Raising the stakes higher in the small commercial vehicle (SCV) space, Tata Motors showcased an all-new rugged and powerful compact truck at a media event near Mumbai, ahead of its official launch, to turn the knob further on the competition. Although the vehicle was first displayed at Auto Expo 2018, Tata Motors explained in detail how the new Tata Intra will combine visual richness and sophistication with robustness and reliability to push the ‘premium tough’ philosophy for commercial vehicles in the segment they created in 2005 with the launch of the super successful Tata Ace.

Positioned as a product that will dominate the market in its segment, Mr. RT Wasan – VP, Sales and Marketing, CVBU, Tata Motors, said: “The new truck you see is the result of customer testing across the country. The participants were asked to rate the vehicle (before they were shown the brand) on interior, technical prowess, given a test drive and on the likely price. This survey helped us reach on a best power and acceleration combination that formed the basics of the customers’ requirement, followed by cabin comfort, low NVH and exterior.”

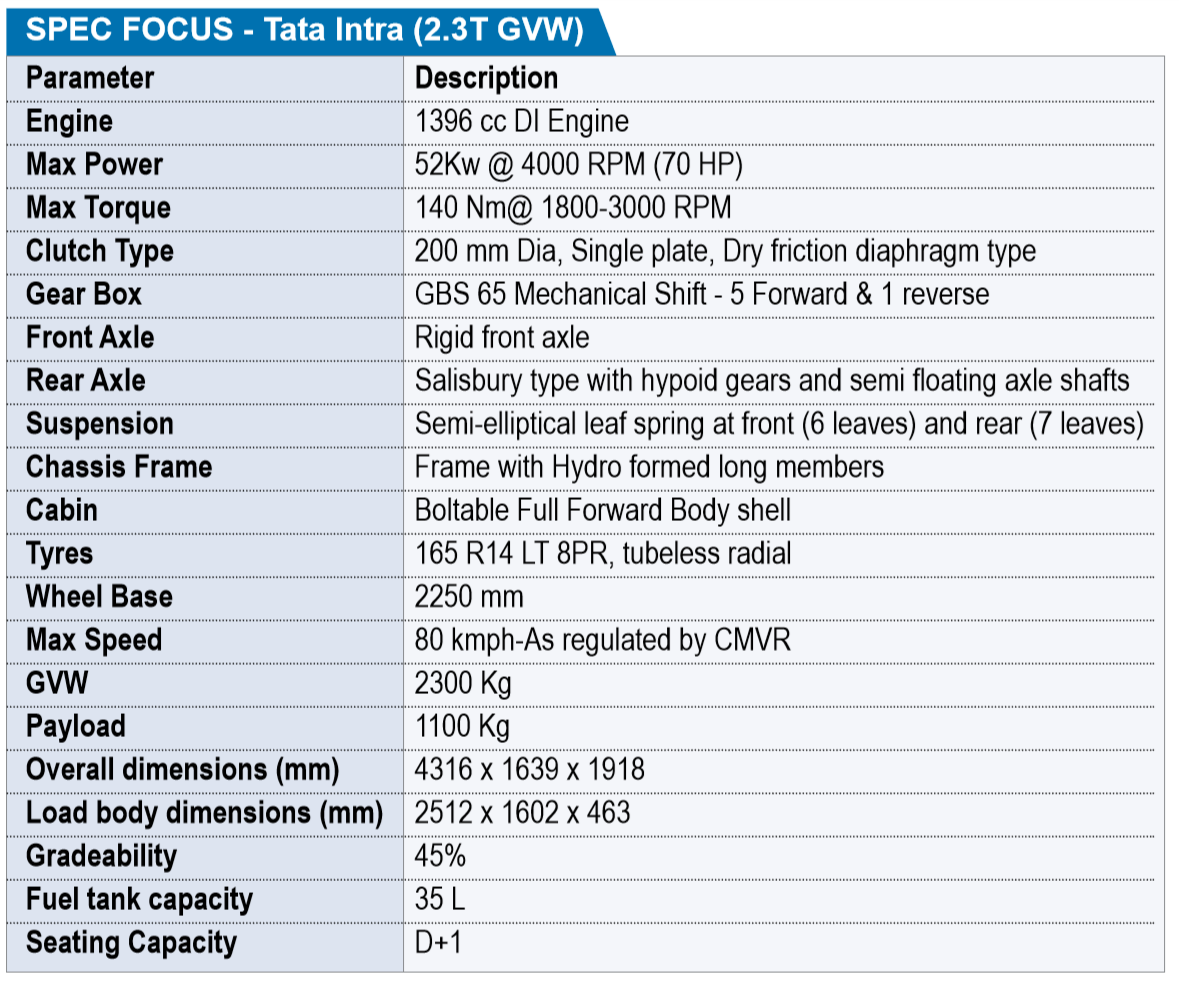

And then the plot thickened. The designing feedback was incorporated. The vehicle is fitted with a new generation powerful DI engine with 70 hp & 140 Nm torque for faster trips and low turnaround time. The 5-speed (dashboard mounted) gear box with cable shift mechanism offers a pleasurable driving experience. The Intra also offer an industry first – gear shift advisor (GSA) in a commercial vehicle. GSA guides the driver to select the correct gear and accordingly assists to shift up or down so that fuel efficiency can be optimised. The chassis frame with hydro-formed long members and fewer joints aids in low NVH and sturdiness.

The 14-inch radial tyres with superior load carrying capability for varied terrains and long tyre life, best-in-class gradeability of 45% for easily negotiating steep hilly roads and flyovers, quick acceleration and a top speed of 80 kmph for faster turnaround time will help the customer enhance productivity.

For a pleasurable driving experience, the Intra has a walk-through cabin, which is big and wide even for a 6-foot tall person, with smart interiors and comfortable D+1 seat. Large loading deck of {2512 mm (8.2 feet) long x 1602 mm (5.3 feet) wide} is believed to help in earning higher revenue and profits.

