In this article, Kaushik Narayanan, CEO of Leaptrucks, brings you the Indian CV industry’s performance in 2020-21 through four simple charts. These will give you a brief idea of the overall performance of the industry last year. He also looks at some major factors that will influence the outlook for the industry in 2021-22

We bring to you the commercial vehicle (CV) industry performance summarised in four simple charts for 2020-21. While CV sales did not live up to our lofty expectations in 2020-21, we witnessed a recovery in Q3 and Q4 of 2020-21. We also look at the major factors that will determine the recovery of the segment in 2021-22 and influence the outlook for 2021-22.

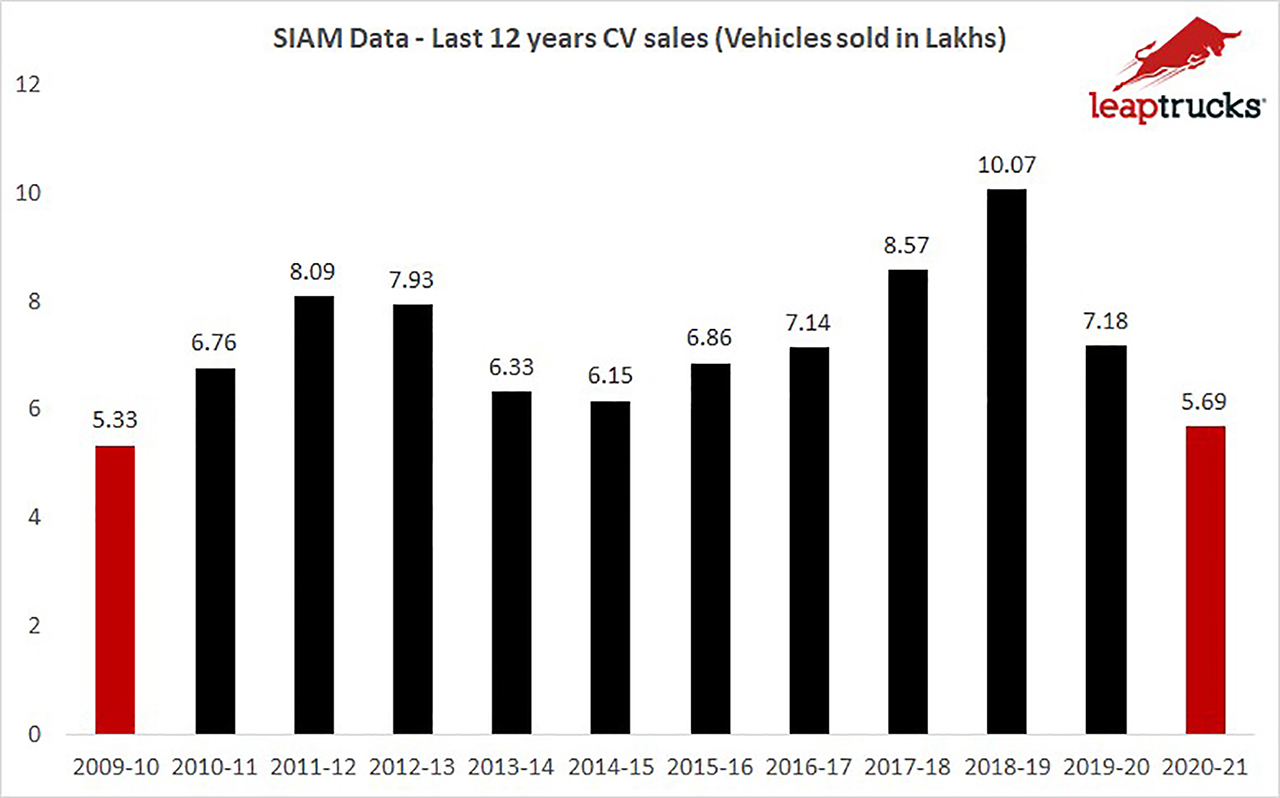

CV Sales in Past 12 Years

The overall sales of CVs fell to the lowest level in the past 11 years. The industry had already crashed in 2019-20 from an all-time high the previous year. It clocked an annual sale of 5.69 lakh units, down 20% as compared to the previous year. The sales were only slightly higher than the sales in 2009-10.

