Tremendous opportunities await component suppliers, amid technological disruptions and shifting market trends, provided priorities and partnership are done right.

With the Indian automotive OEM industry already poised to soar ahead in the coming years to seize global eminence, the tailwinds are perfectly aligned for the local automotive components industry to grow out of mediocrity. The ancillary industry has set its own targets to achieve by 2026 – to double the contribution to manufacturing GDP with a four-fold growth in size and a six-fold growth in exports. At present, the auto components industry accounts for 2.3 per cent of India’s GDP and has a share of 4 per cent share in country’s exports. The industry stood at Rs. 3.45 lakh crores ($51.2 billion) for the period April 2017 to March 2018, registering a growth of 18.3 per cent over the previous year.

But the reality is more than what meets our eye. The global automotive industry is at an inflection point today, facing stark headwinds by a variety of disruptive megatrends that can broadly be categorised into three – electrification, connected technologies and autonomous mobility. There is a pronounced shift towards cleaner, greener, and smarter mobility across the globe, thanks to rapid pace of climate change and sprawling urbanisation woes – India being no exception. The disruptions are questioning the status quo in the automotive sector that was prevalent for over a century, ushering both challenges and new opportunities for the stakeholders including OEMs and suppliers.

Critical trends

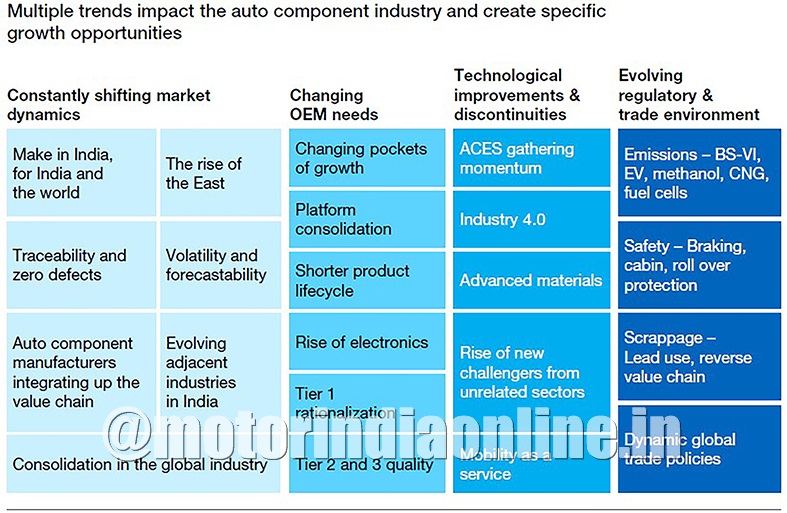

A constantly shifting market dynamics are in place, thus bringing in a multitude of trends and factors impacting the auto components industry in India. In this regard, a comprehensive report titled “The auto component industry in India: Preparing for the future” prepared by McKinsey for the 58th annual conference of ACMA held last year throws critical insights. As per the report, four key dimensions that are shaping this industry are as follows (and illustrated in the infographic below):

- Constantly shifting market dynamics due to changing manufacturing locales, customer demands, operating models and priorities

- Changing needs of OEMs, who are likely to want different, and more agile component inputs. While demand, timelines and processes keep shifting

- Technological improvements and discontinuities that are already starting to change revenue pools, trigger new competition and invite new forms of co-operation

- An evolving regulatory and trade environment forming the backdrop for it all

All these trends together are shaping a set of opportunities for auto component manufacturers. Zeroing in on specific opportunities could be critical for companies as they prepare their future strategies and production pipelines, and help to allocate people and assets to the most important priorities. The clock is ticking, as disruptions never linger around!

A structural recap of Indian automotive industry

In terms of demand channels, the Indian auto components industry broadly caters to two distinct segments. The OE demand accounts for around 80 per cent of the total component demand, while the remaining 20 per cent is traced to aftermarket.

The industry is largely dominated by unorganised players comprising over 10,000 MSMEs, primarily catering to tier-1, tier-2, and aftermarket segments. Cumulatively put, they contribute to over 15 per cent of total industry revenues. The replacement demand off-late has been decreasing, putting pressure on tier-3 and 4 players.

The organised sector, on the other hand, comprises big manufacturers supplying components directly to automakers. There are over 700 tier-1 and 2 players in the country, contributing to about 85 per cent of the market revenues.

In general, the activities of this industry can be categories into two – high-value activities (skill intensive) and low-value activities (labour intensive). In line with the macro-economic scenario, much of our contribution to automotive global value chains (GVCs) is along labour-intensive assembly, large mechanical components, and basic manufacturing.

High-value activities like design, standards-development, specifications, R&D, testing, and market development are performed at lower scales as against other nations shining in the automotive sector. There lies an essential learning for India, for achieving any superlative growth in the Indian automotive component industry warrants significant upgradation of its GVC contributions in terms of increasing the share of high-value activities. This requires significant focus on skill development and improving investments in developing indigenous technological know-hows and local R&D.

Opportunities ahead

Keeping abreast with the changing dynamics, players in the auto ancillary industry must move beyond the traditional field. Devising new priorities and building up required capabilities is crucial to stay afloat in sweeping times. In this regard, pursuing exports aggressively in a big way and expanding their product portfolio to serve adjacent industries can help diversify the customer of suppliers. While identifying component categories that will have higher market demand, especially those that may contribute more to vehicle costs in the future, like batteries for instance, can help streamline your revenue in the long run.