Despite the length, the Intra boasts of a low turning circle radius of 4.75m for easy manoeuvrability even on narrow and congested roads. The vehicle which comes with a 2300 kg GVW offers a payload of 1100 kg. It is able to take the load smoothly and at optimum pace even on rough roads due to its 6 semi-elliptical leaf spring in front and 7 leaves at the rear.

Topping the ‘Ace’

Given the superlative specifications, clearly the rationale behind the Intra is to give customers something bigger and better which is a level beyond the Ace. Giving the fundamental reason for introducing a new vehicle on a new platform rather than adding a variant in the Ace family, Mr. Vinay Pathak, Product Line – Head, SCV, Tata Motors, said: “Over the years the duty cycles have changed. Today the customers need a vehicle that meets the combination of both the first mile and the last mile at a superior power, performance and pace. In an Ace, a customer would typically earn Rs. 25,000-30,000 a month, whereas in an Intra he could earn Rs. 40,000-50,000. So, the positioning, the duty cycle range is different between the Ace and the Intra.”

However, the pertinent question raised during the launch was whether the Intra was to entice customers to buy a better vehicle during the BS-IV regime than buying an Ace during the BS-VI regime (assuming the pre-buying that may happen before BS-VI due to the expected increase in rate for BS-VI vehicles). Mr. Pathak denied: “Our customers buy vehicles as per their need and for their livelihood. Their calculation is to meet the current requirement and might not want to think of pre-buying factor. They are not big fleet operators with money to deploy ahead and take the cost benefit. Therefore, it is not a tactical strategy to enhance the pre-buying for the Intra, but a tactical segment creating product. The Ace will continue during the BS-VI phase and will continue to be a very strong brand with newer variants coming from time to time.”

Summing up the debate on the subject, Mr. KG Prasad, Head Sales and Marketing, SCV and Pick-ups, Tata Motors, asserted: “Just like a Tata Ace customer earns more and performs better than a person owning a cargo three-wheeler, the Intra customer will have an edge over the one with the Ace. Not only is the capability the difference between the Ace and the Intra, there will be difference between the customer profiles, applications of the person buying these vehicles.”

The Intra customer profiles would likely be for mineral water distribution, fruits & vegetables, industrial goods, foodgrains, construction materials (cement bags, tiles, marble, glass, sand, etc.), hardware items, LPG distribution, lubricants, plywood, etc., on a much faster and optimum payload than the existing Ace vehicles.

