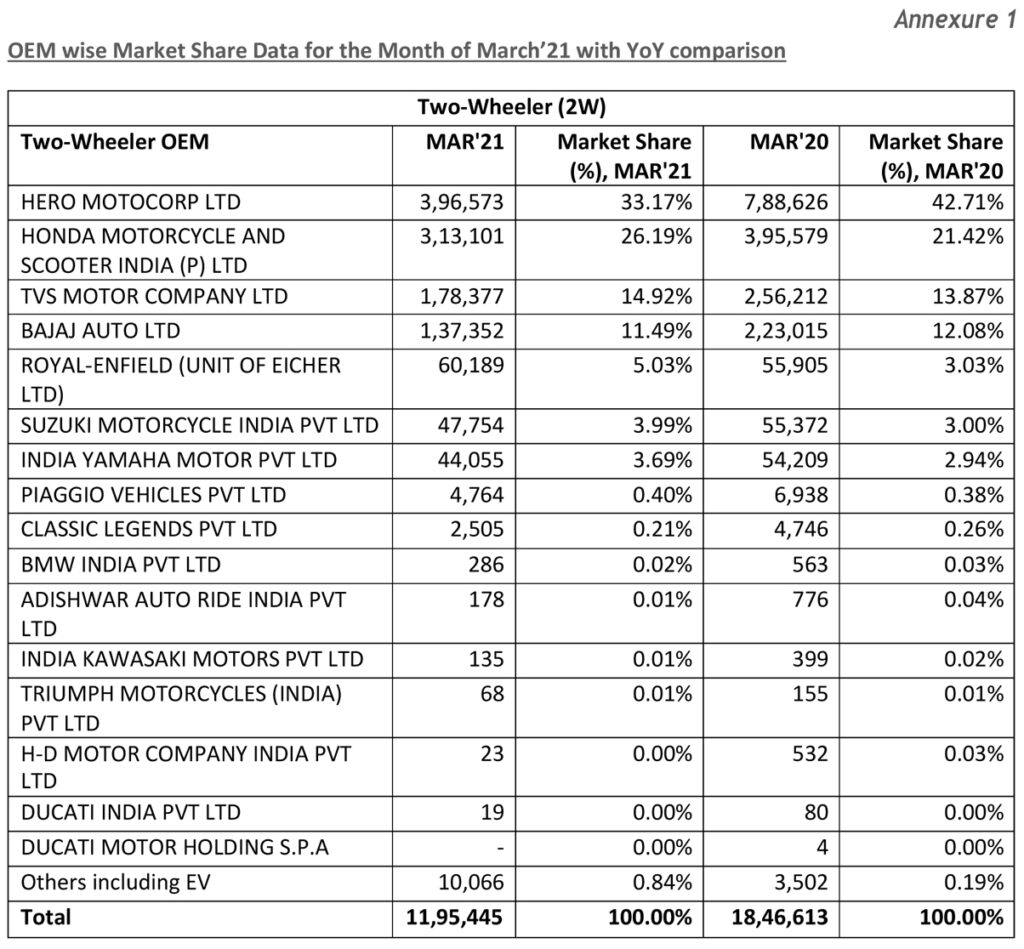

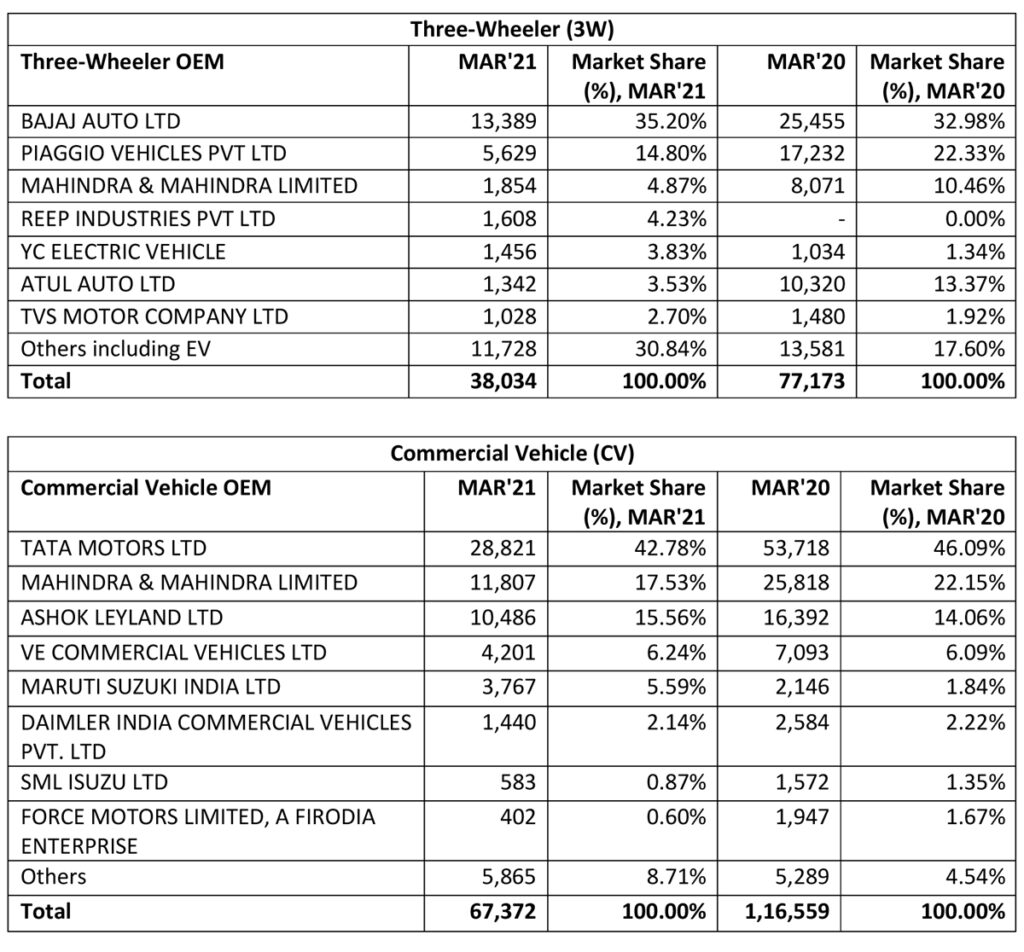

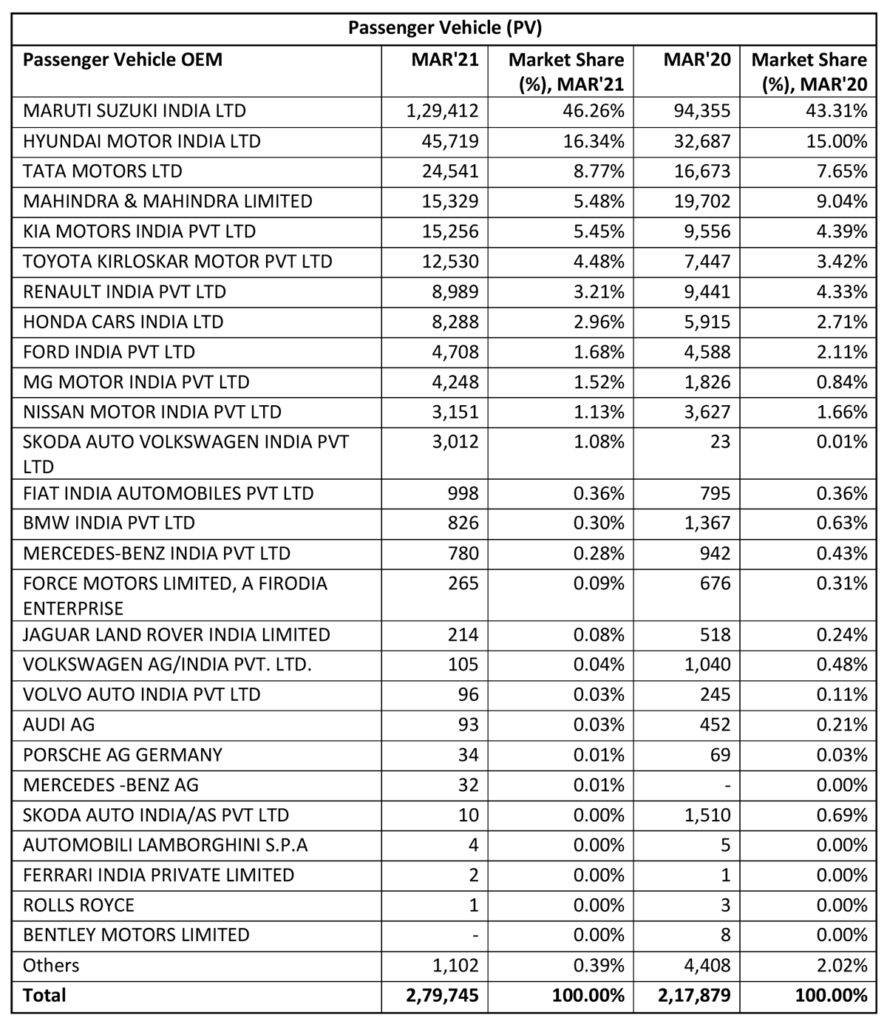

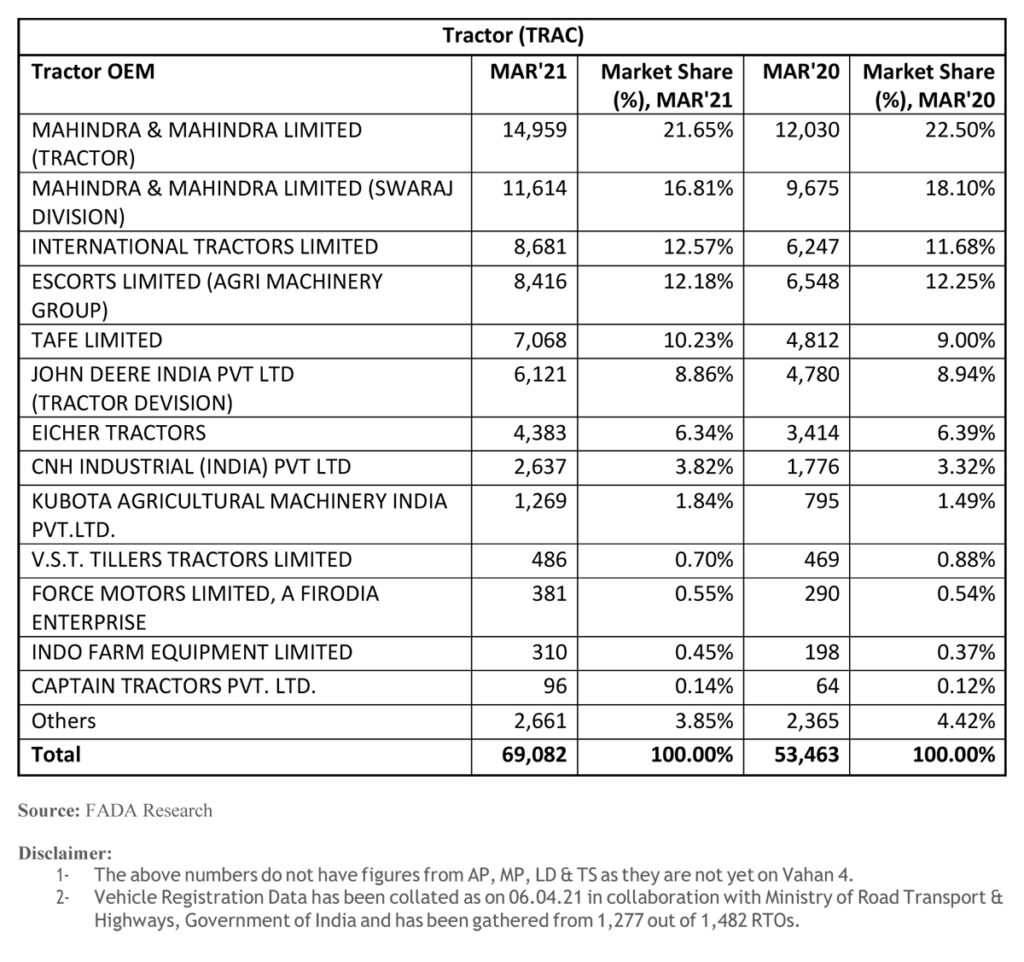

