As a maker of specialty off-highway axles, Kessler & Co. has a strong global presence and is now digging deep roots in India given the rise in demand, says Amit Verma, Head (Business Development), Kessler Drive Systems India Private Ltd. in this interview with N. Balasubramanian

Let us start with a brief background on Kessler’s presence in the Indian market. Since when has the company operated and sold products in India? How established is the brand in the country?

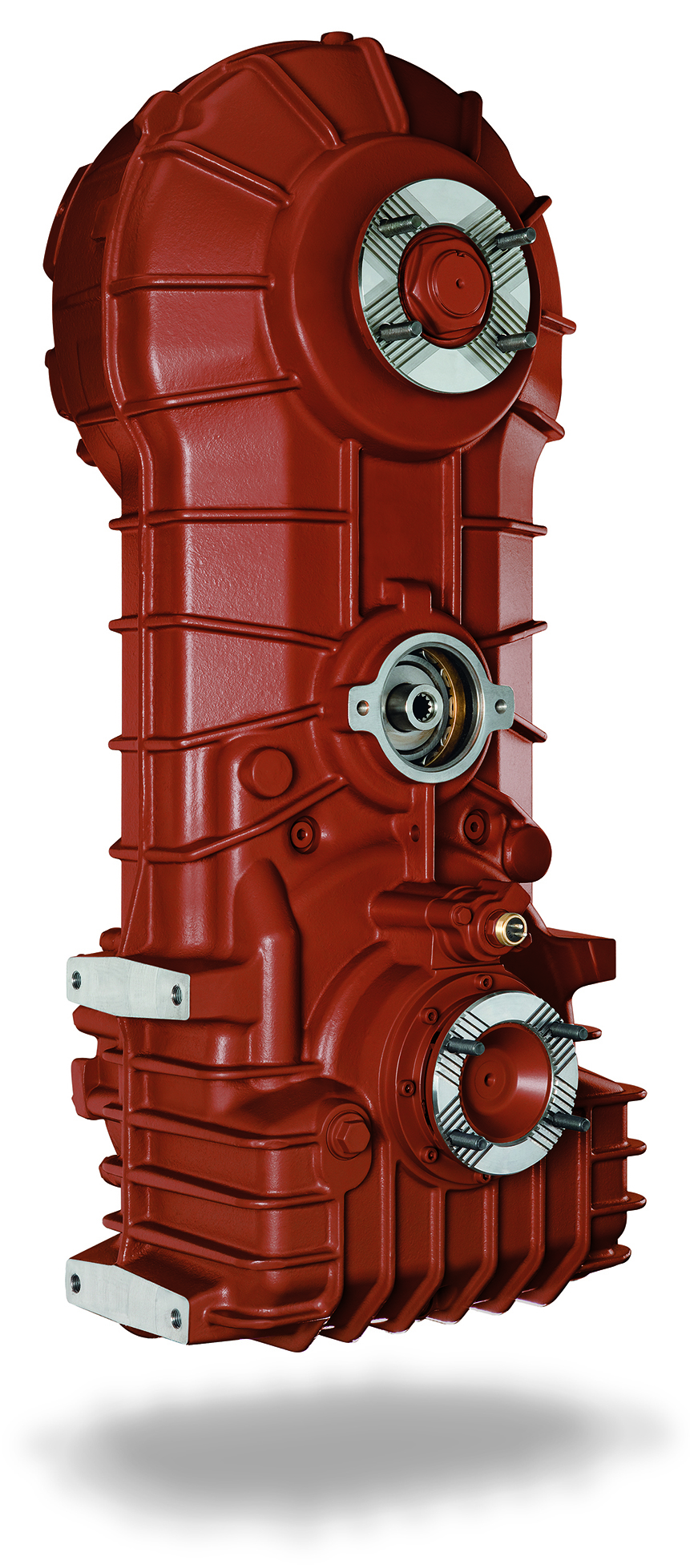

Kessler & Co. was founded in 1950 in Germany and since then it has been serving markets globally. Now, the global company is around 75 years old and is primarily into specialty off-highway axles, including military axles. The company does not deal with conventional on-highway truck axles or commodity driveline parts. Kessler has also specialised gearboxes in its portfolio, but these are very different ones which are used in an all-terrain cranes, for example. The product portfolio is too big to the extent that if you come to the Kessler’s shipment warehouse, you will find all kinds of axles, transfer cases and gearboxes. Every single product is different from one another. Specific to India, it has been delivering its products since early 1990s. The brand itself is well-known and established in the country and is the first choice not only among OEMs but also among end-users.

What does your product portfolio look like and which are the key vehicle or customer segments you are present in or focus on?

At a global level, Kessler is primarily serving speciality off-highway driveline segments, which from a product point of view means axles, gear boxes, transfer cases, and related parts. The market classification is huge and the list is never-ending. When it comes to the company as a whole, Kessler deals in 15 primary applications. There are many more specialty applications in military and aerospace. In India, out of 15, we are doing about 5-6 segments. In the mobile crane segment, you will find a lot of Kessler axles and various other products. Another application is the ground support equipment. These are the axles used for aircraft pushback tractors.

There are also the axles for low-flow buses to bring passengers from the boarding gate to the aircraft and back. Most of the global aircraft rescue fire-fighters have Kessler axles and T-cases in them. These are not the conventional fire-fighters that we see in India. These are very different because the speed is too high; they not only pump the water but also run at a very high speed. Ground support is one of the primary applications. Then we have all kinds of medium to heavy-duty forklifts and container handlers that are called for port equipment applications. These are reach stackers and heavy-duty forklifts as one part.

