Taking a hit from the second wave of the pandemic, especially so in India, the commercial vehicle industry has to once again find new opportunities to get back on the growth track. Nitin Shrotri, CEO, Quantum Leap Consultants analyses the current scenario and points out the trends for the future

The second wave of the corona virus is currently driving the whole world and India more so. The whole economy and segments are under the complete influence of the pandemic and so is the commercial vehicle (CV) industry. Already going through a downturn for the last two financial years, everyone is expecting the industry to bounce back. The pandemic has returned to its peak level like last year during the first quarter of the financial year, and may continue for a few months. The difference compared to last year lies in greater awareness, better readiness and vaccination under progress while the worst part is the much wider and quicker spread of the virus.

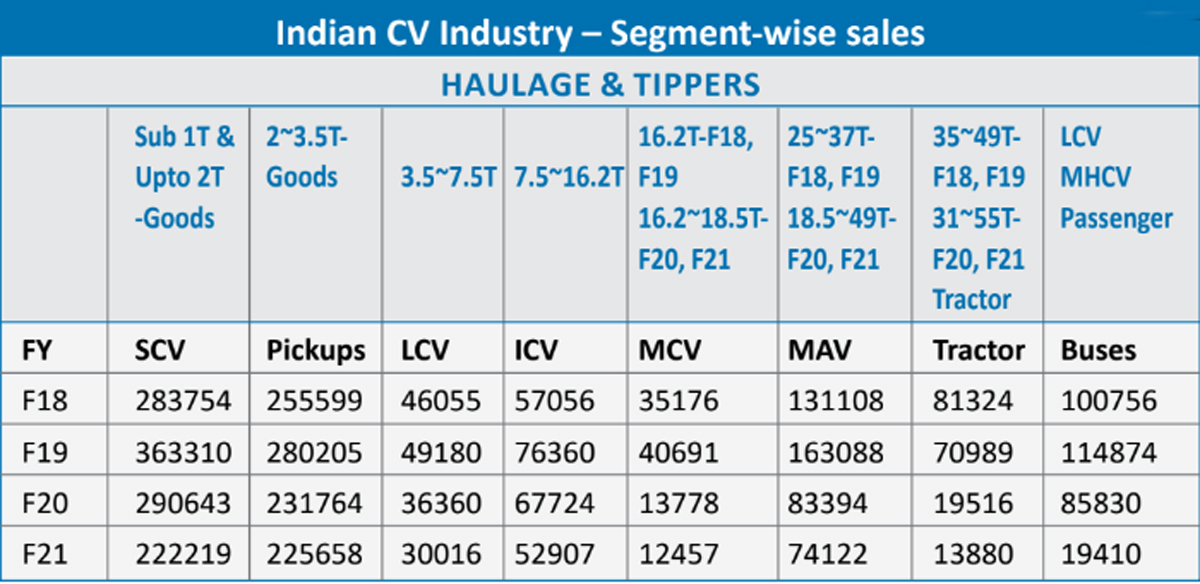

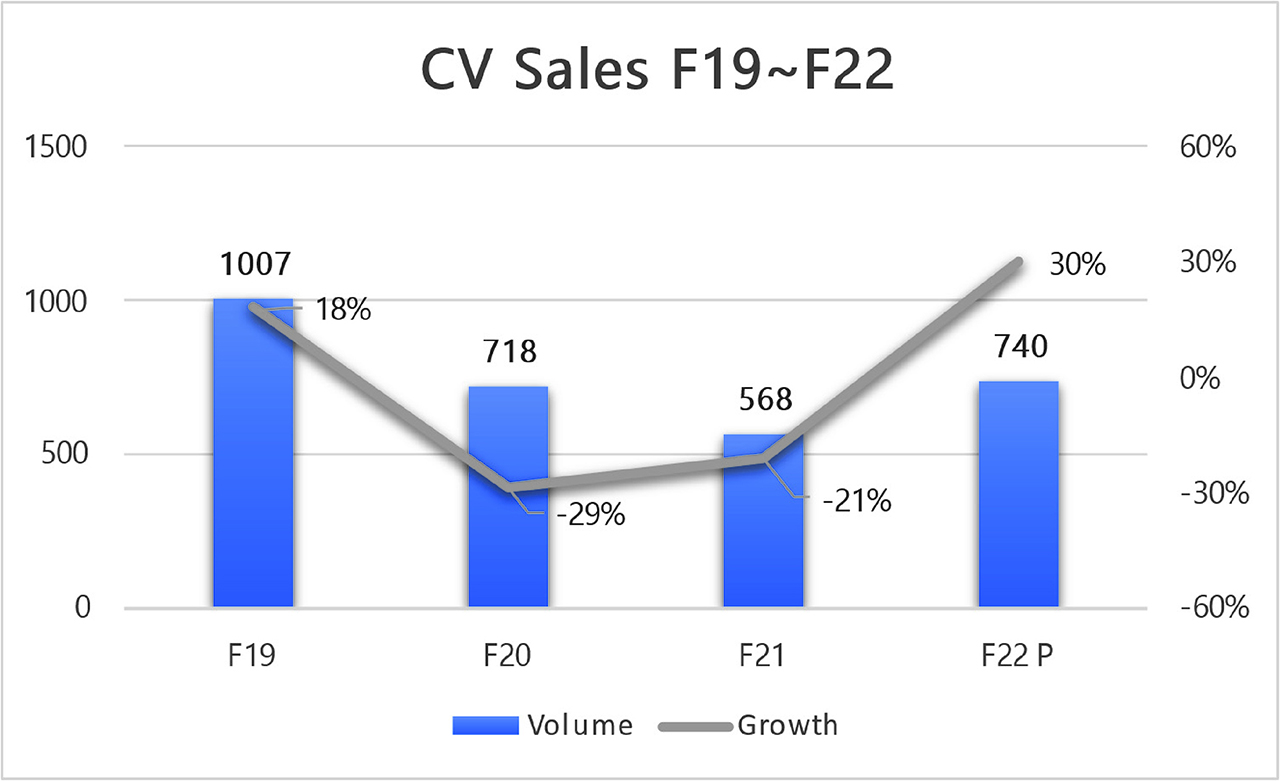

While revenue and job losses, shutdown and stalled product launches by OEMs alongside closing of many start-ups and MSMEs is one side of the story, there is a bright side in terms of new opportunities such as growth in last mile delivery, aggregators, new electric truck start-ups and job creation, to name a few. Overall, CV sales were down by 29% in FY20 after reaching a peak of around one million vehicles due to economic slowdown and the BS-VI launch and further went down by 21% in FY21 due to the first wave of the pandemic. So, within two financial years, the overall CV volume reached 0.5 million, half of that in FY19. While the whole economy is going through the second wave, lockdowns and its adverse effects, there are positive elements like:

• Overall economy revival: FY22 GDP forecast of 11-11.5% by IMF.

• Continuous progress of construction activity by the government and rewarding of new contracts, thus boosting the infrastructure sector.

• Manufacturing activity picking up.

• Beginning of the replacement cycle which normally starts after 3-4 years, reaching the volume of the earlier peak year FY19.

• Increase in last mile delivery due to exponential growth in the e-commerce segment.

• Revival of STU demand.

The restricting factors for this growth are:

• Low buying sentiment due to the second wave of the corona virus.

• Difficulty in getting vehicle finance.

• Supply chain constraints due to lockdowns in many states.

• Price increase of steel and other precious metals.

• Semiconductor supply constraints.

• Increasing prices, in addition to major price hike last year due to BS-VI.

• Less demand for staff and school buses due to work from home and online education.

Assuming that the pandemic is brought under control by the second quarter due to various measures – vaccination being the main – there is the possibility of healthy growth of 30-40% in CV volume. The first quarter normally registers low sales except of tippers.

