Impacted by several factors such as slowing down of economy, the transition to BS VI and certain regulatory issues, the commercial vehicle industry may take a longer time to come out of the woods, opine Aman Madhok, Senior Analyst and Vinay Piparsania, Global Consulting Director, Counterpoint Research

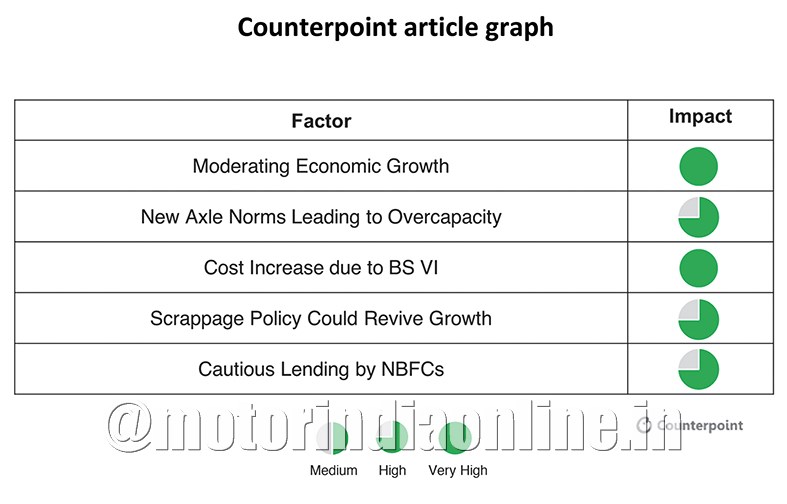

The demand for commercial vehicles declined sharply in 2019, forcing automakers to cut production during the year. Counterpoint Research expects the negative sales trend to continue in 2020. Upcoming BS VI emission norms, lower demand for freight, and overcapacity in the system are the key factors which will continue to adversely affect the commercial vehicle sales in the country this year. Despite continued difficulties, we expect the overall year-on-year decline to moderate over the rest of the year, with anticipation of economic interventions and introduction of the scrappage policy. Some of the factors affecting the Indian commercial vehicle industry are outlined below.

Moderate economic growth

Commercial vehicles sales are heavily dependent on economic conditions since these vehicles are deployed for infrastructure building and transportation of freight across the country. The global economic slowdown impacted the Indian automotive sector, along with that of Europe and China, in 2019. India’s GDP growth in Q3 2019 fell to 4.5% from 5% in Q2, and from 7.1% a year ago, resulting from lowered consumer spending and reduced private investment. The International Monetary Fund has cut its growth forecast for the Indian economy from 7% to 6.1% in 2020.

Regulatory impact

During 2019, automotive OEMs scrambled to comply with new regulations including new axle norms introduced in 2018 which increased the gross vehicle weight of two-axle trucks (two wheels in the front axle and four wheels in the rear) to 18.5 tonnes from 16.2 tonnes, increasing their load carrying capacity by more than 20%. Increased load carrying capacity led to lower utilisation for large fleet operators on trunk routes, adversely affecting the demand for new commercial vehicles. Fleet operators are expected to delay fleet additions in 2020 till the utilisation levels reach the optimal levels.

Cost increase due to BS VI

By April 2020, all new commercial vehicles are mandated to conform to BS VI emission standards, with cost increases estimated to be around 10%. The increased costs are expected to be passed to the customers, leading to overall slump in sales in 2020. However, the industry will see some growth during Q1 2020, as fleet operators pre-buy lower priced (BS IV) commercial vehicles’ inventory before BS VI enters the market.

Scrappage policy awaited

There are estimated more than a million commercial vehicles on Indian roads with age exceeding 15 years. The commercial vehicle players are waiting for the scrappage policy (awaiting final clearance from the government) which will encourage replacement for these vehicles, assisted by government initiatives including hiked fee for registration renewal for old vehicles.

Cautious lending by NBFCs

Non-banking financial companies (NBFCs) finance majority of commercial vehicle purchases. Dealers also depend on NBFCs to fund their wholesale purchasing of vehicles from OEMs. The recent solvency issues surrounding India’s NBFCs have led to cautious lending that adversely affected automotive sales in 2019. These show no signs of abatement. OEMs and dealers have approached India’s Finance Industry Development Council, seeking government intervention to improve the financial health of leading NBFCs.

Conclusion

Overall for 2020, Counterpoint Research’s commercial sales forecast for India remains cautious, with several factors – particularly tight credit conditions, the moderating economy and the transition to BS VI emissions standards – creating uncertainty, obstacles and delays.