In 2017, China had 28.88 million new vehicle sales compared to 17.25 million in the US. It represented almost 30% of the global sales, which was 97 million. The number of passenger vehicles in operation (VIO) will grow from 185 million to 401.7 million from 2017 to 2025. And the average age of a car in China is only 4.4 years, meaning the aftermarket in China will grow rapidly in the coming years, according to the report “Chinese Automotive Aftermarket, Forecast to 2025″ by Research And Markets.

In another report by McKinsey, the Chinese aftermarket will grow 7.5% per year compared to 1.7% in North America and 1.5% in Europe till 2030. It will become a $260 billion market from 101.5 billion currently. The rest of Asia will be the second fastest growing market with growth rate of 6.1% and will become a 220 billion market. Currently, foreign and joint venture companies manufacturing automotive parts are dominating the market, with a 70% revenue share as of 2017. The main reason because Chinese consumers prefer foreign high-quality brands.

One disruptive trend in the Chinese automotive aftermarket is the diversification by eCommerce platforms, especially in online-to-offline parts retail, repair and maintenance services. Alibaba and Tuhu are the key eCommerce platforms leading the Chinese online automotive aftermarket. eCommerce penetration is likely to increase from 12.7% in 2017 to 40% in 2025.

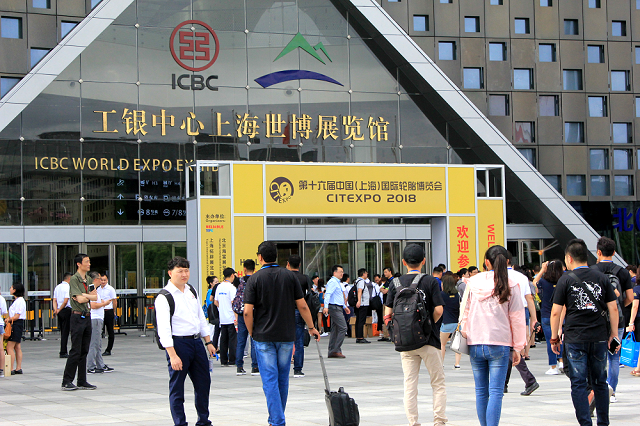

Organized by Reliable Exhibition Services, China International Tire Expo is the biggest tire and wheel focused trade show in Asia-Pacific region and covers PCR, LTR, TBR, and OTR Tires; Wheels / Rims for Car, SUV, and Light and Commercial trucks; Casings and Tubes; Tire Accessories; Equipment for Tire Repairs; Tire Retreading; and Other Related Services and Products. It will take place on August 19-21 in Shanghai World Expo Exhibition & Convention Center.