Mining, steel and cement freight rates saw a healthy on-month increase in December as construction activity resumed. The extended south-west monsoon rains had affected the rates in November.

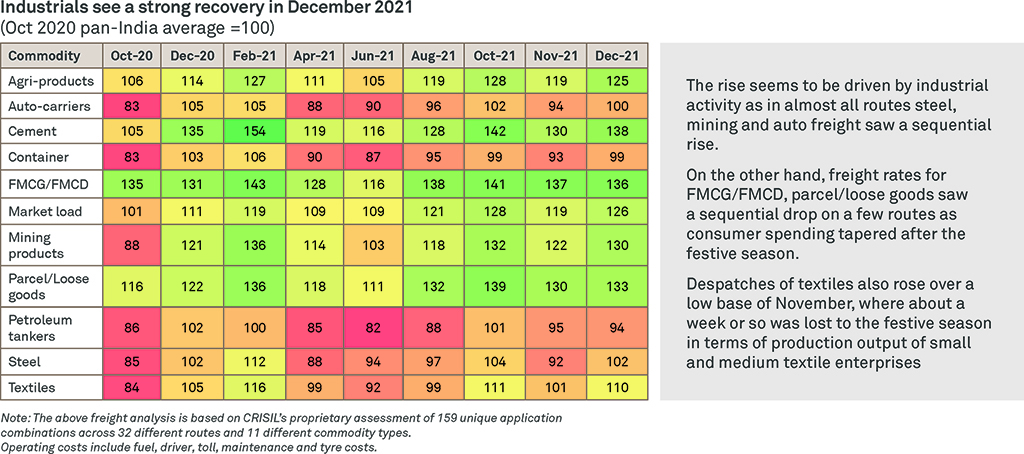

The rise seems to be driven by industrial activity as almost on all routes, steel, mining and auto freight saw a sequential rise. On the other hand, freight rates for fastmoving consumer goods (FMCG)/fast-moving consumer durables (FMCD), parcel/loose goods saw a sequential drop in a few routes as consumer spending tapered after the festive season.

