The Federation of Automobile Dealers Associations (FADA) has released the monthly vehicle registration data for November’20.

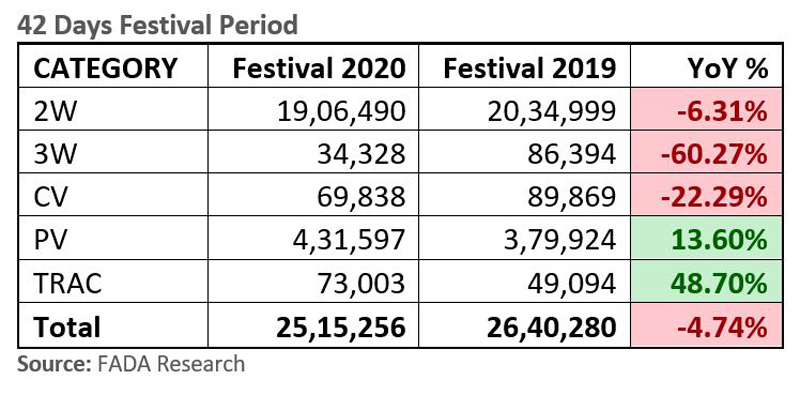

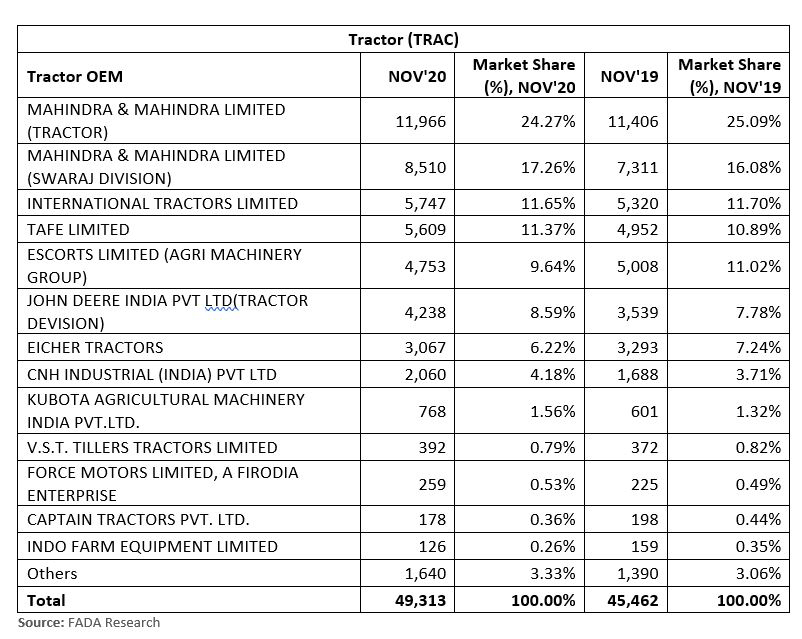

Tractors and PVs kept the festive spirits going by registering a growth of 48.7% and 13.6% but a bigger drop in 2W, CV and 3W by -6.31%, -22.29% and -60.27% respectively, pulled down the registrations by -4.74% during the 42-days festive period.

