The new norms on axle load, expected to be announced by the Government soon, will alter the landscape for commercial vehicles (CVs) in the country.

The current laws have been in vogue for 35 years. The maximum allowable axle load and gross vehicle weight (GVW) of commercial vehicles were notified in 1983, based on the recommendations of a committee set up for the purpose. These were reconfirmed in 1996.

The recent stringency on overloading has led to an increase in the cost per tonne of sand, stones and other construction material, which is hindering implementation of projects the Government is keen to fast-track going into the election year. Contractors who had bid for the contracts, especially in affordable housing and road construction, keeping certain rates for these commodities in mind, are finding it difficult to execute the projects.

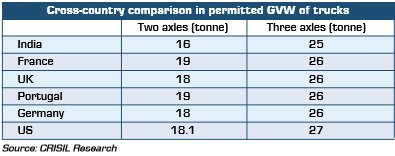

In view of these concerns, the Government is believed to be contemplating new axle norms. As per media reports, the maximum axle load could be increased by as much as 20-25%. This would bring India’s permissible truck axle load limits to the levels prevalent in developed nations.

We believe there are two ways the change in norms can be implemented – an increase in axle load limits for all trucks, or only on new sales. Depending on the option the Government chooses, we look at how the impact would play out:

- If axle load limit of all operational trucks is increased

If the revised norms increase the freight capacity of the entire population of trucks currently operational in India by 20-25%, it will have a visible impact on inter-State movement, which accounts for the bulk of primary freight and where overloading is limited.

A good year sees a billion tonne kilometre (BTKM) growth of 7-8%. Hence, a 20-25% increase in freight carrying capacity would be equivalent to three years of incremental freight demand.

The other impact would be spot freight rates would soften. Large fleet operators, carrying dense bulk commodities, would be able to carry more freight, improving their margins; contractual freight rates would remain resilient until the contracts are renegotiated; and the logistics costs of most companies will come off. This would be positive for infrastructure projects as moving construction material to project sites would turn cheaper.

Competitiveness of small fleet operators would erode

Small fleet operators would be impacted as efficiency gains from being able to carry more rated load per trip would be passed on through lower spot rates.

Besides, the increase in the freight capacity would be less meaningful for intra-State movement where overloading is prevalent – much more than in inter-State movement.

In select States in the north and the east, for instance, the move is only expected to make the current overloading legal. Thus, there would be limited benefit for small fleet operators – it would, in fact, reduce their competitiveness.

Fleet utilisation would fall, impacting CV sales

Increase in supply capacity (owing to the new norms) on trunk routes would lead to a reduction in fleet utilisation for large fleet operators as they would need fewer trucks to carry the same amount of load. Given this, these operators would halt fleet additions until utilisation reaches an optimal level.

Sales of haulage trucks could fall, though tippers, which generally ply intra-State and tend to be overloaded, would be less impacted. Therefore, the tonnage segments on which the norm would be applicable would be a key monitorable.

Trend of shift to higher tonnage vehicles to subside

Stricter implementation of overloading ban had led to shift to higher-tonnage segments such as 37T trucks and 49T T-trailer from 25T and 31T rigid trucks and 40T trailer.

With the change in norms, this shift will subside. Also, considering the current 37T rigid vehicle will have 20% more carrying capacity (taking its GVW to around 44 T), it remains to be seen how the market requirement shapes up for the yet to be launched 41/43T rigid trucks, which would have even higher GVW capacity given the new axle norms.

- If the axle load limit is increased only for new trucks

If only trucks sold after the implementation of the norm are eligible for the higher rated load, transporters could halt purchases of new trucks until the new norms become applicable and then replace as many of their existing fleet with new trucks with revised rated loads. This would lead to a surge in CV sales in the year of implementation of the norm.

With a large number of trucks being replaced, transporters will fetch lower resale value for the trucks that they would be selling, hampering their income.

Besides, execution of this option would be difficult, given that it would be challenging to monitor overloading keeping an additional parameter of manufactured date as a criterion.

Considering the pros and cons of both these options, we believe the norms would be applicable to the population park. This is because, many old vehicles are being used for Government projects, and with no material change in the axle on new trucks, limiting older vehicles with similar axles to a lower-rated load might not be acceptable to transporters.

By Binaifer Jehani, Director, CRISIL Research