The Society of Manufacturers of Electric Vehicles also feels there needs to be greater awareness about the benefits of ‘green’ vehicles before EV manufacturing, sales and infrastructure can post impressive growth

Over the past few years, the Indian electric vehicle (EV) industry has witnessed decent growth. The EV industry sold 2,36,802 electric vehicles, including electric two-wheelers (E2W), electric three-wheelers (E3W) and electric four-wheelers (E4W) in FY20-21. In the E2W segment, the industry registered sales of 1,43,837 units, which include 40,836 high-speed and 1,03,000 low-speed E2W. The sales of E2Ws declined by 6% in FY21, having registered sales of 1,52,000 units in FY20. The E3W segment registered sales of 88,378 E3W as against 1,40, 683 units sold in FY20. The data doesn’t include E3Ws that are not registered with the transport authority. In the E4W segment, the industry witnessed registration of 4,588 units compared to 3,000 units in FY20.

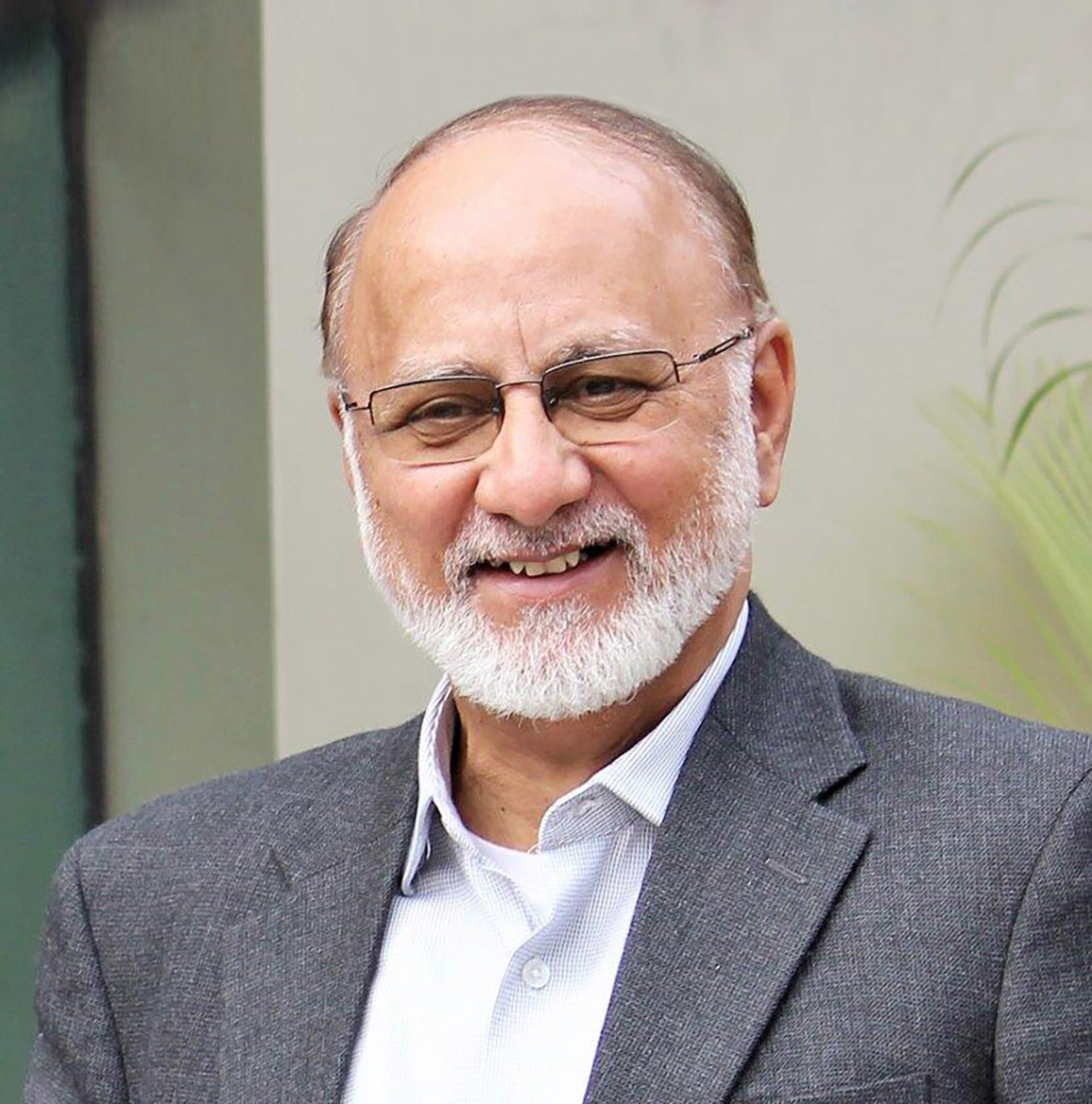

Commenting on the sales report, Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV), said, “We were anticipating good growth before the start of FY21 but sales remained stagnant due to various reasons. The sales in electric three-wheeler and two-wheeler segment stood low as compared to last year. A good thing has happened that people have started moving towards advanced batteries i.e. lithium. The city-speed and high-speed category in the two-wheeler segment have witnessed growth. However, a lot more needs to be done to achieve the target under the FAME II scheme. Timely intervention by the government in the form of policy change is required to fuel growth and achieve the target by the end of FY22.”

Bank Finance

A strong bank finance mechanism is still missing in the country. Only a few banks like State Bank of India and Axis Bank, to name a few, are offering loans on selected models. “The government should ask banks to offer loans on electric vehicles, which will augment sales,” the SMEV report suggests.

Awareness

Another important factor that would transform the industry is creating awareness about green vehicles. The central and state governments can play a crucial role in motivating and encouraging citizens to adopt e-vehicles. We have seen in the case of Delhi wherein the state government is doing a tremendous job in creating awareness, which has encouraged more people to adopt EVs.

B2B Segment

India’s e-commerce sector has shown a steep growth curve of over 200% YoY; hence its dependence on logistics increases proportionately. One major reason for the growth in EV adoption by B2B players is the cash factor – electric vehicles are cheaper to maintain compared to ICE vehicles. Corporates in India are also proactively transitioning towards electric vehicles. For instance, Amazon India and Flipkart have announced that they will deploy EVs in their fleet of delivery vehicles. “The future of the B2B segment is positive and we will see a lot of traction coming from this segment for the next 2-3 years,” the SMEV report points out.

State Government Policy

