Just as the commercial vehicle industry was making some sure-footed recovery after the first wave of the corona virus hit India, the second wave has applied the brakes on this forward movement. While the growth in the e-commerce segment and certain positive government regulations will put the wind back into the CV industry’s sails, the industry will not be able to approach anywhere near the volumes achieved in 2018, says Aditya Kondejkar, Research Analyst – India, Power Systems Research India

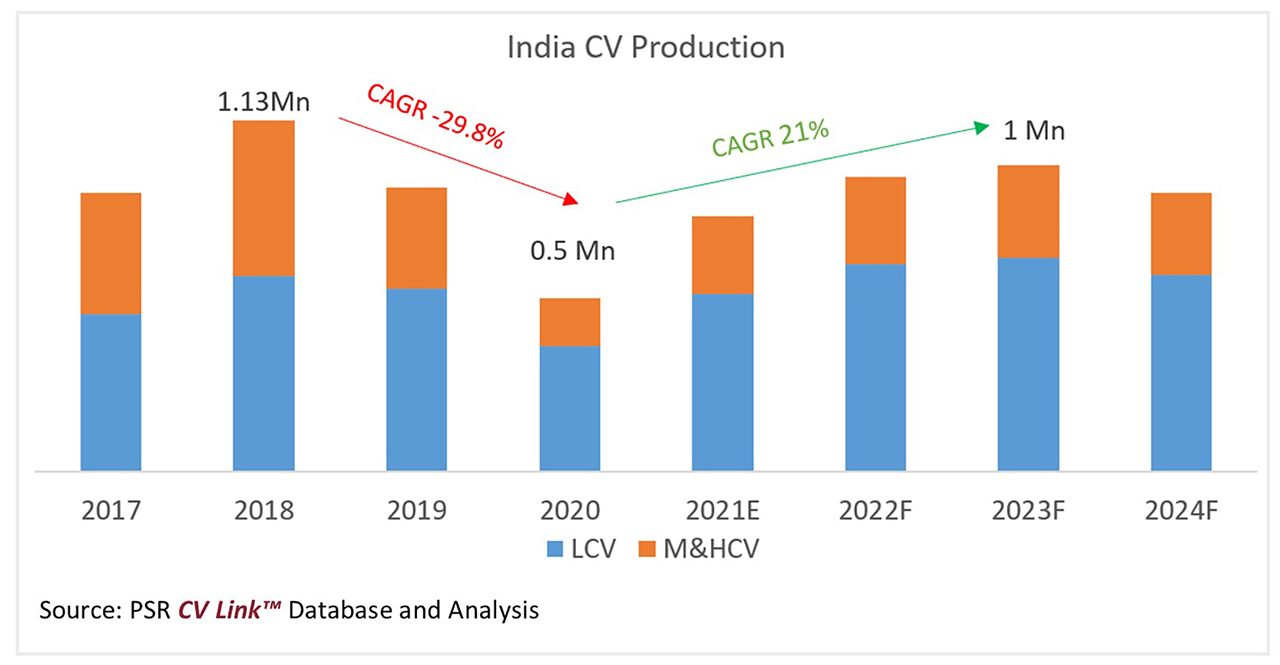

Within the second wave of the pandemic, semiconductor and steel supply shortages as well as weaker consumer demand have forced commercial vehicle production to drop by nearly 60% month-on-month (MoM) in April and a further sharp drop of 35-40% MoM in May is likely. The India CV market witnessed a remarkable performance in 2018 with more than 1.13 million units produced, owing in large part to GST implementation and replacement demand. In 2019, however, the Indian CV market began shrinking as it faced headwinds from revised axle load norms, vehicle over-capacity, BS-VI transition, and a liquidity crunch.

