Even though the pandemic has receded from India, the ongoing Russia-Ukraine conflict, inflation and the renewed lockdown in China could continue to impact vehicle sales, according to the Federation of Automobile Dealers Associations

The Federation of Automobile Dealers Associations (FADA) has released the vehicle retail data for March 2022 and FY 21-22. A brief analysis of numbers reveals the following:

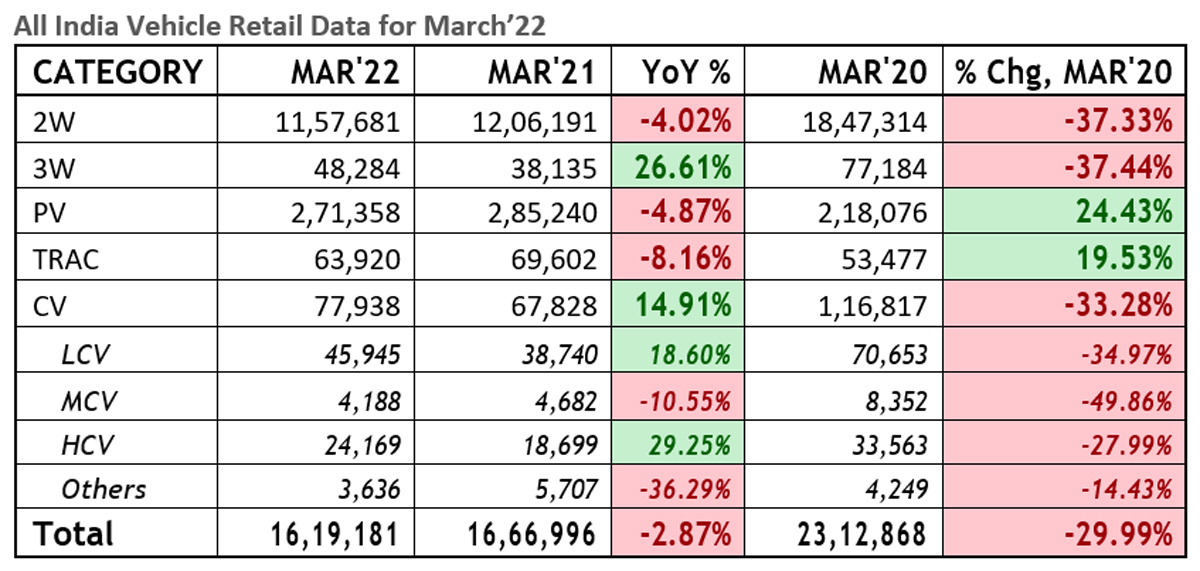

Analysis for March 2022

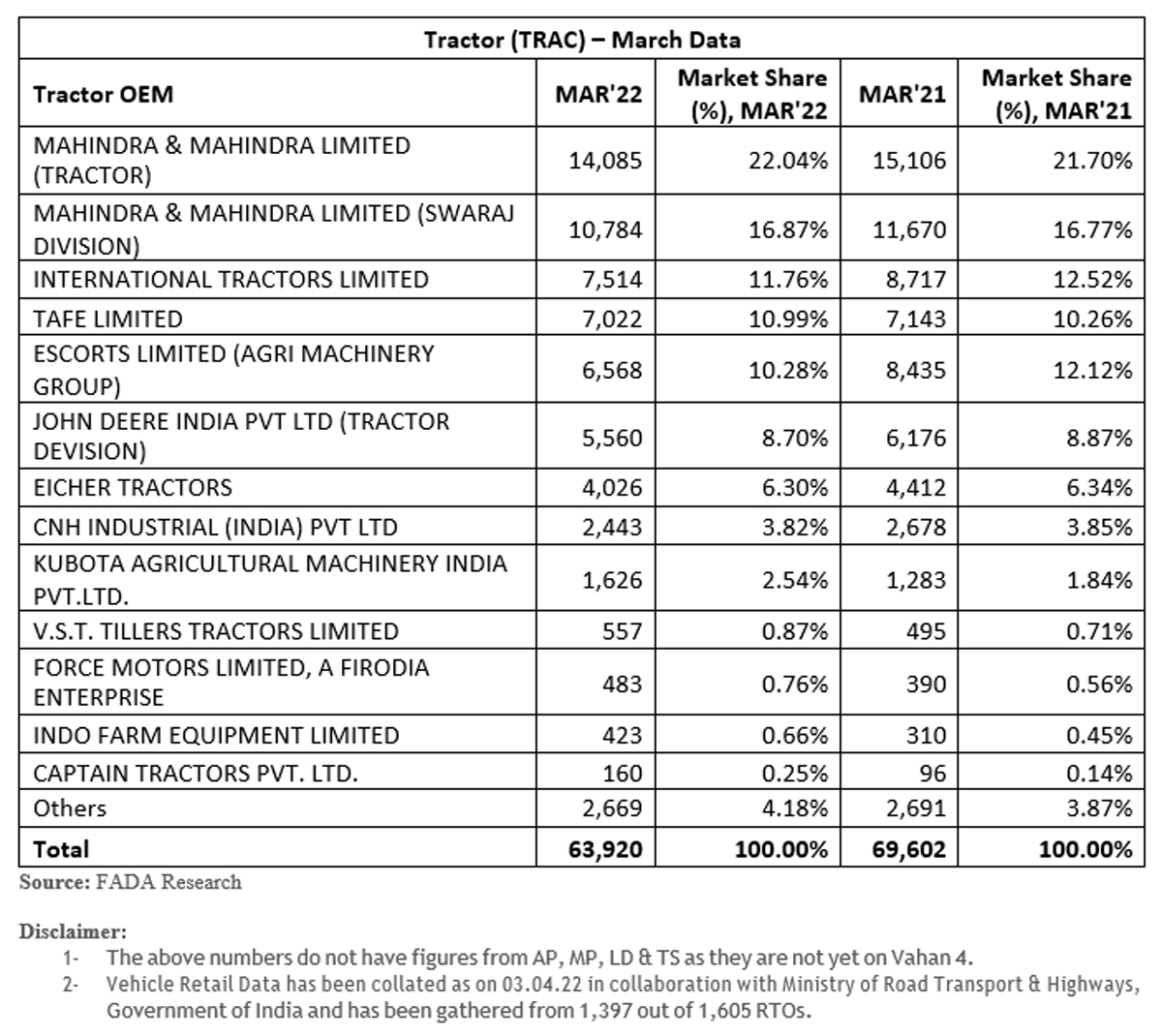

