It is but inevitable that road transport has to rapidly increase its share of renewables or switch to natural gas to facilitate reduction in lifecycle emissions. The future of transportation has to be greener, safer and more efficient, states Shyam Maller, formerly Executive Vice President (Sales, Marketing and Aftermarket) at VE Commercial Vehicles Ltd.

“The shift to a cleaner energy economy won’t happen overnight, and it will require tough choices along the way. But the debate is settled. Climate change is a fact”: Barack Obama, former President of USA. The time is ticking. There is not much of a choice. By 2035, over 95% of the cars, trucks and buses in the world on the road will need to comply with the condition of zero emissions if global warming temperature limit is to be capped to 1.5 degrees Celsius. It is but inevitable that road transport has to rapidly increase its share of renewables or switch to natural gas to facilitate reduction in lifecycle emissions. The future of transportation has to be greener, safer and more efficient.

The world’s energy reliance has overwhelmingly been on fossil fuels for over a century and this has been one of the causes for the adverse impact on climate change that we have been witnessing, and more so in the last decade. Rising temperature, sea levels and extreme weather events like forest fires, floods and hurricanes in several geographies in an unprecedented fashion has had the world on edge. A major goal of the Paris Agreement on Climate Change 2015 envisages keeping global temperature increase well below 2 degrees Celsius – in fact limit it to 1.5 degrees Celsius. The obligation for India is to reduce its carbon footprint by 33-35% from its 2005 levels by the year 2030.

Progressive corporations and companies across the world have embarked on purposeful climate actions to meet the sustainability pledge of carbon neutrality. In fact, they are grappling with the transformation from a linear to a circular economy. This involves working symbiotically with various stakeholders within and outside the organisation, including government bodies, academia and supply chain partners. The technologies of tomorrow, and moving away from ICE to new-age fuels, call for massive unlearning and re-skilling besides building partnerships and working together to build secular and affordable solutions.