Way Ahead

There are some potential growth segments such as:

• Increase in demand for e-commerce segment will lead to growth in small, light and intermediate CVs.

• With growing need for ambulances, light and small commercial vehicles’ demand will continue to spiral upwards in the next three years.

• Transportation of vaccines and medicines during the pandemic will continue to create higher requirement of reefers in the intermediate and medium CV segments.

• In the medium and heavy commercial vehicle category tippers will continue to be in demand due to infrastructure projects.

• STU demand will increase due to tenders being awarded which were on hold in FY21.

The trends driving growth include:

• E-commerce segment will grow from current USD 40 billion to USD 100 billion by 2023. In FY21 the e-commerce segment’s contribution was around 10% of Tata Motors’ intermediate and light commercial vehicles and medium and heavy commercial vehicles’ sales and around 25% of intermediate commercial vehicles and haulage sales of Ashok Leyland. Apart from electronic and white goods and food and grocery items, the segment now includes apparels, furniture, pharmaceuticals, automobiles and textile as new start-ups are coming up fast. Mumbai, Ahmedabad, Pune, Bengaluru, Chennai and NCR have become major e-commerce hubs where the vehicle demand and population have increased significantly.

• Rising diesel prices in Mumbai from Rs 67.75 in February 2020 to Rs 87.79 in May 2021 have led to increasing the percentage contribution in total operating cost to 62%. This has further worsened with BS-VI fuel economy which is yet to be completely established. Some savings are on account of FASTag since vehicles are not stalled at toll centres for long durations. All this is creating an opportunity for alternate fuel vehicles like CNG, LNG, electric and hydrogen that new start-ups like Blue Energy are working upon and new players like Infra Prime Logistics have already been putting 60 T electric tippers into commercial use at one-third the operating cost of diesel tippers.

• The scrappage policy to be implemented from April 2023 will make users scrap their commercial vehicles older than 15 years. Around 7.5 lakh vehicles will get scrapped, leading to a demand for a similar number of fresh vehicles. Apart from pollution reduction, other major benefits would be through the use of recycled material from scrap and reduction in ferrous scrap imports of up to 5 million tons, thereby saving foreign exchange. Setting up of scrappage centres will be an additional business opportunity which some OEMs have already ventured into.

• Start-ups like GoFuel and Repos Energy in fuel transportation and Procure Box in fuel and gas cylinder transportation have identified unmet needs and grown in these segments. In the future too, these as well as similar segments like charged and discharged batteries and transportation of electric vehicles will offer new opportunities.

• Refrigerated vans for vaccine and medicine transportation, in addition to other segments like fruits and vegetables, ice cream and meat will grow, especially in the ICV (line haul), LCV and SCV (last mile) segments. Omega Seiki has launched Rage+ Frost, an electric three-wheeler reefer van, which once charged, can store vaccines up to 72 hours at a temperature of up to -20 degrees Celsius.