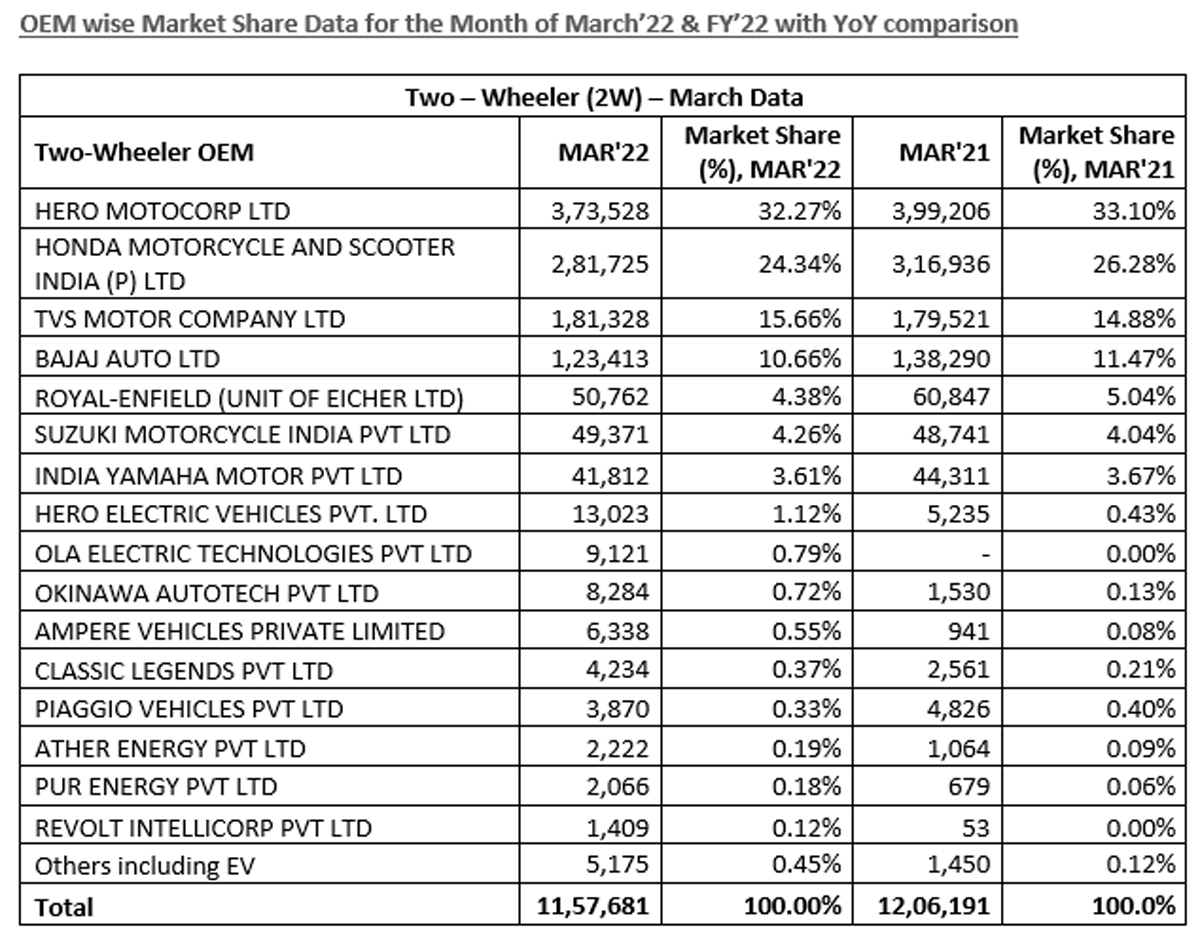

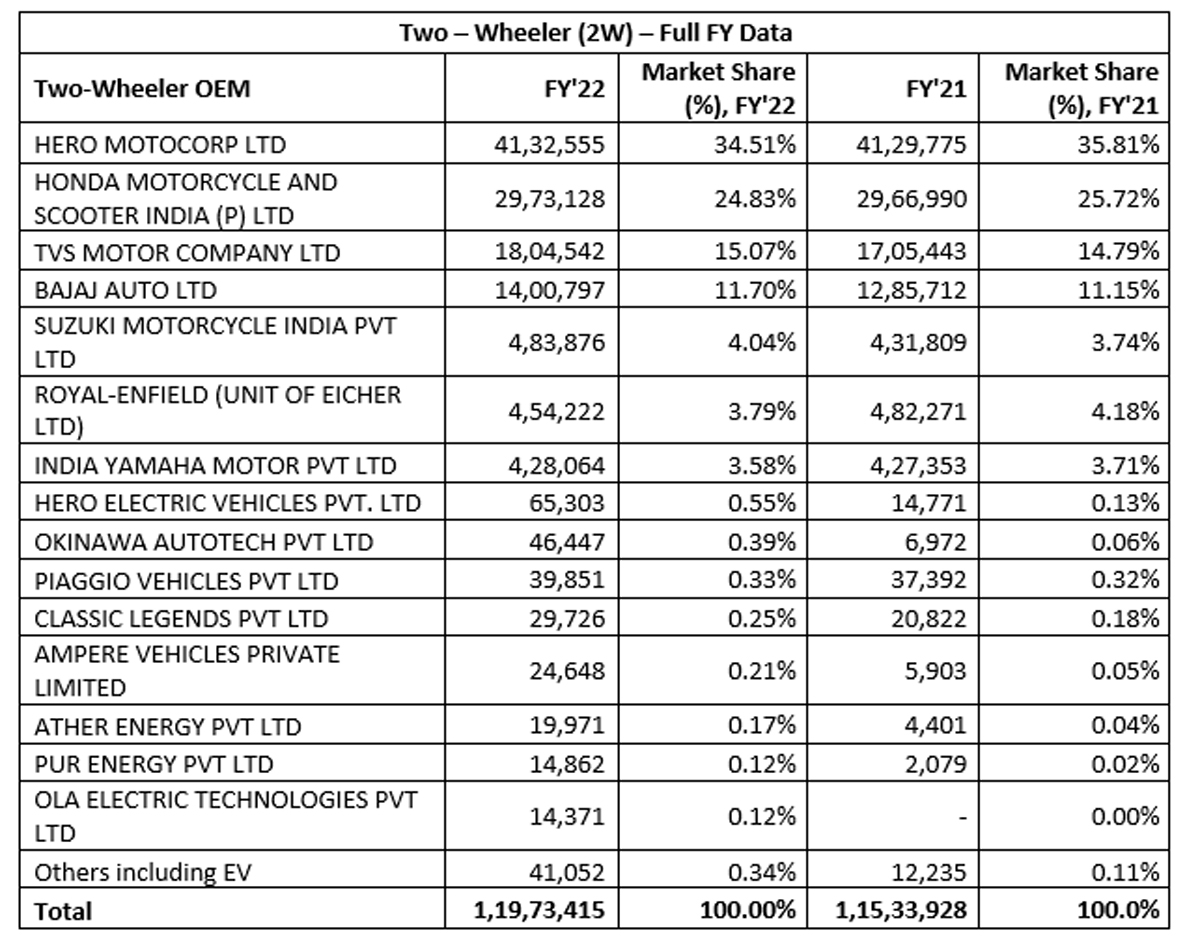

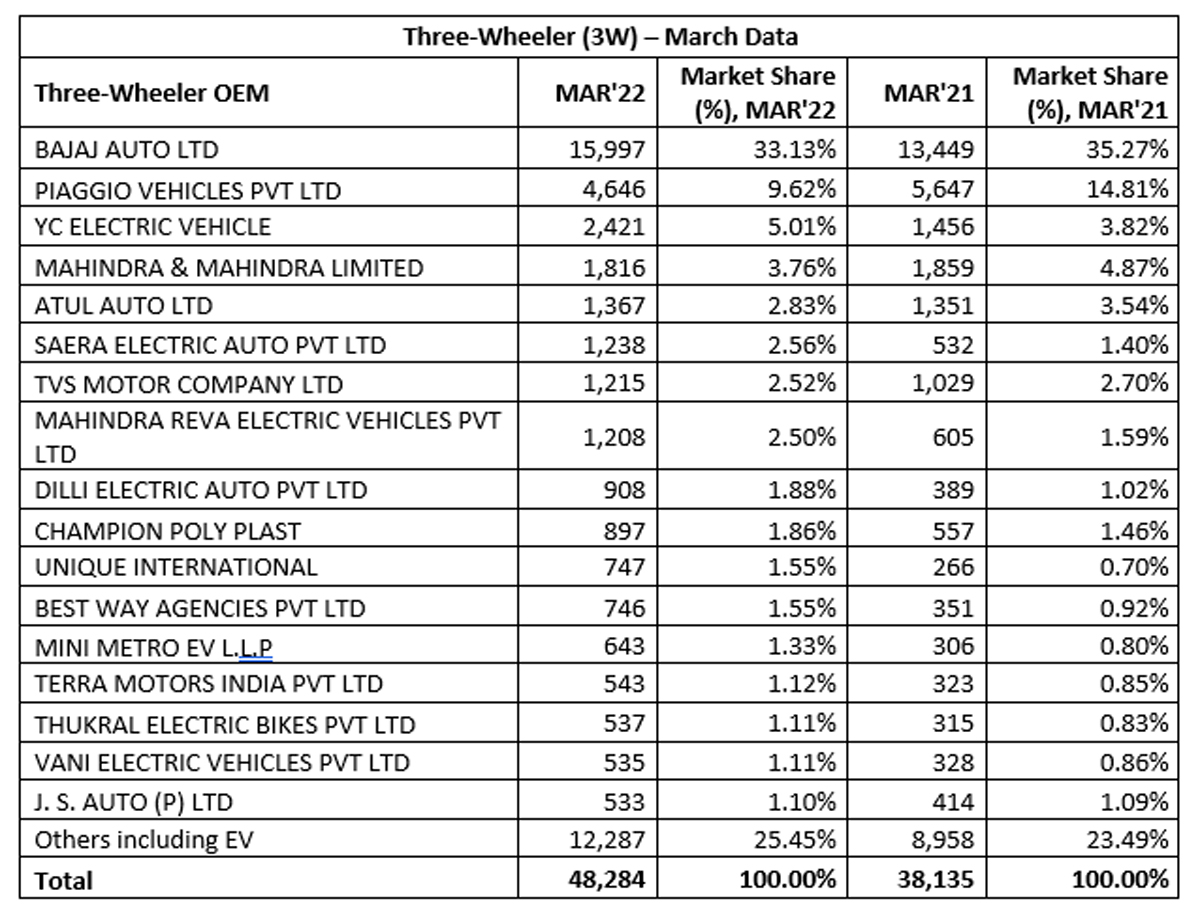

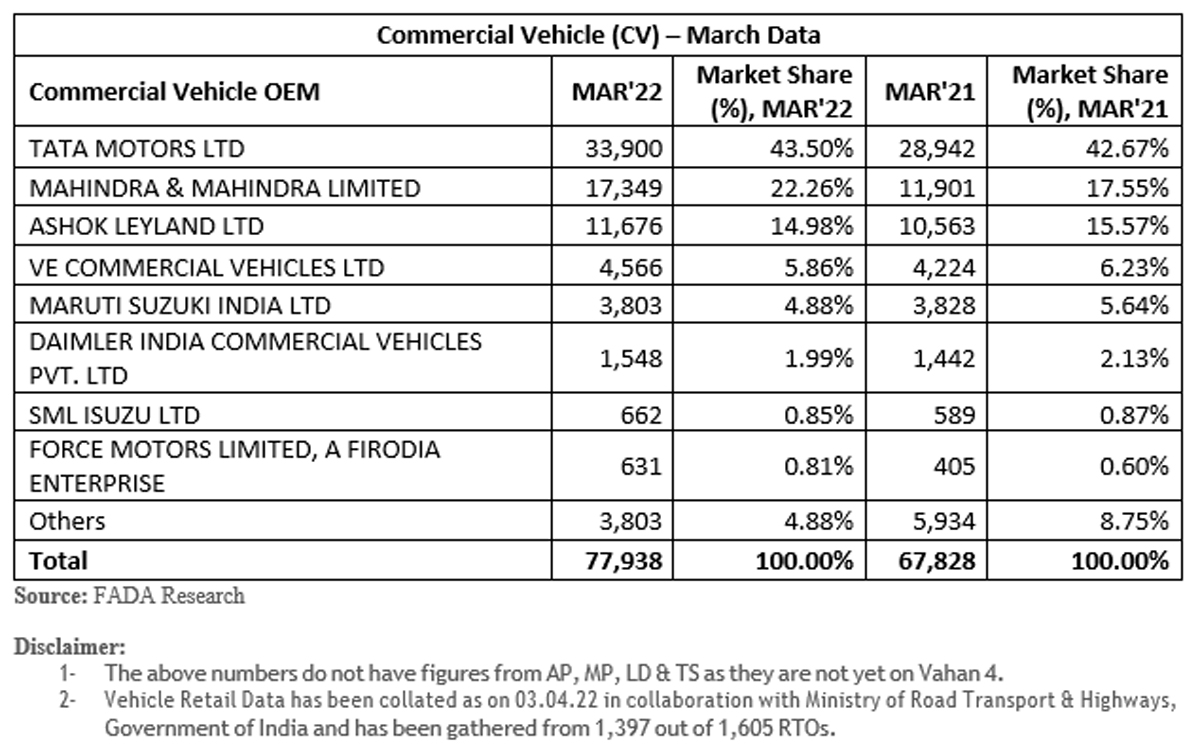

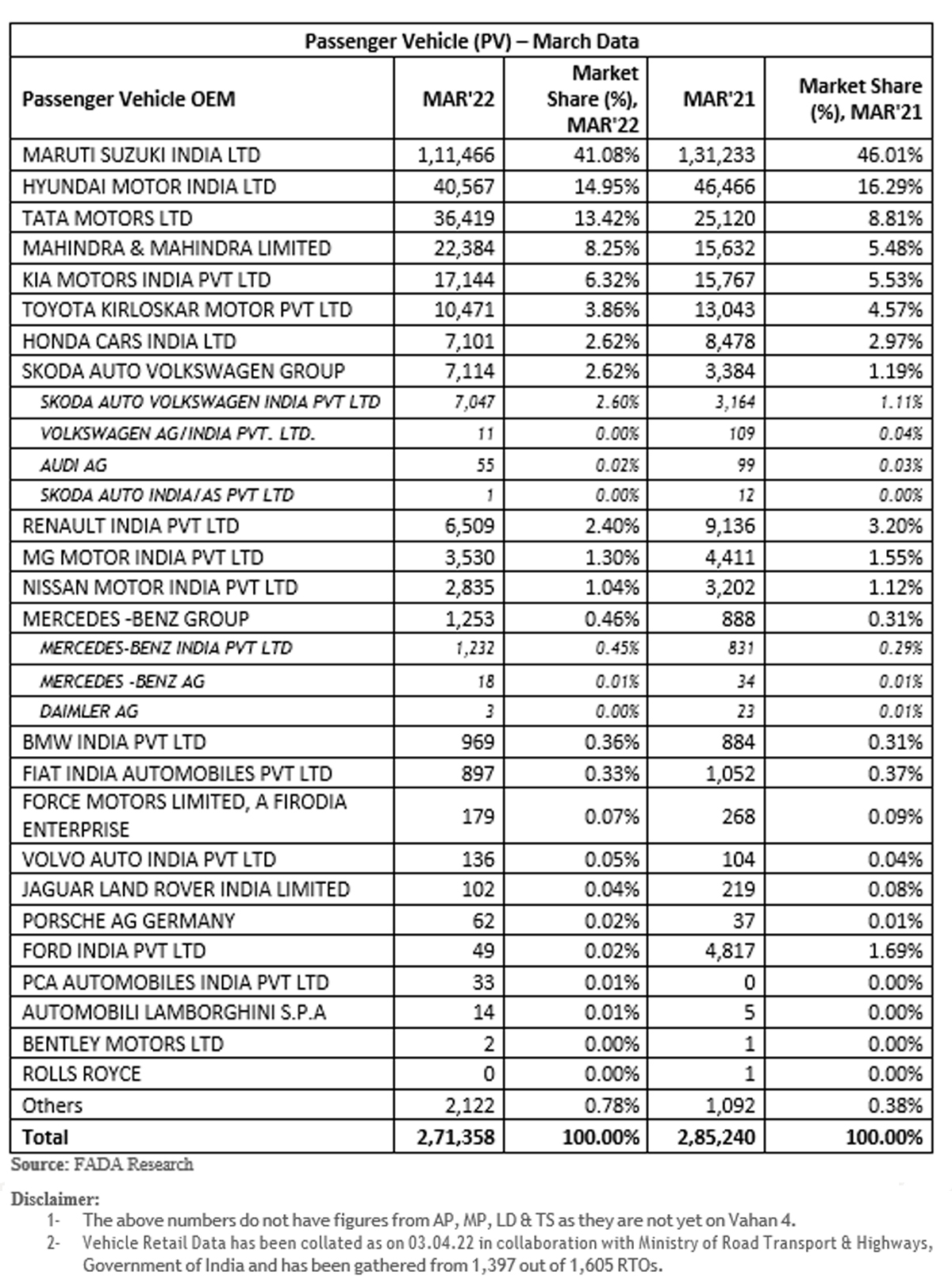

On YoY basis, total vehicle retail for March decreased by 3% and by 30% when compared to March 2020, the month when an all-India lockdown was announced. On YoY basis, three-wheelers and commercial vehicle sales were up by 27% and 15% respectively. Sales of two-wheelers, passenger vehicles and tractors fell by 4%, 5% and 8% respectively.

There does seem to be any sign of recovery since both two-wheelers and tractors continue to sell less. Despite demand from passenger vehicles remaining strong, the supply crunch due to various global phenomena such as the Russia-Ukraine war and the renewed China lockdown have restricted customers from purchasing vehicles. CVs continue to record double-digit growth when compared to last year even though the ride to pre-pandemic levels remains an uphill task.