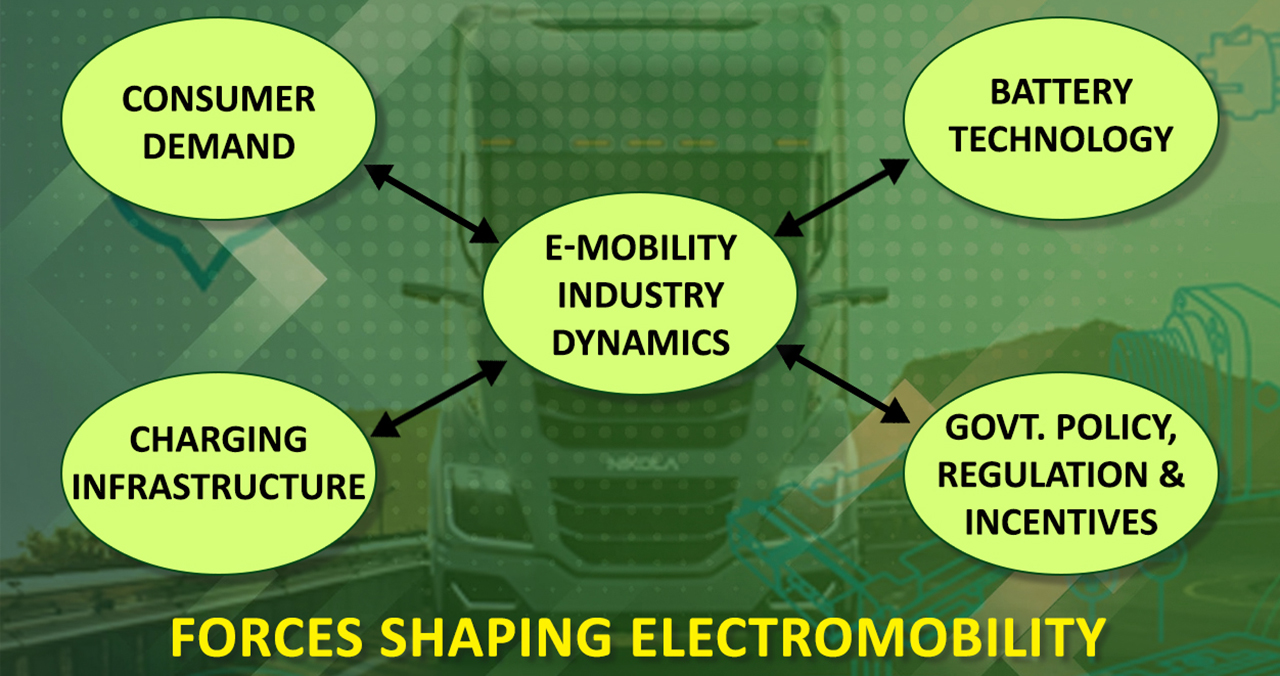

Increasing environmental consciousness, government regulations, spiralling prices of petrol and diesel, emerging growth of smart cities and higher expectations from the populace for cutting down on emissions and pollution are all going to accelerate the adoption of new-age fuels. The transition from fossil to green energy is not going to be an easy one for the world. And more so in India, where emerging technologies have to meet and skilfully balance the price-value equation. It is also about establishing the infrastructure for supply of fuels, batteries or charging. And the OEMs, start-ups and the government are confronted with the classic ‘chicken and egg’ problem.

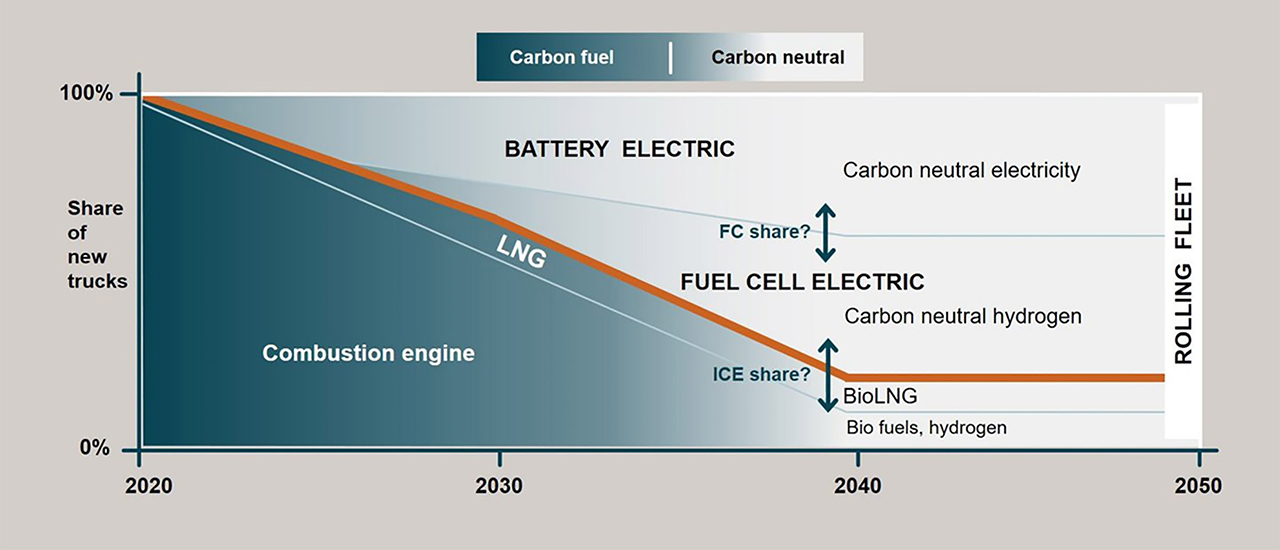

Automotive companies worldwide have drawn up plans for transition to zero carbon. Illustrated below is a high level rendition of the roadmap drawn up by Volvo Trucks to reach net zero greenhouse gas emissions by 2040.

