Despite the many setbacks – primarily the pandemic-enforced lockdowns – India’s MHCV market will start another recovery in the second half of 2021 and over the short term it is estimated that this sector will script a sharp turnaround based on certain factors, points out Paritosh Gupta, Senior Analyst (MHCV Forecasting), IHS Markit

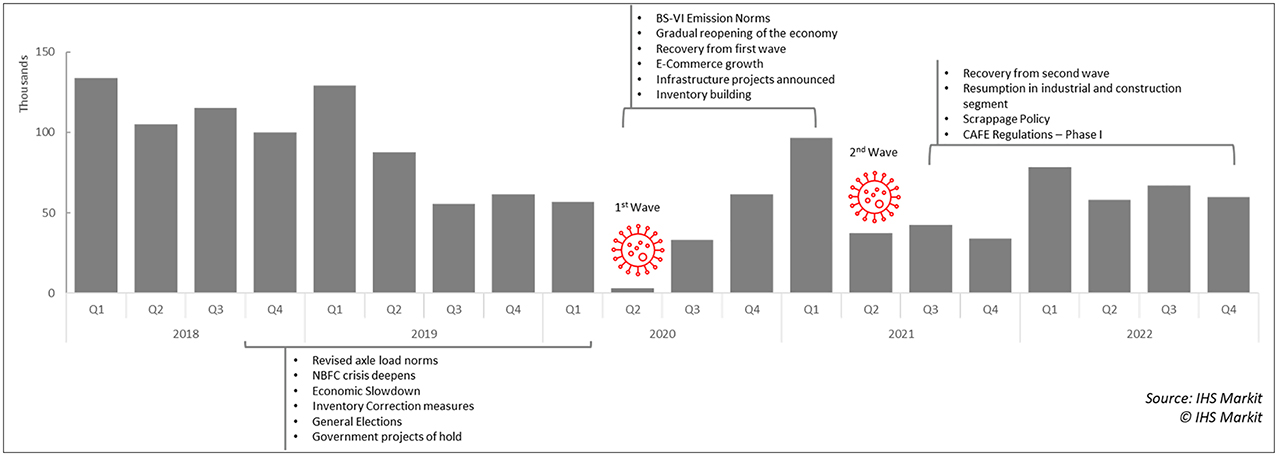

India, the world’s third-largest medium and heavy commercial vehicle (MHCV) – GVW and GCW 6 tons and above – market is enduring unprecedented challenges and changes. While 2020 wreaked significant havoc on the Indian MHCV market, its troubles began much before the corona virus joined the party. After a record-shattering 2018 with over 4,50,000 units dispatched, the industry went through a major downturn in 2019 due to factors such as a lack of availability of finance resulting from the the non-banking financial company (NBFC) crisis, increased efficiency of the existing fleet as an after-effect of the revision in axle load regulations and Goods and Service Tax (GST) implementation, and a slowdown in construction spending and industrial activity.

Heading into 2020, it was supposed to be India’s year as it bolstered its position on the global automotive stage by becoming the only country in the world to leapfrog from Euro-IV equivalent BS-IV to Euro-VI equivalent BS-VI emission regulations. The pandemic, however, had plans of its own and in March 2020 the global pandemic made its way to India. The OEMs, taking cues from their experience during the BS-IV rollout, had enforced inventory correction measures and reduced the production of BS-IV trucks from the last quarter of 2019, which in hindsight, proved to be an excellent judgement call and helped them sell most of their BS-IV inventory before the lockdown’s enforcement from March 25, 2020.

The lockdown lasted till May 31, 2020 and strangled the MHCV industry to an extent that the dispatched volume in the second quarter of 2020 was 95 per cent lower than the previous quarter. Recovery began in the third quarter of the year and dispatch volumes rose consistently as OEMs, despite low retail numbers, continued pushing BS-VI inventory to dealers over the next three quarters. Receding virus cases and commencement of vaccination drives ushered new hopes as Q1 2021 dispatch volumes crossed 96,500 units. However, April 2021 marked the beginning of the second wave of the virus. The latest wave, with a peak four times higher than that of the first wave, derailed the past three quarters’ recovery and once again put the brakes on India’s MHCV market.

Several states enforced new lockdown measures and freight movement restrictions, and thus the industry, quarter on quarter, is estimated to lose over 50 per cent of its volume in the ongoing quarter. The dwindling demand and a disruption in the supply of steel have forced several plant shutdowns. The steel industry’s output has gone down substantially in recent months as commercial oxygen, a critical raw material for the steel industry, has been repurposed towards the medical sector. Tata Motors and Ashok Leyland, the two stalwarts of the MHCV industry, have already announced shutdowns and the rest of the OEMs are expected to follow suit or operate at a reduced scale.

