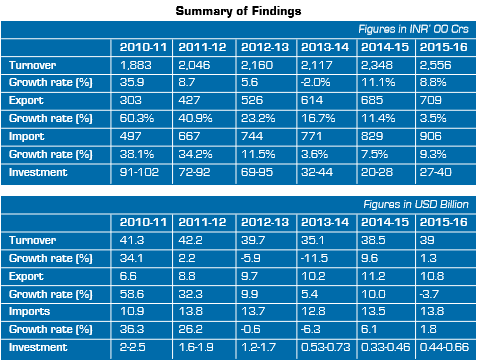

Automotive Component Manufacturers Association of India (ACMA), the apex body representing India’s auto component manufacturing industry, has announced the findings of its Industry Performance Review for the fiscal 2015-16. The turnover of the auto component industry stood at Rs. 2.55 lakh crores ($39 billion) for the period April 2015 to March 2016, registering a growth of 8.8 per cent over the previous year and a CAGR of 6 per cent over the last six years. This data represents the entire supply from the auto component industry (ACMA members and non-members) to the on-road and off-road vehicle manufacturers and the aftermarket in India as well as exports. The data also includes component supplies captive to the OEMs and by the unorganized and smaller players.

Commenting on the performance of the auto component industry, Mr. Arvind Balaji, President, ACMA, said: “Despite a challenging year, the auto component industry has registered a satisfactory growth of 8.8 per cent in 2015-16. Further, while overall exports from India witnessed de-growth of 9.58 per cent, the Indian auto component industry exports grew by 3.5 per cent. With signs of recovery in the auto market in the country and prospects of a better monsoon, the component sector is expected to witness growth in early double digits this year.”

Corroborating the positivity in the industry, Mr. Vinnie Mehta, Director General, ACMA, commented: “The performance of auto component industry in FY15-16 has been satisfactory. This is despite a less than expected performance in the passenger vehicles, two-wheelers and tractors segments. With the ‘Make in India’ initiative and thrust on increased localisation by OEMs, the component industry is actively focussing on delivering enhanced quality products, as well as, on R&D and innovation.”

Key findings of the ACMA Industry Performance Review 2015-16:

Exports: Exports of auto components grew by 3.5 per cent to Rs. 70,900 crores ($10.8 billion) from Rs. 68,500 crores ($11.2 billion) in 2014-15, registering a CAGR of 18 per cent in the last six years. Europe accounted for 36 per cent of exports followed by Asia and North America, each at 25 per cent. Exports to Central America and North America increased by 30 per cent and 3 per cent respectively, over the previous fiscal. The key export items included engine parts, transmission parts, brake system & components, body parts, exhaust systems, turbochargers, etc.

Imports: Imports of auto components grew by 9.3 per cent to Rs. 90,600 crores ($13.8 billion) in 2015-16 from Rs. 82,900 crores ($13.5 billion) in 2014-15; Asia and Europe contributed to 58.6 per cent and 30.9 per cent of the imports respectively.

Aftermarket: With increasing vehicle parc in the country, the aftermarket in 2015-16 grew by 12 per cent to Rs. 44,660 crores ($6.8 billion) from Rs. 39,875 crores ($6.5 billion) in the previous fiscal.

Capacity Addition: For the fiscal 2015-16 an estimated capital investment of Rs. 2,700 – Rs. 4,000 crores ($0.44 – 0.66 billion) was witnessed in the auto component sector compared to Rs. 2,000 – Rs. 2,800 crores ($0.33 – 0.46 billion) in 2014-15. The enhancement in investment can be attributed to better business prospects owing to improving market sentiments in 2016-17.