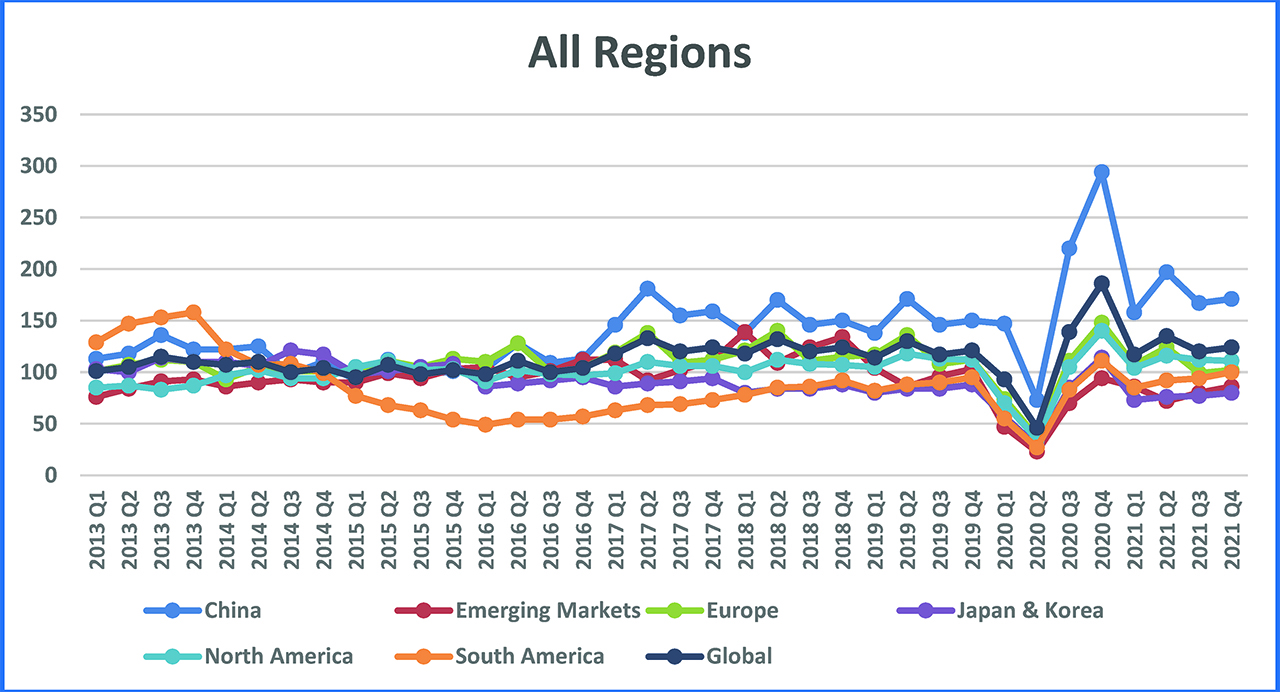

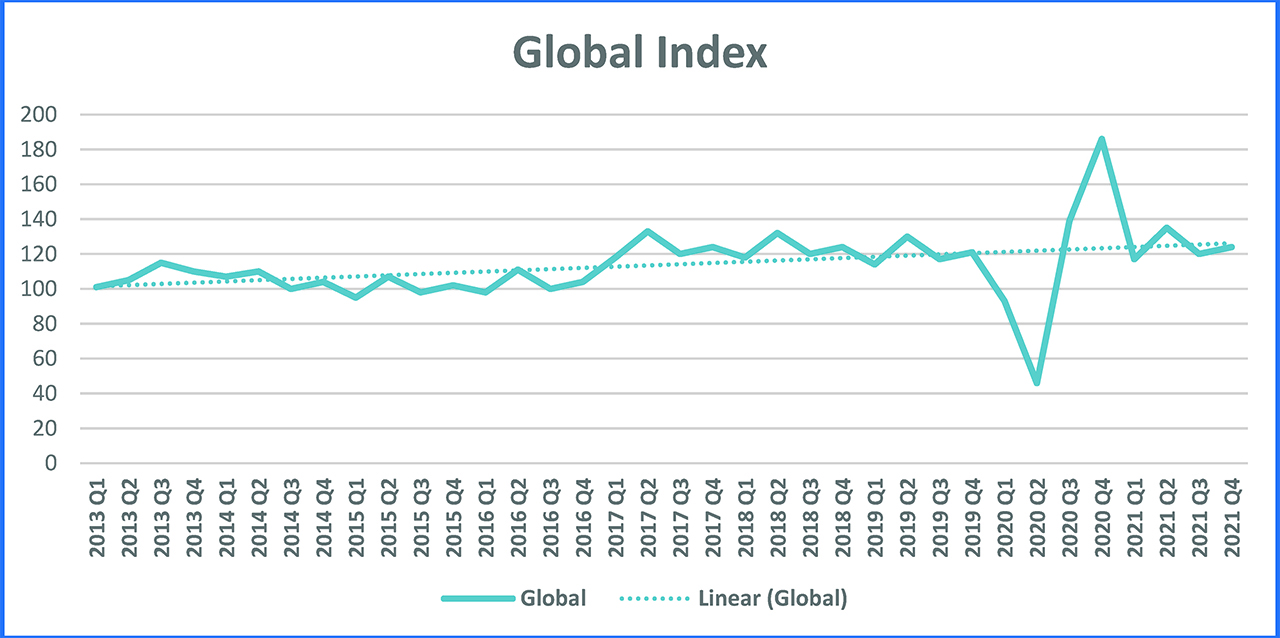

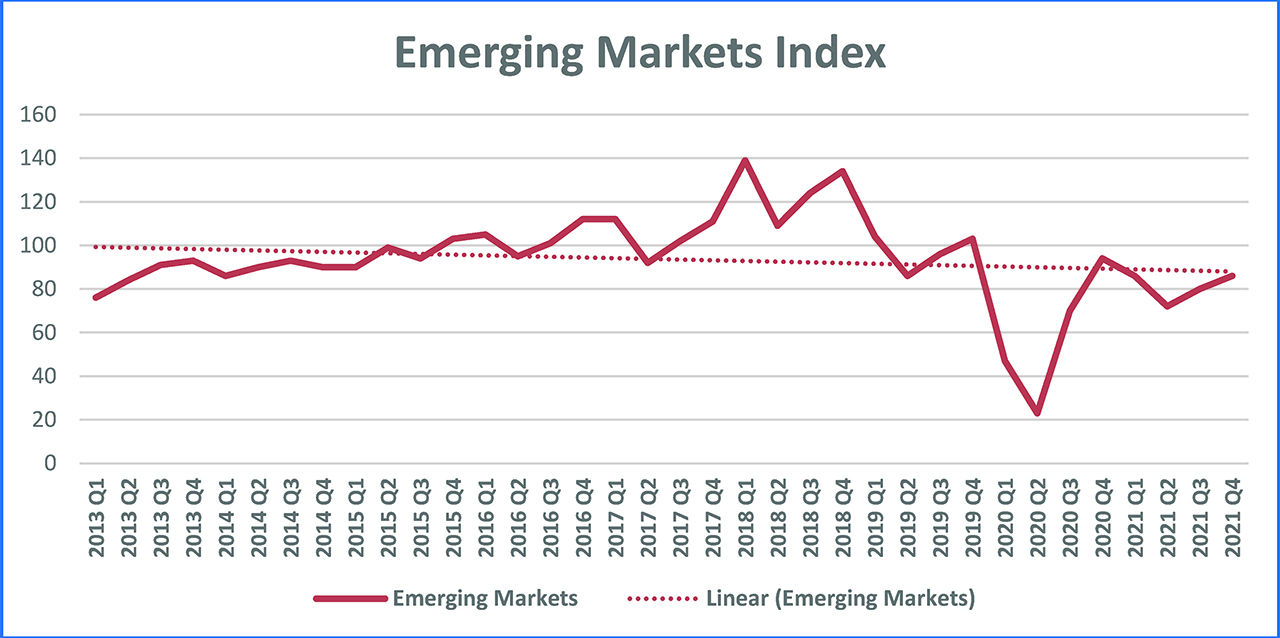

The Power Systems Research Truck Production Index (PSR-TPI) increased 193.5% year-over-year (Q2 2020 to Q2 2021), moving from 46 to 135. For the three-month period ended June 30, 2021 (Q1 2021 to Q2 2021) the TPI climbed 15.4 %, increasing from 117 to 135. The PSR-TPI measures truck production globally and across six regions: North America, China, Europe, South America, Japan and Korea and Emerging Markets. This data comes from OE Link™, the proprietary database maintained by Power Systems Research.

Except for China, all regions are expected to experience solid commercial vehicle demand growth this year and into 2022. Chinese heavy truck demand is expected to decline this year primarily due to the implementation of the China VI emission regulations that adds cost to the vehicles but no significant improvement in fuel economy.

Global Index

Overall, medium and heavy truck demand will finish the year on a strong note and continued strength is expected into 2022. Ongoing supply chain disruptions will continue to impact production throughout the rest of the year and possibly into 2022.

North America

In the United States, freight demand remains extremely strong and freight rates very high primarily due to high levels of consumer spending and the overall strong economy. While the demand side is very strong the supply side is where the issues lie concerning medium and heavy truck production. The ongoing issues with the supply chain are expected to continue for the remainder of the year and possibly into 2022 as OEMs continue to have difficulty sourcing