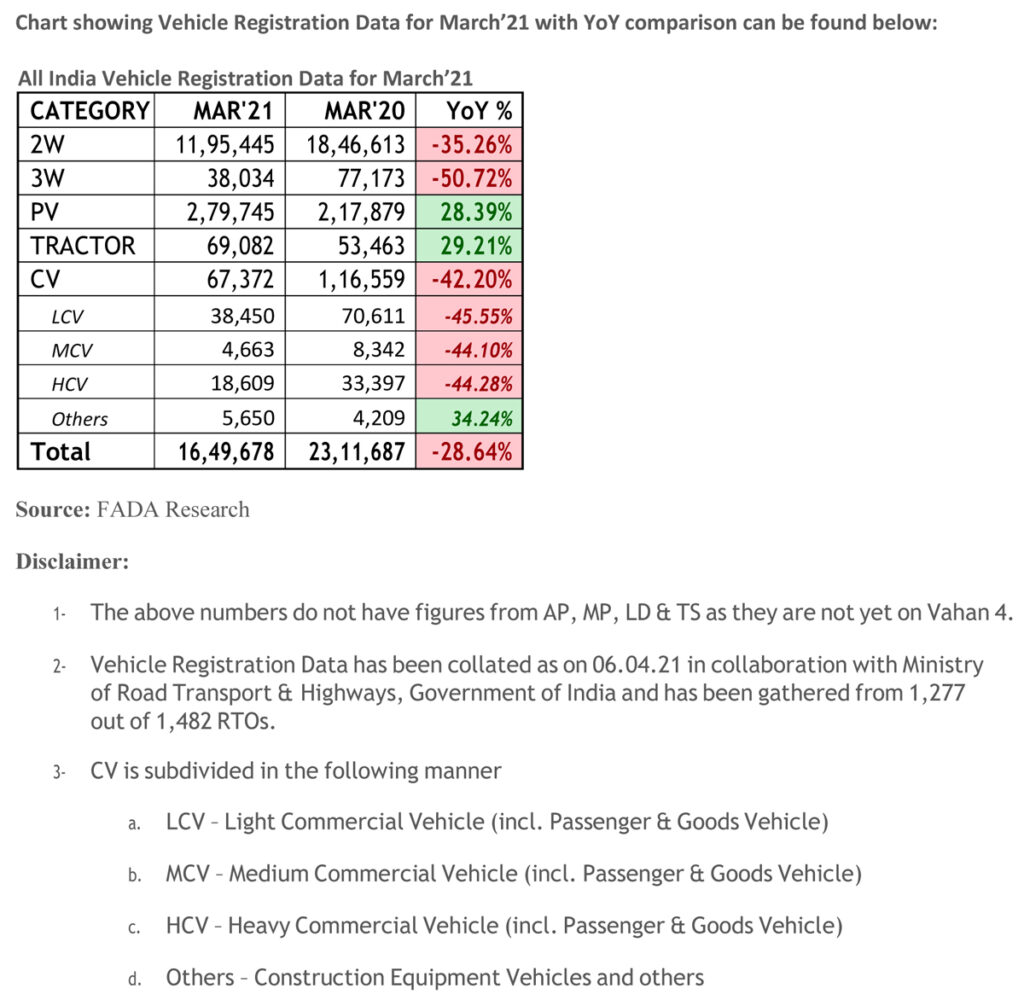

The monthly vehicle registration data for March’21 released by the Federation of Automobile Dealers Associations (FADA) indicated that vehicle registrations fellby 28.64% on YoY basis but grew by 10.05% MoM.Tractors and passenger vehicles sustained their healthy momentum by growing 29.21% and 28.39% YoY respectively on a low base, transition from BS-IV to BS-VI and India going under lockdown last year.On YoY basis, 2W, 3W and CV unrelentingly fell by 35.26%, 50.72% and 42.20% respectively.