Moreover, expanding aftermarket offerings to capture value from existing vehicle parc and pursuing aftermarket exports can help suppliers to seize new opportunities. Especially post-BS VI, a vacuum in the aftermarket for engine and electronics related components is likely to arise, opening new opportunities for tier-1 and tier-2 suppliers. With the advent of connected technologies and smart solutions, developing data-enabled services and solutions can be a good initiative.

“There exists a very healthy and mature relationship on the value chain with proper synchronization between various stakeholders, including OEMs, tier-1, 2, and 3. However, rising interest costs in working capital and non-availability of credit to tier-2 and tier-3 puts burden on tier-1. Lack of fiscal discipline and proper governance at MSME level adds to the woes. Good OEMs and tier-1 players extend support to their suppliers, so as to ensure stability in the value chain.

– Mr. Arvind Joshi, Director and CFO, Sandhar Technologies

Emerging value technologies in vehicles such as AMT, ABS braking, electronic control units/sensors, and advanced engine designs for BS-VI and beyond may gain more momentum in the coming years. Further, with safety becoming the main concern, the OEM demand for advanced driver assistance systems for lane assistance, and vehicle-to-vehicle communication, is on the rise.

“Key technologies reside with tier-1 suppliers and solution providers and not OEMs. For instance, with regard to BS-VI, they have the humongous task of providing specific systems for every vehicles and their variants. I’m sure they are doing their best, specialised companies are coming up with solutions, to make automakers meet the deadlines of the industry. Once solutions are validated, localisation process is a matter of investment, that will definitely catch on.

– Mr. Vishnu Mathur, Director General, SIAM

However, offering new tech products at Indian market costs can be challenging. Yet, faster commoditization of premium features, more so in passenger vehicles, is a clear indicator of emerging customer demand for these products. Premium features now appear on mass-segment vehicles in half the time it took earlier. It is important that suppliers anticipate such potentials and rapidly add these to their pipeline could help them tap the opportunity, especially on the strength of the famed Indian frugal innovation.

Export – Import scenario

According to ACMA, the exports of auto components manufactured in India grew by 23.9 per cent to Rs. 90,571 crores ($13.5 billion) in 2017-18 as against the previous fiscal. Interestingly, the imports has also grown by 17.8 per cent to Rs. 1,06,672 crores ($15.9 billion) in 2017-2018. This points to the export deficit nature of this industry, which is a major inhibiting factor for the Indian automotive industry to realise its growth targets.

About 30-35 per cent of the auto components used by automakers in India are imported. The share of imported consumption has significantly increased over the last one decade with the entry of new global automotive brands. Powertrain, transmission, steering and suspension parts account for over 50 per cent of the total component import portfolio, while the same categories of components manufactured in India account for over 40 per cent of export portfolio. A majority of India’s component exports comprises of plastic trims and bumpers, rubber products, chassis and related aggregates, to name a few.

The import dependence puts pressure on local suppliers, as cheaper imports enable OEMs to negotiate on component pricing to ensure competitive platform pricing. But the silver lining is that the scenario does offer an opportunity for them to understand the changing requirements of OEMs and strengthen their value chains to inculcate cost and quality competitiveness. Localisation of auto parts is dependent of the development of capabilities of local manufacturers through modularisation.

Aftermarket (replacement market) scenario

The domestic aftermarket grew by 9.8 per cent to Rs. 61,601 crores ($9.2 billion) from in 2017-18, thanks to the broadening vehicle base in the country. According to a recent study by CII, this space has grown at a CAGR of 14 per cent over the past five years, with passenger vehicles and commercial vehicles dominating the aftermarket with 37 and 30 per cent respectively. The report projects that the segment would hit $10.75 billion by 2020.

“The highly unorganised nature of aftermarket business in India is getting more and more organised, which means new opportunities for established tier-1 suppliers in this space, as a level-playing field is now possible”, observed Mr. Arvind Joshi of Sandhar Technologies, while pointing out to a serious of reforms and digitisation of processes happening in this segment.

Further, a host of disruptive changes happening in the industry brings attractive opportunities in the auto aftermarket. For instance, automakers are creating their own brands for the aftermarket and there is a growing global trend of distributor consolidation, either supplier or OEM dependent channels. In addition, a host of cyber platforms are emerging for online auto parts sales, while customer preferences are moving towards tailored and premium service offerings.

Moreover, the growing penetration of technology products like parking cameras and sensors, keyless entry, LED headlamps and DRLs, infotainment and connectivity systems, telematics solutions, etc. Offer plenty of scope in the aftermarket space, cashing on the existing high vehicle parc in India.

Conclusion

In the immediate period including FY2018-19, CRISIL Research expects the auto components industry to grow 12-14 per cent on-year over a high base, on the back of demand from domestic manufacturers across vehicle segments. Led by improved rural demand and state pay commission pay-outs, the demand for two-wheeler and passenger vehicle segments is likely to remain buoyant. Higher sourcing is expected from commercial vehicle and tractor manufacturers, it adds.

On the whole, the Indian auto component industry is committed to its vision for impressive growth and consolidation on a global level. The afore-discussed trends and growth trajectories indicate the importance of making priorities for companies that can lead to specific opportunities, without getting lost in the dynamic disruptions. Driving company wide change to focus on these priorities, along with support from industry stakeholders, could be a potent recipe for success in a dynamic market environment.