OEMs anticipate a huge pent-up demand in the next financial year FY 2022-23 but will also face challenges due to overblown input raw material costs, supply chain woes and stringent regulatory compliances, opines Rajesh Khanna, Director, RACE Innovations (P) Ltd.

The Indian commercial vehicle (CV) industry commenced stabilisation post the pandemic but currently faces headwinds linked to the ongoing geopolitical tensions in Ukraine, related supply chain disruption, cost spikes in raw materials, and fuel and chip shortages. These challenges push hard the Indian players to build self-reliant technologies to be self-dependant, further funnelling the Indian CV industry to emerge as one of the renowned exporters to global markets. The Indian CV industry recorded cumulative sales of 4,66,763 units for the period April to December 2021, a 30% jump compared to 3,58,203 units for the similar period in FY 2020-21.

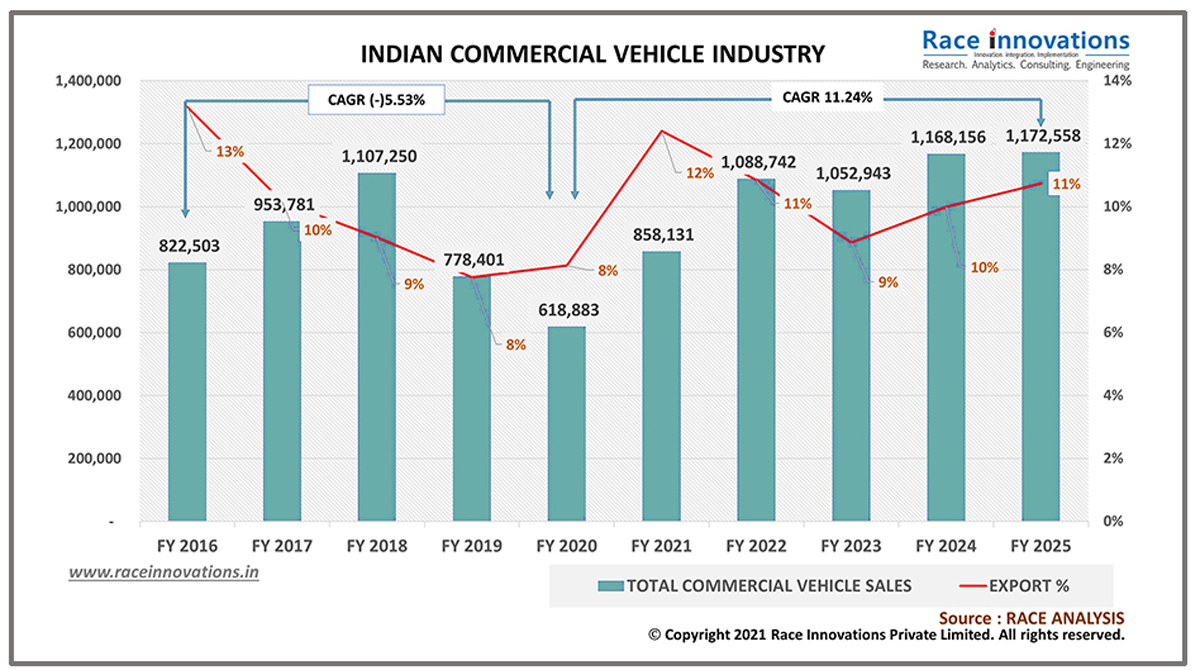

In the fragmented third quarter of October to December 2021, sales reflected a 19% jump compared to FY 2020-21 for the same period. We estimate FY 2021-22 to end with around 8,58,000 units including an increase of 38% in exports compared to FY 2020-21. Fast-tracked infrastructure planning, executions, e-commerce sector activities, mining, retail consumption pent-up demands, systemised implementation of a roadmap of scrapping policies, enhanced utilisation levels and demand for new vehicles are the factors that have led to improvement in truck and trailer demands.

Opening up of trade activities following the lifting of restrictions has invigorated people movement while revenge tourism has instigated passenger vehicle demand during this period. The industry forecasted a great deal of challenges due to the Omicron variant of the virus spreading in the last quarter but this was well-contained. Another issue was the chip shortage along with the conflict between Ukraine and Russia and the supply chain disruptions leading to lesser prospects of achieving higher sales numbers.

Increasing Demand

OEMs anticipate a huge pent-up demand in the next financial year FY 2022-23 and while holding their horses they are slated to raise product prices owing to overblown input raw material costs, supply chain woes and stringent regulatory compliances. A study reveals that OEMs anticipate 3-4% shrinkage in their profit margins in pursuit of achieving their targeted volumes and retaining their market shares while export remains a wild card. The C-OEMs (component OEMs) and ancillary and accessory manufacturers are now going through a tough phase wherein a few major biggies keep harping on the most decorated PLI schemes (production related incentives) – a real buzzword aimed at expanding their capacities.

Micro, small and medium enterprises are yet to recover from their past catastrophes and we anticipate 2022-23 to be a decent recovery period for them. A study also reveals that manufacturing channels have changed from JIT (just-in-time) concepts to heavy stock to prevent unplanned price escalations and supply disruptions. Dealerships and distribution channels have been through tough times, commencing from the emission norms changeover and followed by a series of pandemic-related waves, lockdowns and long lead time delivery schedules due to supply chain woes that have further led to a change in the strategy of distribution.

