The Indian truck industry has largely become consolidated with a handful of players catering to the entire market. Since the product offerings of these brands are more or less at par with each other, the customer experience on aftersales service support becomes a key differentiating factor in deciding who comes on top. Over the last few years, Eicher Trucks and Buses a business unit of VE Commercial Vehicles (VECV) has invested enormous amount of time, effort and resources to address persistent issues that have plagued the sales & service side of the value chain. Today, having topped the FADA Dealer Satisfaction Survey in the CV segment for two consecutive years, the company is reaping rich dividends for all its dedicated efforts. N. Balasubramanian caught up with an industry veteran who has been at the heart of the exciting transformation, Ramesh Rajagopalan, SVP – Customer Services & Network Strategy, VECV, to understand in detail about the CV maker’s pursuit of ‘Retail Excellence’

How are sentiments in the CV industry currently?

The current sentiments in the truck industry are absolutely positive and the reasons are plenty. The overall mood is extremely upbeat which reflects in the kind of new vehicle enquiries we get. At the heart of the growth are a lot of infrastructure projects with a lot of expansion happening which in turn drives the movement of steel, cement and other material. Another segment that is driving consumption is e-commerce. Since COVID there is very high demand for purchase of goods through digital / e-commerce which has taken logistics to a different level.

The service and parts business is also growing at a phenomenal rate, so much so that most of the OEMs are finding it difficult to handle and hence setting up new dealerships and expanding their network. We are seeing a huge upswing in vehicles coming to workshops for service. This growth is being driven by multiple factors.

The main factor driven by overall economic growth is the number of km trucks clock in a month. For instance, trucks in the e-commerce segment used to do 12,000 km per month; in the last year, we see trucks clocking 25,000 km a month. We are talking about 200,000 km a year in a medium- & heavy-duty truck for e-commerce use which was unheard of and never thought about before COVID. The vehicle reliability is much better these days and the roads are also a lot better. So the trucks run more, fleet owners earn more and in spite of increased replacement intervals, we see a 30-35% YoY increase in service inflow. So the rise in overall market consumption is significantly driving our business.

Also, a lot of fleet replacement and pent-up demand created by COVID has contributed to the growth. Dealers, financiers and other key stakeholders are also giving a very positive view of the current market scenario.

According to you, how important a role do dealerships play in the CV industry’s growth and progress? What is Eicher doing to ensure your dealer partners are ready, motivated and profitable in business?

In India, we operate through channel partners unlike markets like Japan and Europe where they largely have company-owned set ups with private dealers lesser in number. In our country’s business model, dealers become a very strong, important and integral part of the value chain. In fact, the entire supply chain depends a lot on the efficiency and success of the dealer network so the stakes are high on CV dealerships.

In the last 3-4 years, thanks to COVID, financially mismanaged dealership set ups were forced out of the system. Also, the experience proved to be a checkpoint for many as the industry was not prepared for such a challenge; while many dealers corrected and realigned themselves, OEMs put a lot of stringent processes in place.

At Eicher we are clear with our direction; we want to steer the change from wholesale to retail sales as we feel the latter is the real sale. It eliminates artificial sale involving pushing of stock to the dealer end. What dealers look for is transparency – they are ready to sell and want us to support them throughout the lifecycle of the product. We have understood this well and are committed to supporting our dealer partners for the long-term.

Moving forward, we see much closer engagement between us and the dealer network to be able to understand the market better and serve our customers better. Eicher has taken a clear lead in this front and ensure our dealers are profitable; otherwise, once in 5 years, the dealer keeps changing which is a common trend in the market. All it takes is to have the right approach and will, and ensure what we plan is executed at the ground level. If the dealer is efficient and profitable, the customer will automatically be happy and satisfied. It becomes a win-win-win for all of us.

Could you highlight some of the key initiatives taken by Eicher to support your dealer partners?

Around 18 months back, we introduced a system through which the dealer stocks are directly monitored by us. It is a scientific model which tells each dealership the kind of parts to be stocked based on consumption patterns and the vehicles running in the region. This ensures the right parts availability at the right time and right place. Previously, the parts availability and stock planning were being handled by dealers’ workforce which made it extremely difficult to streamline. Another thing is that we have different layers of parts suppliers so if a retailer does not have stock, it comes from a distributor. We have also recently kickstarted an e-commerce initiative through which parts can be ordered online or by call.

Also, some dealers have huge stocks of old unused parts about which no one is usually aware of; these parts are actually the dealer’s working capital locked up. Through our new system, the parts that gets consumed get replaced. The parts that don’t get consumed over a particular period of time are taken back by us for which we offer a full buyback. So, the dealer has zero risk since he has stocks of all relevant necessary parts and doesn’t have to worry about cash getting blocked in unsold parts. As a result, the financial efficiency of our dealer partners has dramatically increased. Such initiatives have contributed to Eicher topping the FADA Dealer Satisfaction Survey in the CV segment for two consecutive years so clearly we are seeing results.

What’s happening on the service side? How is Eicher ensuring maximum uptime for fleet customers?

These days, fleets want to save time by not sending their vehicle to the workshop for service, they expect the service to be done at their place. We are moving aggressively towards being where the customer wants us. We offer on-site support for large fleets and also at mining sites. We offer site support at 158 locations across the country where we provide guaranteed uptime and back it up with parts, training, tools and diagnostics. Through this we have seen productivity of fleets increase dramatically. We try and remove such small bottlenecks that are pain-points for our customer. We tell them, ‘You take care of your business, vehicle is our business’. We guarantee their fleet’s uptime and take pride in pioneering this in the Indian CV industry.