Exclusive interview with Mr. R.T. Wasan, Vice President – Sales and Marketing – Commercial Vehicle, Tata Motors

“The growth in the hub-and-spoke model, the fast emergence of e-Commerce industry and the evolving demand from rural markets, added with improved road connectivity and increased overall consumption, is all leading to strong growth in the SCV space in the coming years”, says Mr. R.T. Wasan, Vice President – Sales and Marketing – Commercial Vehicle, Tata Motors.

Mr. Wasan tells us about the new Intra, the runaway success of the Tata Ace, and how the company plans to further build on its first-mover advantage in the segment.

Excerpts:

With the SCV segment posting impressive growth in the last five years, how has your experience been in this regard?

The commercial vehicle industry has seen strong growth having rebounded from the impact of the BS-3 to BS-4 transition, the initial uncertainty around the GST implementation during the first quarter of 17-18. Since then, the industry has been growing across all categories, including MHCVs, ILCVs, SCVs and pick-up segments. Our SCV cargo and pick-up segments recorded a growth of 25 per cent in FY 2018-19 as compared to last year. The growth is driven by the fast emergence of the e-commerce sector, the Swachh Bharat initiative and the continued evolution of the hub-spoke model. The growing rural consumption has also led to small vehicles demand for last-mile connectivity.

The timely launch of a range of new and technologically superior products, including the Ace Gold and Yodha pick-up, along with fully built solutions across platforms, have contributed to the robust growth in our volumes, while also helping Tata Motors to gain market share. Our enhanced customer experience, with the full platter of value-added services under the banner of Sampoorna Seva, including the Tata Alert, Tata Suraskha, Tata Delight and many others, are all appreciated by our customers leading to not only repeat purchases but also a positive word of mouth.

We are confident that with the launch of the ‘Intra’, our new compact truck, and other upcoming products, enhanced customer-focused strategies and introduction of path breaking technologies and innovations, we will be able to grow our market presence in FY 2019-20.

Elucidate on your SCV product range. Any new products on the anvil?

Tata Motors has been the pioneer of the concept of mini-trucks in India. The Tata Ace has proven to be a strong, reliable, best performing mini-truck which has provided over 2 million customers a means of livelihood and employment. Since its inception in 2005, businesses have relied on Tata Ace for their transport and logistics needs. Today, more than 2 million vehicles on the Ace platform are plying on our roads.

Currently, the Tata Ace family comprises of models like Ace HT, Ace Gold, Zip, Mega, XL range and Mint for SCV cargo, and Magic, Mantra and Iris for passenger applications. Our SCV range comprises of multiple variants of fuel (diesel and CNG) and applications (ARAI-certified container, high deck load body, half deck load body, various municipal applications, etc).

Debuting on a whole new platform is the Intra, a product born out of strategic market study and feedback from existing and potential customers. It is conceived in such a way that it will not overlap with the Ace family. Both are distinct products and have their respective space in the market. A customer looking for a basic entry-level product in the CV space will go for Ace and one looking for higher load and performance will go for Intra.

How are the SCV passenger applications models performing?

Tata Magic and Magic Iris, in particular, have been category creators in the SCV passenger segments they operate in today. They provide for an optimum last mile public transport solution, for operators and commuters alike. Today, about half a million vehicles in the last mile public mobility services in the country boast our moniker.

As a leading automaker, Tata Motors is constantly engaged with our customers to assess their stated and unstated needs to continuously come out with new products and services to meet their future requirements. This effort will continue to be invested and we will see more new products and service offering in the days to come.

What is the percentage of SCVs in your total sales? Any changing trends according to you?

Currently SCV contributes to around 40 per cent of the overall Tata CV sales. With maturation of the hub and spoke system and increase in rural and urban consumption, their contribution is likely to see an increase in the upcoming years.

What according to you are the technological megatrends that shape the SCVs in India?

A slew of Government regulations and rising fuel prices have pronounced the need for lightweighting. Lightweighting options and other innovative processes not only result in weight reduction but also enable cost savings over a period of time. An efficient small commercial vehicle can provide more space while facilitating superior performance and increasing the total revenue from operations.

With the advent of BS-VI, the use of electronics and after treatment technologies are likely to increase in SCVs, which will also impact consumers’ buying costs. We are also seeing an increasing trend of adoption of alternative fuels by our customers.

Further, the electrification trend is also emerging now. Tata Motors is keen on introducing new products and technologies from time to time to meet the evolving needs of the market space. Continuous development is being done on multiple fronts.