The market decline continued to a historically low production volume of 0.5 million units in 2020 as the turmoil of the initial corona virus pandemic spread. Although the Indian economy managed to revive itself after the first wave to quickly achieve a V-shaped recovery, from April 2020 through today the medium and heavy commercial vehicle (MHCV) segment has been the hardest hit of all vehicle categories. During the 2020 festival seasons, booming sectors like e-commerce and FMCG drove the light commercial vehicle (LCV) and intermediate commercial vehicle (ICV) markets. In Q3FY21 the government’s aggressive investment in infrastructure and construction activities helped boost the struggling MHCV segment.

This growth trajectory continued in Q4FY21. However, when the CV industry was about to accelerate, the gloomy clouds of the second wave of the corona virus re-emerged and transported us back to where we were a year ago – unsure of what the next fortnight holds. The uncertainty facing India’s MH vehicle industry has amplified this year due to semiconductor and steel supply shortages as well as weaker consumer demand. As a result, CV production has dropped by nearly 60% MoM in April and is likely to witness a further sharp drop of 35-40% MoM in May. Moreover, OEMs with stressed financial balance-sheets are experiencing additional burdens from the government regarding scrappage policy incentives, BS-VI Phase II implementation and CAFE norms.

Hence, the CV industry, especially the MHCV segment, has an arduous trek ahead. Owing to the low-base effect, the industry will witness high percentage growth, but we don’t foresee industry volumes approaching anywhere near the volumes achieved in 2018. Had I written this article a month ago, the analysis would have been entirely different. By the last week of March, it seemed we were well out of the rut. Without stringent regulation or lockdown, we hadn’t witnessed a spike in the corona virus cases – even during the 2020 festival season. And, with the prospect of vaccinations, everyone thought that the world was moving towards a pandemic-free stage. Now, the second wave has crashed upon us, hitting much harder than the first wave.

Demand Side Analysis

Key states have imposed strict localised lockdowns in April and May to curb the rising cases. Despite the lockdown and dented consumer sentiments, macro-economic indicators have managed to stay in the growth zone, including record-high GST collection in April of Rs 1.41 lakh crore – an increase of 14% MoM – and a positive April PMI of 55.5. Currently, there is no restriction on road movement and other infrastructure activities; hence the haulage and tipper segment has not been severely impacted. However, there are restrictions with e-commerce deliveries in some states. So, LCV and ICV segments have seen a marginal drop in freight utilisation rates. Low freight utilisation coupled with volatility and uncertainty have delayed the replacement demand of vehicles and temporarily impacted domestic sales.

