The frequent hike in world petrochemical prices has severely impacted the fuel supply and costing in India, resulting in destabilising the automotive sector with higher fuel prices being paid by vehicle users as well as fleet operators.

Prices in the $3-trillion-plus global petrochemicals market climbed 10 per cent in April from a month ago, posting the first double-digit increase since February 2012. This marked the first time since 2013 that global petrochemical prices have climbed for three consecutive months.

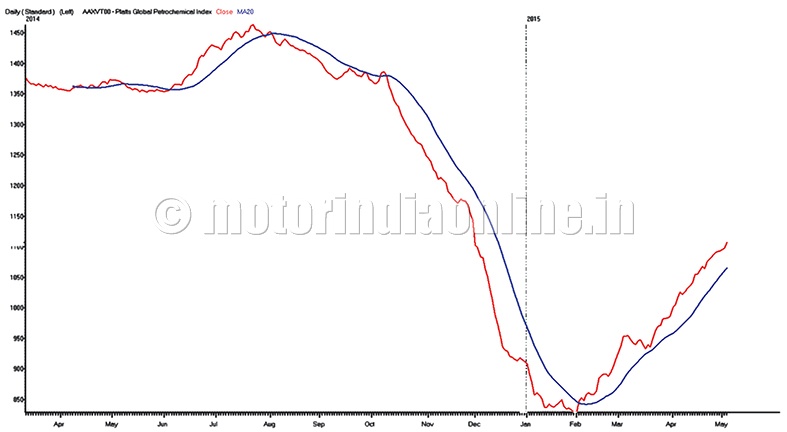

Petrochemical prices, expressed as a monthly average, increased $97 per metric ton from March to $1,052 in April, according to the just-released monthly Platts Global Petrochemical Index (PGPI).

PGPI is a benchmark basket of seven widely used petrochemicals and is published by Platts, a leading global provider of energy, petrochemicals, metals and agriculture information and a top source of benchmark price references.

“Petrochemical prices were reacting to increasing crude and naphtha prices,” said Jim Foster, director of petrochemical analysis at Platts. “Naphtha, which is the most commonly used feedstock to produce olefins, climbed 13% in April as crude was up about 16%. As those feedstock prices climb, petrochemicals tend to trend higher. The tightness in supply due to maintenance turnarounds in the global ethylene markets also contributed to the strong gains.”

Petrochemicals are used to make plastic, rubber, nylon and other consumer products and are utilized in manufacturing, construction, pharmaceuticals, aviation, electronics and nearly every commercial industry.

Olefins

Prices of olefins, a group of hydrocarbon compounds which are the building blocks of many petrochemical products used to produce everyday goods, were mixed in April. Ethylene prices jumped 19 per cent to $1,096/mt. Maintenance turnarounds caused tight supply in the global ethylene markets, pushing the price higher. Propylene, though, saw prices fall two per cent in April as strong refinery production rates pushed more propylene into the market.

Polyethylene and polypropylene plastics manufactured from ethylene and propylene respectively were both stronger in April. Global polyethylene prices climbed 12 per cent to $1,422/mt, while global polypropylene prices moved up seven per cent to $1,368/mt.

Prices of aromatics, a group of scented hydrocarbons with benzene rings used to make a variety of petrochemicals, also were on an uptrend in April. Benzene saw the largest increase of any aromatic component in the PGPI, with prices climbing 14 per cent from March to $831/mt in April. Toluene prices rose 6 per cent to $730/mt, while paraxylene prices were up 9 per cent at $859/mt.