By Imran Shaikh, Founder – Profound Consulting, Sr. Member – American Society for Quality, Advisor – Yagna Entrepreneur Success Services LLP

Unprecedented times call for rethinking and redesigning strategies to operate businesses. Most of the organisations have embraced various best practices but still, a couple of months of fall in revenue can break most of these businesses. This is the bitter reality that calls for our businesses to be more resilient to overcome crisis situations in future.

The current COVID-19 crisis has a larger economic, social and political impact globally. The supply chains are struggling as the demand and supply cycle is thrown out of gear. Non-availability of even a single part can bring the entire supply chain to a grinding halt. Technological complexities and economies of scale drive the decision across supply chain.

Current Reality & Challenges

- Significant drop in revenue

- Profits, ROI and cash flow are under pressure

- Cash constraint

- Demand & supply uncertainty and volatility

- Disrupted supply chains with long lead time

- Delivery failures

- Pressure on pricing and credit from customers and suppliers

- Resource variability

Few Facts (from companies listed under Indian Stock exchange)

Companies that grew sales every year for 8 years – 380

Companies that grew profits every year for 8 years – 37

Companies that have minimum ROCE of 25% for 8 years – 19

Companies that fulfilled all of the above – Only 4 (two software and two FMCG companies)

What is so challenging for most of the companies to grow consistently year on year and what should change?

Supply Chain

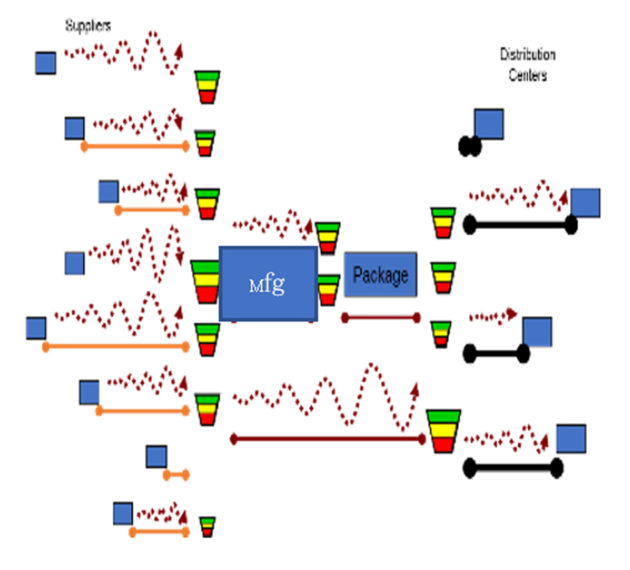

Organisations have been operating on the classical push mode of operation since decades and long supply chains amplify volume fluctuations. Besides the physical complexity, the way the supply chains are structured makes it difficult for the individual players to assess the level of demand. Minimum order quantity is a prevalent policy being followed throughout the ages across the supply chain without thinking, resulting in negative ramifications in most scenarios.

Changes in consumer demand affect the companies in a supply chain to order more / less goods to meet the new demand. This causes bullwhip effect and usually flows up the supply chain, starting with the retailer, wholesaler, distributor, manufacturer and then the raw materials supplier causing a domino effect. The effect is alarming stocking and destocking across the supply chain, resulting in material shortages, surplus, productivity loss, sale loss and blockage of substantial cash.

Manufacturing

Organisations have always been operating with certain incorrect assumptions like producing only to minimum batch size. As a result of such batching, pulling ahead or pushing back of similar orders is done. This leads to production of goods which are not immediately required while those in immediate demand are delayed. Changes are done on every process, assuming it will bring in improvement. Substantial time, money and efforts go into such changes; however, the impact on the bottom-line is not realised in most of these improvement initiatives. The entire supply chain and manufacturing is disrupted, creating conflicts.

Organisational dilemma

The current pandemic has caught the whole world in a vicious cycle that has aggravated undesirable effects in organisations.

The lockdown has affected the whole world and businesses have literally came to a sudden halt. Recovering from this will be a major challenge. Consumer demand has gone down (except in few sectors like pharma, essential goods and some tech companies). Organisations are laying off people. There is no liquidity. The financial institutions are under pressure. The governments of countries are trying to monetize the economy, however, this may lead to inflation.