From FY23 business corporations worldwide, including India, are expected to produce sustainability reports which will detail the organisation’s environmental and social performance, including information on annual greenhouse gas (GHG) emissions. Sustainability is founded on the three pillars of economy (profit), society (people) and environment (planet). ESG viz. environmental, social, governance is becoming an important proposition for companies as they can accelerate sustainability actions leading to lower cost of operations emanating from lower usage of water and energy consumption. Let us take a peek at the journey of the Indian commercial vehicle (CV) industry as it metamorphoses from diesel and petrol to CNG and potentially to LNG, battery electric vehicles (BEVs) and hydrogen fuel cell vehicles over time.

Compressed Natural Gas (CNG)

With skyrocketing diesel and petrol prices besides environmental regulations, there is empirical evidence about the explosion in the deployment of more and more vehicles with CNG powertrains. What started off in 1998 with the Supreme Court’s ruling – a landmark one – to alleviate the image of Delhi as the world’s most polluted city, led to the conversion of the city’s public transportation system to the cleaner CNG fuel. Since then there has been a runaway rise in the registration of CNG vehicles – pickup trucks, LCVs, three-wheelers and buses. This received a further impetus in 2016 with the introduction of environmental compensation charge (ECC) each time a loaded commercial vehicle enters Delhi.

The CNG station network in NCR started growing and with it the sales of CNG LCVs, pickup trucks too. Until 2020, NCR accounted for over 95% of the CNG LCVs sold in the country. But over the last 2-3 years the picture is transforming with wider deployment of CNG trucks and buses across the country. Compared with liquid fuels, CNG produces significantly lower carbon dioxide emissions and the tailpipe exhaust being virtually particle-free makes it environmentally friendly. And the Government of India has set its ambition towards making India a gas-based economy.

New CNG vehicle sales from OEMs have particularly risen at a fast clip. It is estimated that of the SCVs sold, nearly 40% of the total sales of Tata Ace, Dost, Suzuki Carry, etc. must be CNG. In the case of LCVs and ICVs, CNG truck sales have expanded from high single-digit to nearly 21-23% of the light and medium duty truck TIV. It must be noted that when the bus segment picks up next fiscal we will see the share of CNG ballooning. Going forward, and in the short to medium term, we can envisage CNG trucks and buses to constitute 23-25% of overall sales in the SCV, ILCV trucks and buses.

The limitation is that in case of trucks the power ratings of CNG engines are limited to 100 kW (135 HP). In respect of shared mobility, there has been a spate of tenders from STUs for converting (retrofitment) a certain volume of diesel buses to CNG and LNG and very clearly with a view to cutting down the diesel costs. Kerala State Road Transport Corporation, Maharashtra State Road Transport Corporation, Nagpur Municipal Corporation, Pune Mahanagar Parivahan Mahamandal Limited are amongst the early movers in this direction.

The STUs will also be able to extend the life of buses by seven more years beyond the eight years and avoid Green Tax that comes into effect from April 1, 2022 for 8+ years’ public transport vehicles. While there is not much data on aftermarket CNG retrofitment kit sales for CVs, the assessment is that it must be very robust and across vehicle segments including MHCV trucks, especially construction and quarry tippers. India’s CNG demand is projected to double between 2020 and 2024 while there are very strong indications in respect of an upward revision in regulated gas prices.

