre-delivery inspection (PDI) checks are performed.

Says Mr. Amit Singh: “We are a young company and have grown very rapidly. After Volkswagen, we have added JCB, Mercedes and MAN as our customers. Our work is to maintain the quality of the vehicle from the end-of-production to delivery. We have value-added services which bring down the costs, dealer claims and warranty claims for our customers.”

Mosolf has the expertise to provide technical services for its customers, which is an additional advantage. The company is currently setting up its first multi-brand vehicle yards in Pune and is looking at opening similar yards at around 20 locations across the country.

“We are working on carrying multi-brand vehicles in one trip which would save a lot of time and enhance the transportation efficiency. By this, the OEMs can save a lot of cost, because they usually pay for empty capacity after the vehicles are off-loaded. The country is getting ready for GST and moving forward, we hope the OEMs would use the factory space only for making cars and push the vehicles out to multi-brand yards. Rail access is also an option for the future, but it depends on a lot of factors and might take long in our country”, he added.

The HLM expertise

HLM is the third globally-renowned name with which TSI has tied up, in line with its vision of delivering world-class transport solutions in the country. HLM India Pvt. Ltd. is TSI’s 50:50 JV company with HLM Holland BV. HLM is a world leader in the reefer vans, reefer trailers and insulated panels industry with operations in Holland, Turkey, China and India.

Almost 40 per cent of India’s food and perishable goods produced is wasted due to inadequate cold chain infrastructure for storage and transportation. The Indian Government has recognized this and has announced several subsidies and promotion schemes for cold chain solutions for reefer trucks and trailers. The Indian reefer truck market is currently dominated by small, local and unorganized manufacturers with outdated technology. TSI had identified the cold chain segment as a highly potential one for future growth and has established HLM India to cater the growing demands in this space.

“HLM will be a very important focus area for us. We have made huge improvements on the product since it was first launched. The cost has come down to just 5 to 10 per cent higher than the common steel containers after we had optimized the design. We have also done a lot of value engineering in the product and offer tailor-made end-solutions to our customers. Our OEM customers include Mahindra Navistar, Hino Motors, MAN and BharatBenz with talks in progress with Tata Motors and Ashok Leyland”, adds Mr. Anand Singh.

While the growth of the reefer segment was initially driven by the transport of frozen foods such as ice creams, the current trend indicates that the transport of fruits, vegetables and other daily foods is stimulating the segment’s growth. Though initially some customers had expressed fear and uncertainty over the strength and reliability of the GRP material used for building the reefer panels, HLM has seen its customer base gradually expanding and has also received repeat orders from several customers. Currently, the factory is fully booked with delivery period extending to several weeks.

“We have had big breakthroughs with some customers who have used the reefer box for over two years and now they have placed repeat orders. We have sold around 250 to 300 reefers till now but we are just three years old. Once we complete five years, the life cycle of the product would be complete and then the common perception that the strength of the reefers is not up to the mark will be broken. Customers have begun calculating and are able to understand that our reefers offer increased payload, reduce the vehicle weight and can help carry additional volume in a very hygenic and FDA/ATP-norms-compliant manner”, he adds.

With regular discussions and efforts made by the Government to develop the domestic cold chain industry, HLM India seems to be in pole position to tap the huge market potential in the coming years.

ACCL-PL Haulwel Trailers

One might expect a fourth JV here, but no, this one is a complete takeover. In February last, TSI made a huge leap forward by acquiring Automotive Coaches and Components Ltd. (ACCL), a company known for its quality range of truck and trailer applications in India for nearly three decades. The buyout gives TSI the control over the reputed ACCL and PL Haulwel brands and also the latter’s facilities at different locations in south India – Pondicherry, Ambattur, Gummidipoondi and Oragadam.

TSI has been a strong player with establishments in the western part of the country. The new acquisition in the South opens up a wide range of opportunities in the southern markets for the company which, boosted by the new capabilities, is set to become a Rs. 1,000-crore powerhouse in the next five years. TSI as an independent company is likely to register a turnover of Rs. 200 crores in 2013-14.

When it comes to the product mix, there are complementary products and also some exclusive products between TSI and ACCL & PL Haulwel. ACCL makes a range of on-chassis and after-chassis products and also some special trailers and applications which would widen TSI’s portfolio.

“We are continuously improving our capabilities and with the addition of ACCL, we will further strengthen our product portfolio. We will step up our presence in the Defense sector as they have very strong presence in the segment. Overall, with ACCL’s expertise, technology, and strong service network in the south, we could offer a very interesting range of products and solutions to our customers”, observes Mr. V.K. Singh.

“The ACCL acquisition will help us enhance our presence in the southern markets. We will now be able to penetrate more and gain market share in the southern States. We will retain the brand names as such because there is a value to ACCL and PL Haulwel which we do not wish to dilute”, says Mr. Anand Singh.

In addition to the acquired facilities in the South, TSI is having its greater focus on the North by expanding its sales team in the region. PL Haulwel also has its strong presence in areas like Chattisgarh and Bilaspur because of its range of tip-trailers which are the primary products in demand in the region.

TSI is looking to make inroads into the South by setting up a new assembly facility for HLM India. From a HLM perspective, the new takeover paves the way for easier RTO approvals and the possibility of offering multi-location deliveries and pan-India service for its customers. In terms of customers, HLM can cater better to OEMs in the South, including Ashok Leyland, BharatBenz, Volvo and Scania.

It has been eight years in the making, and today TSI has established a strong foundation with the right strategies for the Indian market. With three truly world-class partnerships, to add to its own range of products and solutions, and not to forget the recent massive acquisition, Transport Solutions India is in its own right gearing up to become the country’s largest transport solutions provider in the coming decade.