The semiconductor chip shortage, which has thwarted several plants across the globe, has had a comparatively diluted effect on the Indian market as Indian product offerings are much less electronically complex, and because of the high inventory levels at the dealers’ end. This and the dwindling demand in the domestic market have forced several plant shutdowns. That said, India’s MHCV market will start another recovery in the second half of 2021 and over the short term we estimate India’s MHCV industry to script a sharp turnaround based on the following factors:

1) Economic Growth: India’s GDP and industrial activity are poised to grow at an average rate of 7 per cent and 7.4 per cent respectively over the next five years, signalling a spurt in consumer demand, domestic consumption and fixed investment. Industrial growth’s criticality to the MHCV sector’s growth is undisputed and thus it will help the market’s growth.

2) Infrastructure and Construction Spending: The Government of India’s bullish position on highway and infrastructure construction has been a vital cog in the MHCV industry’s growth over the last seven years. In the recent budget, the government awarded new projects worth Rs 2,000 billion and shared their ambitious plans for the years to come. We estimate India’s infrastructure construction spending to grow at a rate of 17 per cent CAGR over the next five years, which bodes well for the MHCV industry’s prospects in India.

3) Government Policies: After successfully deploying BS-VI emission norms, the next step in the government’s plan to further clean India’s MHCV fleet is two-pronged. First to ensure the new vehicle’s adherence to stringent emission and efficiency norms and to this effect, the second phase of corporate average fuel efficiency (CAFE) norms is slated for an April 2022 roll-out. The second step is to lower the existing fleet’s emissions by taking old and polluting vehicles off the road. This is where the recently announced scrappage policy comes into the picture.

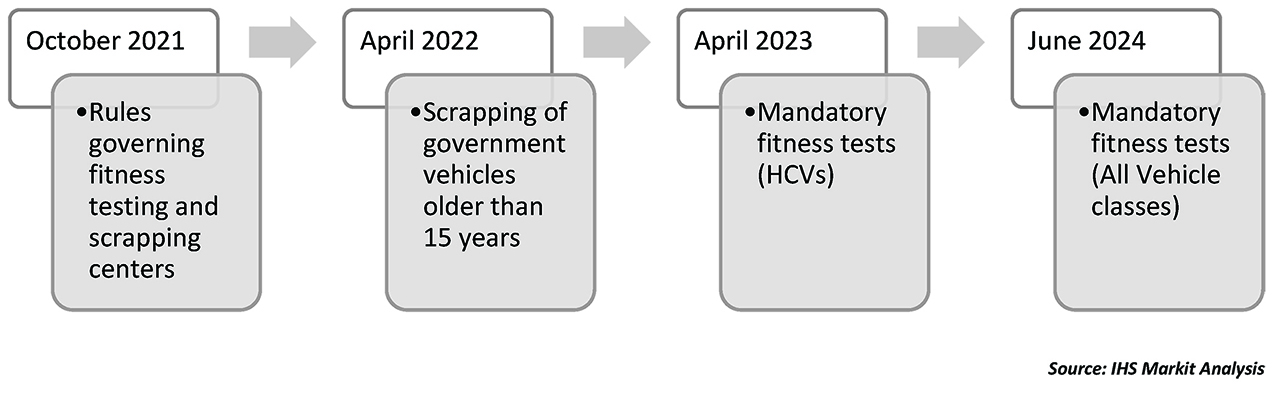

• Scrappage Policy: India, by 2022, will have more than 6,80,000 end-of-life i.e. greater than 15 years old MHCVs on the road. These vehicles not only are highly polluting but also abysmal in terms of safety. The policy, which starts rolling out in October 2021, will thus serve a ‘two birds with one stone’ purpose for the government by not only reducing vehicular pollution but also by pulling unsafe vehicles off the road. The scrappage policy will also reduce OEMs’ capital costs by way of recycling metal and other materials.

The incentives as advised by the central government to the OEMs and state governments include rebates on tax and registration charges, and a 4-5 per cent discount on new vehicle prices. These incentives have so far received a lukewarm response from stakeholders as the cost of replacing a vehicle still far outweighs the cost of getting an older vehicle’s registration renewed, even though the government has increased the renewal charges manifold.

