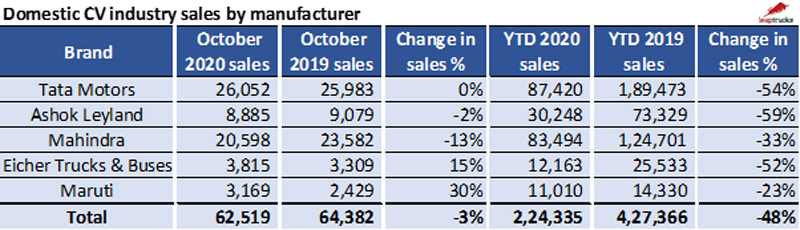

Kaushik Narayan, CEO, Leaptrucks, looks at five factors that will impact the sales of commercial vehicles in November 2020. He also looks at the performance of the industry in October 2020 in terms of manufacturers and segments for a deeper understanding

October was a strong month for all major manufacturers. The industry de-grew slightly by 3% in October 2020 in comparison to October 2019. On the bright side, the industry grew by almost 15% in comparison with the previous month. Maruti Suzuki maintained its momentum for 2020 and grew by an impressive 30%. They were followed by Eicher Trucks and Buses with a strong 15% growth. Tata Motors and Ashok Leyland both ended the month almost flat in comparison to last year. Mahindra & Mahindra had a drop of 13% in comparison to last year (more details on this in the SCV section below). However, the pandemic has had a significant negative impact of 48% on year to date CV industry volumes against the same period last year.

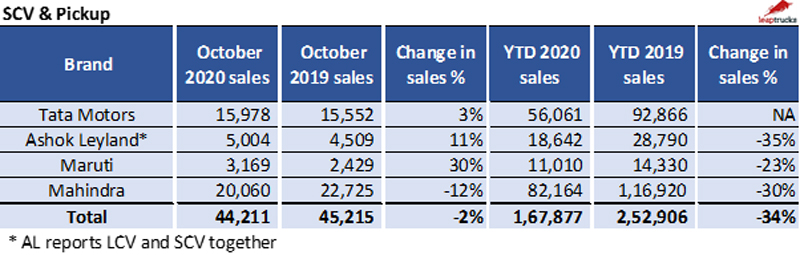

Small Commercial Vehicles Performance

The SCV segment de-grew slightly by 2% in October 2020 over the same month last year. This follows two consecutive months of growth against last year. All manufacturers performed well in the segment with the exception of the market leader Mahindra & Mahindra. As indicated earlier, Maruti Suzuki grew strongly by 30% followed by Ashok Leyland with growth of 11%. Tata Motors also had an impressive growth of 3%. Mahindra & Mahindra had a drop of negative 12% in comparison to the same month last year. We also observed that Mahindra & Mahindra grew by almost 8% from a strong performance in September 2020.

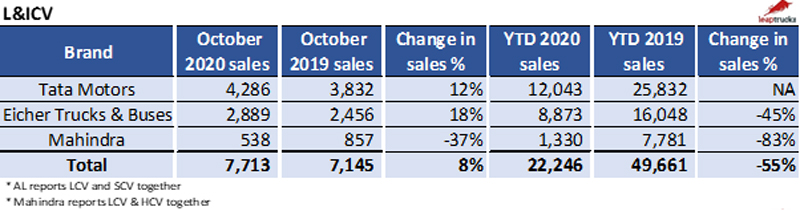

Light and Intermediate Commercial Vehicle Performance

This segment grew by over 8% in October 2020 over October 2019. Both Tata Motors and Eicher Trucks and Buses performed strongly with double-digit growth in this segment. Mahindra & Mahindra reported the light and intermediate commercial vehicle and medium and heavy commercial vehicle numbers together and showed a drop of 37%. This sets the stage for a strong finish to the year for the former segment.

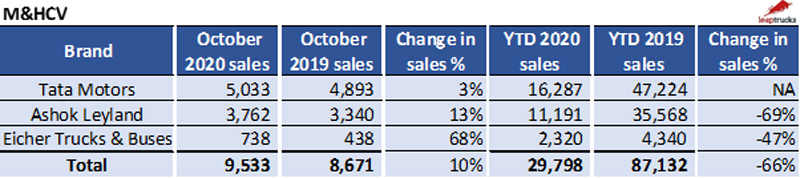

Medium and Heavy Commercial Vehicle Performance

October 2020 was a crucial month for this segment. A strong performance by all major players was not expected to happen as early as October 2020 with a growth of 10% over October 2019. Eicher Trucks and Buses grew by an impressive 68% followed by Ashok Leyland at 13% and Tata Motors at 3%. This bodes well for a faster turnaround in this segment. However, the industry is down by 66% in comparison to the same time last year.

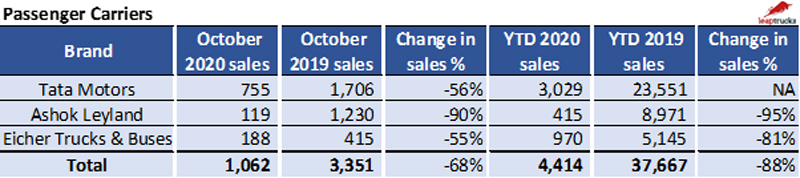

Passenger Segment Summary

Passenger transportation continues to struggle in the midst of the pandemic. Sales in October 2020 were flat month-on-month with September 2020. However, the industry was down by negative 68% against the same month last year. All the major players reported a significant drop in volumes in October 2020.

Five Factors Affecting November 2020 Sales

We have summarised five major factors that will impact sales in November 2020:

- Decrease in diesel prices: Diesel prices dropped by 4% last month. This should provide relaxation and improved profitability to operators despite flat freight rates. Further reduction in fuel prices will improve the viability of BS VI trucks.

- Improved truck utilisation: Utilisation of trucks in most market segments was better in October as opposed to September. We expect the trend to continue in November and the second half of the year.

- Financing challenges: Financiers continue to await the Supreme Court verdict on the loan moratorium which is currently deferred to November 18th. This will dampen the appetite of financiers to resume disbursement at the pre-pandemic levels.

- Passenger segment difficulties: Passenger transportation continues to be impacted negatively across the country. As colleges and schools re-open in some states, there will be some recovery in demand. However, this segment will have a very slow recovery

- Festive season: This year, Diwali will be celebrated in November as against October last year. We anticipate positive sentiments and additional momentum to sales as a result of the shift.

In summary, we continue to be bullish about the CV industry performance in H2 2020. October 2020 provides a good springboard to the industry to finish the year well after a very disappointing start.

Leaptrucks is a marketplace for buying and selling used trucks, buses and construction machinery. You can see all our listings at www.leaptrucks.com/listings/. If you are from the industry and would like to contribute to our blog, please contact us at hello@leaptrucks.com.