Supply Side Analysis

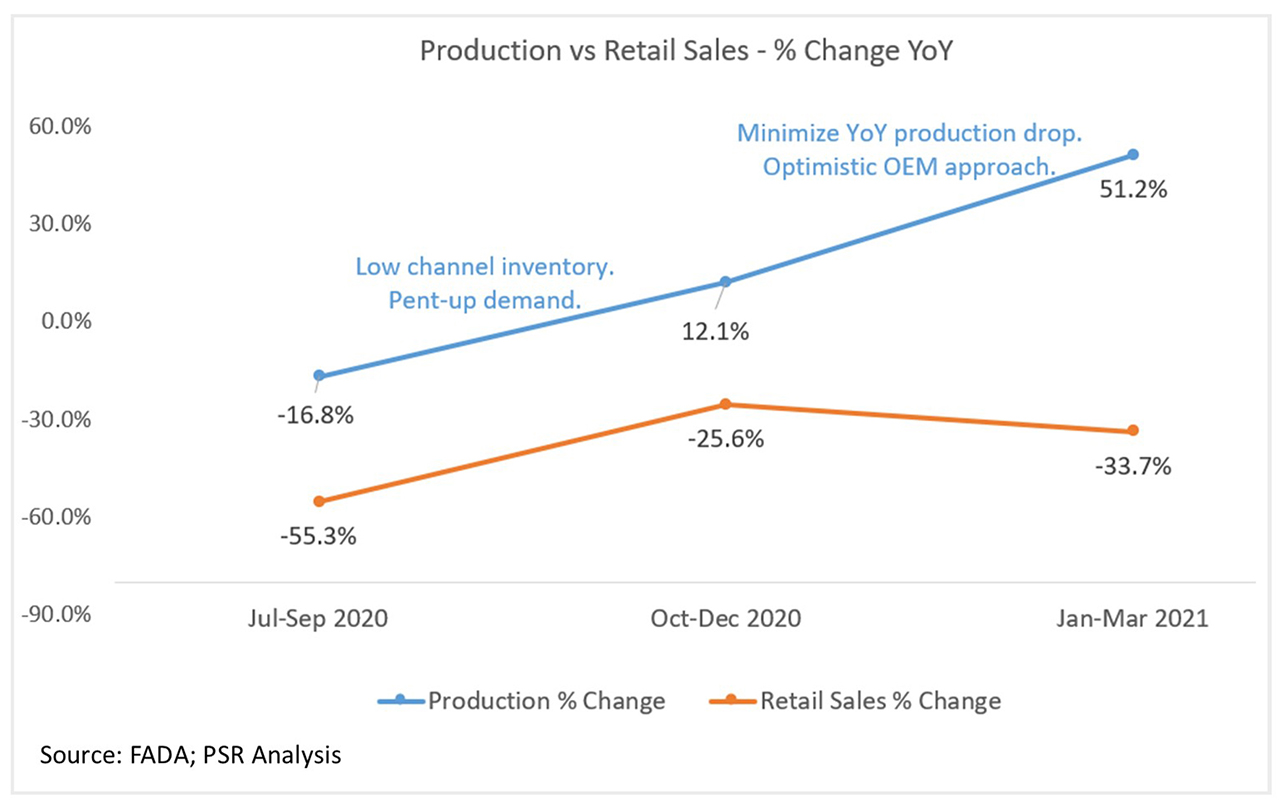

• Production versus Retail Sales

OEMs scaled-down BS-IV production in December 2019 to adhere to the BS-VI transition timelines. At that time, OEMs focused on utilising the dealer and channel inventory. However, the first nationwide lockdown halted BS-VI truck production in April and May 2020. As a result, the entire channel inventory was impacted. CV production witnessed an uptick during the unlocking phase to address low inventories and pent-up demand. Despite decreased retail sales, OEMs adopted an optimistic approach in Q4FY21 resulting in excess capacity in the current market.

• Disrupted Supply Chain – Semiconductors and Steel

For MHCVs, semiconductors are essential for components used to meet BS-VI norms and increasingly to support the adoption of smart trucking. The global semiconductor shortage was offset initially by OEMs’ ability to use existing inventory to fulfil orders through Q4FY21. Our initial assessment is that the shortage is peaking now – April through May. It will recede in the coming months but continue its impact till Q2FY22. This scenario is playing out in other regions as well. Chris Fisher, PSR’s Senior Commercial Vehicle Analyst, explains that “in North America and Western Europe, the pandemic continues to be a problem, but the current impact is not as significant as what is happening in India.”

“The biggest problem we see is the supply chain disruption that was caused by the corona virus. The stronger-than-expected commercial vehicle demand has created a shortage of various components including semiconductors, foam for reefer bodies and exhaust gas recirculation coolers,” he adds. In Brazil, PSR’s Director of Business Development for South America, Fabio Ferraresi, describes how “the pandemic impacted production in March with plants shut down due to lockdown in some cities, affecting both OEMs and suppliers. The shutdown was caused not only by the pandemic but also constraints on the supply chain from other countries, mainly China.”