various components such as semi-conductors. While the 2021 Class 8 truck order boards are mostly filled and orders for next year are also expected to be strong, there are some concerns surrounding higher levels of inflation. Ongoing supply chain disruptions, worker shortages and possible negative effects from high levels of government spending could fuel higher inflation moving forward.

Europe

During the first four months of the year, European medium and heavy commercial truck registrations improved by 28.5% compared to the same period in 2020. Order bookings remain strong primarily due to an improved economy. However, Europe is facing the same problems as other regions with various supply chain disruptions. While sourcing of semi-conductors continues to be a problem, the EU’s proposal to extend the restriction on steel imports into Europe remains a point of concern. While most of the steel is sourced in the EU, imports are needed to fill in the gaps, especially during periods of high vehicle demand.

South Asia

Medium and heavy commercial vehicle production in India is expected to reach 2,61,000 vehicles in 2021 which is an increase of 55% over last year. Moderate growth is also expected in 2022 and 2023 before declining in 2024 partially due to it being an election year. The medium and heavy truck segment will continue to face headwinds due to excess capacity in the market, increased rail freight usage, relative constant freight rate and booming fuel prices. Further, we are witnessing a change in product dynamics–the share of higher tonnage vehicles is rising. Because of this trend, fewer trucks will be needed to haul the same amount of freight.

South America