Going forward we see digitalisation, technological advancement and artificial intelligence likely to create an affable purchasing condition for customers. RACE predicts the CV distribution network to change over from an intensive distribution strategy to selective distribution strategy. On the consumption side, logistics and transporters have not replaced their old fleets and have been trying to enhance their utilisation levels.

A current study by RACE states that their utilisation levels have gone up to 80% with new demands being catered to through used vehicles while new vehicle purchases are being postponed. The study also reveals that the logistics and transportation operation efficiency has improved tremendously, thus yielding better profitability. With the opening up of the trade getting robust, there is anticipation that this will create a huge demand to replace old fleets along with the deployment of highly productive vehicles.

As regards the governmental and institutional side of demand, it appears to be peaking up as most of the indents are getting materialised with funds being reallocated for new purchases. This is also being aided by demand for vehicle replacements as would be enforced with the policy of scrapping old vehicles. Recent studies by RACE reflect a seismic shift of end-users demanding a model of operational expansion that will gain popularity over the capital expansion model. This will be a major game-changer challenging traditional suppliers. Moving forward, we can witness new entrants in the CV industry quickly gaining market share, thereby shadowing the traditional players.

EV Update

The much-hyped electric vehicle programme under National Electric Mobility Mission Plan (NEMMP) has progressed with absorption rate below 0.5% of the total CV volumes compared to fast adoption in two-wheelers. Consensus on going electric prevails but consensus on when we will migrate to electric vehicles is not being addressed. The two-wheeler segment witnessed faster absorption owing to less changeover cost but is still overshadowed by concerns on range anxiety, localisation of battery technologies, safety of batteries on account of fire incidents, life of battery and vehicle, fast track implementation of ecosystem for charging, etc.

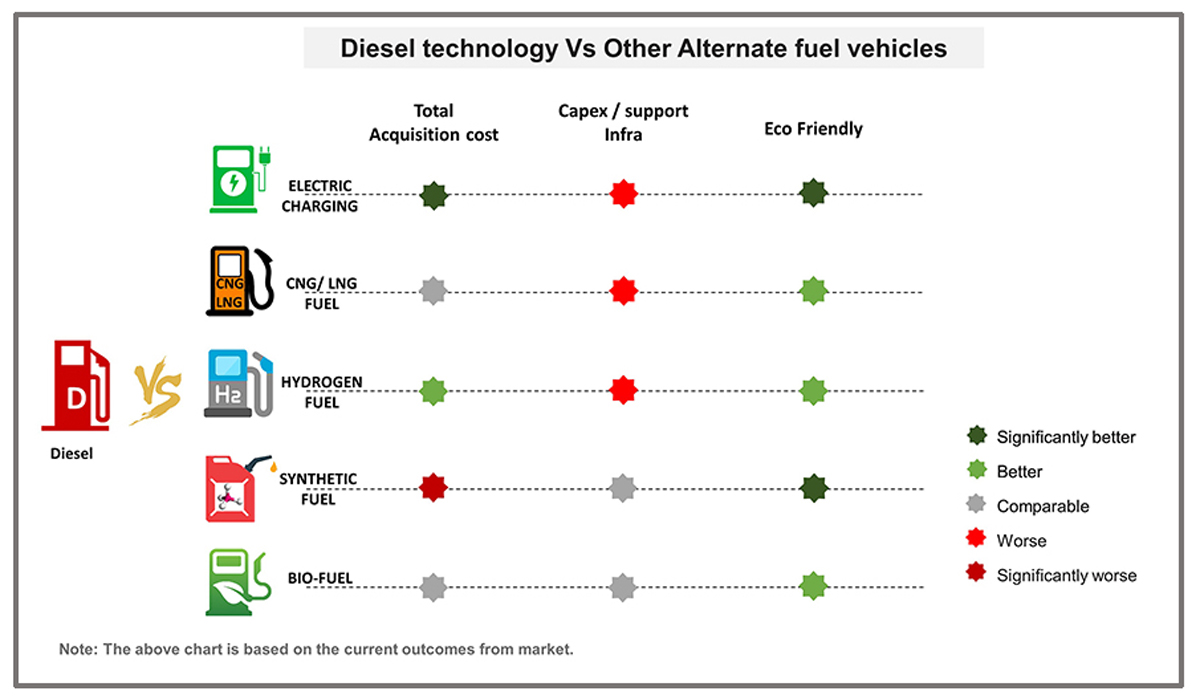

The Indian CV market and related automotive market is quite big and a focus on only EVs will not support the cause even though the EV space is considered a golden sector owing to various government incentives. However, our recommendation is that there should be a consensus to push a bucket of alternative fuel options for vehicles to drive the mobility sector in India under the current circumstances. The charts alongside indicate various alternative fuel options to conventional fossil fuels. Globally, organisations are keen to work on hybrids to make the product attractive and affable to customers.

To conclude, the Indian CV industry is witnessing major tectonic shifts and challenges from various corners and yet remains a prospective and attractive segment in the Indian growth story. It’s observed that a lot of technical advancement is being anticipated with new products lined up by OEM’s. FY 2022-23 is expected to witness abnormal price fluctuation in raw materials and that could be a real spoiler for achieving targets. On the consumption side there been a huge pent-up demand both locally and globally that will goad Indian manufacturers to gear up supplies.