India Ratings and Research (Ind-Ra) has maintained a stable outlook on the auto sector for FY17 on the expectations of an uptick in passenger vehicle (PV) volumes, continued growth in medium & heavy commercial vehicles (MHCVs), though at a lower rate, and a revival in light commercial vehicles (LCVs).

The PV segment is likely to post 6-9% yoy volume growth in FY17 supported by the car (8-10 per cent) and the utility vehicle (UV) segments (2-5%). The commercial vehicle (CV) segment’s volumes in FY17 will continue to be driven by MHCVs (12-15% growth), with LCVs posting a modest recovery of 0-5% after three years of decline. The overall growth in CV would be 5-10% in FY17.

Low commodity prices driving improved financials

Ind-Ra’s sample set of 11 listed auto companies registered an increase in the median EBITDA margins to 1.2% in FY15 and further to 2.3% during 1HFY16. The profitability was largely driven by the softening of prices of steel, aluminium and rubber. In addition, their inputs are mostly in the form of bought out components, whose prices reflect increased labour, power and other operating costs. The credit profiles of most companies in the sample set continued to be strong in FY15, with median net leverage below 0x (due to net cash position) and EBITDA interest coverage of close to 15x.

Ind-Ra expects these companies to sustain their credit profiles in FY16 and FY17 due to improved profitability. This, along with their current low leverage, leads the agency to believe that despite the significant capex planned in the PV segment in FY17 for increasing industry capacity by 0.5 million units to around 6.6 million units, their financial profiles will not be affected.

Ind-Ra expects MHCV volumes to continue displaying steady growth of 12-15% yoy in FY17, albeit lower than the 25-30% growth likely for FY16. The growth is expected to be driven by a combination of replacement of old vehicles and the demand for high tonnage vehicles to achieve cost efficiency in operations.

Ind-Ra believes that the decline in LCV volumes would bottom out in FY16 with the segment registering 3-5% lower year-on-year sales volumes. Thereafter, in FY17, a moderate volume recovery at 0-5% yoy is expected, led by demand from the fast growing e-tailing industry.

Capacity Overhang to Persist

In Ind-Ra’s assessment, the capacity utilisation in case of PVs and CVs in FY15 was around 57% and 48%, respectively of the estimated capacity of 5.6 million and 1.4 million. After factoring in the volume growth in PVs and CVs in FY17, the agency believes that utilisation levels could range between 55% to 60% for PVs and 53% to 55% for CVs in the year. This is based on the capacity addition of almost one million units in PVs with no additional capacities in CVs during FY16-FY17. Hence, auto original equipment manufacturers (OEMs) would continue to grapple with low capacity utilisation levels despite an uptick in volumes.

Persistent MHCV growth

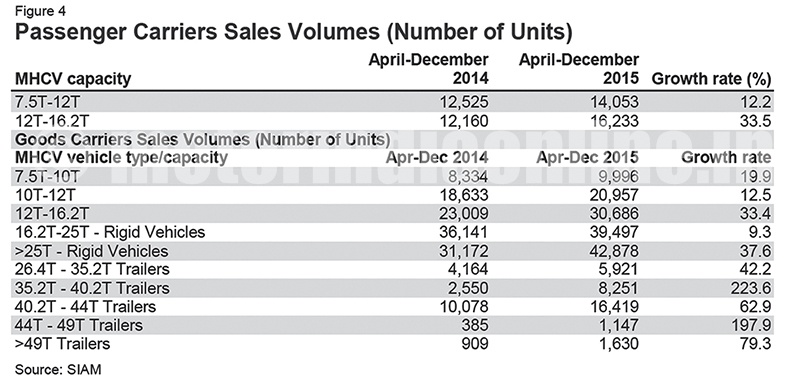

Ind-Ra believes that MHCVs volume will grow at 12-15% in FY17, lower than the growth rate of 29.7% witnessed during April-December 2015 due to the tapering off of replacement demand. The demand for higher tonnage vehicles will also increase as fleet owners aim for improving their per ton transportation cost.