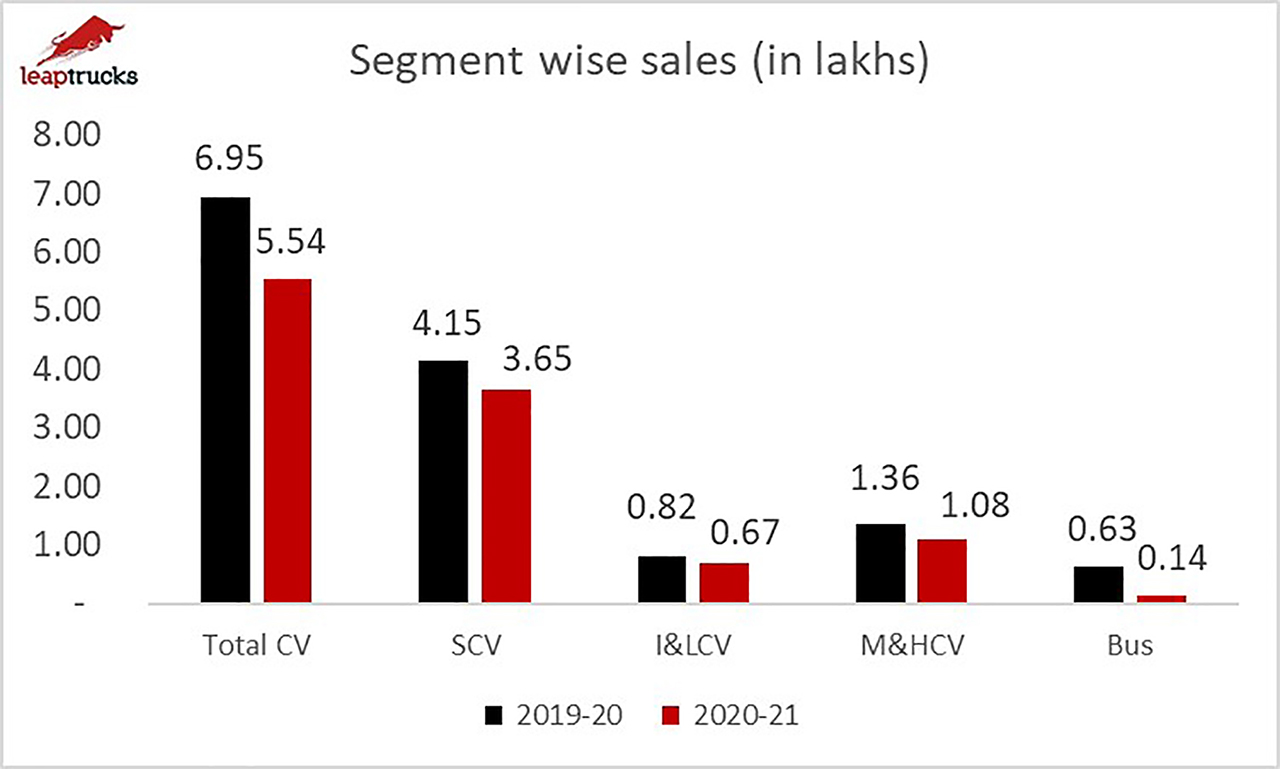

Segment-Wise Performance

While the overall industry fell 20%, the small commercial vehicle (SCV) segment performed best. It de-grew by 12% followed by the intermediate and light commercial vehicle segment at 17% and the medium and heavy commercial vehicle segment at 21%. The bus segment had the steepest fall of 78% as the pandemic impacted passenger transportation across India.