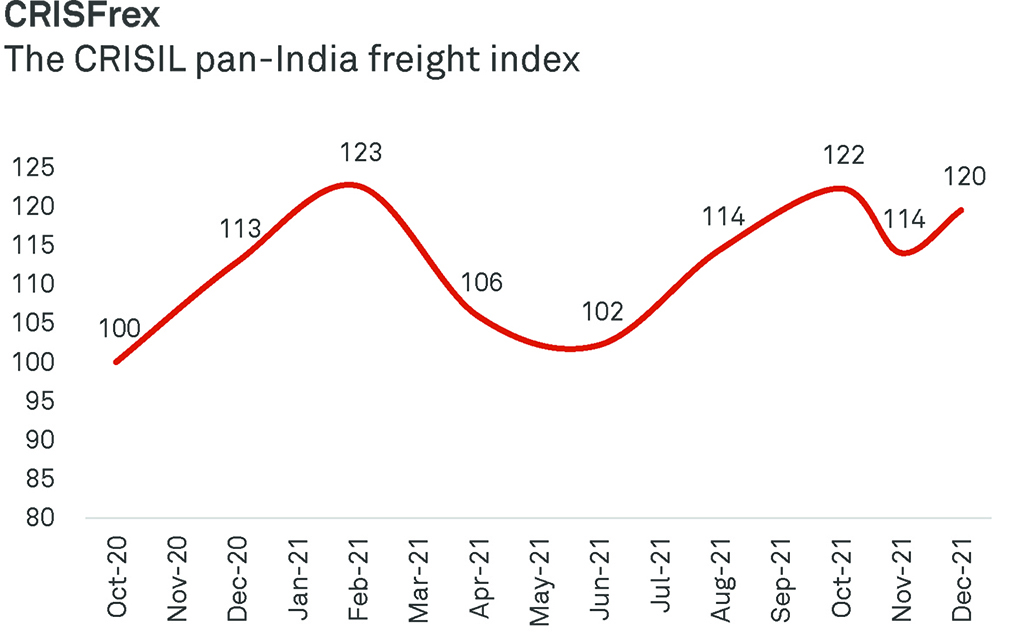

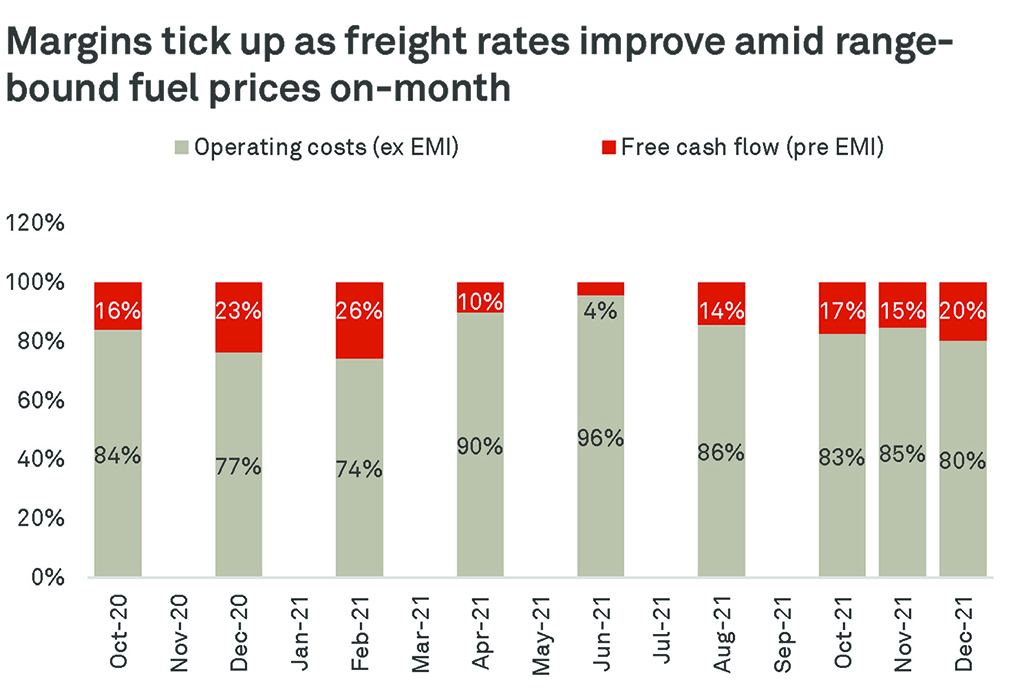

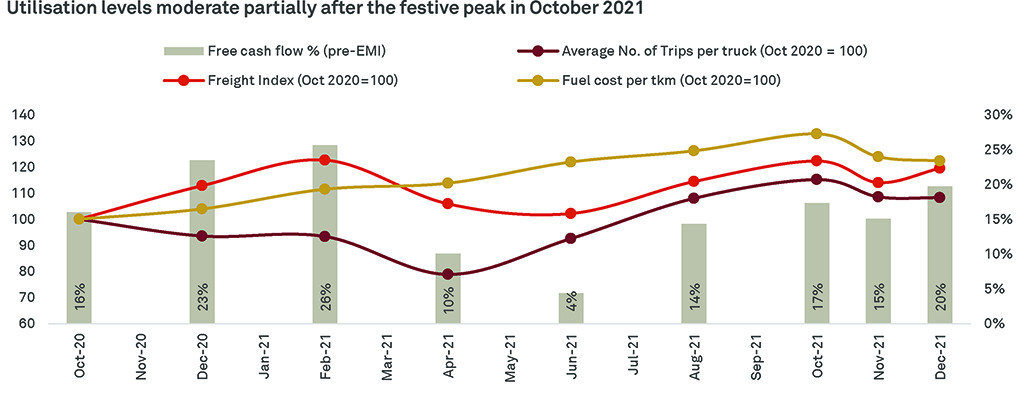

A first-of-its-kind index in India, CRISFrex not only captures the changes in freight rates on a sequential basis, but also tracks the free cash flow, or FCF, (pre-EMI) of transporters on an ongoing basis. Typically, higher FCF improves demand for commercial vehicles.