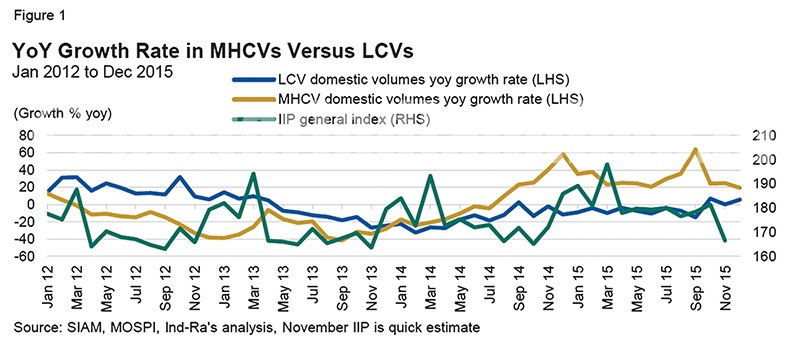

MHCV sales have displayed a strong and consistent growth since August 2014, after declining sharply in FY13 and FY14. During August 2014-March 2015, the domestic volume growth was 30.5% yoy while during April-December 2015 it was 29.8%. Based on interactions with auto OEMs, the agency believes that the growth is partly attributed to the replacement of old vehicles by large fleet operators. In FY13 and FY14, fleet operators had been delaying replacement of their old vehicles beyond the normal term of five to seven years given the weak industrial demand for freight and the consequent low freight rates.

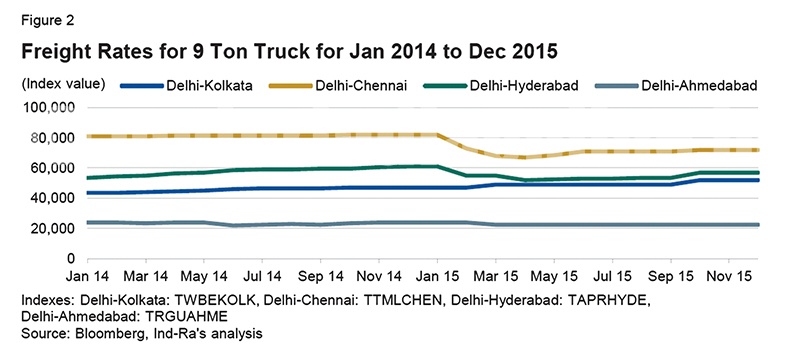

While the low industrial demand continues, the significant lowering of diesel prices has positively impacted the profitability of fleet operators prompting them to use additional cash flows for fleet replacement. In the MHCV segment, demand for larger tonnage trailers in FY16 has been higher than in FY15 from fleet operators who wish to take advantage of the improved road infrastructure, particularly along the Golden Quadrilateral, to reduce per ton transportation cost. This is evident from the high volume growth rates ranging from 37-224% yoy witnessed in the various sub-segments of MHCVs of capacity 25T and above.

Inconsistent industrial output as reflected in the volatility in the Index of Industrial Production (IIP) in the 12 months ended December 2015 leads Ind-Ra to believe that the uptick in demand for MHCVs has not been due to the revival in industrial demand for freight. According to the data available on Bloomberg, road freight rates softened significantly around February 2015 across most sectors in the country and have only shown a marginal recovery in some sectors towards the end of 2015.

Ind-Ra believes that some improvement in MHCV sales volumes till September 2015 is attributed to pre-emptive purchases on account of price increases due to the mandatory adoption of anti-skid braking systems (ABS) by all CV manufacturers from October 1, 2015. This safety feature had increased the price of vehicles by around Rs. 40,000 on average. The agency’s postulation is backed by the steep drop in MHCV volumes from September to October 2015. This factor also leads the agency to believe that the growth rate in this category in FY17 would be lower than in FY16.

Bottoming out of demand decline for LCVs

In Ind-Ra’s assessment, LCVs will display 0-5% yoy volume growth in FY17 and a likely bottoming out of volume decline in FY16, with growth being led by increased urban demand from e-tailing.

LCV domestic sales volumes registered an 11.6% yoy decline in FY15 and 17.6% yoy decline in FY14. Ind-Ra believes that demand for LCVs is on account of both industrial demand and non-discretionary consumer demand for transportation of food items, as well as for transportation applications such as rural taxis. Considering the weakened demand for industry-related freight in FY16, the sales volumes were largely driven by non-discretionary consumer demand.

For FY16, the decline is likely to bottom out to 3-5%. Ind-Ra believes that while the bottoming out of volume decline is largely attributed to the base effect, the demand growth driver would be the explosion of online retailing (e-tailing) in the past two years. Last mile delivery of goods is expected to lead the demand for LCVs, with urban areas generating a greater proportion of incremental demand than rural areas.