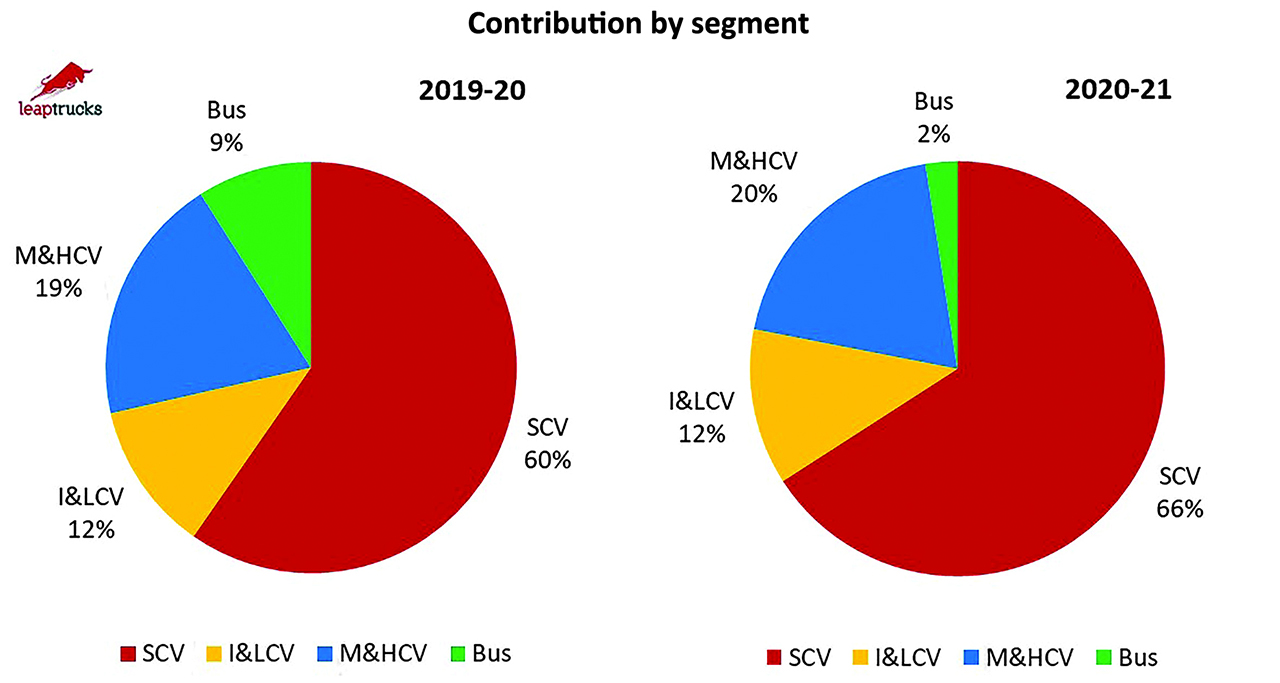

Contribution by Segment

The SCV segment grew to be an even bigger portion of the overall CV business in 2020-21. The SCV segment made up 66% of the overall CV business versus 60% last year. The bus segment shrunk from 9% last year to only 2% this year. The medium and heavy commercial vehicle segment grew slightly while the intermediate and light commercial vehicle segment contribution remained unchanged.