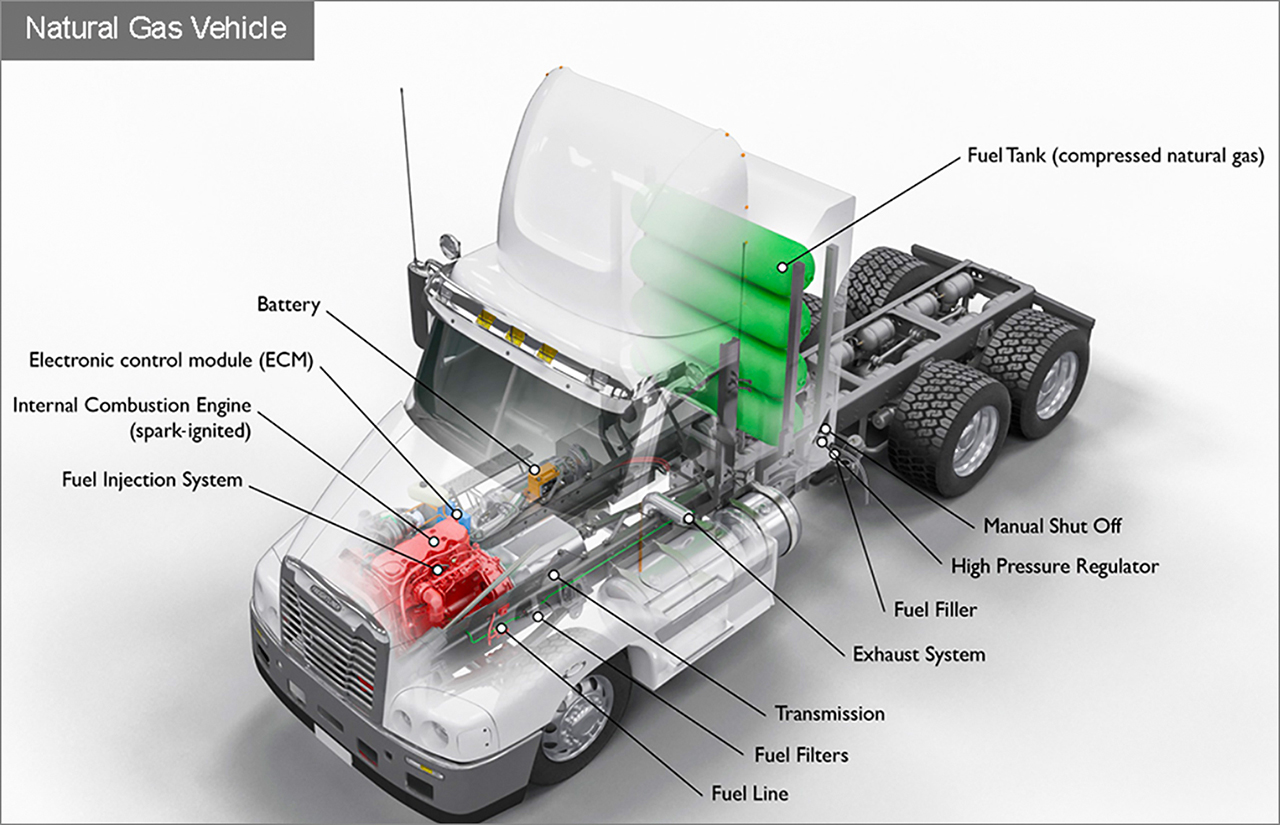

Liquefied Natural Gas (LNG)

With manifold benefits in terms of reducing vehicular pollution, forex savings i.e. the import bill of the country and the operating cost benefits for fleet operators, vehicle manufacturers and other players in the gas domain are working at a frenetic pace for use of LNG as a transport fuel .The Ministry of Petroleum and Natural Gas has outlined a USD 60 billion investment for creating gas infrastructure in the country till 2024, and gas’ share in the energy mix is expected to rise to 15% from the current level of 6% by 2030. Clean mobility solutions with greater use of LNG as a transportation fuel, including long-haul trucking, will be the norm.

A study reveals that there is a potential for LNG to take a share of at least 10% of the total 10 million trucks in India. The long-haul trucking segment and the mining sector have shown interest in the conversion of heavy vehicles and equipment to LNG – with LNG 30-40% cheaper, logistics costs will come down. LNG retrofit plans are underway not only for larger class mining trucks but also the huge fleet of 100 ton class Caterpillar, Komatsu and BEML trucks that operate with Coal India and its divisions, iron ore miners like Tata, JSW Steel, NMDC, etc. as well as large contract mining companies in the private sector. The higher energy density compared to CNG makes LNG a favourable option for long-haul trucks and buses. A 600-800 km run on a single fill means a lot for interstate operations.