The other parts are rubber tyre gantry cranes, harbour mobile cranes, straddle carriers and automated guided vehicles. In this, we have been providing solutions for several decades. The other important application of Kessler products is in mining, especially underground mining. We have applications for surface mining and shallow mining trucks, but these are very heavy-duty and super-speciality in some very critical applications of the mining area. The other Kessler application is agricultural machinery. Kessler does not deal in single reduction axles. They are meant to drive the vehicle at a speed.

In agriculture, the company deals with combine harvesters. For example, sugar feed harvester is very critical and heavy-duty in industrialised agricultural fields. We do not mind giving one or two prototypes a year and are always keen to be a development partner of a new model or programme. The military is another important application. Whenever you need vehicle mobility, Kessler is always there. We also have transfer case solutions for military applications. The last but not the least, electric mobility is the segment we focus on the most from a technology perspective. With our experience and our understanding of the system, we are also increasingly offering individually tailored electric drive system solutions for all applications and intend to further expand our portfolio in this segment.

Where are your products manufactured and what sort of production capacities have you installed? How strong is your manufacturing, sales and service footprint across the Indian subcontinent?

From the point of view of manufacturing and product engineering, Kessler has four installed plants but all are co-located in Germany. In India, we are working through partners which are supervised directly by the parent company. We have presence and a full-fledged organisation in China, North America and now in India while we have representatives working in Japan and Korea. As a company, we are centralised; every engineering designed application work is done in Germany. We have a warehouse in North America and China and the scale of shipments are higher than those in other parts of Asia. So far the ideology was to keep things in one location and continue to support the programmes across the world, but at present we are also discussing to extend production to India or China.

What are the USPs of your products and brand? Why should an OE customer consider partnering with you when there are a number of other options in the market?

Tailor-made designs, diversified options, no minimum volume requirements and state-of-the-art product features, and at the same time cost effectiveness, are the key differentiators. Our investment in research and development since the last 75 years is way beyond the market average. With the exception of some supply chain disruptions, the lockdown imposed by the pandemic in the last two years had minimum impact on the industry we serve. More than 60,000 speciality axles and gear boxes were produced last year i.e. in 2021, which is also a record production for us.

From a technology and research and development angle, how strong is Kessler? Are there any cases or examples where you have developed an innovative product to meet a specific customer requirement or solve a specific problem for your customer?

Kessler & Co. makes only customer-specific products and there are no part lists, product lists or price lists. When it comes to engineering, we start working from existing available parts which is the building block system. And if the need arises to develop or design from scratch even for a prototype for a machine which is not yet in existence, Kessler & Co. would be the first company to act on it. Before I elaborate more on this part, I would like to jump to the next question of electro-mobility. Kessler is designing, engineering and manufacturing electric axles for more than 18 years. We have more than 50 mass produced and diversified programs running globally which are fully electric besides several other hybrid drives. There are some applications such as harbour mobile cranes, AGVs, etc. where we virtually have no competition.

What is Kessler’s outlook on the future of electro-mobility in the Indian market? How confident are you about future prospects and what is your take on the pace of adoption of EVs in the segments relevant for your products?

When we discuss about electro-mobility, we must specify which segment and class of vehicles we are focussing on. Electrification of 45 T reach stackers require an entirely different set of engineering intelligence, creative willpower and out-of-box investments when compared with a city bus or an electric three-wheeler, etc. For a segment such as off-highway and speciality off-highway, from a global perspective India as a country is in a state of infancy even on paper, forget ground reality.

As a matter of fact, the regulations for standard operating off-highway equipments are way behind the mid-tier industrial countries such as Malaysia, Thailand and South Africa, not to forget those in developed countries. But, as pointed out earlier, for off-highway and speciality vehicles, electrification is still long way to go and diesel is to stay here as the king even in the longer run. That is unfortunate but the hard reality. The key factors responsible for it are mainly lack of driving force and clear focus, outdated regulations and slower industrialisation rate.

Do you have a presence in the aftermarket segment? If yes, please share details such as geographic reach across the country, number of distribution partners, etc.

We do serve the entire country, in fact, all of South Asia through our sales and service networks. We have regular online and offline training and education programmes for both new OEMs and for distributors. Due to these growing programmes and higher presence of products in South Asia, especially in India, we have made arrangements to ship the products at the end-user site and provide service within 48 working hours. Our target is to achieve close to 24 hour. This is the level of fine tuning we have achieved so far.

What is Kessler’s medium to long-term plans for the Indian market? Please share your targets with respect to new product introduction, market segments, OE customer addition and financial targets.

We have more than 90% market share now in India and have been growing exponentially. The main growth drivers are modernisation of old ports including development of new ports, growth in road infrastructure and shift towards renewable source especially wind power. One such example would be the application of all-terrain crane used to mount or dismantle an 80-metre high windmill at a farm. One can have as many as 12 Kessler products within one machine. From the Indian perspective, the order book is still looking very good.

In fact, we are breaking records this year and working for order forecast 2023 and middle of 2024. The challenge in India is the cost versus price. India being a commoditised market, every discussion starts with cost. It does not start with the value, application, specification, quality, performance or reliability. We are facing this problem and we are not an exception to it. We have added 20 active customers in the last three years in several segments while a few years ago we had only a couple of them. In the long run, we as an engineering and manufacturing company, would like India to contribute at least 3% of our global revenue.