On MoM basis 2W, 3W, CV, PV and tractors grew by 9.54%, 14.15%, 14,15%, 10,11% and 12.60% respectively. Passenger vehicle waiting period continued to hold its ground and remained as high as 7 months as scarcity of semiconductors remained put. 47% PV dealers said that they lost more than 20% sales due to supply side constraints.

There was no significant change in dealer inventory days as PV & 2W inventory remained in the range of 10-15 and 30-35 days respectively.

Commenting on how March’21 performed, FADA President Vinkesh Gulati said: “Auto registrations for the month of March witnessed double-digit fall to the tune of -28.64% YoY, in spite of 7 days of lockdown last year.

Tractors and passenger vehicles were the only 2 categories which saw healthy double-digit growth. This growth can be associated with multiple factors like low base of last year, transition from BS-4 to BS-6 and India going under total lockdown. Global shortage of wafers which is an input for semiconductor, continued to linger around and kept PV waiting period as high as 7 months. According to FADA Survey, 47% PV dealers said that they lost more than 20% sales due to supply side constraints.

Tractors continued its dream run as rural incomes saw improvements after successive monsoons and good rabi produce. If experts are to be believed, India will witness a normal monsoon for the third year in a row. This will further see tractors performing well in FY 21-22.

According to Pew Research, financial woes brought by COVID-19 have pushed about 32 million Indians out of the middle class, undoing years of economic gains. This had its impact on 2-wheelers as it saw one of its steepest de-growth in last few months. This coupled with high fuel prices and price increase acted as double whammy. It not only created a havoc in entry level customers mind but also kept them away from visiting showrooms.

The 3-wheeler segment is witnessing a tactical shift from ICE to EV’s. While prices of vehicles are increasing due to BS-6 and metals prices, customers coming from lower income category are not able to re-pay EMI’s due to poor income. This coupled with social distancing norms and educational institutions still closed are keeping riders away.

Commercial vehicles continued to degrow on YoY basis. High BS-6 prices, low finance availability, repayment pressure due to moratorium period getting over, were the few reasons for non- performance. The category showed growth in some markets/sub categories where Government Infrastructure spending has begun. Bus segment continued to suffer due to ongoing Pandemic.”

Near Term Outlook

The month of April comes with festivities like Ugadi, Gudi Padwa, Baisakhi and Poila Boishakh. This coupled with marriage season is generally a high sales period. At this juncture, the second wave of COVID is not only spreading faster but is also trying to destabilize the growth which India has been able to achieve in last few months. Any lockdown at this point will severely hamper the momentum which is getting built for auto industry to come out of the woods.

Increase of COVID and fear amongst consumers with last year’s sight in mind has started keeping them away from making high ticket purchase. The effects of the same can be seen in 2-wheeler category where inquiry levels are low. This coupled with semiconductor shortage will continue to hamper not only passenger vehicles but also two wheelers as ABS shortage is currently ringing alarm bells.

Since Maharashtra contributes 10-11% of the auto retail, the current Lockdown will have catastrophic effect on overall sales for the month of April. Overall, FADA maintains extreme caution for the month of April as COVID rises to newer highs.

Key Findings from our Online Members Survey

- Sentiments

- 43.9% dealers rated it as Good

- 35.7% dealers rated it as Neutral

- 20.4% dealers rated it as Bad

- Liquidity

- 45.5% dealers rated it as Good

- 37% dealers rated it as Neutral

- 17.5% dealers rated it as Bad

- Expectation in April

- 48.7% dealers rated it as Growth

- 31.7% dealers rated it as Flat

- 19.6% dealers rated it as De-growth

- Inventory

- Average inventory for Passenger Vehicles ranges from 10 – 15 days

- Average inventory for Two-Wheeler ranges from 30 – 35 days