We are set to witness investments of around Rs 10,000 crore over the next three years for creating LNG infrastructure for long-haul transportation. This will include the setting up of 1,000 LNG stations of which around 150 such fuel stations are expected to come up on the golden quadrilateral where LNG stations will be spaced at 200 kilometres. One of the first LNG stations has already been set up at Nagpur in July where LNG is retailed out at Rs. 62 per kg. The Indian Oil Corporation, which has obtained several licences in recent years, plans to build LNG stations in its areas. GAIL (India) is also in talks with ExxonMobil and Mitsui, which can potentially partner as LNG suppliers as well as financiers for the initial lot of LNG trucks planned to hit Indian roads. The stations will connect the four metros cities of Delhi, Mumbai, Chennai and Kolkata besides industrial hubs and mining areas. The CV OEMs obviously are working on prototypes to seize the opportunity that is expected to unfold over the next 12 months.

Hydrogen Fuel Cells

In the Union Budget 2020-21, there was an announcement of a National Hydrogen Energy Mission (NHM) and as part of the renewable energy development it received an allocation of Rs 1,500 crore – the overall goal being 175 GW from renewable sources by 2022. Besides fulfilling the objective of reducing the import dependency on fossil fuels, it would facilitate meeting the Paris Climate Change protocol. Among the biggest challenges faced by the industry for using hydrogen commercially is the economic sustainability of extracting green or blue hydrogen.

The technology used in production and the use of hydrogen as for example hydrogen fuel cell technology is at a nascent stage and expensive. Commercial usage of hydrogen as a fuel requires massive investments in research and development and creating the infrastructure for production, storage, transportation as well as developing the demand. Here is the status region-wise:

Europe: A new common-interest alliance called H2Accelerate (H2A) is aiming to help hydrogen trucks achieve a breakthrough across Europe. The initiative is backed by Daimler Truck, Iveco, OMV, Shell and the Volvo Group. The alliance plans to put the first hydrogen trucks on the road with the help of customers who ‘commit to this technology at an early stage’. Initially, the trucks are expected to operate in regional clusters and along European transport routes with high-capacity utilisation backed by good hydrogen filling station coverage. Over the course of the decade, H2Accelerate then aims to link these clusters with each other, creating a Europe-wide network.

USA: There are many OEMs adapting hydrogen fuel cell technology for use in heavy-duty Class 8 trucks. Toyota Motor North America (TMNA) and Hino USA have agreed to jointly develop a Class 8 fuel cell electric truck (FCET) for the North American market. Cummins and Navistar are working together to develop a Class 8 electric truck powered by hydrogen fuel cells. Hyundai too announced plans to sell hydrogen fuel cell-powered trucks in the United States by 2022. The US rollout will add to Hyundai’s current hydrogen truck operations in Switzerland, where the first 10 of the Xcient fuel cell trucks were shipped in October 2020. The challenge for OEMs will be the adoption of zero emission fuel cell technologies that are viable for commercial fleets on TCO basis.

India: A new energy transition coalition consisting of Indian corporates and global majors, the India H2 Alliance (IH2A), focuses on commercialising hydrogen technologies and systems to build a net zero carbon infrastructure. It is expected to build the hydrogen economy and supply chain and help develop blue and green hydrogen production and storage as well as build hydrogen-use industrial clusters and transport use-cases with hydrogen-powered fuel cells. The focus will be on industrial segments like steel, cement, fertiliser, oil and gas, ports and logistics as well as heavy-duty transport use cases. The alliance will also establish standards for storage and transport hydrogen in pressurised and liquefied form. Early days, but the beginnings have been made.

