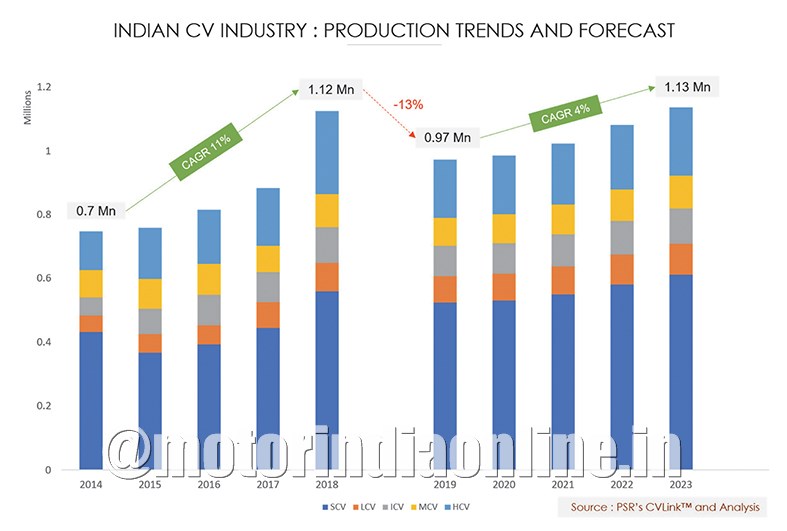

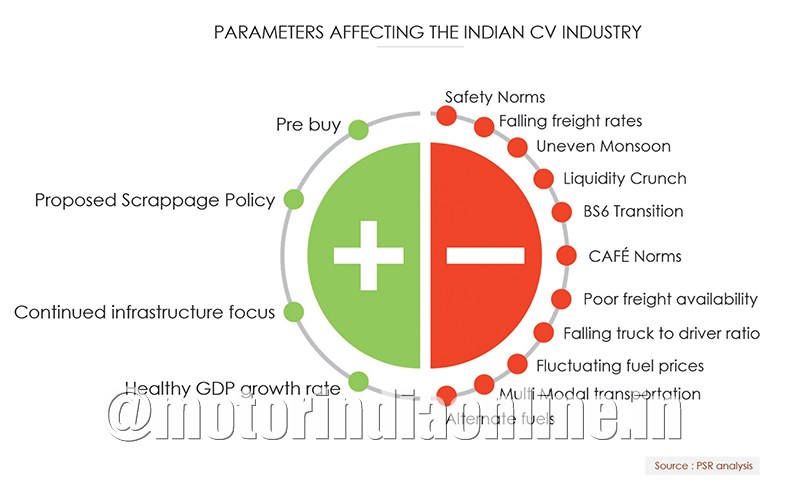

After a blockbuster growth in 2017 and 2018 which was largely driven by demand for tipper trucks due to the new infrastructure, mining projects and fleet replacement; the party got over in Q4 of 2018 as the industry experienced the sharpest contrast in growth between 2018 and 2019 mainly due to liquidity crunch, revised axel norms, slowdown in manufacturing and infrastructure along with uncertainties due to the general elections. The CV market is likely to continue exhibiting subdued demand as customers defer purchases as the poor freight availability or under-utilization of trucks and falling freight rates affect their viability. The slowing down of the economy is hurting overall customer sentiments and impacting demand for new vehicles.

Fortunately, the political climate has cooled off, ending months of speculation and uncertainty over the formation of a stable government with a decisive mandate. This should pave the way for strong economic reforms and a much-needed stimulus to boost the slowing economy.

The importance of the CV segment can be measured from the fact that road freight transportation constitutes ~65% of the logistics industry. Robust growth in industry, agriculture and imports, improving road connectivity and ongoing capacity constraints in railways have fuelled growth of road transportation in recent years. This is expected to continue in mid-to-long term, given the economy’s prospects.

For perspective, small fleet operators (<5 trucks) comprise ~67% of the road transport operators in India with ~70% ownership of <12T trucks. Medium fleet operators (6-20 trucks) and large fleet operators (>20 trucks) account for the rest.

An important stakeholder in the transportation business, and often less talked about, is the availability of drivers. The ratio has fallen to ~600 truck drivers per 1,000 in 2018 from ~900 per 1,000 in 2002. This does impact the truck and/or fleet utilisation levels.

The increasing concerns of regulatory authorities on emissions (CO2, NOx, PM, SO2) from the road transportation segment, especially commercial vehicles, are likely to impact the choice of product-powertrain mix and push towards cleaner and greener fuels.

We highlight some of the short- to mid-term trends, pain points and prospects that will shape up the industry over next five years.

Due to delayed monsoon in June and uneven spread in the first half of July, the near-term outlook of 6-8 weeks remains negative as weak consumer sentiment and tight liquidity conditions continue.

