With electrification gaining the upper hand across the globe along with hydrogen as fuel, the commercial vehicle industry is on the brink of a major revolution, says Jinal Shah, Director, Expandus

Globally, as economies and industries weather multiple storms, the art that everyone is really trying to master is the ability to manage and thrive in these volatile but exciting times! Through this journey, the commercial vehicle industry has been continuously reinventing itself, driven by rapidly changing regulations, evolving customer needs, advanced technologies, electrification and lower carbon fuels – not only meeting the future needs of transportation but exceeding what we previously thought was possible! A simple search reveals how this buzz in our industry is dominating the headlines — and provides an example of where commercial vehicle research and development and marketing dollars are trending for future products and components.

The Future CV Powertrain

Driven by environmental concerns and stricter emission compliances, it is clear at this point that there is a major shift happening in the commercial vehicle market. Every major OEM and many start-ups have developed fully electric commercial vehicle models ahead of both a TCO and regulatory push to introduce these vehicles. The stakeholders’ primary focus is towards shifting energy mix and reduced carbon intensity with three primary areas: zero emissions technologies such as battery electric and fuel cell electric, low to zero carbon fuels and fuel-agnostic powertrain platforms.

While this decade will be shaped by two trends: those that will make the leap to zero and the rise of low to zero carbon fuels like renewable natural gas, biodiesel blends and hydrogen will lead the way and internal combustion engine technology will see improved efficiencies. In the first half of 2030s, we will begin to see a marked scale-up of new technologies and fuels. Battery electric and fuel cell electric solutions will be viable for more use cases, especially with urban vehicles. Towards latter part of 2030’s decade, as the vehicle electrification eliminates tank-to-wheel emissions, well-to-tank emissions will get increasing spotlight.

Technology Adaptations: Safety, Comfort, Connected, ADAS

The CV sector has already begun a safer, more reliable and efficient transportation powered by software helping fleets avoid accidents, optimise their fuel usage and identify the best routes. Going forward, safety will continue to be dominant. Meanwhile, connectivity and software development will revolutionise condition monitoring and performance optimisation at asset-level, system-level and intermodal levels.

Most OEMs have proprietary telematics solutions coupled with a wide array of aftermarket third-party solutions and software providers offering apps and platforms for data management. For fleet operators who typically own a mix of vehicle brand and age, there is an overwhelming choice of telematics solutions which do not integrate well with each other. We believe, this challenge is clearly driving the connectivity trend towards offering more holistic solutions.

New Business Models and Evolving Value Chain

The evolving future market requirements has offered an opportunity for many new entrants to address existing need gaps in the value chain, thus expanding the supply side. According to us, the vehicle as a service will gain traction where capital expansion resources are limited. As such, the vehicle as a service model will have limited impact in commercial transportation as there are not a large reserve of under-utilised assets or challenge of access to finance. While until now, the OEMs have gained the press podium to the largest degree but we believe that component and intermediate product or service suppliers are and will play a huge critical role in this new game and the show is simply a slower go unless all the stakeholders are aligned at the right pace.

Autonomous Vehicles

Given the complexity involved in achieving full autonomy in all conditions and all situations coupled with political headwind created in replacing millions of jobs, it seems full autonomy is going to be limited to very specific, high-value use cases for commercial vehicles.

Vehicle Architecture: Modularisation of Platforms

The ‘traditional’ basic truck chassis architecture has changed very little in decades. However, with the fuel-agnostic approach of OEMs this is bound to change and has potential for disruption specifically for electric modular chassis that can be used to create up to 10 unique vehicles – ranging from a pickup to a dump truck. One notable trend that start-ups have brought in is that of modular ‘skateboard’, especially for light commercial vehicles and evidence from the likes of the recent partnerships that these could migrate to higher weight classes.