Medium and heavy commercial vehicle production is expected to increase by 36% this year over 2020 with truck production improving by 41%. Increased vaccinations and an overall improving regional and global economy are driving the growth in vehicle demand. However, continued supply chain disruptions are negatively impacting production and this trend is expected to continue throughout the remainder of the year.

Japan/Korea

Medium and heavy commercial vehicle production in Japan and South Korea is expected to increase by 16% this year over 2020. While South Korean production is expected to increase by 28% this year, Japan production continues to lag and is expected to improve by 14.8%. Japan has been hit particularly hard by the supply chain disruption. PSR expects continued volatility in this region throughout the remainder of the year.

Greater China

Heavy truck demand during the first half of the year was strong primarily due to a truck pre-buy ahead of the China VI emission standard implementation in July 2021. The cost of the emission technology for China VI vehicles is not offset with any significant improvement in fuel economy. The heavy truck growth rate changed from positive in April to negative in May. Also, in May, the inventory of heavy trucks exceeded 3,00,000 units. Considering that June to July is the off-season, the short-term heavy truck sales are expected to experience downward pressure. The industry is currently expecting production of heavy trucks to be approximately 1.4 million which is a decrease of 14% compared with 2020.

The next update of the Power Systems Research TPI will be in October 2021 and will reflect changes in the TPI during Q3 2021.