Many states, including Delhi, Maharashtra, Andhra Pradesh, Bihar, Chandigarh, Haryana, Karnataka, Kerala, Madhya Pradesh, Odisha, Meghalaya, Punjab, Tamil Nadu, Telangana, Uttar Pradesh and Uttarakhand have rolled out their EV policy. However, some states are yet to implement the policy. The early implementation of state-level policy could assist in creating a larger ecosystem in the country that would help the industry to grow at a much faster pace. Additionally, the state government policy should be focused on demand generation for the initial period that would help in getting more volumes on the road.

Charging Infrastructure

According to the SMEV report, there has been rapid movement in this space. Around, 1,300 charging stations have been set up till now. “Many corporates have ventured into the segment and started installing charging stations across the country. We anticipate that in the next 5-6 years we would be able to create a robust charging infrastructure in the country,” the report states.

Commenting on the sales report, Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV), said, “We were anticipating good growth before the start of FY21 but sales remained stagnant due to various reasons. The sales in electric three-wheeler and two-wheeler segment stood low as compared to last year. A good thing has happened that people have started moving towards advanced batteries i.e. lithium. The city-speed and high-speed category in the two-wheeler segment have witnessed growth. However, a lot more needs to be done to achieve the target under the FAME II scheme. Timely intervention by the government in the form of policy change is required to fuel growth and achieve the target by the end of FY22.”

—

Govt. extends validity of FAME-II certificates

The Ministry of Heavy Industry and Public Enterprises Department of Heavy Industry has extended the validity of FAME-II certificates. Earlier, FAME-II eligibility certificates issued by testing agencies and approval of models of electric vehicles by NAB/DHI was valid up to 31 March 2021. All vehicle models approved under this scheme were required to submit re-validation certificate for availing demand incentives under FAME-India Scheme Phase-II. To streamline the process and evenly spread it out, the Ministry has shared a notification stating “The FAME-II certificate will be valid for one year from the date of its issue for all approved vehicle models (e-2W, e-3W & e-4W). In addition, the OEMs/testing agencies are informed that all approved models will have to submit re-validation certificate within an additional timeline of one month from the last date of the validity of the certificate.”

The notification further added, “If the vehicle model(s) are not re-validated within stipulated time period, its registration with FAME-India Scheme Phase-II online web portal is liable to be cancelled. Once the model(s) is re-certificate/re-validated, it will be approved by DHI/NAB. Further, demand incentive for these vehicle model(s) sold after one year of certification date shall be admissible only if re-validation is done within an additional time of one month, as per Operational Guidelines issued by the Department for delivery of demand incentive under FAME-II Scheme.”