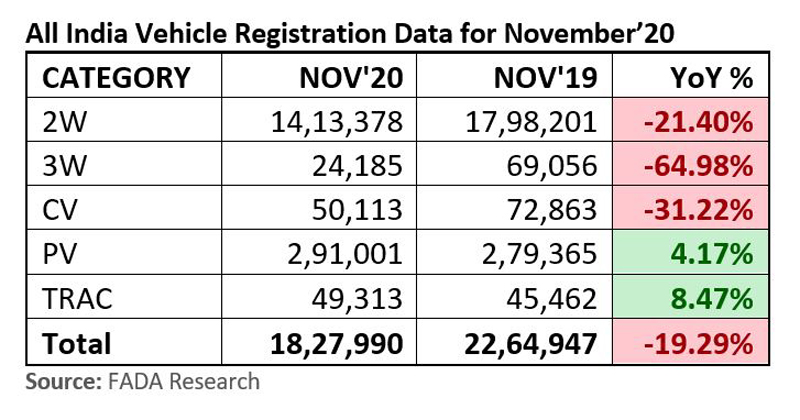

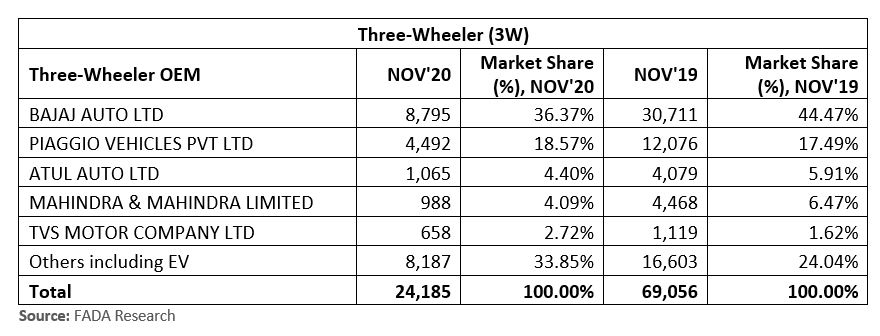

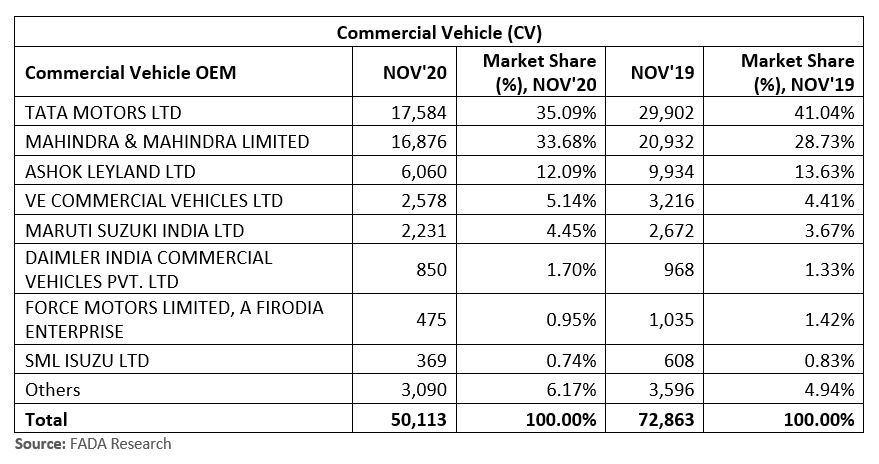

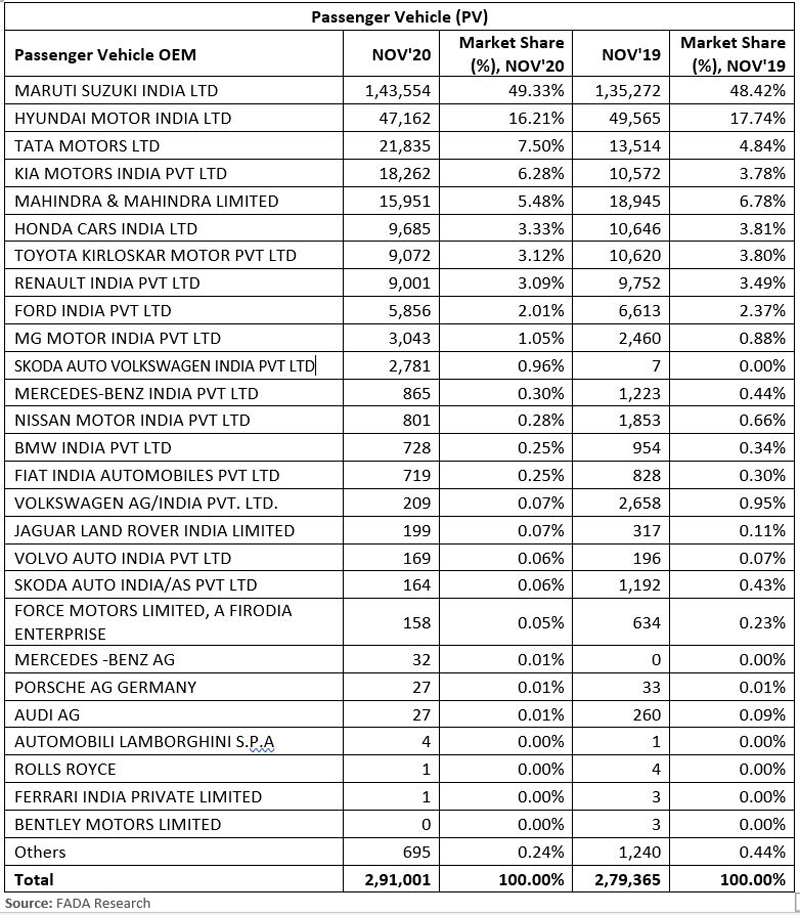

While vehicle registrations in November continued to grow by 29.32% on MoM basis, it fell by 19.29% on YoY basis. During November, tractors and PV grew by 8.47% and 4.17% YoY. 2W, CV and 3W continued to fall by -21.4%, -31.22% and -64.98% YoY respectively.

While inventory level for PVs (25-30 days) is now closer to FADA recommended range of 21 days, 2W inventory continues to be in high range of 45-50 days. PV dealers continues to face supply side issues.

FADA has once again requested the Government to increase infra spending (including timely payment) and urgently announce an attractive incentive-based scrappage policy to help revive the M&HCV segment.

November’20 Registration

Commenting on how November’20 performed, FADA President, Vinkesh Gulati said: “The automobile industry has seen one of the best recovery rates since unlocking began, as November continues to see positive momentum by growing 29.32% on MoM basis. On YoY basis, the negative slide continues with degrowth of -19.29%.