Electric Vehicles (EVs)

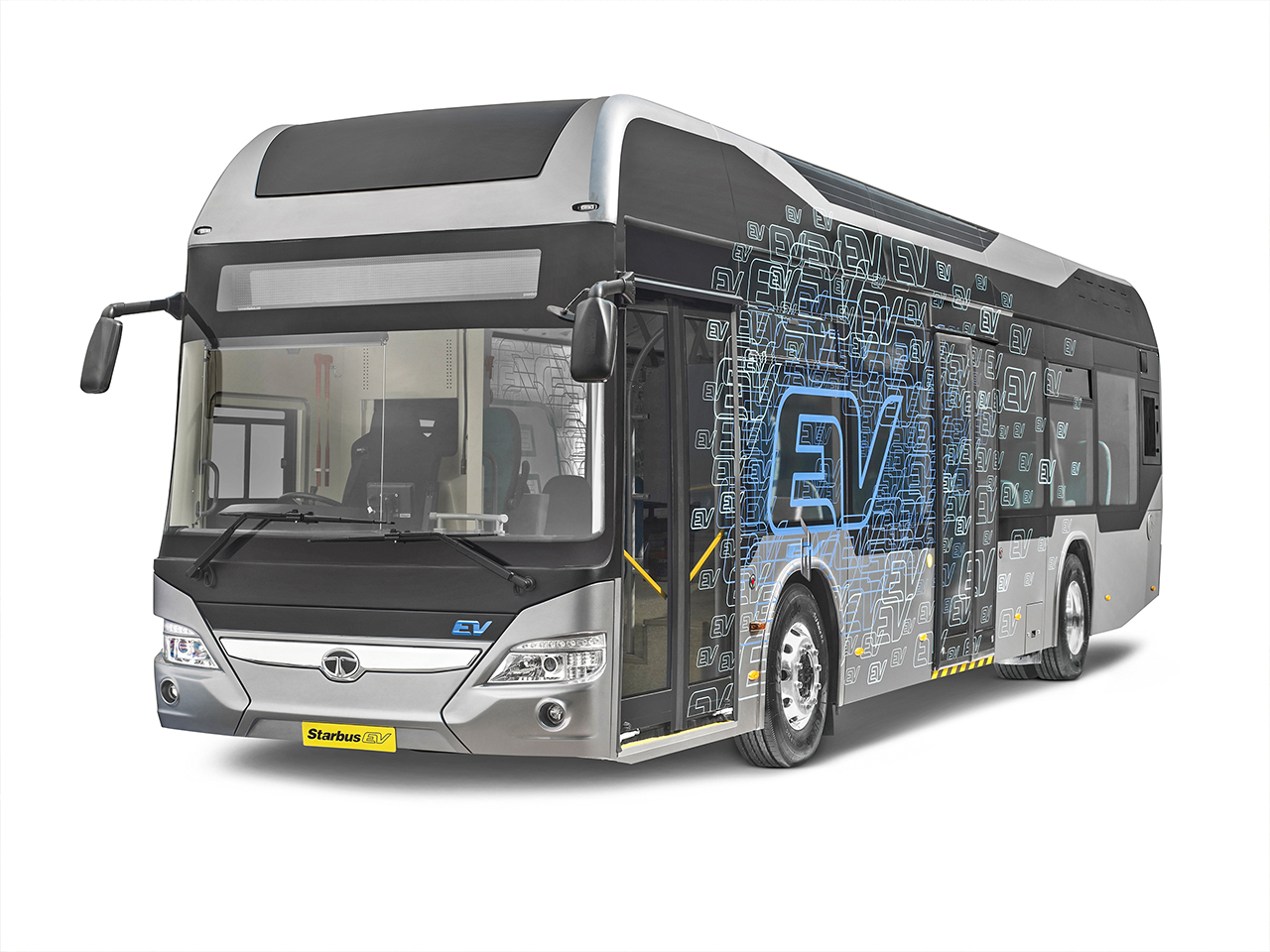

The proliferation of EVs in the automobile sector in India is being witnessed largely in the two-wheeler and three-wheeler areas besides to an extent in intra-city buses and passenger cars. Decarbonising shared mobility, particularly in cities for intra-city commuters, took off in 2019 and orders were placed by 64 cities under FAME I (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) launched to encourage progressive induction of reliable, affordable and efficient electric and hybrid vehicles (xEVs). As of April 2021, over 1,100 electric buses are on the roads out of the nearly 5,595 buses.

