The Indian commercial vehicles (CV) industry is undergoing a huge transformation in terms of technology and product offerings. The Indian Government’s push to implement Bharat Stage VI (BS-VI) emission norms from early 2020, as well as the Voluntary Vehicle Fleet Modernisation Programme (V-VMP), which aims at scrapping 15-year-old CVs, have accelerated the need for OEMs to upgrade their models.

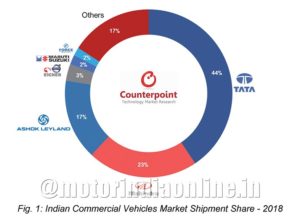

Government regulations have continually pushed fleet management companies to replace their older fleet of CVs with newer vehicles, leading to an increase in the sales of CVs. Indian CV shipments increased by 25% year-on-year (YoY) in 2018. Tata Motors, Ashok Leyland, and Volvo-Eicher registered a growth of 27%, 29%, and 34%, respectively (Fig. 1). Both heavy commercial vehicle (HCV) and light commercial vehicle (LCV) segments saw an increase.

From April 2020, India will be switching to BS-VI emission norms, equivalent to Euro-VI. Heightened safety norms also have required the OEMs to invest in offering mandatory safety features like ABS (anti-lock braking system) on their products. OEMs and oil refining companies, who have invested billions of US dollars to supply BS-VI grade fuel, will need time to recoup their investments before gearing up for another mandatory technological upheaval.

Key component additions

Based on government regulations and technology adoption, the following are the main components which will increase the electronic component share in commercial vehicles:

Exhaust Gas Regulators and Selective Catalytic Reduction: BS-VI mandates a 68% reduction in NOx and an 87% reduction in PM (particulate matter) for diesel engines as compared to BS-IV standards, while petrol engines require a 25% reduction of NOx. All vehicles need an EGR (Exhaust Gas Regulator) to comply with BS-VI emission norms and reduce NOx emissions. EGR reduces NOx by lowering the oxygen concentration in the combustion chamber, as well as through heat absorption. Similarly, SCR (Selective Catalytic Reduction) adoption will rise. SCR is an advanced active emissions control technology that injects a liquid-reductant agent through a special catalyst into the exhaust stream of a diesel engine. All CVs will need emission-reducing electronic components by 2023. As a result, the electronics component share in the BoM (Bill of Materials) cost of CVs will increase by 3%.

On-Board Diagnostics: Another electronic component which will pick up the pace will be OBD (On-Board Diagnostics). OBD is an electronic system which helps keep the emission levels of engines in check by monitoring the performance index of various components. BS-VI regulations mandate that all vehicles manufactured on or after April 1, 2020, must have an applicable OBD-I threshold. Vehicles manufactured on or after April 1, 2023, require an applicable OBD-II threshold. OBD installation in commercial vehicles will further increase the electronic component share by 2% of the BoM cost.

Key factors impact analysis

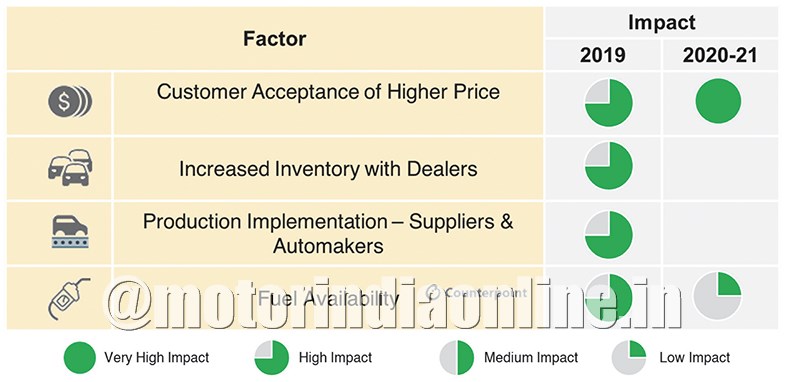

The figure below analyses various factors affecting the CV industry in its shift towards BS-VI.

- Prices of CVs are set to increase with the addition of BS-VI compliant components. Fleet owners in India remain price-sensitive and might not easily accept increased CV prices. However, in 2019, CV sales will be benefited by increased intake of BS-IV compliant vehicles due to their lower cost.

