The Indian commercial vehicle industry is being dominated by a few local manufacturers with decades of isolation driving them to establish low-cost technological products well adapted to the Indian environment. Of late, Indian customers have been gradually exposed to sophisticated technological products from foreign OEMs creating excitement, further driving customer’s futuristic demands (beyond 2020) towards greater quality, safer and more reliable products of appropriate technologies at reasonable costs.

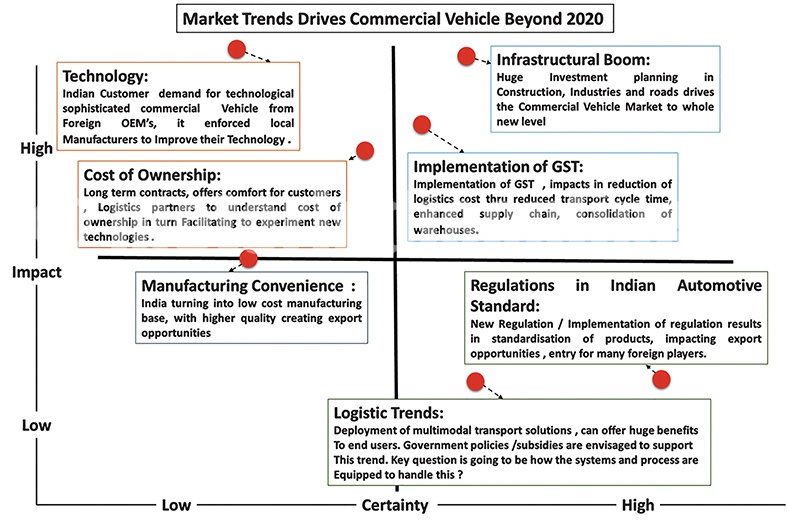

The overall CV volume, post-economic crisis, remains unaltered, but there have been segmental improvements and downfalls. Predominantly the M&HCV trucks and trailer segment has shown major improvements, while the LCV goods segment registered a downfall. On the contrary, LCV buses witnessed improvements mainly due to the focus on feeder connections, special applications for schools, staff and ambulances. Bigger capacity buses displayed shrinkage in volume mainly due to refinement of governmental schemes (JnNURM schemes), policies, regulatory framework (implementation of bus body codes, ABS being mandated, etc.). The market beyond 2020 is expected to be stable and would move ahead in view of the implementation of GST, the infrastructure boom, the favorable logistics trends, etc.

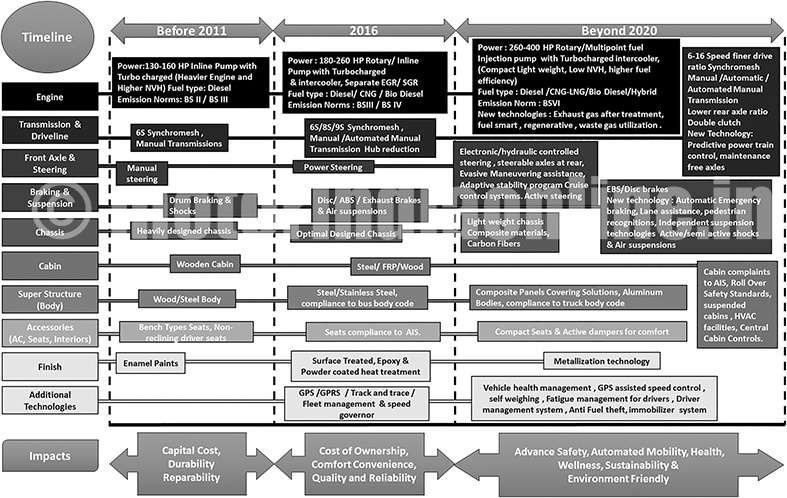

The nucleus of the futuristic products will have more emphasis on energy efficiency, alternate fuels, emission reduction, safety and weight reduction. Some upcoming developments in OEM technology specific to various segments are as follows:

- Transmissions focussed on predictive power train technologies, finer drives (6-16 speed), reduced rear axle ratios, double clutching and maintenance-free systems. Automatic transmission might find its way into urban applications. Long distance will still remain with automated manual transmission with intelligent shift in technologies.

- Engines focussed on higher power generation, fuel efficient, light-weight compact engines operating at lower NVH levels compliance to new emission norms. Also interest would be more on hybrids and alternate fuels making products competitive.

- Steerings: Major developments envisaged in steering technologies as it plays a vital role in emphasising safety. Advancement includes active steering, parking assist, lane warning systems, adaptive stability programs through electronics, and cruise control for driving comfort.

- Braking system: Auxiliary braking systems, disc brakes will be getting mandated, air and exhaust braking system will be offered as a standard OE fitment. It is expected to witness a complete integral system which can integrate all braking technologies in the vehicle and can function to the fullest need. Other anticipated technologies would be active brake assist systems in vehicles, use of retardation energy to generate power.

- Suspension: Air suspensions in buses, haulage trucks with sensitive loads are looked upon as standard fitment from OEMs. Active suspension will have its cross civilian development from military applications for better comfort and manoeuvrability.

- Chassis & cabins: Work space area or cabin has been a subject of discussion and debate. So far it has been an area of neglect by the fleet owners. In the current system shortage of drivers, demand for safety, comfort and emphasis on cabin codes will drive OEMs to deliver cabins with focus on ergonomics, infotainment, storage space, suspended comfortable cabins, superior seats with active suspensions and adjustments for better drive comfort. Chassis will evolve to suit various applications, becoming integral portion of the body, and various weight reduction techniques will be looked upon.

- Superstructure: We expect a sea-change in the truck and bus body. Body codes will bring structure, standardisation in the so-called unorganised segment. Strict monitoring of payload triggers light weight body structures for various applications.

- Other areas

- Electricals/electronics: A major development is expected in vehicle electricals and electronics to integrate all technologies in various sub-systems. Multiplexing of wires integrated with ECUs with self-diagnosis health management tools, advanced electricals and electronics to support electric and hybrid vehicles.

- IT-enabled systems: The current level of telematics is expected to get into major advancement benefiting fleet operators and drivers. Systems and gadgets offered to fleet operators to focus on monitoring cargo, driver, vehicle in terms of safety and productivity. These offered to drivers aid in infotainment, safety, comfort, guidance and in ease of operation.

The above technology advancement is quite a good scenario for the CV Industry for all stake-holders which, in turn, calls upon OEMs to make adequate infrastructure planning for technology and after-sales support.

The latent needs of all Indian commercial vehicle operators are being focussed on technologies to improve fuel efficiency, reliability (OEMs willingness to undertake responsibility for maintenance and ensuring uptime), advanced technologies to ensure vehicle, cargo safety, and systems to monitor. On the other hand, drivers are more focussed on comfort, driving assistance systems, ergonomics, entertainment systems and safety standards.

Historically developed markets have undergone various phases of implementation of regulatory framework over the years. These new regulations have always been driven by bureaucrats and policy makers forcing OEMs and body builders to implement it with great difficulty and with no end-customer actually deriving benefits from it.

The Indian market is also in a similar situation as regards implementation of regulatory systems, wherein it would be ideal for the manufacturers to arrive at a solution based on the need analysis of customers, stake-holders in the industry and environmental factors contributing to sustained mobility.

By Rajesh Khanna, Chief Operating Officer, RACE Innovations Pvt. Ltd.