FAME II with an outlay of Rs 10,000 crore for a period of three years commencing from April 1, 2019 is set to incentivise demand creation for xEVs in the country. This phase aims to generate demand by way of supporting 7,000 electric buses, 5 lakh three-wheelers, 55,000 four-wheeler passenger cars and 10 lakh two-wheelers. From a SCV and ILCV perspective we are still some years away as the hygiene issues of vehicle cost (including TCO), battery longevity (life) and range on a single charge besides charging infrastructure, finance availability and impact on payload have to cover considerable ground. A reasonably well thought through estimate is that while the EV growth will be bottom up from SCVs and intra-city vehicles and backed by fiscal incentives, I do not see the EV sales needle moving till 2025 unless the battery prices come down significantly.

The lead will be taken by ESG-conscious MNCs and corporations like Amazon, Flipkart and DHL to name a few who have considerable intra-city cargo movement. According to industry experts, BEVs will be commercially feasible only when the battery pack cost per kWHr goes down to USD 100 and that is expected only around 2023-24. Meanwhile, in Europe, an unprecedented agreement between truck majors Volvo-Daimler-Traton (the group that owns Scania, MAN) will lead to a collective investment of Euro 500 million to install and operate at least 1,700 high-performance green energy charging points close to highways as well as at logistic and destination points within five years from the establishment of the JV. The objective is to deliver CO2-neutral transport solutions to achieve climate neutrality by 2050.

Conclusion

Increasing environmental consciousness, growth in ‘smart’ and ‘clean’ cities, government policies and regulation on carbon dioxide emission limits, spiralling petroleum prices, incentives for EV purchases and investments in charging infrastructure are going to provide impetus for the adoption of new-age fuels. The transition to a sustainable energy economy will see a churn in India’s energy basket. The automotive companies will need to smartly toggle between ICE and new fuels while not losing out on their desire to be at the forefront of new fuel technologies including connected and autonomous so that they can successfully deliver efficient, flexible, cost-optimised and sustainable mobility solutions.

—

The staggering growth in CNG LCV and ICV sales in India and particularly in the last two years, and continuing, is on account of various factors:

1. The cost of CNG in rupees per kg is 48% that of diesel in rupees per litre. For example, in Delhi CNG retails at Rs 43.40 per kg while diesel sells at Rs 89.87 per litre.

2. The fuel mileage in kmpl is identical for a CNG and diesel truck. On a monthly running of 7,000 km the CNG trucks can earn nearly Rs 30,000 more than a diesel truck.

3. Post BS-VI and particularly in the LCV and ICV segments CNG truck prices have seen relatively lesser increase compared to diesel trucks that now have an additional consumable, Ad Blue as diesel exhaust fluid.

4. The initial cost of a CNG LCV and ICV compared to an equivalent in diesel is cheaper in terms of MRP by about Rs 1 lakh approximately.

5. The spread of CNG stations across the country has risen to 3,343 stations as of April 30, 2021 and the Ministry of Petroleum and Natural Gas has plans to expand the footprint to 10,000 stations by 2030. Licences have been awarded to several players in the private sector as well.

6. With the growing expansive footprint of CNG stations, OEMs too have expanded the range of variants in the offerings which now span across from SCVs to 16T GVW ICVs. With CNG tank capacities of intermediate and light commercial vehicles ranging from 180 litres to 565 litres, truck operators are confidently able to do regional distribution as well as in some cases long distance interstate trips.

—

The author was formerly Executive Vice President-Sales, Marketing and Aftermarket at Volvo-Eicher Commercial Vehicles Ltd. The views expressed by the author are his personal opinion and do not necessarily reflect the views of Motorindia.