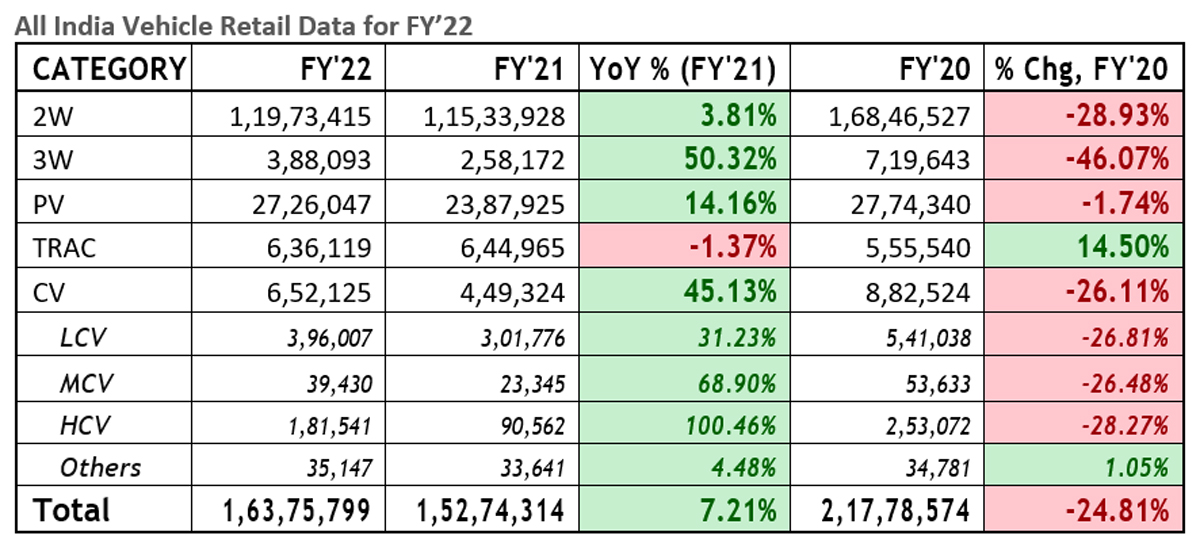

FY22 Review

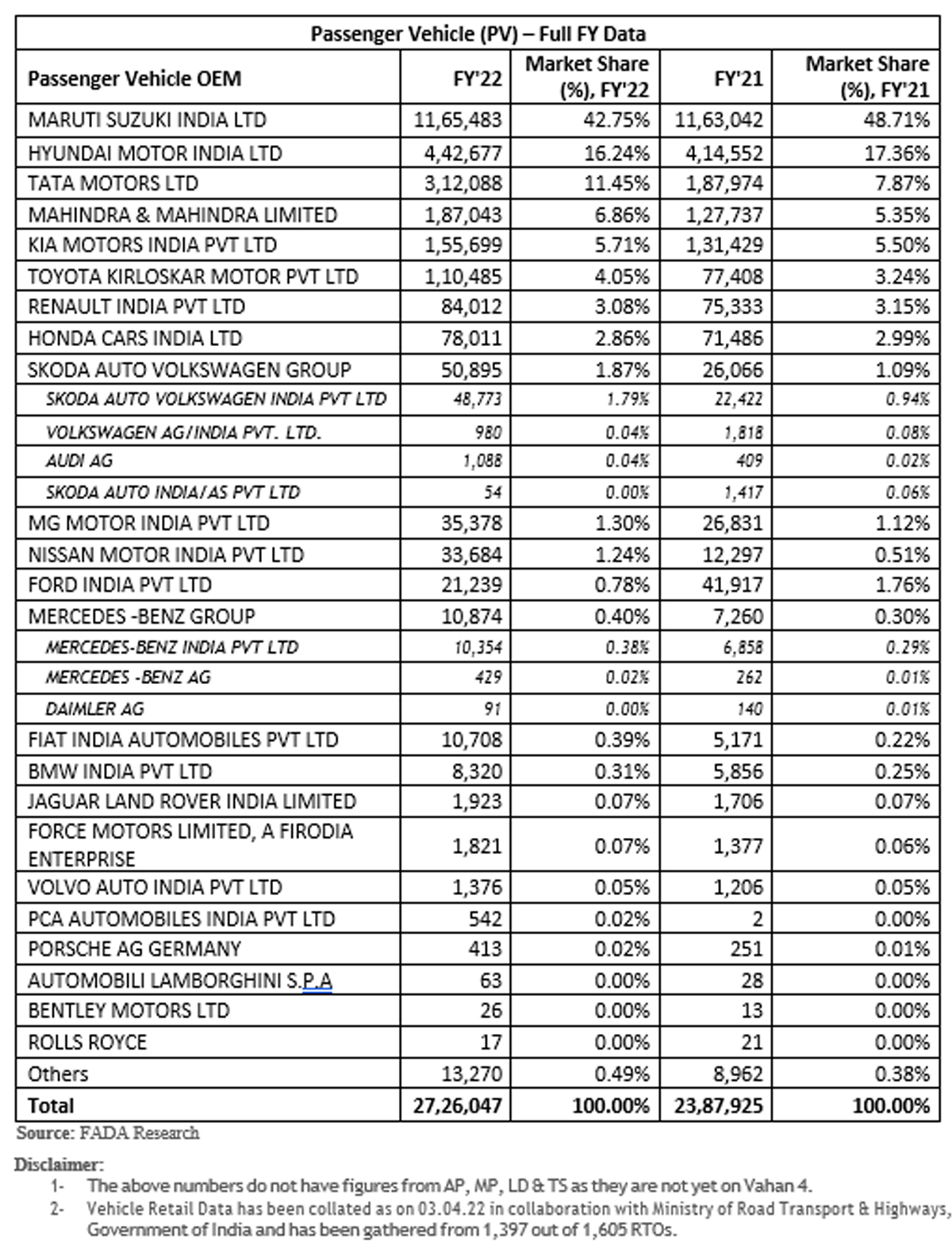

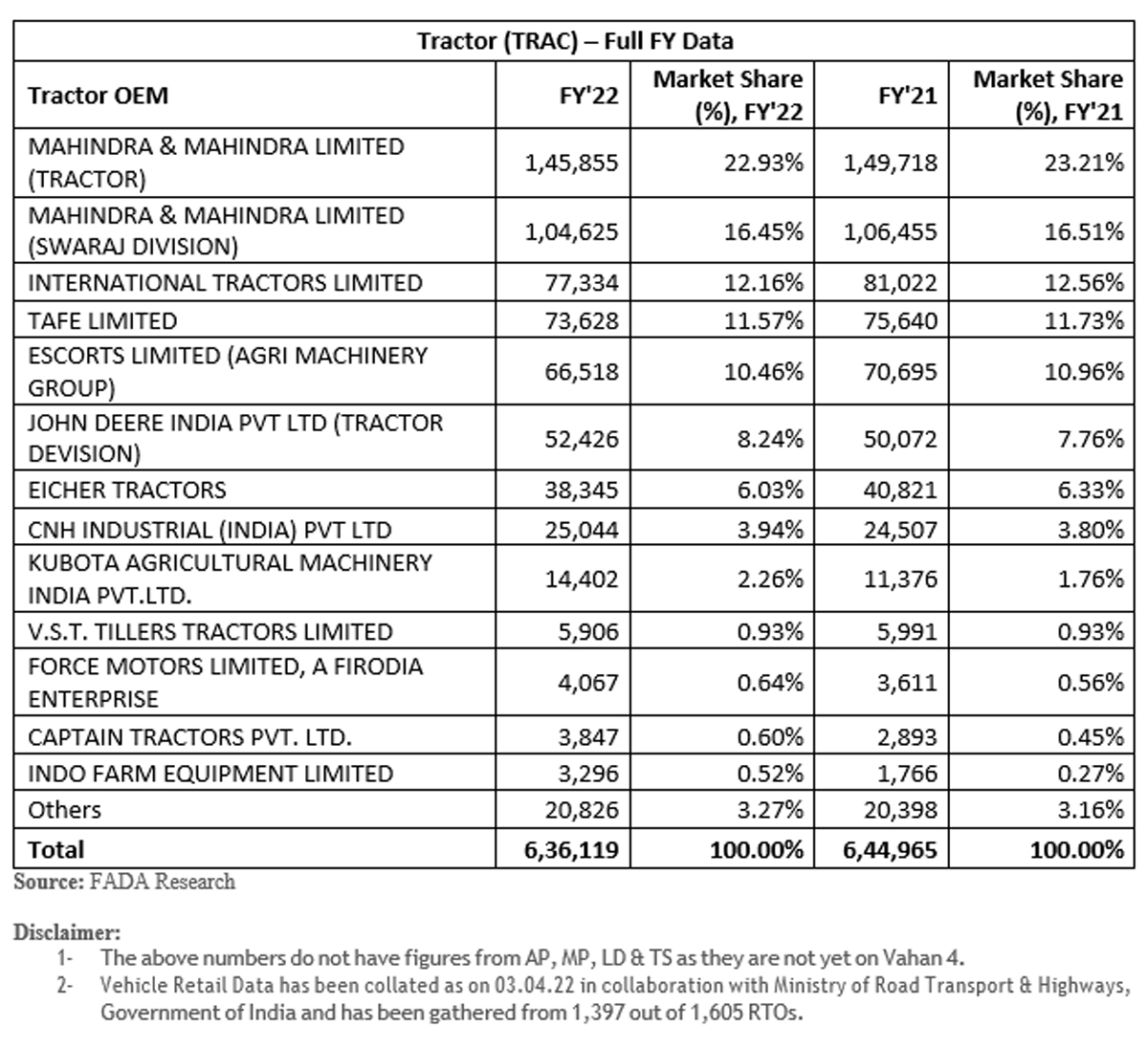

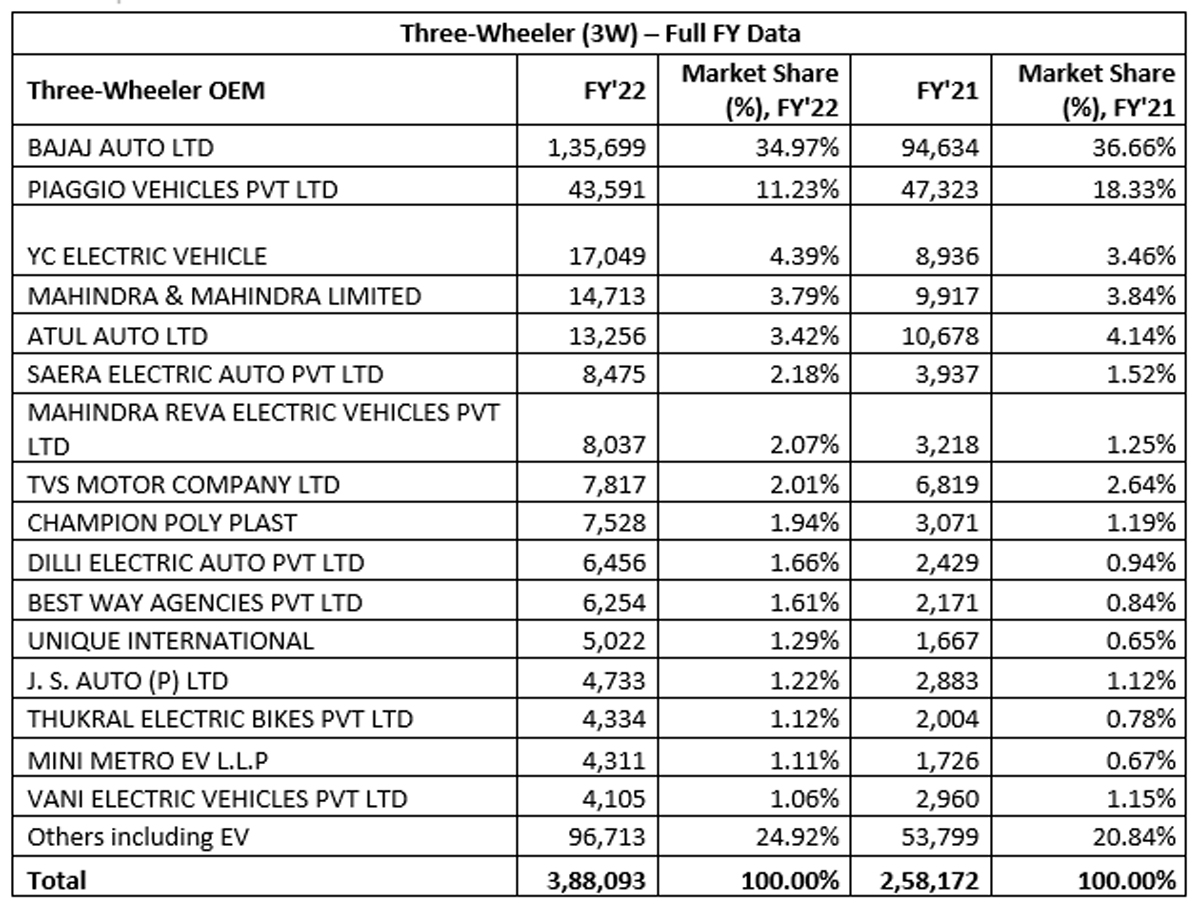

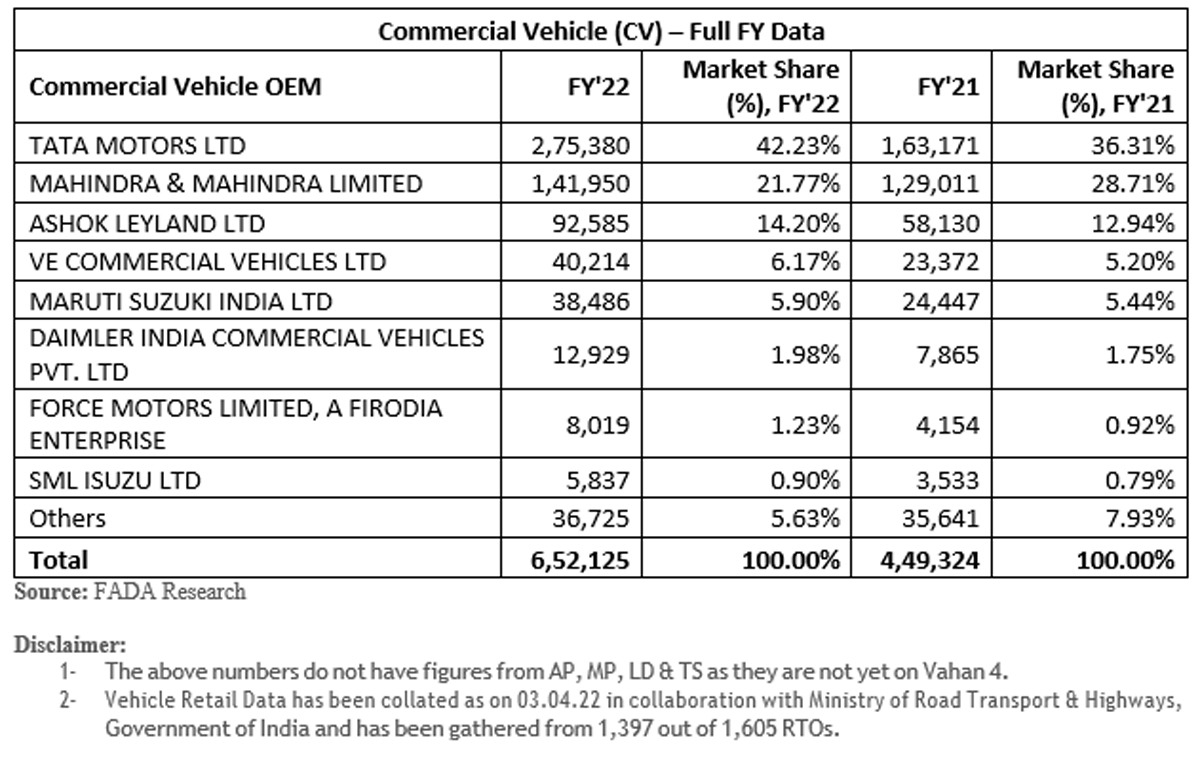

For the full FY 2022, total vehicle retail sales increased by 7% but YoY numbers fell by 25% when compared to FY 2020, which was largely a pre-pandemic year. Except tractors, which fell by 1%, all other categories like 2W, 3W, PV and CV grew by 4%, 50%, 14% and 45% YoY, respectively. The year was no different when compared to the month of March as tractors and 2W with low single-digit growth underperformed, thus giving signals of stress which continues to prevail in that specific market. Already snarled by supply bottlenecks, persistent high inflation and tightening financial conditions, the global economy is being dragged to the edge of a cliff. The recent challenges in the rural economy, however, are due to the devastation caused by the second wave in April-June. Workers who returned to their villages from urban areas are yet to go back to their jobs.

