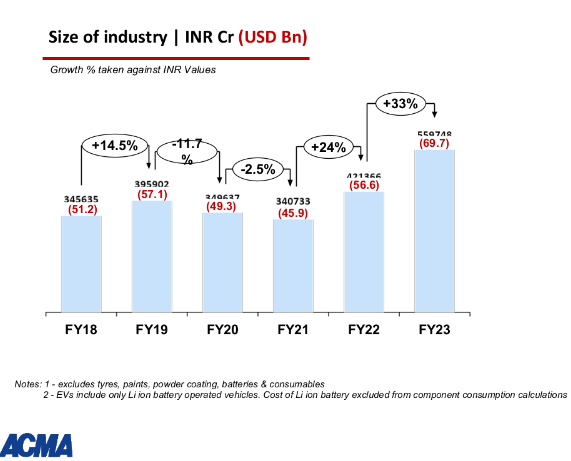

The Automotive Component Manufacturers Association of India (ACMA), the leading body representing India’s auto component manufacturing industry, has unveiled the results of its Industry Performance Review for the fiscal year 2022-23. The turnover of the automotive component industry reached INR 5.6 trillion (USD 69.7 billion) during the period from April 2022 to March 2023, showcasing a remarkable growth of 32.8% compared to the previous year.

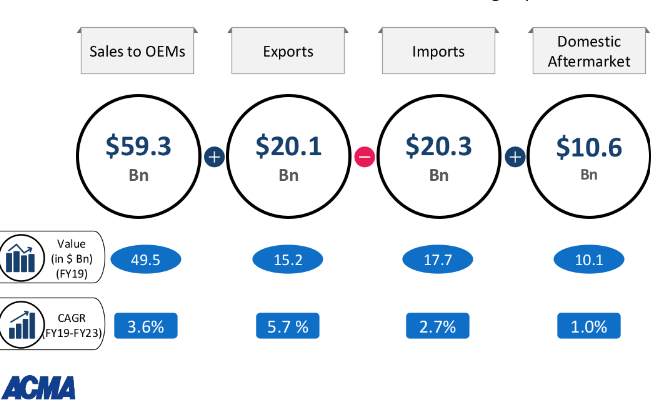

Commenting on the auto component industry’s performance, Vinnie Mehta, Director General of ACMA, remarked, “Fueled by robust vehicle sales in the country, a strong aftermarket, and steady exports, the auto component industry achieved its most outstanding performance in FY23. The component industry reached a size of INR 5.6 trillion (USD 69.7 billion), achieving a growth of 32.8%, thus surpassing its previous record turnover of INR 4.2 trillion in FY21-22. Exports experienced a 5.2% increase, reaching INR 1.61 trillion (USD 20.1 billion), while imports expanded by 10.9%, reaching INR 1.63 trillion (USD 20.3 billion). The aftermarket, estimated at INR 85,333 crore, also demonstrated steady growth of 15%. Component sales to domestic Original Equipment Manufacturers (OEMs) surged by 39.5%, reaching INR 4.76 trillion.”

Offering insights into the industry’s performance, Sunjay Kapur, President of ACMA and Chairman of Sona Comstar, noted, “It’s important to highlight that besides the rise in vehicle sales, substantial value addition from the component sector played a significant role in its impressive performance in FY23. Despite recessionary trends in Europe and the US, major export destinations for the auto components industry, there has been commendable growth in exports. The domestic market’s strong rebound in vehicle sales also triggered a notable increase in imports, resulting in a trade deficit this year.”

Kapur further elaborated on the industry’s sentiment and near-future outlook, stating, “Although the automotive value chain faced significant disruptions due to the pandemic, vehicle sales, particularly in the Passenger Vehicle (PV), Commercial Vehicle (CV), and tractor segments, have now regained pre-pandemic levels. Even the two-wheeler industry has shown substantial recovery. With improvements in semiconductor availability, raw material costs, and logistics, the vehicle industry’s favorable performance is expected to continue in FY24, boding well for the auto components sector. Additionally, exports and growth in the domestic aftermarket remain robust.”

Key Highlights of the ACMA Annual Industry Performance Review for 2022-23:

OEM Sales: Auto component sales to domestic OEMs reached INR 4.76 trillion (USD 59.3 billion), marking a remarkable growth of 39.5% compared to the previous year. Increased consumption of value-added components and a shift in market preference towards larger and more powerful vehicles contributed to the sector’s enhanced turnover.

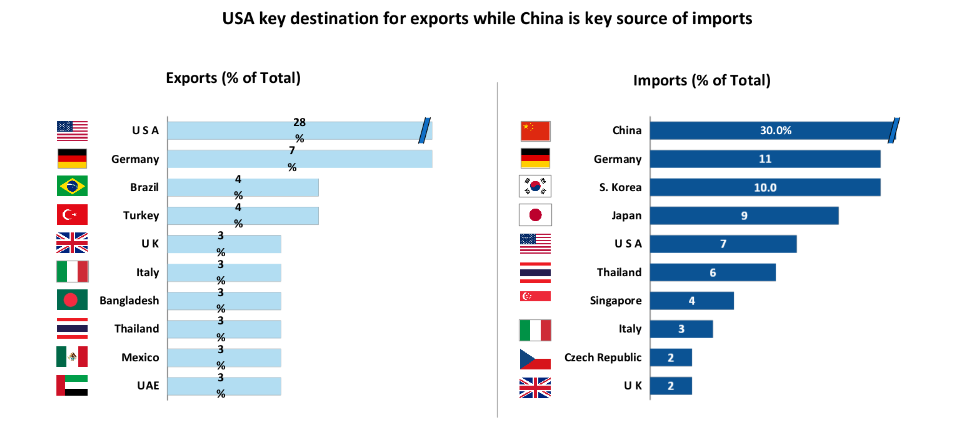

Exports: Exports of auto components observed a growth of 5.2%, reaching INR 1.61 trillion (USD 20.1 billion) in 2022-23, compared to INR 1.41 trillion (USD 19.0 billion) in 2021-22. Exports to North America, accounting for 32% of the total, witnessed an 8% growth. Europe, comprising 31%, and Asia, comprising 26%, experienced growth rates of 3% and 4% respectively. Key export items encompassed drive transmission and steering, engine components, body/chassis, suspension, and braking systems.

Imports: The traction in the domestic market was mirrored in component imports into India. Imports grew by 10.9% in 2022-23, reaching INR 1.63 trillion (USD 20.3 billion), compared to INR 1.36 trillion (USD 18.3 billion) in 2021-22. Imports from Asia accounted for 66%, followed by Europe and North America at 26% and 6% respectively. Imports from Asia experienced a 12% growth, while those from Europe grew by 6%, and North American imports surged by 23%.

Aftermarket: The increased movement of vehicles post-pandemic and a surge in demand for used vehicles contributed to the buoyancy in the aftermarket across all segments. The turnover of the aftermarket in FY 2022-23 reached INR 85,333 crore (USD 10.6 billion), compared to INR 74,203 crore (USD 10.0 billion) in the previous year.