We are heading to a perfect VUCA world and businesses need to restart, redesign, regenerate and flourish.

So, how can businesses be always prepared for such uncertainties and be recession proof? Is there something powerful over and above the lean approach and other best practices?

Restart

The immediate action for organisations is to start monitoring and controlling their cash flow daily. Special emphasis must be given on the following actions to have a healthy cash flow:

- Reduce cash to cash cycle time

- Monitor and control cash every week, every day

- Focus on your highly profitable business verticals / product segments / markets

- Explore possibilities to increase throughput (gross margin)

- Pay your employees, suppliers, service providers on time

- Reduce Investment, inventories and receivables. Calculate the ROI before any investment

- Influence suppliers to supply only what is consumed. Operate on pure ‘pull’

- The above action will reduce RM inventory / shrink cash to cash time

- Collect money stuck with government agencies: Excess taxes paid, incentives etc.

- Settle disputed claims quickly.

Redesign – a paradigm shift

Throughout the years, organisations have been operating on forecast-based push mode and have built expensive software to improve the forecast though we know forecasts are never accurate; this results in most organisations ending up with low Inventory turns, huge cash blocked in inventory across supply chain, frequent delivery failures, loss of sales and even loss of business. These are the ones which are most vulnerable to such crisis.

Businesses comprise of inter-dependent variables and even a minor change in one of the links can have a big impact on the entire chain. Similarly, even a big initiative might fail to have the anticipated impact. Businesses are highly dynamic and evolving at a rapid pace wherein leaders need to build the flexibility and quick response systems in their organisations to adapt to the change. Even annual business plans need to be reviewed every week/month. It all depends on opportunity and innovative initiatives. It is likely that one of your moves may enable your business to achieve the annual business plan in only a single quarter. Contrary, an innovative move from competition can disrupt your entire business plan. Nokia struggled with its business as it was not prepared to react fast to the disruptive moves from other innovative brands.

“There are decades where nothing happens and there are weeks where decades happen” said Vladimir Lenin.

There is an urgent need to move away from forecasting to a consumption-based planning and execution. The entities upstream in the supply chain need to supply, produce and replenish only that quantum which is consumed by the subsequent downstream entities. The supply chains have to be scientifically designed to be flexible enough to adjust to the ever-changing demand without sales loss to any entity in the chain. This is a paradigm shift.

Leaders need to be opportunistic, communicate frequently with customers, employees, shareholders and other stakeholders. They need to build high performance teams, train, mentor and motivate them. They need to act beyond conventional wisdom. Quality and speed of decision and actions will be key.