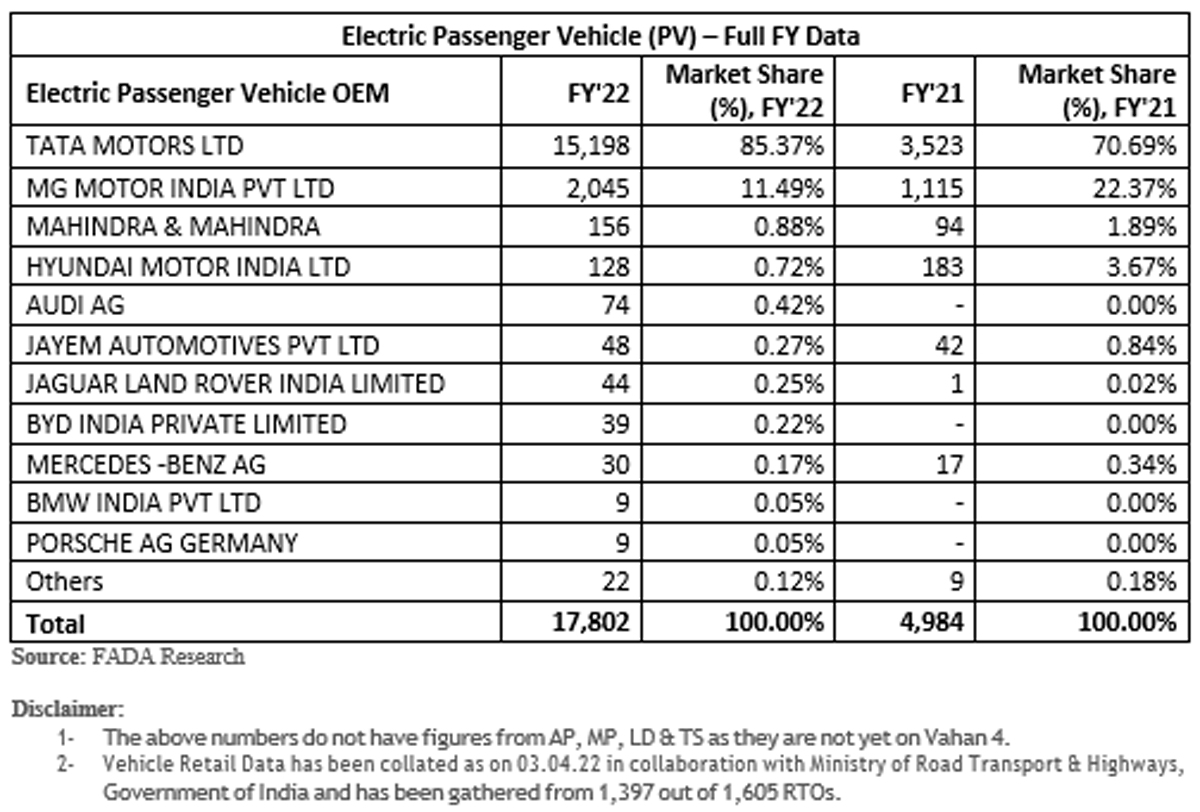

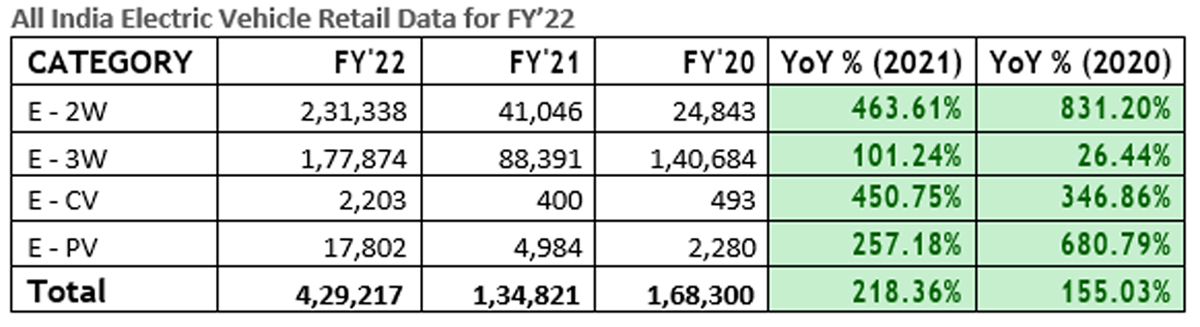

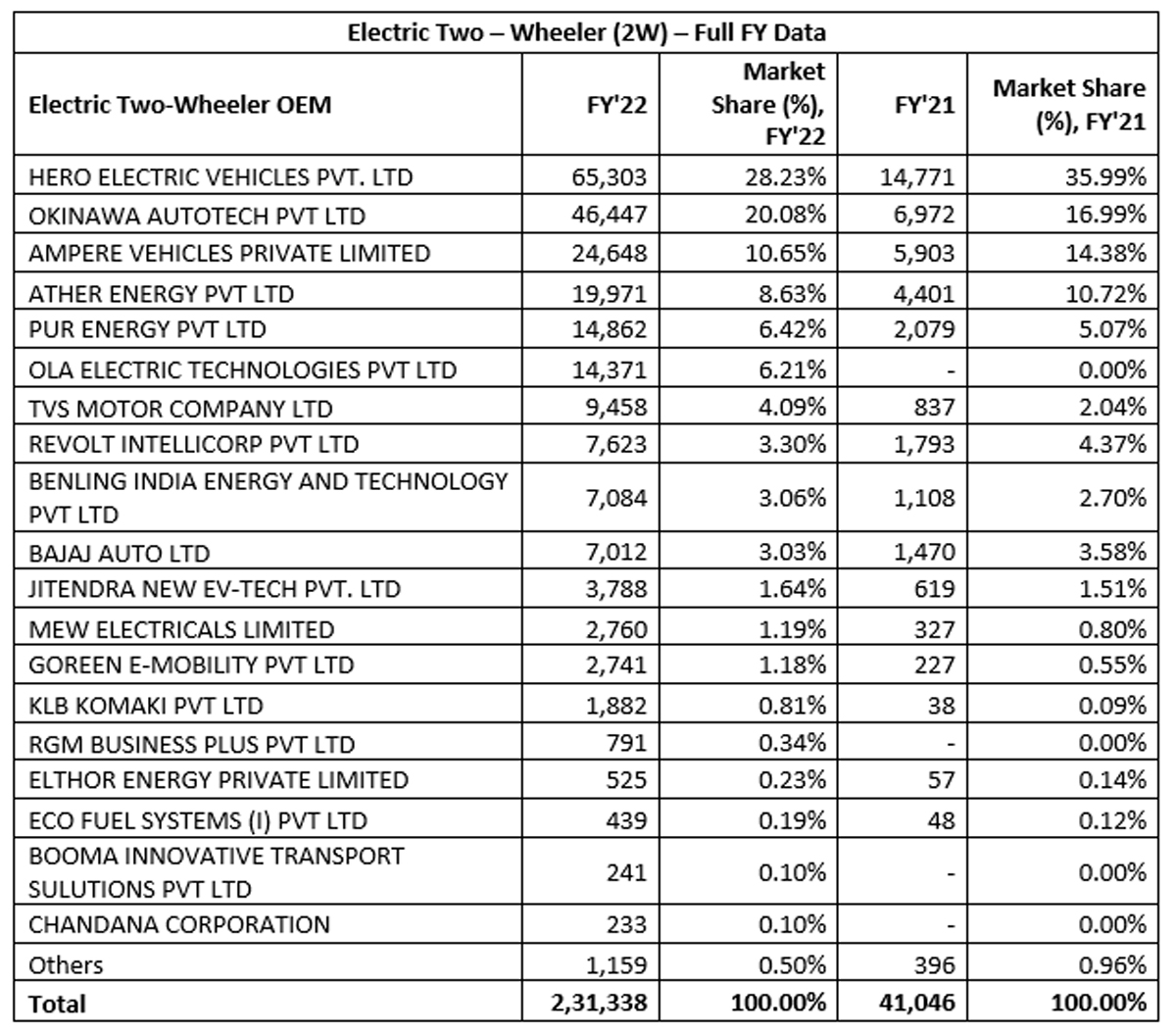

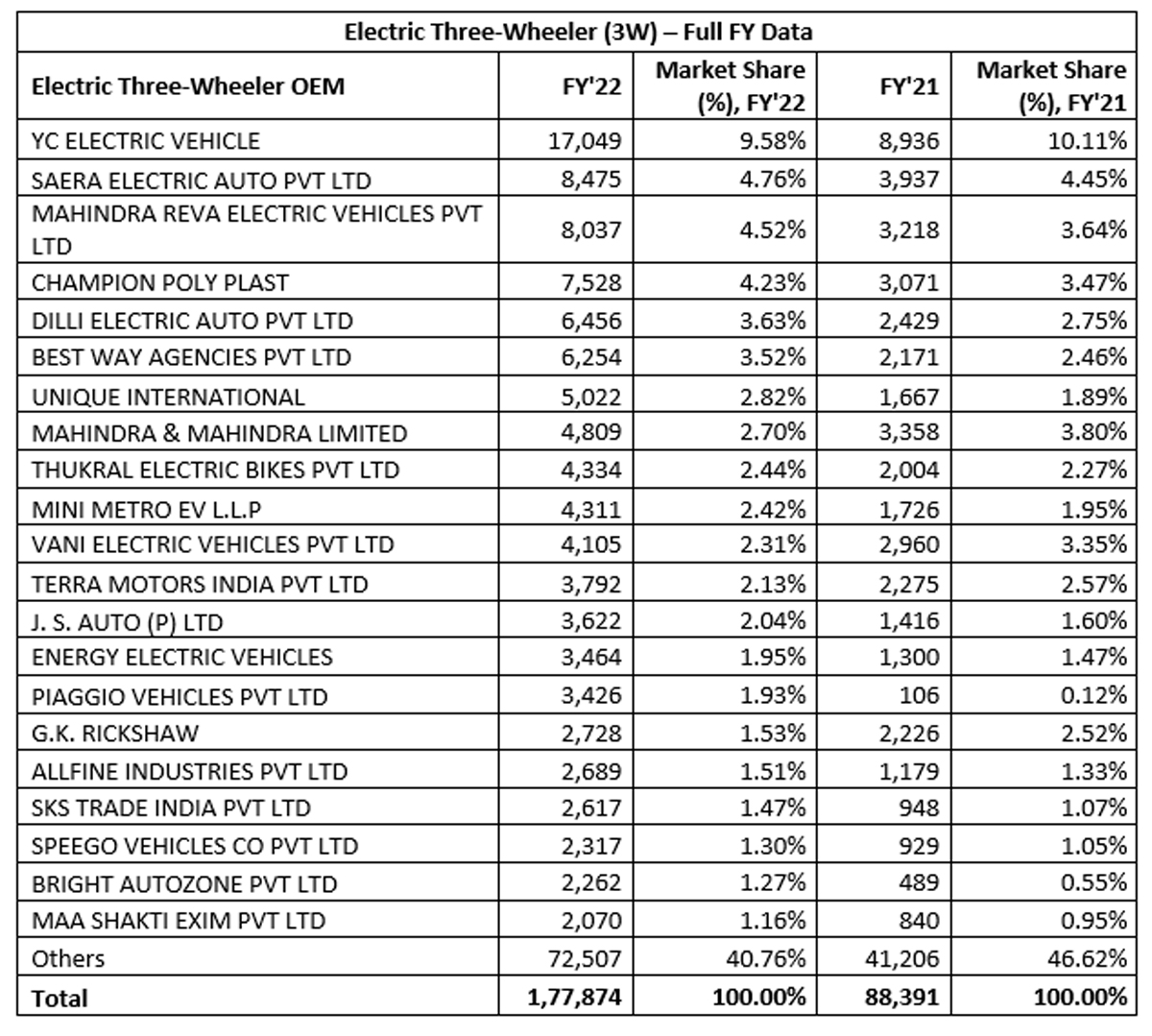

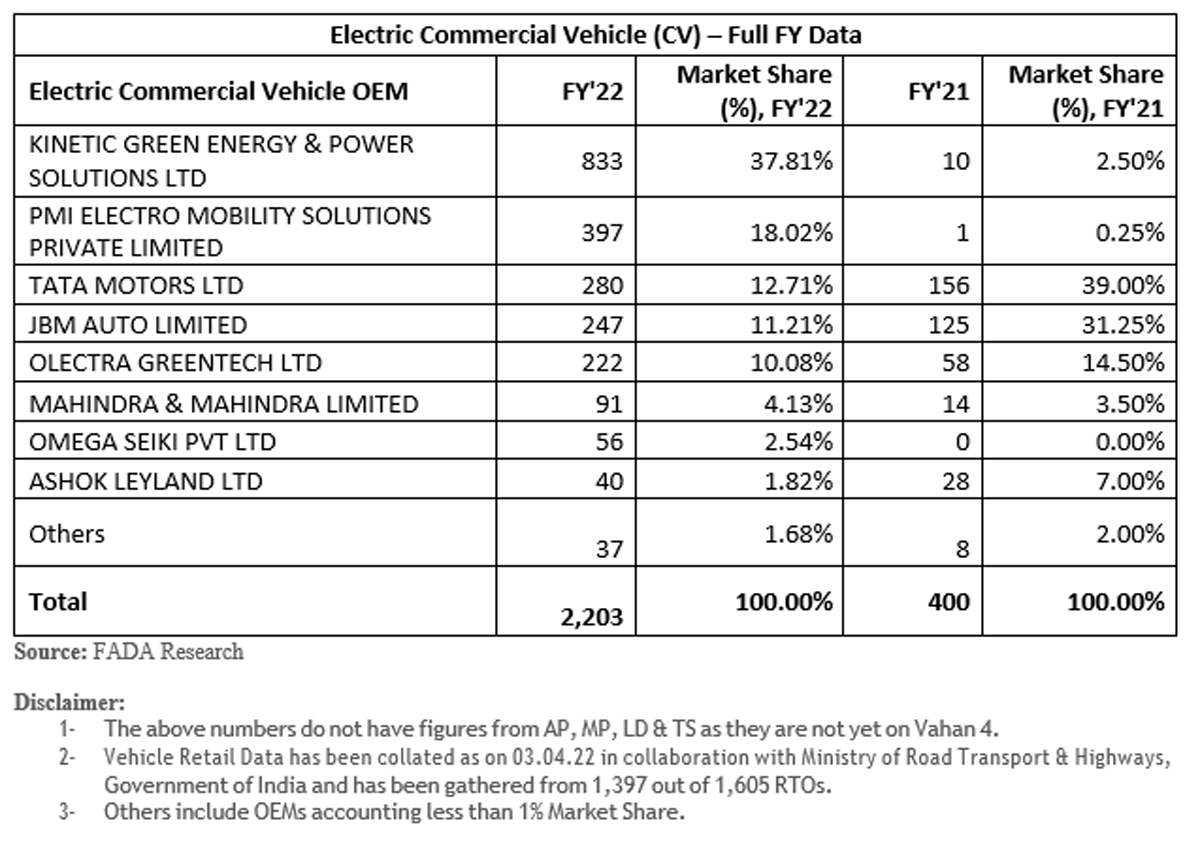

The PV segment for the entire year saw high demand with low supplies due to the semi- conductor shortage. 3W segment is witnessing a shrinking market. A tactical shift from ICE to EV is also visible as 45% of the 3W market is now driven by EVs. International crude prices crossed $100 mark for the first time since 2014. This resulted in petrol and diesel prices to skyrocket, thus negatively impacting consumer confidence.

March 2022 Retails

Commenting on the industry’s performance in March 2022, Vinkesh Gulati, FADA President, said: “The Indian automotive industry during March tried its best to be at par YoY but fell short by 3% and 30% when compared to March 2020, a month which saw BS IV to BS VI transition. The 2W segment which was already a non-performer due to rural distress saw further dampening due to rise in vehicle ownership cost coupled with rising fuel cost. I once again urge all 2W OEMs to introduce special schemes to uplift the morale of this segment to boost sales. The 3W segment was witnessing shrinkage in market size due to permit issues, educational institutions being closed and work from home phenomenon. With India now completely opening up, the segment is seeing strong double-digit growth when compared to YoY.”

“EVs are now contributing 45%+ market share in this segment. There is also good demand for load vehicles from captive customers. PVs continue to see high demand and long waiting period as semi-conductor availability still remains a challenge even though supplies slightly improved from the previous month. The Russia-Ukraine war and China lockdown will further dent supplies and hence press brakes on vehicle availability, thus making the waiting period more frustrating for customers. CVs continue to inch forward even though full recovery from FY20 perspective is still away. Sentiment for the segment remains positive as the government’s infrastructure push coupled with replacement demand is driving sales,” he added.