The I&LCV truck, along with SCV cargo and pick-up segments, will register low single-digit growth of about ~4%. We anticipate a pre-buy in the CV segment to spread over Q4 CY’19 and Q1 CY’20 which should allow the industry to recover from a downhill drive.

Weak demand & liquidity crisis

High base effect of 2017 and 2018, specifically the 37T category, has weakened the demand for CVs in 2019. Liquidity continues to be a major worry, both on the retail front as well as for the dealers’ working capital. With NBFCs and banks still in a cautious mood, normalcy in lending which is required to get the CV industry back to growth still seems two quarters away. The Budget provisions considered for liquidity easing are yet to take effect and, coupled with delayed and deficient monsoon for June, lead to weakening of overall sentiments.

Although limited impact, demand of cargo trucks started seeing volume contraction post the implementation of the revised axle norms.

Rising operational costs

Addition of cess on diesel by a rupee will impact the CV segment. The fuel cost comprises ~50% of the freight rate, making it the single-largest cost head for transporters.

Besides higher fuel prices, transporters have been hurt by increasing driver salaries ~5-8% for fleet operators even as trucks lie unutilised because there just aren’t enough drivers. So, a fleet operator’s ability to protect the margins depends on his ability to pass on any hike which in the current demand scenario looks challenging.

Only about 25% of truck owners, typically large fleet operators have escalation clauses that allow pass-through of incremental costs based on long-term annual contracts with consignors. The rest of the operators work on spot freight rates.

Transition from BS-IV to BS-VI norms, safety norms & pre-buy

- We are moving into an era of electronic engines from mechanical, and this is set to change the very DNA of auto companies, making them accountable for each unit of particulate matter and emissions caused by automobiles.

- BS-VI norms will lead to addition of more electronics and will also increase the weight of an MHCV by ~275 kg on an average because of additional exhaust management components which will push up prices across vehicle segments. Therefore, we anticipate advancement in sales of BS-IV vehicles as we near the BS-VI deadline. However, the benefit of pre-buying will be partially offset by inventory liquidation.

Impact of alternate fuels on CV

- Considering the challenges revolving around EV ecosystem and LNG/CNG terminals, it will be difficult to imagine commercial vehicles without diesel engines at least during the forecast period although we may see growing adaptability of these in SCVs, LCVs and bus segments.

Proposed scrappage policy

- While new vehicles in the BS-VI era will usher in clean-exhaust, there should be a plan for retrofitting older vehicles with appropriate after treatment, so that the huge number of such vehicles do not slow down the main purpose of achieving clean-air, as envisaged with this change. The proposed voluntary scrappage policy is likely to be ineffective considering the fact that 15 year+ vehicles in-service and in-use may be limited, and the owners may not be in a position financially to take benefits of the policy.

Multi-modal transportation

The current Government focus has been to deploy optimal modes of transportation. Due to significant economies of scale which create low variable costs and intrinsically higher energy efficiencies, modes such as rail, water and pipeline offer the potential to move goods much more cost effectively than trucks, and with far lower energy consumption and CO2 emissions. Although they are not a universal solution for goods transport, they typically are able to transport goods cost effectively on high volume corridors over long distances.

As such, we do see an impact on the HCV category in mid-to-long term as the DFCs and waterways develop with rail taking significant shift of load from trucks.

Conclusion

As the industry aggressively moves to BS-VI, the decisive mandate at the general elections, stable economic policies, higher infrastructure investments and gradual recovery in consumption could bode well for the CV sector over the medium term. Also, with the recapitalisation of nationalised banks announced in the Budget, we will see the over cautious approach diminish and return of the banking and NBFC industry to normal, which is much required for growth of the CV industry.

The OEMs will have to walk a tightrope managing sales growth, digitisation, electrification, technological upgradation and inventory liquidation – all at the same time!

While the CV industry is facing very high level of VUCA times and the challenges appear multi-fold, we all know where we stand with respect to pollution and safety in India, and it is imperative to look at these evolutionary, revolutionary and disruptive changes with the opportunities for a cleaner, greener future across the country.

Power Systems Research

Power Systems Research (PSR) is indeed a leader in market research, data development, analysis and forecasting for the global vehicle and power equipment industries. The company’s experience and expertise are focused on 13 industry segments, along with the powertrain systems employed by the various vehicles, mobile and stationary equipment comprising those segments.

This encompasses an extensive range of internal combustion engine, battery- electric and hybrid-drive powertrain technologies.

Industry-leading clients around the world rely on production and forecast data from PSR’s proprietary databases to bypass the guesswork and minimize risk in their planning processes.

A range of market tracking services and custom-tailored studies help individual clients develop unique solutions to the challenges of rapidly changing markets.

By Jinal Shah, Regional Director of South Asia Operations, Power Systems Research (PSR)