FY16 saw the much-awaited and much-needed recovery in the commercial vehicle segment in the country. The overall performance of OEMs in the bus segment was reasonably better in FY16 compared to FY15. While the ICV segment sales during the year were similar to the previous year, MDV buses registered strong growth in FY16. We take a look at how the top five OEMs performed during the year in this FY16 bus segment performance review.

Tata Motors

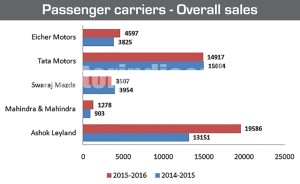

Tata Motors Ltd. (TML) maintained its overall sales at just about 15,000 units. Between 15,004 units in FY15 and 14,917 units in FY16, sales have dropped by one per cent. Effectively TML has not increased its sales in either ICV or MDV buses with its overall market share standing at 34 per cent in FY16 as against 41 per cent last year.

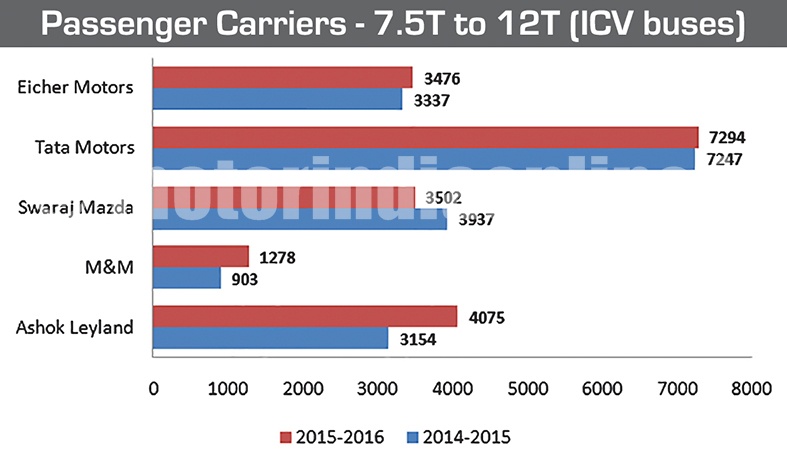

A leader in ICV buses with its wide range of Star bus and Ultra models, TML has sold 7,294 units which is one per cent higher than its sales of 7,247 units last year. Though the company has maintained its leadership in ICV buses with a market share of 37 per cent, it has lost two per cent of its share since last year. While its new range Ultra has started contributing well to its sales, the platform is still available only in a few wheel base options. JnNurm II sales have also contributed partially to the company’s sales this year.

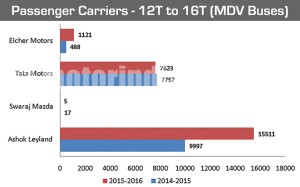

TML’s MDV bus sales were at 7,623 units, down two per cent from 7,757 units last year. While 1512, 1623 and 1618 are some of its key products in this category, a thorough overhaul of products could boost the company’s prospects in the MDV space in the coming years.

Ashok Leyland

FY16 seems to be an excellent year for Ashok Leyland (AL), with an impressive 49 per cent increase in sales of passenger carriers. A jump from 13,151 units in FY15 to 19,586 units in FY16, the increase in sales has been due to equal contribution from both ICV and MDV buses. The JnNurm II sales have given a massive boost for the company which continues to lead the passenger carrier segment with an overall market share of 45 per cent.

AL’s ICV bus sales have gone up from 3,154 units to 4,075 units, up by about 23 per cent. The Stag and Lynx were the two offerings from the manufacturer during the year, though of late the Stag has been replaced by the Lynx Smart and the Lynx by the Lynx Strong, with both new models available with an in-line pump, a major USP for AL in this segment. Its ICV market share has grown from 17 per cent to 21 per cent, making it the second largest ICV bus manufacturer in the country.

The MDV segment has been AL’s bread and butter in which the company has traditionally come out on top in sales with clear margins. The Viking, Cheetah, 12 m and its range of city buses like Janbus, ULE and RESLF have contributed to the sales increase from 9,997 units in FY15 to 15,511 units in FY16. Product upgradation, newer features and higher reliability among competitors have enabled the company to extend its leadership in this segment with an all-time high market share of 64 per cent.

Volvo Eicher Commercial Vehicles

Volvo Eicher Commercial Vehicles (VECV) has shown an effective 20 per cent sales increase from 3,825 units in FY15 to 4,997 units in FY16, keeping its market share of 10 per cent intact. Eicher is predominantly strong in ICV buses with its Skyliner series, and the addition of the new Pro series to its range has increased its sales by four per cent to 3,476 units in FY16 from 3,337 units the previous year, maintaining a market share of 18 per cent.

Eicher has been a consistent fighter in the MDV segment and a few good orders from APSRTC, GSRTC and KeSRTC have seen its sales shoot from 488 units in FY15 to 1,121 units in FY16, making it the highest gainer in the category. Eicher’s MDV bus market share for FY16 stood at five per cent, up from three per cent in FY15. With around a decade of expertise in large bus manufacture, Eicher has made clear inroads in the MDV segment in States like Tamil Nadu and is looking to further boost its sales in different markets in the coming years.

SML Isuzu

SML Isuzu’s overall bus sales were at 3,507 units in FY16 as against 3,954 units the previous year. This has led to a decline in its market share to eight per cent from 11 per cent last year. SML, a strong contender in the ICV segment, saw its sales stand at 3,502 units in FY16 in comparison to the 3,937 units it sold last year. Its ICV market share fell to 18 per cent from 21 per cent last year which also saw it drop to the third place in the category in FY16 from being the second in the list in FY15.

Though SML Isuzu had launched few products in the MDV category, the response from customers is yet to pick up. While some units of the Isuzu-branded LT 134 rear engine coach still run in select markets, it is probably time for the bus maker to come up with new exciting products to attract customer attention.

M&M

Mahindra is present only in the ICV segment with its range of Tourister and Cosmo models in various wheel base and seating options. Mahindra was the biggest gainer in the ICV space in terms of sales, selling 1,278 units in FY16 as against 903 units the previous year, clocking a whopping growth of 29 per cent. While its ICV market share has gone up from five per cent to seven per cent, Mahindra’s overall bus segment market share stands at three per cent. We have seen some test mules of Mahindra’s RE coach in the past and hope to see some interesting announcements from the company soon.