Turnover projected to cross $100 billion by 2020

The turnover of the Indian auto component industry stood at Rs. 2.34 lakh crores ($38.5 billion) for the period April 2014 to March 2015, registering a growth of 11 per cent over the previous year and a CAGR of 11 per cent over the last six years. This data, revealed as part of the Automotive Component Manufacturers Association of India’s (ACMA) findings of its industry performance review for 2014-15, represents the entire supply from the Indian auto component industry to on-road and off-road vehicle manufacturers and the aftermarket in India as well as overseas. The data also covers captive suppliers to the OEMs and the unorganized and smaller players.

Commenting on the performance of the auto component industry, Mr. Ramesh Suri, ACMA President, said: “Despite a challenging year 2013-14, the auto component industry bounced back, registering an impressive growth of 11 per cent in 2014-15. It is also interesting to note that while India’s total exports stagnated, auto component exports grew by 11.4 per cent. Consistent growth in auto component exports is an indication of growing credibility of ‘India made’ components. ACMA has played a critical role in supporting its members in discovering and harnessing new market opportunities. Further, favourable government policies, including the foreign trade policy, need to be given due credit for the commendable export performance.”

Corroborating the positivity in the industry, Mr. Vinnie Mehta, ACMA Director General, commented: “We are pleased with the auto component industry’s performance for FY14-15 and are confident that driven by ‘Make in India’ it will lead the growth story for India. The auto component industry in India is expected to grow to $100 billion in turnover by 2020 with exports growing in the range of $35-40 billion. During the last fiscal several macro headwinds obstructed the growth of the industry, including flagging vehicle sales, high capital costs, rising interest rates and slowing down of investment in manufacturing. The industry focus on exports, quality and various cost saving initiatives has helped it weather the weak business environment, leading to a double-digit growth.”

Key findings of the ACMA industry performance review 2014-15:

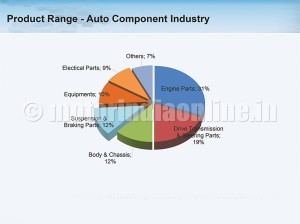

• Exports of auto components grew by 11.4 per cent to Rs. 68,500 crores ($11.2 billion) from Rs. 61,400 crores ($10.2 billion) in 2013-14, registering a CAGR of 29 per cent in the last six years. Europe accounted for 36.9 per cent of exports, followed by Asia at 25.2 per cent and North America at 23.2 per cent. Exports to Africa, Latin America and North America increased by 12.6 per cent, 4.6 per cent and 18.9 per cent respectively over the previous fiscal. The key export items include engine parts, transmission parts, brake system & components, body parts, exhaust systems, turbochargers, etc.

• Imports of auto components grew by 7.5 per cent to Rs. 82,900 crores ($13.58 billion) in 2014-15 from Rs. 77,160 crores ($12.8 billion) in 2013-14. Asia and Europe contributed to a maximum 57.9 per cent and 32.4 per cent of the imports respectively. This was followed by North America and Latin America.

• With increasing vehicle parc in the country, the aftermarket in 2014-15 grew by 12 per cent to Rs. 39,875 crores from Rs. 35,603 crores in the previous fiscal.

• As for capacity addition, for 2014-15 an estimated capital investment of around $0.3-0.4 billion (Rs. 1,980-Rs. 2,767 crores) was made in the auto component sector. Due to moderation in vehicle sales and depressed market sentiments, investment in 2014-15 declined as compared to the previous year. Capex in 2013-14 stood at around $0.5-0.7 billion (Rs. 3,200-Rs. 4,400 crores).