CRISFrex and FCF signals

Freight rates in December improved at a mid-single-digit level on-month. They rose for almost all commodities barring FMCG and petroleum products.

For consumer essentials such as FMCG/FMCD, which are relatively resilient and stable segments, the drop was limited to less than 1% on-month.

Industrials such as mining products (coal, iron ore, and limestone), cement and steel are seeing a sequential recovery as freight rates for these applications have improved by more than 5%. A key driver for this improvement is the resumption in construction and mining activities, which were subdued in December after a slow November due to prolonged monsoon.

Discretionary goods such as automobiles and textiles also saw an improvement in freight rates. The improvement in auto carriers is driven by a slowly improving scenario in terms of vehicle dispatches (which has thus far been marred by supply issues), while that in textile is driven by restocking of inventory in December after festive buying seen in November.

Cumulatively, the CRISFrex Index improved to 120 in December 2021 from 114 in the past month due to these factors. Further, relatively stable fuel prices have resulted in this increase translating into a direct increase in margins. FCF, (pre-EMI) as assessed by CRISIL, is estimated to be at about 20% of freight earnings compared with 15% in November 2021, translating into a sequential rise in terms of margins, but margins are still slightly below levels seen in December 2020.

Methodology

CRISIL incorporates the views of 100-150 transporters to understand freight dynamics and operational aspects such as the number of trips and key cost heads (fuel, driver, toll, tyre and maintenance).

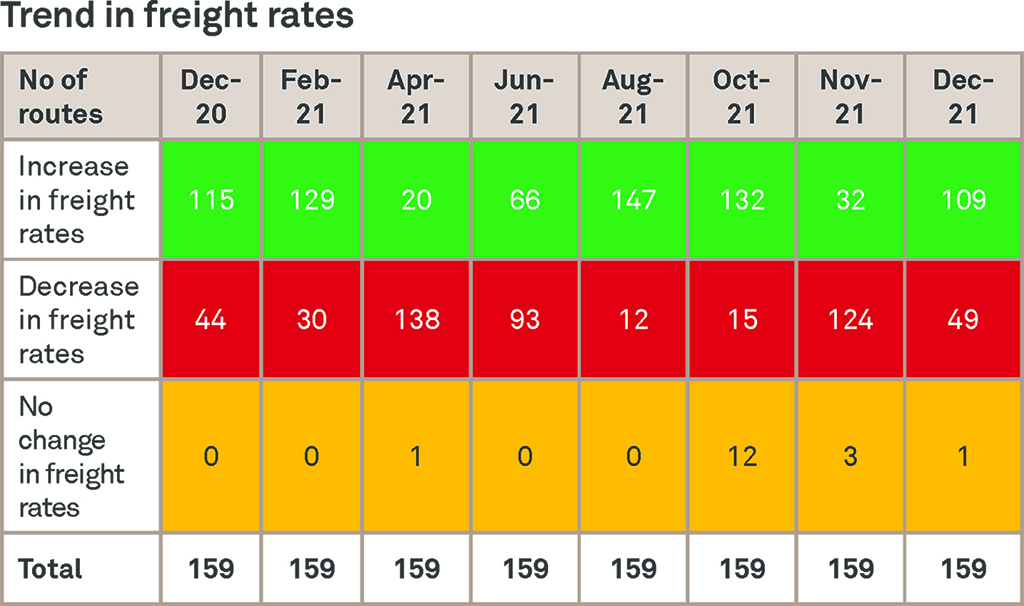

This exercise is conducted on a closed sample of 159 route-commodity combinations spanning 32 routes, 11 commodity types and 5 truck platforms with differing load bodies depending on the commodity carried. The analysis depicts an aggregated view of the inputs collected to arrive at a holistic picture of the overall trucking scenario in India.