The 42-days festive period saw good traction in the current pandemic hit world as overall degrowth of -4.74% was much less than expectation. While registrations during Navratri were tepid, people came out in good numbers to purchase their dream vehicles during the Dhanteras – Diwali period. Tractor segment continued to gallop ahead. The fear of pandemic leading to safer means of travel for the entire family saw good sales in passenger vehicles as it grew in double digits at 13.6%.

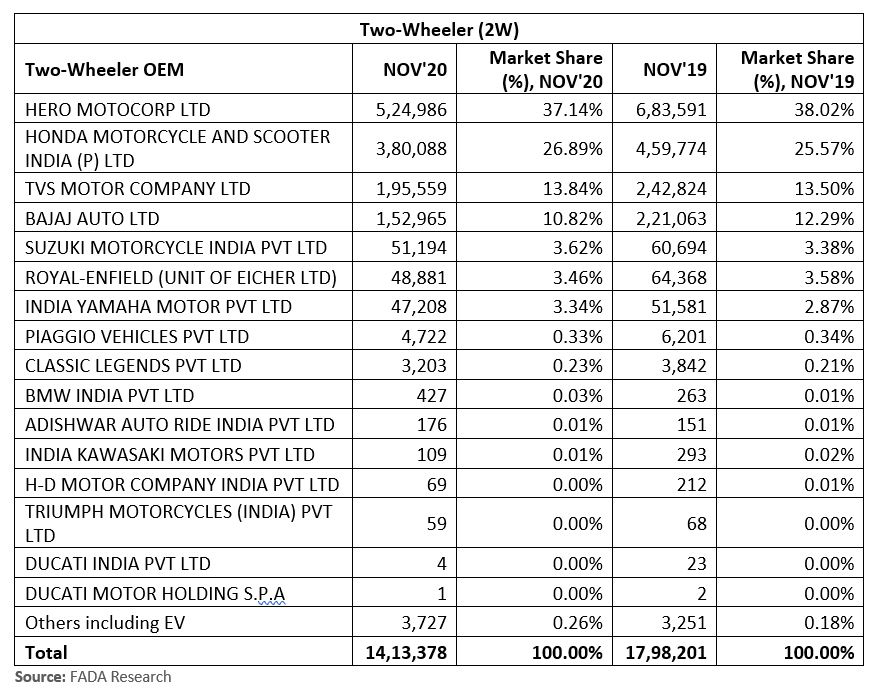

New launches and especially compact SUV’s continued to show good demand in PV segment. The focus in 2W continued its shift from 100cc to 125cc and above category due to good harvesting coupled with Dhanteras-Diwali and Marriage Season.

Small goods commercial vehicles continued to see good demand with increased level of transportation and last mile connectivity needs. With safer means of travel in customer’s mind and schools and colleges continued to remain closed, demand of Bus remains weak. Similarly, M&HCV segment continues to play spoilsport with excessive capacity, high prices of BS-6 models, finance issues and higher fuel prices.

FADA once again urges our Government to increase infrastructure spending including timely payment to vendors and introduce attractive incentive-based scrappage policy to revive the M&HCV segment.”

Near-term outlook

With the festive season now over, heavy rains in certain parts of the country leading to crop damage and pent-up demand almost negligible, demand revival now solely depends on exciting year-end schemes. If the supply chain issues in PV segment are controlled, we may see continued growth in December.

FADA once again cautions 2W OEMs and dealers to keep a check on vehicle inventory as post festivals as demand may remain subdued.

Key Findings from FADA Online Members Survey

- Sentiments

- 44.6% dealers rated it as Good

- 41.6% dealers rated it as Neutral

- 13.8% dealers rated it as Bad

- Liquidity

- 45.2% dealers rated it as Good

- 42.2% dealers rated it as Neutral

- 12.6% dealers rated it as Bad

- Expectation in December

- 39% dealers rated it as Flat

- 36.1% dealers rated it as De-Growth

- 24.9% dealers rated it as Growth

- Inventory

- Average inventory for passenger vehicles ranges from 25 – 30 days

- Average inventory for two-wheeler ranges from 45 – 50 days

Disclaimer:

1- The above numbers do not have figures from AP, MP, LD & TS as all these States/UT’s are not yet on Vahan 4.

2- Vehicle Registration Data has been collated as on 06.12.20 and in collaboration with Ministry of Road Transport & Highways, Government of India and has been gathered from 1,265 out of 1,472 RTOs.

3- 42 days festival period in 2020: 17-10-20 till 28-11-20

4- 42 days festival period in 2019: 29-09-19 till 09-11-19

Disclaimer:

1- The above numbers do not have figures from AP, MP, LD & TS as all these States/UT’s are not yet on Vahan 4.

2- Vehicle Registration Data has been collated as on 06.12.20 and in collaboration with Ministry of Road Transport & Highways, Government of India and has been gathered from 1,265 out of 1,472 RTOs.