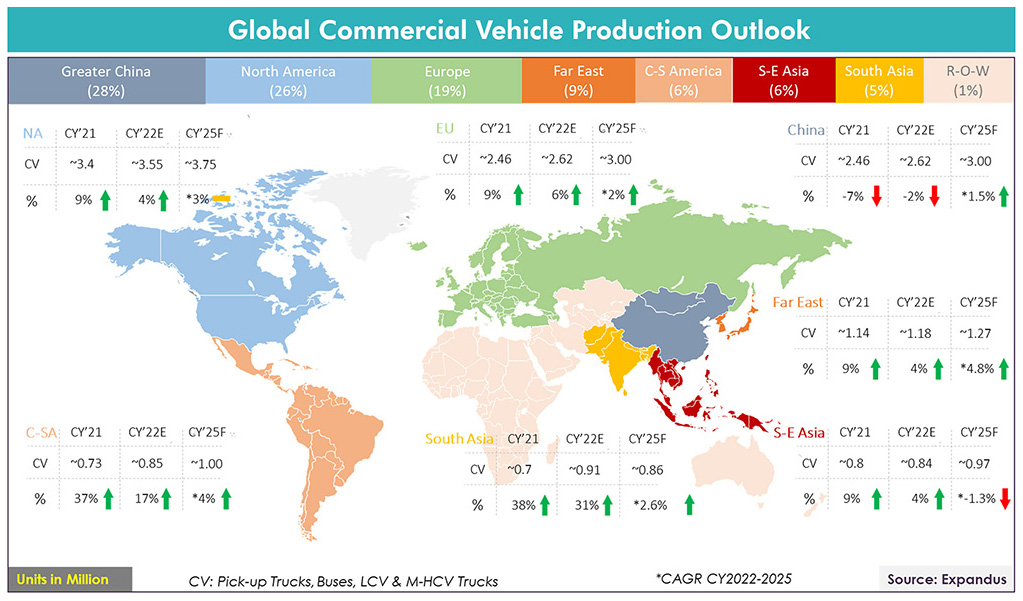

Global Commercial Vehicle Production & Market Perspectives

Meanwhile, the global production in CY 2021 saw recovery in varying capacities due to lower base in 2020 caused by the pandemic-triggered disruption. The world produced ~13 million commercial vehicles – about 7% higher than CY 2020. However, reaching 2019 production mark looks about 3-4 years away. Global CV production is expected to grow moderately by 5% in CY 2022 primarily due to a drop in demand in China and Eastern Europe coupled with recessionary trends in key economies, inflation, interest rates, supply chain shortages and the Russia-Ukraine war, to list a few. The impact of these parameters will slow down growth in most economies before recovering in 2025.

North America

Rising fuel costs, interest rates, inflation and economic downturn threats are likely to cause the forecast for LCVs to be static for the next years. MHCV will grow in 2023 as fleets continue to reduce supply chain backlogs and strong freight demand at least until H12023 before steep downturn in 2024.

China

Coupled with recent upgradation of emissions to China VI and the pandemic, China witnessed a continued depressed logistics and transportation market, further curbing demand for new trucks. The production recovered in H12022 supported by imposition of the national purchase tax policy and the introduction of the heavy truck subsidy policies in select places. While sluggish growth will continue through 2025, China will continue to be the largest EV producer and consumer of electric fleets driven by buses and light commercial trucks.

Europe

Production of CV in this region with continue as a mixed bag with higher growth in Western Europe and much lower demand in Eastern Europe impacted by war with production almost ceasing in Ukraine while other countries are being impacted by truck supply kits for assembly from Russia.

Central-South America

Driven by exceedingly elevated levels of CV production in Brazil in CY 2021, overall production in South America is expected to increase in healthy double-digits in CY 2022 before declining in CY 2023 due to sufficient truck capacities, rising interest rates and upcoming emission regulations of P8, equivalent to Euro VI in January 2023 for vehicles above 3.8 tons.

Far East

The economic slowdown and supply constraints in Japan and Korea will register low volume growth as they also export significant CVs in ASEAN countries.

South East Asia

Indonesia’s economy is expected to grow by 5% in 2022 and 5.2% in 2023 and has USD412B road infrastructure projects, BRTS, railway projects, etc. which will support demand for CVs over the forecast period. Indonesia will need 100,000 buses for replacing old fleet of buses in the next five years. For Thailand, imports are going up to meet the demand in CY 2022 but production is hit due to disruptions in supply chain from the prolonged Russia-Ukraine war. Overall, SE Asia’s CV production will have a low-digit growth through the forecast period.

South Asia

Supported by a very strong economic recovery in India in CY 2021, CY 2022 will witness healthy growth supported by fleet replacements, rapid growth of e-commerce driving logistics requirements specifically for LCVs and last mile deliveries, recovery in bus demand as offices and schools reopen along with strong infrastructure push driving tippers and Class 8 segments. The trend is likely to continue with low single-digit growth in CY 2023 before registering a decline in CY 2024. India is witnessing a significant shift in alternate fuel demand driven by ever-rising fuel prices and TCO requirements.

Looking Ahead

The future of commercial transportation will be shaped by three perspectives: a shifting energy mix, innovations in software and evolving business models driven by use cases. We are at the forefront in the industry when it comes to the getting the ‘green’ tag for the transport sector. While the world was earlier divided by sulphur content, it is moving into a transition of being divided by BEV along with or hydrogen. While there isn’t a shortage of problems globally, these situations potentially will make the commercial vehicle industry more resilient, stronger and collaborative.

About Expandus (www.expandus.co.in)

With 40+ years of cumulative experience in Manufacturing, B2B Research and Consulting industry; Expandus is Your Hands-On Partner. Our Mission is to fast-track efforts to accomplish Your Vision. We partner with decision makers in Automotive, Electronics and Plastics industries to offer a range of growth consulting services and custom-tailored studies helping individual clients develop unique solutions to the challenges of rapidly changing markets. For Commercial Vehicle Industry, Expandus offers Model-Level Production-Sales-VIO Data intelligence and forecasting, component level opportunity identification and competitive intelligence.