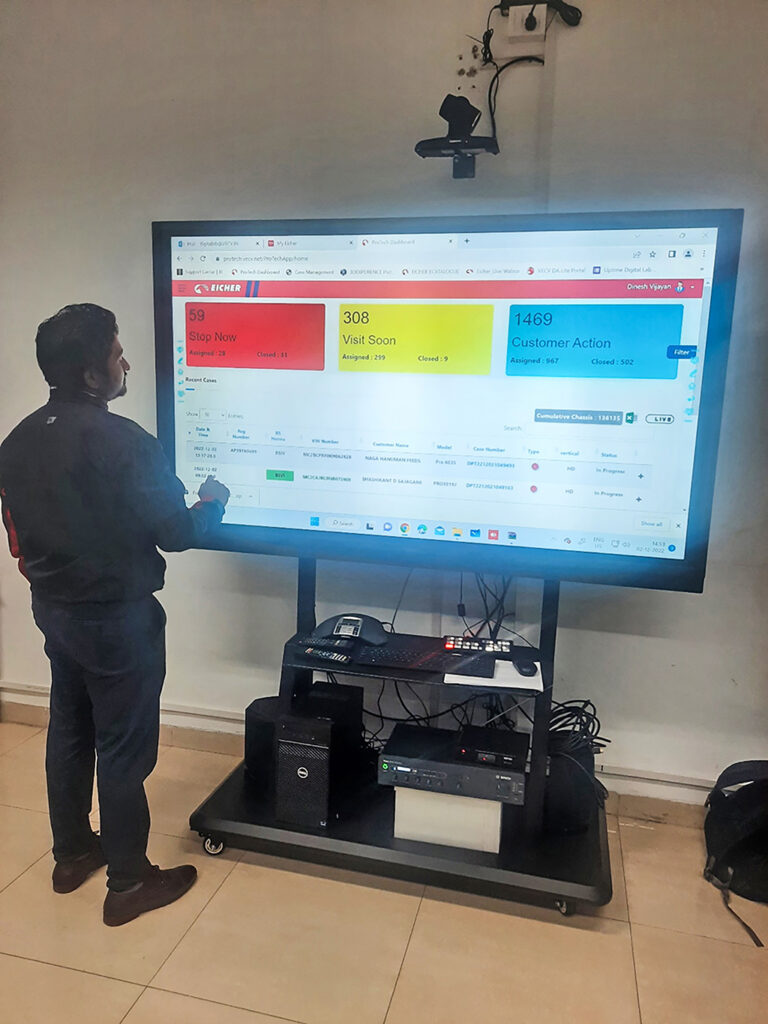

We measure uptime not only in mines or on-road, we measure it even for workshops, as a different metric called ‘workshop responsiveness’ which includes monitoring 7-8 strong KPI parameters. This is a big initiative that is dramatically improving efficiency of our workshops. We also have an app called ‘MyEicher’ which gives the customer full transparency of his vehicle and its service schedule.

We do not just demand that our workshops operate at peak efficiency, we facilitate it by focusing on competency, parts availability and diagnostic capabilities. Post BS-IV, there has been a sea change in diagnostics, so technicians need to be trained. We have 4 levels of competency – learner, performer, expert and master and maintain a sharp focus on training. We have around 6 regional development centres and 9 mobile training vans to ensure our dealers are constantly updated on competency. We have a digital platform called iLearn which is like a Youtube channel that is constantly updated.

Also, to support our technicians, especially those in the hinterlands, we provide remote diagnostics assistance through which they can connect with our 24×7 Uptime Centre at Pithampur who can take over the diagnostics remotely and resolve the program. We have a technically qualified team handling these calls and ensure the issues are resolved on priority. Why? Because we don’t want to make our customer wait for any reason and are committed to getting his truck back on road with urgency.

That’s quite an impressive work you and your team are doing. How is all this reflecting on the network side? What is your overall reach across the country at present?

Customers don’t expect a showroom experience. What they want is a functional workshop that can handles trucks efficiently, competent manpower, right tools & equipment and parts, lowest downtime and turnaround time at affordable price. We felt the softer aspects are very important which is why our aim is ‘Retail Excellence’.

Every month we are adding around 9-10 new touchpoints so the count is very dynamic. We have around 720+ touchpoints at present; this includes all our outlets from 1S to 3S and the on-site support locations. We have 8,000+ parts retailers connected to us and 10,000+ technicians in our network. In the last 30 months, typically post COVID, we have added around 290-300 outlets, so that’s the kind of growth and demand we are seeing.

Post BS-VI, due to the complexity of the trucks, we see a general tendency for customers to come only to dealerships for service. Other key factors that are driving flow of vehicles to dealerships include increase in warranty period, better acceptance of service contracts and longer life and running time of vehicles. We have to be prepared for it now and for the future but it is a happy problem to have. In fact, around 200+ of our workshops are enabled for extended working hours and to function on Sundays while 22-23 set ups operate 24×7. This is how we gear up for the growing demand.

Lastly, what challenges do you see hampering the growth of the service sector? How is Eicher addressing the same?

The availability of good, qualified resources is a major challenge. We at Eicher are actively engaged in skilling and training and are creating a resource bank. We invest a lot of time, money and resources in upgrading our workforce’s skillsets and also accept dealership manpower into apprentice roles which helps them in many ways. We are proactively involved in ASDC initiatives, we support their programs by sharing a lot of valuable content, in framing the curriculum, etc. on the CV side.

Another one that is not a challenge but more of a rapid change is digitalization – how quickly and effectively dealers, customers and technicians become tech-savvy. Technology adoption is a bit tricky because even if we as an OEM want to move forward with new solutions on telematics and related areas, the other stakeholders involved need to be educated and made aware of its advantages for them to accept and appreciate the change.