Steel is the basic raw material for the forging industry and typically constitutes 60-65% of the ex-factory value of forgings. As such, high steel prices have hammered the forging industry in India

The disruption caused by the corona virus has affected the automobile industry and hence the automotive components and forging industries too. While the industry was reviving post the pandemic, the increase in steel prices has hammered the forging industry in India. Forging steel manufacturers have hiked the price by 10% over the last six months, and have now sought a further 15% increase. The initial increase itself was all but impossible to sustain; the further increase will prove to be disastrous. Steel is the basic raw material for the forging industry and typically constitutes 60-65% of the ex-factory value of forgings. With these two increases this is expected to rise to around 75%.

With such an increase in percentage of the input cost, survival of the industry has become challenging, the Association of Indian Forging Industry (AIFI) said in a statement. At the moment, the prices of steel are at unprecedented highs. Due to increased demand amid low allocation of production for the domestic market coupled with minimal imports due to import restrictions imposed by the Government of India, domestic steel manufacturers have increased the prices twice in the current quarter for forging quality steel and three times in the current month for other types of steel, bringing the benchmark hot-rolled coil prices in the wholesale market (ex-Mumbai) to Rs 52,000 per ton from only 36,500 per ton in July, a rise of 43%.

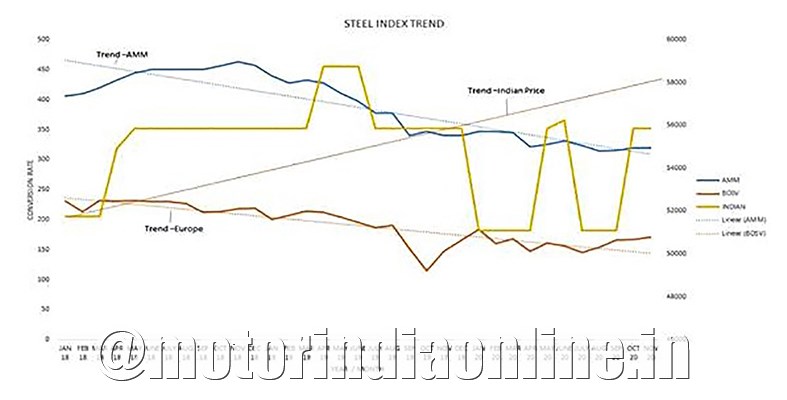

This is an indicator that the prices of forging quality steel will be further revised upwards in the immediate future in line with the increases in the prices of hot rolled coil prices. The price increases of steel in the domestic market are due to the increase in exports to neighbouring countries and resultant reduction in supply within the domestic market. This has resulted in Indian prices moving contrarian to the prices of steel in the European and American markets, thereby reducing the price competitiveness of the Indian manufactures in these markets, besides forcing the manufacturers to absorb the increases on existing orders, resulting in them incurring losses on them.

Apart from the increased export of steel, India’s iron ore exports too have increased by 63%. This increase in exports is mainly motivated by the record steel production of the world’s largest steel manufacturer—China. In FY20, India’s iron exports increased by 133% to 37.69 million tons over the period April-July 2020 compared to the corresponding period in FY19. And more than 80% of these exports have been to China. “Hence, domestically produced iron ore in India has met the needs of another country before catering to our own requirements. If Indian steel price are higher than international steel prices, it will lead to exports becoming uncompetitive. Export rates have risen sharply in the post pandemic period and have almost doubled,” AIFI said.

Commenting on this situation, Vikas Bajaj, President, AIFI, said, “Steel prices have increased by 25-30% in the last three months, putting the forging industry at serious risk, particularly when we are still recovering from pandemic-inflicted business losses and the resultant pressure on cash flow and cash reserves. The industry is still going through a very difficult time and is not in a position to absorb losses. I believe that the rising demand for steel and low steel production for the domestic market due to increased steel exports are the prime reasons for price hikes. The AIFI requests the government to consider a ban on steel and iron ore exports so that demand of steel within the country can be met in a cost-effective manner.”

Steel accounts for 7% of the country’s GDP and given that steel prices have increased by 10% and projected to increase by another 15%, this could ultimately lead to an inflation rise of about 1.5%. If inflation increases, it will result in higher interest rates, leading to a slowdown of the economy. India’s exports of finished and semi-finished steel to China increased sharply in this financial year despite the growing border tensions. Also, India’s overall iron and steel exports to China in the first five months of this fiscal year were more than three times the amount for the entire fiscal year 2019-20. This is illustrated in the graph below:

Steel Index Trend: Price Movement Comparison between Europe, America and India

Impact on Forging Industry

The Indian forging industry is one of the key players in the automotive component manufacturing sector and a major contributor to the government’s ‘Make in India’ initiative. The industry, apart from catering to the automotive, solar, aerospace, railways and wind sectors, also plays a key role in contributing to the foreign exchange by way of huge exports. The current overall capacity utilisation of the forging industry stands around 50-55% against a normal of 65% and the industry provides direct employment to 2,50,000+ people and indirect employment to approximately 2,50,000 people against 6,00,000 earlier. The industry has a turnover of around Rs 34,000 crore.

Said Yash Jinendra Munot, Vice President, AIFI, “Export of steel is the major reason for the rate hike. Large mills now prefer to export steel to neighbouring countries. Also, orders have been booked for Europe, the Middle East, etc., which is one reason for the shortage of steel in India. Thus, steel companies are in a position to increase prices at their will due to the gap in supply and demand. The government should consider banning the export of steel and iron ore for the next six to eight months or till such time that the local demand is met and should look at regulating steel prices for domestic consumption.”

Another factor that can be attributed to steel manufacturers to increase prices is minimal imports from other countries. Japan and Korea, the main two exporting countries to India apart from China, are exporting more to Europe due to the restrictions placed upon imports into India by the Government of India.

—

“Steel prices have increased by 25-30% in the last three months, putting the forging industry at serious risk, particularly when we are still recovering from pandemic-inflicted business losses and the resultant pressure on cash flow and cash reserves…

– Vikas Bajaj, President, AIFI

—

“Export of steel is the major reason for the rate hike. Large mills now prefer to export steel to neighbouring countries. Also, orders have been booked for Europe, the Middle East, etc., which is one reason for the shortage of steel in India. Thus, steel companies are in a position to increase prices at their will due to the gap in supply and demand….

– Yash Jinendra Munot, Vice President, AIFI