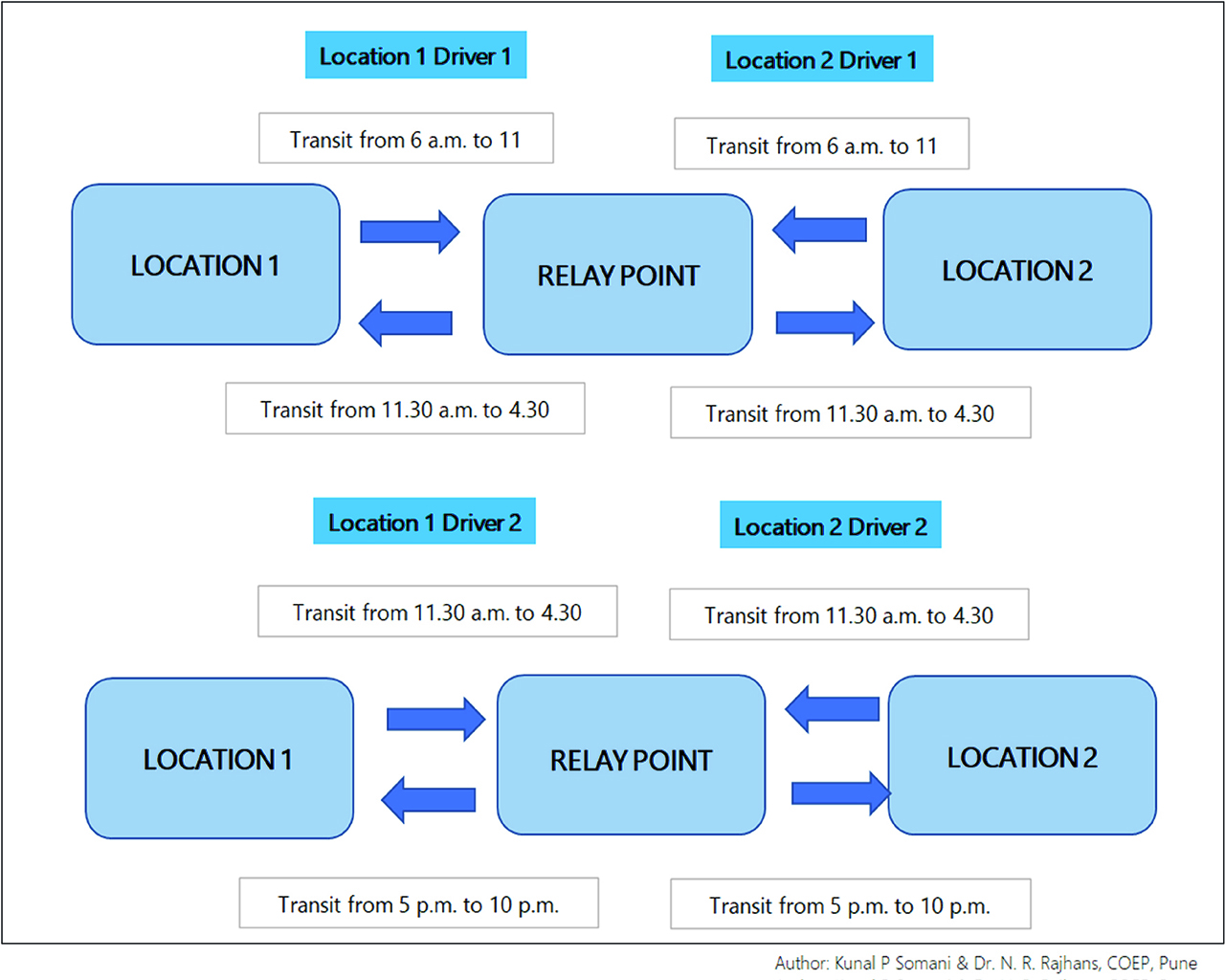

• Aggregators like Rivigo will grow more in both numbers and revenue. The relay model leading to faster delivery time at lower cost and also higher comfort for drivers due to fixed route running and returning to home at the end of the day is keeping them fresh every day for optimum efficiency. It is bearing fruits for logistics providers, drivers and the end customers, as for example e-commerce companies like Amazon, by delivering faster than flight and at 20% cost. There are 70 pit stops over the country, having a distance of 250 km between each of them requiring five hours to cover on an average.

• The use of latest technology viz. IoT-enabled real time tracking helps reduce breakdowns while remote temperature monitoring for applications like reefers further makes the transporter and end user’s life comfortable.

• Consolidation of dealerships will happen. Like in passenger cars, multi-brand dealerships will come up for better viability of dealers.

—

About the author: Nitin Shrotri is CEO, Quantum Leap Consultants which offers consultancy services in Market Research, Project and Product Management, New Product Development, Electric Vehicles. He can be reached on +91 9011065862, info@quantumleapconsultants.in , www.quantumleapconsultants.in