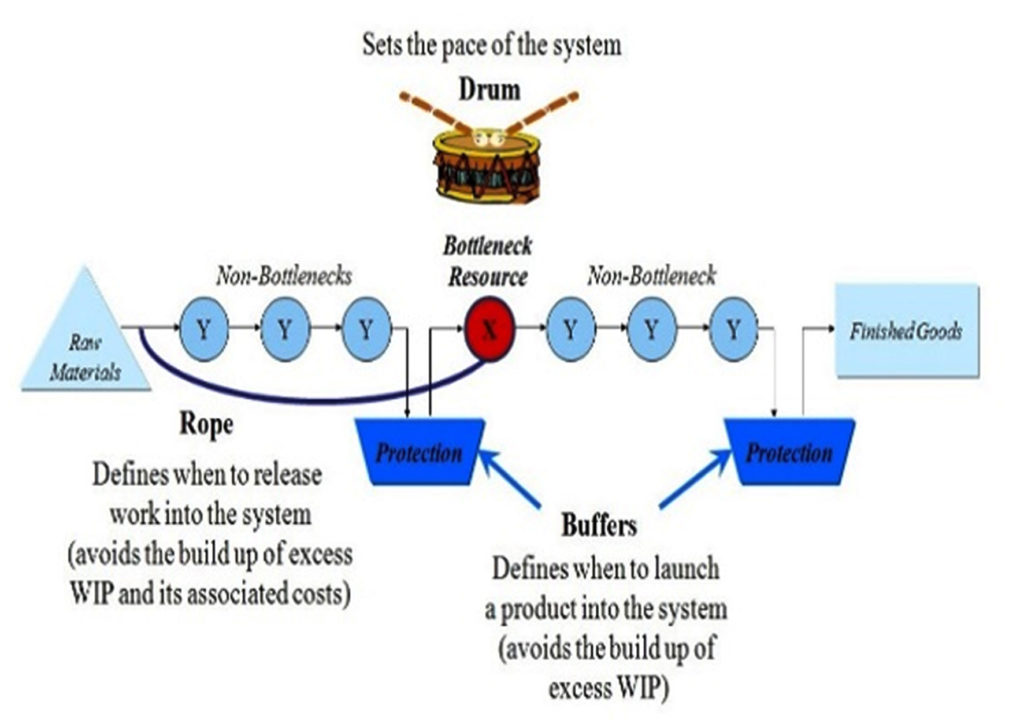

An interesting solution lies in the “Theory of Constraints”, a revolutionary business management approach which can help organisations achieve breakthrough results at warp speed.

How to bring about the change?

Regenerate and flourish

Every entity in the supply chain aims to keep inventory levels low but maintain high availability, manage variety, low supply lead times and increase sales, profits, ROI. For this to occur, replenishment lead times must drop drastically across the supply chain. With higher inventory turns, 100% availability, lesser replenishment lead time, high ROI, the supply chain entities will flourish. Flow and focus are key. Companies can capitalize on this decisive competitive edge and further increase their sales by increasing share of business and acquiring more customers and markets.

Following are the key processes:

- Define the goal of your organisation, identify the constraint, exploit the constraint, align your resources to this common goal and generate additional revenue, profits and cash without increasing expenses and without capital expenses.

- Categorise the products into fast and slow movers. Categorise the fast movers as products which need to be made for Availability (MTA) and slow movers under Made to Order (MTO). Establish a plant warehouse for finished goods buffers. Similarly, there will be defined buffers for raw materials. The demand variability is high at the OEM end or consumer end & thus Plant warehouse will provide benefit of aggregation. Similarly, there has to be defined Inventory norms (MTA) at the upstream suppliers & they need to Replenish only that quantity which is being consumed by the downstream entity. Abolish MOQ. Order daily, replenish frequently.

- Production at OEMs and each of the upstream supply chains have to be as per the priority defined by the SKUs whose buffers are most penetrated. Generally categorised into Green, Yellow, Red which is dynamically adjusted based on change in consumption. This ensures there is no overproduction and supply/replenishment happen only to the tune of the consumption and there is drastic reduction in lead time. There should be an IT system established to communicate the daily consumption at the various tiers.

- Build SOPs.

- Digitise your bottleneck processes.

- Establish a daily / weekly / monthly review mechanism for key operational and financial process measures & take timely actions.

Financial Results

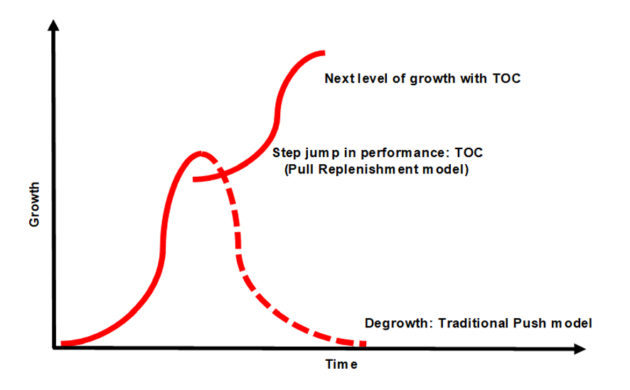

Organisations who have adopted Theory of Constraints [TOC] have experienced hyper business growth rapidly. Few results achieved in less than two years are shared below.

- Revenue growth ~ 2X

- Growth in Profit ~ 3X

- Reduction in Inventory ~ 50%

- Reduction in Lead Time ~ 70%

- Delivery & Reliability ~ 100%

- Substantial improvement in cash and free capacity is released

Business leaders irrespective of the product / service segment need to rethink, believe and embrace the Theory of Constraints, to experience the next level of growth and stability.