FY 21-22 Retails

Commenting on how FY 2022 performed, Vinkesh Gulati said: “FY 2022 was the first year of recovery after the pandemic hit us in 2020-21. The financial year didn’t begin on a good note as with the beginning of April the second wave of the corona virus hit us hard. This time, the spread was not only limited to urban markets but had also taken rural India in its grasp. Unlike last year, the lockdown this time around had been imposed by state governments and not the central government. Many states continued to remain under lockdown even in May and for over 60 days, thus impacting lives, economy and automobile sales.”

“Despite total chaos, India automotive retails saw a 7% rise YoY. All segments except tractors closed in the positive. While the 2W segment saw the lowest growth due to rural phenomenon, the segments of 3W, PV and CV posted double-digit growths. The government’s vaccination drive saved India from the third wave which saw negligible impact in terms of either lives or automotive retails on an overall basis. Overall, full recovery is yet to be seen as automotive retails are down by -25% when compared to FY20, which was largely a pre-pandemic year and a year of transition from BS IV to BS VI,” he added.

Near-Term Outlook

With the impact of lockdown during the April of FY20 and FY21, April 2022 will see growth, though on a low base. However, when compared to a pre-pandemic year, it will still be in deep red. The near-term outlook for the Indian automotive industry continues to remain a challenge as the ongoing Russia-Ukraine war and China lockdown does not hint towards a smooth path. Crude is on a boil and hence fuel prices have been raised by around Rs. 10. This will continue to rise and further hit sentiments on lowering the spending. Along with this, increase in raw material costs has made OEMs increase the prices of their vehicles.

