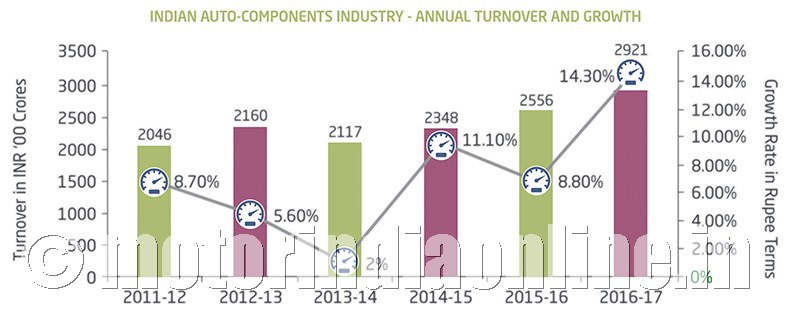

Automotive Component Manufacturers Association of India (ACMA), the apex body representing India’s auto component manufacturing industry, announced the findings of its Industry Performance Review for the fiscal 2016-2017. The turnover of the auto component industry stood at Rs. 2.92 lakh crores ($43.5 billion) for the period April 2016 to March 2017, registering a growth of 14.3 per cent over the previous year and a CAGR of 7 per cent over the last six years. This data represents the entire supply from the auto component industry (ACMA members and non-members) to the on-road and off-road vehicle manufacturers and the aftermarket in India as well as exports. The data also includes component supplies captive to the OEMs.

Commenting on the performance of the auto component industry in India, Mr. Rattan Kapur, President, ACMA, said: “Despite the challenges of demonetisation and uncertainty in implementation of GST, the vehicle production remained buoyant. In this backdrop, the auto component industry as well posted an encouraging performance; the industry grew by 14.3 per cent over the previous year, scaling Rs. 29,2184 crores ($43.5 billion). Further exports, grew by 3.1 per cent in FY 2016-17 to Rs. 73,128 crores ($10.9 billion) registering a CAGR of 11 per cent over a period of six years. The aftermarket was however a silver lining, that grew by 25.6 per cent to Rs. 56,096 crores ($8.4 billion).

Further commenting on the future prospects of the industry, Mr. Kapur added: “We believe that a technological transformation of the automotive industry is imminent, which calls upon the component industry to invest in R&D, create IP, acquire and develop relevant technologies at a much faster pace to remain relevant for future needs”.

Corroborating the thought of Mr. Kapur, Mr. Vinnie Mehta, Director General, ACMA, commented: “Undoubtedly the auto component industry will need to prepare for transformation to e-mobility, but our hands at this juncture are also full in graduating from BS-IV to BS-VI, which by no means is a small change. Leapfrogging a generation of technology in just three years not only calls for sizeable investments for technology acquisition and absorption, but also for skilling of people”.

“Therefore, a long-term stable, technology-agnostic roadmap for the automotive industry driven by a sound regulatory framework is the need of the hour. So that the industry can invest for sustainable growth and development, in line with the aspirations of all stakeholders”, Mr. Mehta added.

Key findings of the ACMA Industry Performance Review 2016-17:

- Exports: Exports of auto components grew by 3.1 per cent to Rs. 73,128 crores ($10.90 billion) from Rs. 70,916 crores ($10.81 billion) in 2015-16, registering a CAGR of 11 per cent over a period of six years. Europe accounted for 35 per cent of exports followed by Asia and North America, with 27 per cent and 26 per cent respectively.

* Exports to Asia increased by 4.6 per cent followed by Europe with 2.6 per cent whereas, exports to North America decreased by 3.8 per cent as exporters catered to regions with rising export demand.

* The key export items included engine parts, transmission parts, steering parts, chassis, bumpers, rubber products, etc.

- Imports: Imports of auto components decreased by 0.1 per cent from Rs. 90,662 crores ($13.82 billion) in 2016-2017 to Rs. 90,571 crores ($13.50 billion) in 2016-2017. The imports from Asia increased by 2.4 per cent but decreased from North America and Europe by 14.6 per cent and 7.3 per cent respectively.

* Technological collaboration of Indian players with global majors, OEMs’ focus on localization to improve cost competitiveness are some of the factors for reducing imports trend.

- Aftermarket: With increasing vehicle parc in the country, the aftermarket in 2016-17 grew by 25.6 per cent to Rs. 56,096 ($8.4 billion) crores from Rs. 44,660 ($6.8 billion) crores in the previous fiscal.