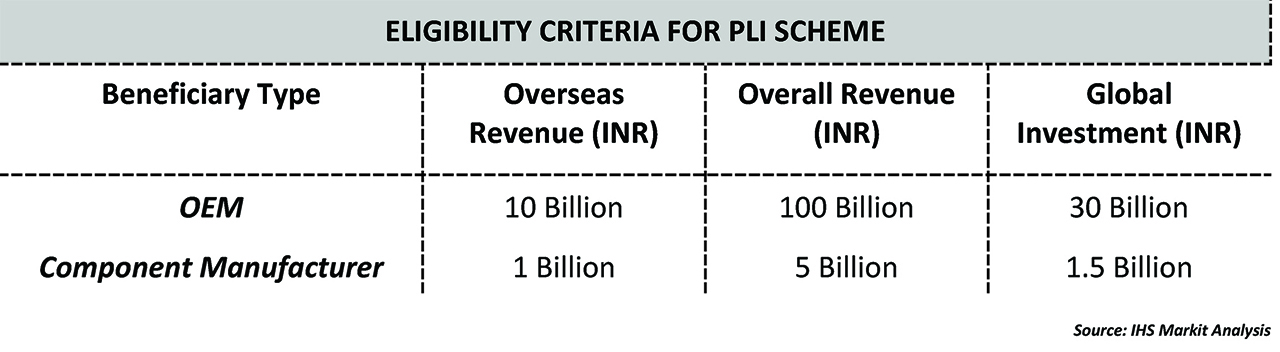

• Production Linked Incentive (PLI) Program: Targeted at the production end of the business, the PLI program aims to develop India as a global automotive manufacturing hub. The government has earmarked Rs 570 billion for the industry which will be offered in the form of cash-back ranging from 2-12 per cent based on sales and exports. Indian OEMs, in 2018, exported over 55,000 units to destinations primarily in Africa, South East Asia and the Middle East. The PLI program will encourage OEMs to further expand their horizons and sell made-in-India vehicles across more markets. The government has also put in place strict eligibility criteria to ensure the quality of products produced in India complies with global standards.

4) Freight Movement: The MHCV industry is intertwined with freight movement and India’s freight movement demand is estimated to grow by more than 50 per cent from 2020 to 2026. Land transport accounted for over 65 per cent of all freight movement in 2020 and this figure is estimated to cross the 70 per cent mark by end of this decade. Part of this growth will also come from the upcoming dedicated railway freight corridors, but road transport will also contribute a substantial chunk.

Looking Ahead

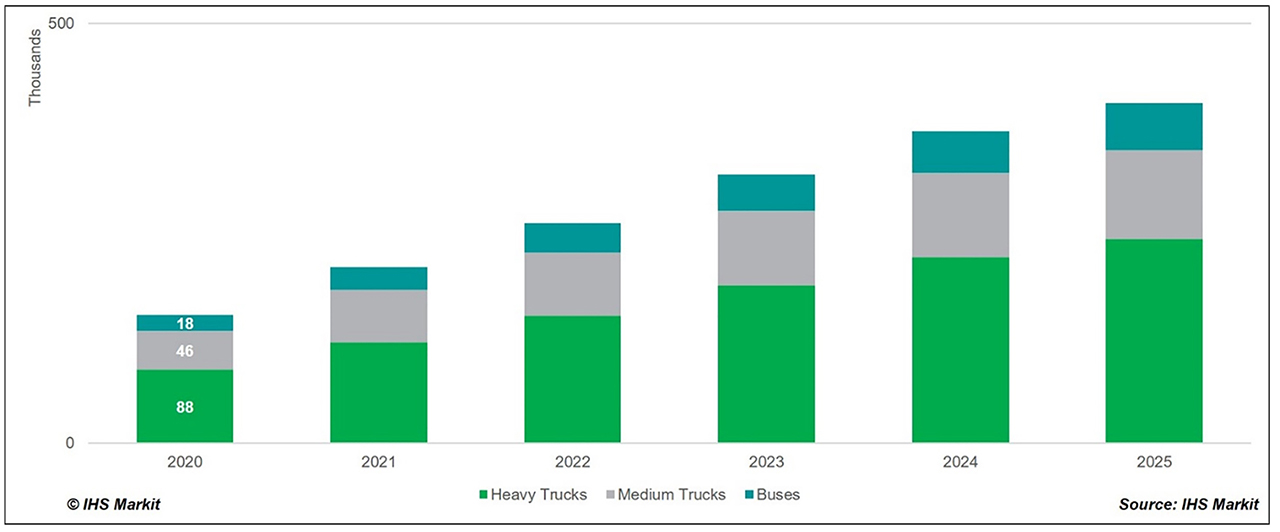

Combined, these factors will propel the MHCV industry in India over the next decade and despite the setback of the second wave, demand for MHCVs in 2021 will crack the 2,10,000 units’ mark. Going forward, between 2021 and 2026, MHCV demand will grow at a CAGR of 14 per cent and regain its pre-pandemic levels by 2024. The 2018 peak remains elusive and only towards the end of this decade do we see another peak of substantial magnitude.