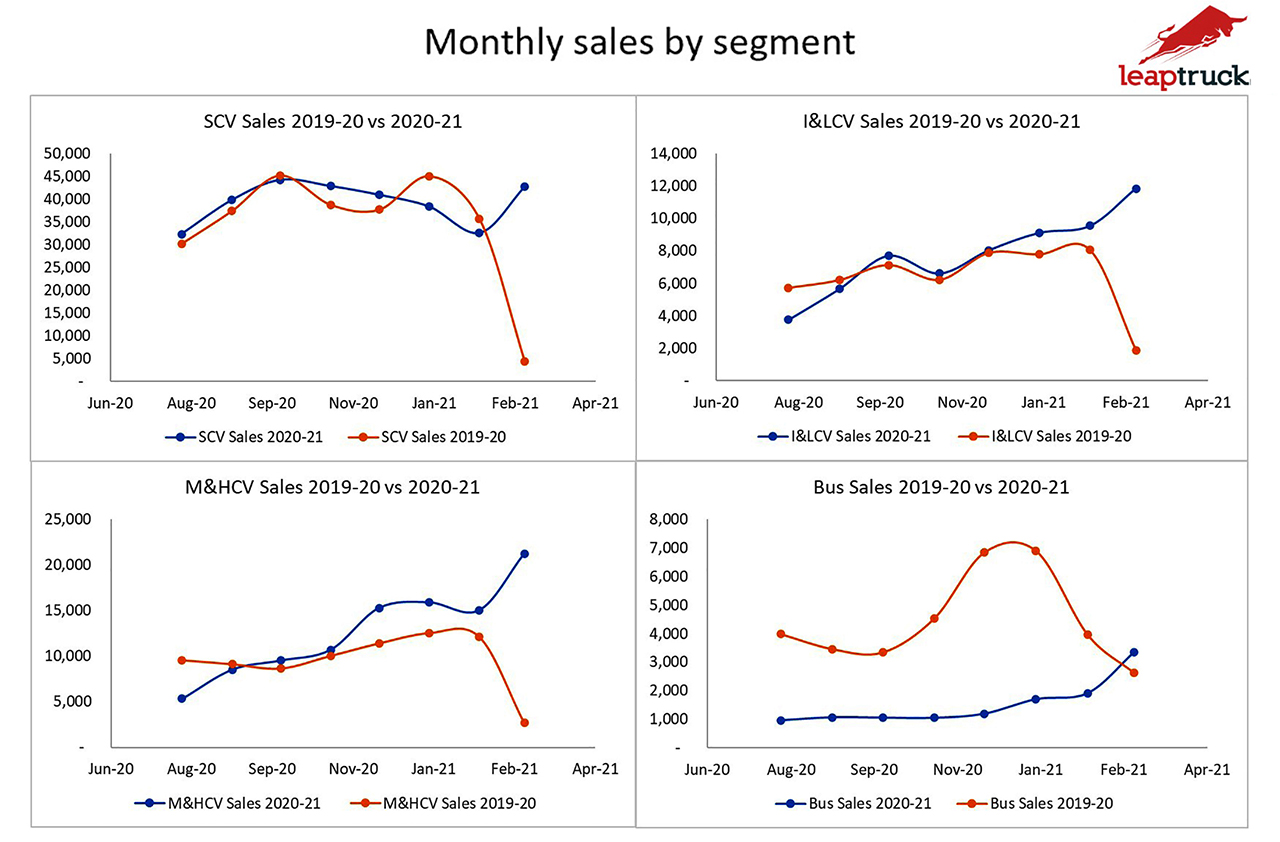

Monthly Sales and Momentum by Segment

The SCV segment recovered first. However, it struggled in January 2021 and February 2021 due to supply issues related to semi-conductor availability before recovering in March 2021. The intermediate and light commercial vehicle segment and the medium and heavy commercial vehicle segment both performed consistently above last year from September 2020 onwards and posted their best sales in the month of March 2021. While the passenger segment struggled all year, it recovered slightly in March 2021 to finish the year on a positive note. In summary, all segments finished the year on a strong note in March.

Economic and Expert Industry Outlook for 2021-22

We will briefly summarise the outlook for the Indian economy and the CV industry by experts in the segment below. We review the expectation for the Indian economy, the CV industry and one of the major drivers of growth for the industry.

• IMF Estimates for India GDP at 12.5%: The IMF has projected a growth of 12.5% in GDP. While we de-grew last year, we believe that the Indian economy will come back stronger this year. A strong growth in GDP bodes well for a strong performance in the CV industry.

• CRISIL CV Growth Estimates at 35%: CRISIL has estimated that the CV industry will grow at a healthy rate of 34 – 36% for the year 2021-22. This was based on the continued focus on infrastructure and roads by the government and the improved demand from Q3 2020-21 which should provide a strong base for growth in 2021-22.

• Infrastructure Investments Growing at 35%: The Indian government has planned to invest 35% more in infrastructure versus FY 2020-21 in the budget announced in February. This bodes well for the CV industry, especially the medium and heavy commercial vehicle segment. The government is also pushing state government transport undertakings to move to the PPP model to efficiently operate buses across India. The scrapping policy may also have a minor positive impact on the prospects of the CV industry this year.

Factors Affecting CV Performance in 2021-22

However, as Covid cases continue to rise, the outlook for 2021-22 will remain dynamic and unpredictable. While the CV industry sales in March were the best for the last financial year, a bevy of factors will determine the performance of the industry in 2021-22. These include:

1. Containing the Pandemic: The second wave of the pandemic is witnessing a rapid increase in the number of corona virus cases. The effectiveness of the containment strategy will directly impact the performance of the CV sector. This will also impact the confidence level of drivers who travel to high-risk locations and keep goods moving.

2. State Level Restrictions: As more states impose restrictions on out-of-state visitors, confusion gets created for interstate goods movement. Since a large number of CVs operate across multiple states, this will in turn impact their viability.

3. Fuel Prices: While demand has continued to grow in Q3 and Q4 2020-21, operators continue to be challenged by high fuel prices. The rise in freight rates has always lagged the rise in diesel prices. This also makes the viability of BS-VI trucks, which are 20-30% more expensive than BS-IV variants, more challenging and in turn impacts new truck sales.

4. Public Transport: The bus segment was down 78% last year. With cases rising and people continuing to lean towards private transportation or staying at home, public transportation such as buses, staff buses, school buses, share auto-rickshaws will not be operational without widespread vaccination.

5. New Vehicle Supplies: OEMs continue to face supply shortages of critical components using semi-conductors. This has impacted the SCV segment the most and is expected to impact supplies until Q2 2021-22. OEMs will also be impacted by shortened operations in case they have outbreaks of the virus in their plants.

6. Rising Costs: OEMs are also battling rising costs of commodities. Steel prices have increased by around 50% from a year ago. OEMs anticipate further price increases in the coming quarters as demand outstrips supply. Rising cost makes the viability of CVs a major issue until freight rates rise to match higher costs.

The prospects for both the Indian economy and the CV industry are closely linked to the timely containment of the pandemic. Accelerated vaccination of the public, maintaining social distancing and wearing masks at all times will help us control the spread of the virus. While the first initiative is in the hands of the government, the second and third are in the hands of the public. We are confident that India will rise to the challenge and beat the virus this year and make the Indian tiger roar again. We are also optimistic about the turnaround of the CV industry in 2021-22 despite the challenging circumstances this year.

Leaptrucks is a platform for the sale and purchase of used trucks, buses and construction machinery. All their assets available for purchase can be seen at www.leaptrucks.com. Follow them on twitter at www.twitter.com/leaptrucks. If you liked the above article, subscribe to their blog at www.leaptrucks.com/blog.