PSR’s Russia Market Analyst, Maxim Sakov, points out that “the production of CVs has been met with a deficit of component supplies, especially electronic parts and chips. Some OEMs, like Isuzu, are delivering trucks only with a firm contract, and delivery time reaches several months. Some companies accept only orders with delivery not before 2022. In this situation, automakers with a low share of imported components have the advantage. Russia’s largest LCV maker, GAZ Group, has increased truck production by 29% in Q1 2021. Similar results are shown by KAMAZ, the largest heavy truck maker in Russia. Russian statistics show total growth of on-highway vehicle production in Q1 2021 reaching 13.7%. Generally, after resolving logistics and production issues and filling the demand, the market will return to moderate growth figures of 5-6%. Significant long-term impact from pandemic-related factors is not expected at this time.”

Another hurdle for the automobile industry is the supply of steel. During the second week of April, the country witnessed a severe shortage of medical oxygen, a raw material used in steel plants. Hence a commodity has seen an altered pattern in the consumption – skewed towards medical supply. This situation is likely to continue until early June. In early May, it was reported that in response to this situation, Ashok Leyland is halting production for about three weeks in May.

Other OEMs likely have done the same by the time of publishing this article. Usually, CV production points south from April through July due to the new financial year and coming monsoon season, majorly impacting MHCV production. Since these supply side issues have arisen during the natural down-cycle of CV production, we anticipate it will have a moderate impact on the segment. Furthermore, the excess inventory created during Q4FY21 will help meet current and short-term demand.

Government Regulations

To support the struggling CV industry, the government has taken a couple of initiatives:

1) Scrappage Policy

The scrappage policy will be effective April 1, 2022. We are still awaiting official word regarding government and OEM incentives, scrap yard procedures (cost burden, logistics management, material recycling, SOPs, etc.). As of now, the government has recommended OEMs offer a 5% discount for new purchases against a scrap certificate. Additionally, scrap value for old vehicles will be 4-6% of the new vehicle ex-showroom price. There will also be an incentive against road tax.

During implementation of this policy, the critical task is to build a modern and compliant infrastructure that ensures that scrapped vehicles can be properly processed and don’t find their way back to the roads. This policy may help boost production to some extent in the early stages. However, considering the current stressed financial conditions of freight owners and OEMs, we believe the scrappage policy alone will not generate the anticipated high pull to the CV industry.

2) PLI Scheme

The timing of the PLI scheme implementation could not have been better. As the industry has transitioned to BS-VI, OEMs can cater their same products to any market by altering a few specs or parameters. The OEMs may supply products to meet global demand from Indian factories to further achieve economies of scale. Once the second wave of the pandemic starts receding, OEMs will again adopt an optimistic approach. As a result, we anticipate witnessing healthy production during and post the 2021 festival season.

Market Outlook – Near Term

Though the current wave is creating a roadblock for growth, we firmly believe the industry will follow the recovery path it had followed after the first wave. Increased e-commerce activities, last-mile delivery and good agricultural output will ensure the continuous demand of LCV and ICV goods carriers. Similarly, Russia’s Sakov sees a similar dynamic in Russia. “After a 5-15% drop in 2020, the Russian CV market is restoring demand. One factor is the development of online trade. For example, Ford Transit sales have increased by 62% since the beginning of 2021. Meeting this demand required expanding production capacity at the Ford Sollers’ plant in Elabuga.”

The government will continue its focus on construction and mining activities till the general election, which will support the MHCV segment to some extent. However, overall weaker financial conditions will force MHCV operators to adopt a cautious approach regarding new purchases. Additional competition will come from the used truck market which is gaining traction due to its affordability. As we explained in a recent HDMA webinar, “The used truck sector is a highly unorganised market which gives opportunities for companies pursuing the certified used truck business.” Owing to the low-base effect, the industry will witness high percentage growth, but we don’t foresee that industry volumes will approach anywhere near the volumes achieved in 2018.

—

About Power Systems Research

PSR Power Systems Research India Private Limited (PSR India), located in Pune, is the India branch of Power Systems Research, a global leader in data, forecasting and solutions for industries related to powertrains, on-highway and off-highway vehicles and equipment, as well as their related components. For more information, visit the website www.powersys.com. Contact via e-mail at infoin@powersys.com.