The Indian MHCV industry is broadly divided into three segments, as listed below. Each of these segments has its own set of drivers and restraints, and thus represents a different set of buyers for the industry. The potential for growth in all segments remains high and post-pandemic we will see sharp upticks in their demand.

1: Heavy-Duty Trucks

These with GVW and GCW greater than 15 tons account for the lion’s share in India’s MHCV market and are estimated to be the most lucrative segment of the market. The tipper segment has shown tremendous potential in recent months and considering the expected uptick in the construction sector, it is safe to say that tippers will see great growth in the coming years as well. Tractor-trailers lost a considerable chunk of their share in the market to their haulage and tipper counterparts because of the revision in axle load regulations but have shown signs of a resurgence as industrial and construction activity starts picking up pace.

Tata Motors and Ashok Leyland lead the segment with a mammoth share of over 80 per cent, which is expected to rise beyond 84 per cent in 2026. That, however, is not the complete picture as Volvo Eicher (VECV) and Bharat Benz even with their much lower share have been the flag-bearers for technological advancements in the industry. They have advocated for the concept of value over cost and have managed to entice customers with their offerings in the past few years. Daimler, Bharat Benz’s parent group, has also seen India as a manufacturing hub for its international brands such as Fuso, Freightliner and Mercedes Benz, and, is in fact, the second-largest exporter of heavy-duty trucks from India.

2: Medium-Duty Trucks

These with GVW and GCW greater than 6-15 tons performed much better than the heavy-duty segment over the past two years as India’s e-commerce industry struck a chord with the masses and the introduction of GST helped them employ the hub-and-spoke model of operation. Medium-duty trucks will continue their growth trajectory going forward as well, albeit at a slower pace than their exponential growth between 2016 and 2018. In recent years, almost all OEMs have updated their product portfolio in the segment with advancements in connectivity and driver comfort. The Ultra series of trucks from Tata Motors, Pro series from VECV and the Ecomet series from Ashok Leyland have upped the ante for smaller players like SML. In terms of market share, Tata Motors has dethroned VECV from its top spot in the segment over the last two years, but we estimate VECV will regain its leadership spot soon and engage in a neck-to-neck competition with Tata Motors.

3: Buses

These with GVW greater than 6 tons are the worst pandemic-hit segment of the MHCV sector as public transport usage fell off a cliff and users shifted to personal mobility. We estimate them to post a sharp recovery in the short term as the fleet renewal process at state-owned transport companies comes into the picture. Ashok Leyland and Tata Motors have gone back and forth for the leader’s spot over the last seven years, but Ashok Leyland has managed to edge out Tata Motors since 2018. We estimate the market to remain in a status quo over the foreseeable future with Ashok Leyland maintaining its lead.

Buses are also at the forefront when it comes to electrification in the Indian MHCV ecosystem with several players already marking their presence. Tata Motors, BYD Olectra and PMI Foton are the pioneers of the electrification initiative in India. The government has allocated almost 5,600 buses for deployment across 64 cities, and several states have already signed Memorandums of Understanding with OEMs to purchase their allocations. The pricing of these buses, however, renders them out of reach for private fleet operators currently. Developments in battery technologies and lowering prices should help push e-buses into mainstream public transport sooner than later.

—

About the author

Paritosh Gupta, Sr. Analyst at IHS Markit, heads the medium and heavy commercial vehicles production forecasts for the APAC region (excl. China and Japan) and the sales forecast for India. He has worked in the automotive market research industry for almost the entirety of his career starting with Markets and Markets before moving to IHS Markit in 2016.

About IHS Markit

IHS Markit is a global leader in information, analytics and solutions for major industries and markets worldwide. IHS Markit serves more than 50,000 key customers in business, finance and government and helps them see the big picture with unrivaled insights that lead to well-informed, confident decisions.