Mr. Anand Singh has been the driving force behind the success and growth of TSI. Ably supporting his father Mr. V.K.Singh, a veteran himself in the commercial vehicle industry, Anand has been instrumental in forging TSI’s global partnerships and continues to play a vital role in the growing success of the JVs. With a keen eye for the finest of details, Anand’s focus on quality is at par with the best, which is one of many reasons behind the impressive growth of the company. He and his team are well on their way towards building a truly formidable force in the Indian vehicle applications industry.

Interview with Mr. Philippe Fortmann, MD,

Lohr India Pvt. Ltd.

How important is the Indian market for Lohr?

The whole of Asia is a very important market for Lohr in which India and China are important manufacturing bases. As part of our Asian strategy, we have decided to have a manufacturing location in both countries. That has now been accomplished. We are working in bringing in global technology and quality standards to cater to the OEMs requirements in the country because the OEM practices in India are the same as the rest of the world. We bring our global expertise and experience to India and have designed and developed our products to suit the local conditions.

We brought in the concept of chassis on trailer which has taken off very well. We have been successful in the last 18 months in taking the market leadership position with a manufacturing capacity of 100 trailers per month, which is by far the largest for vehicle carriers in India.

What are the different models of vehicle carriers you are currently offering?

We have different models for vehicle carrying. We offer vehicles which can carry up to three small car units, 16 and 25-tonne carriers which can take five or six car units and semi-trailers for transporting 10 to 12 car units in one go. We have a range of semi-trailers for truck and chassis transportation. We have also recently developed a bike-cum-car carrier on a semi-trailer platform as well as on a 16 T platform. We have a range of other customized products and solutions depending on the customer requirements.

What are the differences in terms of features between your newly developed products for India and your European product range?

There are some features which improve the vehicle performance without any extra effort on the part of the driver. Our European products come with a lot of hydraulics. Sliding roofs were used to improve safety. In India, these features were not appreciated when we first entered the market, because the long-term advantages were far out weighed by the customers’ focus on the initial cost.

We are now beginning to see a change in the market trend, with many customers seeking products with such advanced features. One good example is the air suspension, which is still not very popular in the Indian trailer industry. We had eliminated it from our standard product as there were no takers for the technology, but after testing them out with our trailers, many of our customers have expressed interest, realizing that the ride comfort and safety is much better with air suspensions than with steel suspensions.

We understand that Lohr has been able to bring down the product cost by nearly 50 per cent since entering the Indian market in 2008. How has this been possible?

It’s a combination of three factors, I would say. First, the design. We brought in technology from our global expertise, and to stay different from our competitors, we had to keep that technology and so we did not want to compromise on quality and technology. With the help of our European and Indian designers, we have simplified the products, retaining the essential aspects and eliminating the extra features which might take some more time to be appreciated by transport companies in the country.

Second, local sourcing of most of the components, which was probably the most difficult part of it. The trailer component industry in India is still very fragmented, but is slowly becoming more organized as we see more global brands entering the market. During the initial days, we had to locally develop components in small volumes from scratch when we faced challenges of poor quality and high costs because of the low volume.

Third, volume. Four years back, we were making around five trailers every month, and now the number is close to 100. The rise in volume has led to growing interest shown by suppliers, which has, in turn, reduced the cost.

All this has cut the final product cost by nearly 40 to 60 per cent.

Is the Indian customer different from others across the world? What are your observations?

I have been travelling around the world for many years and find that the Indian customer is no different from others, especially in the B2B segment. Our customers buy trailers for adding value to their customers, so we have to add value to them as well. Some are very keen on new technology, so they might be easier to convince, but they are also more difficult to satisfy.

Our existing customers promote our products because they are happy with the overall performance. We have removed the image of being very expensive and complicated to use, and today a lot of our customers are finding our vehicles much easier to use than the local ones. Some customers have zero turnover of drivers after switching to Lohr trailers, so driver retention has improved because of our products.

We at Lohr believe that the driver is the first promoter of our products. We have driver training schools in all countries where we are present, and it is a global practice at Lohr. We have a driver training school in India since two years where every Lohr driver is given complete training before vehicle delivery. The training module takes three days and covers preventive maintenance, usage, safety and loading and unloading practices. After training is over, the trainee is certified as ‘captain’ of the ‘vessel’. Today we have 800 vehicles on road in India, which gives us 1,600 drivers to promote our products.

What are the takeaways for Lohr from the Indian market?

India has really helped us to understand the kind of approach needed for the emerging markets. Until five years back, because of the size of the Western European, Eastern European and North American markets, the emerging countries were not our main focus. We were selling a few trailers in the emerging countries, which was actually a loss of technology for us, as our products were being copied.

The process of localization, together with simplifying the design, yet maintaining the DNA of Lohr, has given us an edge in the emerging markets. We are now capable of supplying to the emerging markets such as South-East Asia from India without having a cost disadvantage. We were not ready for these markets before, but today we are.

We are currently exporting our products to Philippines, Thailand, Indonesia, South Africa, Tanzania, and many more countries, either as fully-built vehicles or as CKDs. The Indian experience has also helped us create the capacity of adding and removing features from our products, which has made us a lot more flexible.

Moving forward, what is your outlook for Lohr in the Indian market in the coming years?

Very optimistic. The slowdown which we are going through is not going to last long. We are continuing to invest a lot because we are hopeful that the Indian market will grow, become more mature and more professional in the coming years. There are many players who are investing in commercial vehicle body building and the trailer industry, and most of our expansion is also based on investment on new products and facilities. Our focus is on developing new product ranges which would take us to the next level in the market.