Looking Back at 2020

As many industry experts reiterated, the year 2020 was one of survival. Not everyone knew everything about what to do as the pandemic unfolded but many of them knew something. Meticulous planning and execution of tasks as a team steered us out of the adversity without a single infection in our company thus far. Our company did very well initially focussing on identifying high risks as a consequence of the onset of the pandemic and ensured employees were sufficiently remunerated during the difficult lockdown period and stayed in high spirits with continuous engagement with them. Upon restarting we were supported by intercompany orders and we could clock some decent sales to stay black.

Starting December 2020, it has been a big ramp-up. Most of our peers, higher and lower tier companies I am sure, managed well. The CV industry had a multitude of hurdles to get over since 2019 itself facing low demand as a consequence of IL&FS crisis, surplus capacity due to implementation of GST and increased axle load norms, change over from BS IV to BS VI emission regulations with vehicles getting more expensive and as if all these were not enough the onset of the pandemic was a crippling blow bringing things to a grinding halt. The truck segment in the CV domain saw significant de-growth in the last couple of years – 2018 to 2019 was close to – 35% and 2019 to 2020 was about – 60%.

Takeaways and Positives from Challenging Year

For us the challenge started in 2019 itself due to the low demand in CV for reasons I mentioned earlier and we had already started our ‘fitness’ activities quite intensely. The year 2020 brought out so many facets of brilliance that seemed to be hidden in individuals specifically and in our team collectively. Managing adversities through patient planning and execution, empathetic approach of sharing experiences and compensating for the weakest link in the chain, staying humble and firmly grounded in tough situations and re-discovering new ways of working through innovations in the new normal situation are the few takeaways for us from the 2020 experience.

On the positives, we recalibrated our strategies: a) to increase the product range, b) changing depth of manufacture through in-sourcing, and c) strengthening our supplier partner relationship through communication, timely payments and short term forecasts. Needless to say, these steps were taken to stay nimble and be highly flexible to serve our customers’ changing requirements. This approach has placed us at the cusp of a very good period of at least the next three years in terms of market stability and growth. We made calculated and proportionate capex investments based on our past experience and that will pay off now.

We see big opportunities in the agriculture farm tractor market with the addition of the ‘Quicke’ brand of products to our existing wide range of products from JOST, ROCKINGER, TRIDEC and EDBRO brands for the truck, tipper and trailer segments. Front loaders, backhoe loaders, implements and sub-frames as a product range holds big promise for us since India is the biggest farm tractor market of the world with an annual production of close to 8,00,000 tractors.

Thoughts on PLI Scheme, Scrappage Policy

Both the schemes are undoubtedly game-changing ones aimed at increasing domestic manufacture tied with remunerative incentives. Since India is heavily dependent on oil imports the trade deficit will be increasing until a long term balanced solution between IC engine-driven and battery-driven vehicles are found. There are actions put in place by the government in the policymaking on this topic. PLI would surely be a step towards accelerating the reduction of trade deficit if more import substitutes are found through domestic manufacture. I also understand that 10 additional sectors have been included expanding the ambit of PLI touching the daily lives of ordinary citizens.

Higher domestic consumption would result in increased demand in goods transportation and a direct beneficiary of this would be the CV segment. Further, if the CV manufacturing segment is also able to show increased sales through domestic manufacture replacing imports, the incentives through PLI would help them either improve their bottom-lines or pass on the same as a purchase benefit to the end customer. Overall it is advantage ‘industry’.

The vehicle scrappage policy was being waited upon with bated breath by the entire CV fraternity. We see trucks virtually crawling on the streets some being more than a couple of decades old. Having said that, the devil lies in the details which are still awaited. The government has taken a very good approach to announce the implementation in phases considering the limited infrastructure on scrapping and fitness testing centres. Initially it would be voluntary as I understand with incentives on purchase of new vehicles. Going forward I am sure at some point mandatory scrapping would be implemented.

This would ensure sufficient availability of scrap material for steel consumers to recycle reducing the pressure on disproportionate mining. As a consequence costs could come down and installed capacities of OEMs would be better utilised due to increase in demand for new vehicles in a definite cycle reducing or removing seasonality and cyclicity. Depending on the scrappage mandate of old vehicles either 15 or 20 years old, the immediate demand in the truck segment could be anywhere between 1,00,000 and 3,00,000 vehicles.

Plans for Current Year

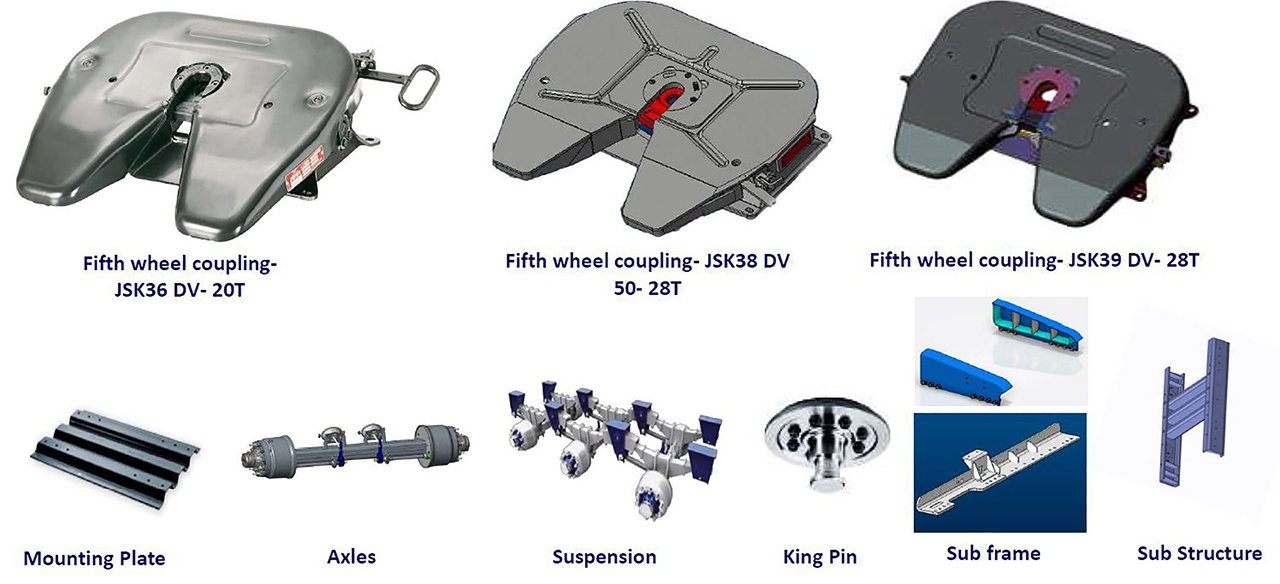

We firmly believe in having clear strategies for both organic and inorganic growth. If one tracks the story of JOST history it is clearly evident how we added more brands to our portfolio through acquisitions. On the organic side we are cashing in on the rise in demand for fifth wheels and have also increased the added value in the existing product range to offer to our current customers in the form of more chassis parts. Our focus on the trailer segment has been intensified through sale of axles, suspensions, landing gear and kingpins. We have already seen very good traction in sale of our trailer products in the last four months.

To specific segments having over-dimensional cargo (ODC) tractor-trailer combinations we are also offering products through imports from Germany. We have a very good installed capacity to cater to the demand in both the truck-tractor and trailer segments. In order to offer additional flexibility to our OEMs for meeting their JIT / JIS requirements we have also started our external warehouses in Pantnagar and Hosur. Hopefully soon we should be starting a warehouse in Lucknow as well.