While no dent in terms of demand has been seen in the PV segment, it will definitely have its impact on the 2W segment, which is an extremely price-sensitive market. On the other hand, with several festivals in the offing along with the marriage season and reopening of educational institutions and offices, we will see some pent-up demand coming in, especially in the 2W segment. Precious metals and neon gas which comes from the war-hit zone will further slow the supply of semi-conductors, thus making waiting periods longer for PVs. Overall, FADA remains extremely cautious in terms of any recovery in sight until the Russia-Ukraine war and China lockdown comes to an end.

Long-Term Outlook

The Reserve Bank of India in its recent note has said that the age of abundant liquidity is drawing to a close. Already snarled by supply bottlenecks, persistent high inflation and tightening financial conditions, the global economy is being dragged to the edge of the wall. The long-term implications are disruptions to global supply chains if physical infrastructure such as pipelines and ports are destroyed. For India, the recent reverberations of war have, in fact, tilted the balance of risks downwards. The government’s thrust on capital expenditure in 2022-23 can, however, be a game-changer this time around.

This could be through enhancing productive capacity, crowding in private investment and strengthening aggregate demand amidst the favourable financial conditions engendered by the RBI. This will improve business and consumer confidence. Overall, a lot depends on how the Russia-Ukraine war unfolds. Also, for India to come out of the woods faster than other economies, we anticipate that there will be no further impact of the pandemic with vaccination being the shield. Overall, we anticipate that the automotive industry may come out of the dark tunnel it presently is passing through and reach the pre-pandemic highs by FY 2024.