- Dealers already have a high inventory of CVs due to the market slowdown. Increased inventory will have a high impact in 2019, with dealers needing to offer discounts to clear BS-IV inventory.

- Despite extensive planning to shift to BS-VI compliant vehicles, suppliers and automakers have a huge challenge to implement production of BS-VI specific components, and eventually decommissioning BS-IV assembly lines.

- BS-VI fuel availability is an important factor. Industry participants are predicting BS-VI fuels will be available in key cities in 2020 and after that in smaller cities.

Counterpoint view

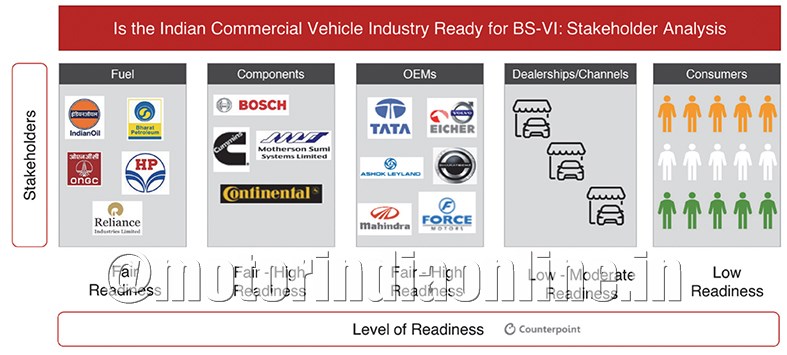

As per industry interviews by Counterpoint, the estimated level of commercial vehicle industry readiness towards BS-VI is as follows:

Successful implementation of BS-VI emission norms will require full awareness and focus from all stakeholders in the value chain. According to Counterpoint Research, oil companies in India are the most geared up for BS-VI implementation. ONGC’s Mangalore Refinery and Petrochemicals Ltd. (MRPL) has committed Rs. 1,810 crores in R&D spending for developing BS-VI compliant fuel. Indian Oil Corporation Ltd. (IOCL) has announced that all of its refineries will be upgrading and has invested approximately Rs. 16,500 crores. Similarly, Bharat Petroleum Corporation and Hindustan Petroleum will invest Rs. 3,550 crores and Rs. 5,000 crores respectively, to upgrade their existing refineries for the production of BS-VI compliant fuel.

Component manufacturers are also rated “Fair-High” on being geared up for providing BS-VI compliant auto parts. The larger multinational component manufacturers, such as Continental, Bosch, Denso, Cummins, Delphi, etc., are quite ready to supply these components, having already started supplies in more advanced markets such as Europe, with Euro-VI emission norms. However, local component makers may find it difficult to supply BS-VI compliant parts, and will require high investment in R&D.

In India, CV OEMs are rated “Fair-High” on its preparedness for complying to BS-VI emission norms. Mahindra & Mahindra has stated that it will introduce BS-VI compliant diesel vehicles by the end of 2019 or January 2020. Volvo-Eicher has claimed that it will leverage Volvo’s expertise for manufacturing BS-VI vehicles, as Volvo has quite a good experience with producing Euro-VI compliant vehicles. Tata Motors has announced that it will invest Rs. 1,200 crores for the switch to BS-VI. Similarly, Ashok Leyland will invest Rs. 2,000 crores as capital expenditure in FY20 and FY21 for its vehicles. Daimler India has got its first BS-VI certificate for its heavy-duty tractor-trailer model “5528TT”.

As per Counterpoint’s analysis, the downstream end of the value-chain, namely, dealers and customers, have a relatively lower BS-VI readiness and will be the vulnerable ‘bottleneck’ in the value chain. They need to be managed carefully to ensure a smooth industry transition to BS-VI.

Counterpoint Research is a fast-growing analyst firm, founded by senior industry experts with well established reputation and industry wide networks. Counterpoint covers major markets worldwide covering IoT, smartphones, automotive and emerging technologies with its research quoted widely in the media.

By Prachir Singh and Aman Madhok, Senior Analysts, Counterpoint Research