The Goods and Service Tax (GST) – taxation on goods and services consumed on value additional basis without any distinction is the directive in the Indian tax reforms with effect from July 1, 2017. It is expected to play a crucial role in integrating the fragmented logistics industry, a major contributor in improving supply chain efficiency and product cost.

The $130 billion Indian logistics industry is growing at 15% CAGR. The real backbone of the Indian economy, it is currently reeling under heaviness, making it unattractive, the main reasons for it being the unorganised stature of the players, absence of clarity in taxation, multi-layered effects, and harassment at each cross-over points, all adding to the cost to the customer and productivity delays.

Customer demands in the market place have been changing over the years which evolved the logistics providers from 1PL1 to integrated 4PL service providers offering various service levels in the supply chain involving packaging, warehousing, transportation, manpower supply for inspection, consulting, logistics optimisation, etc.

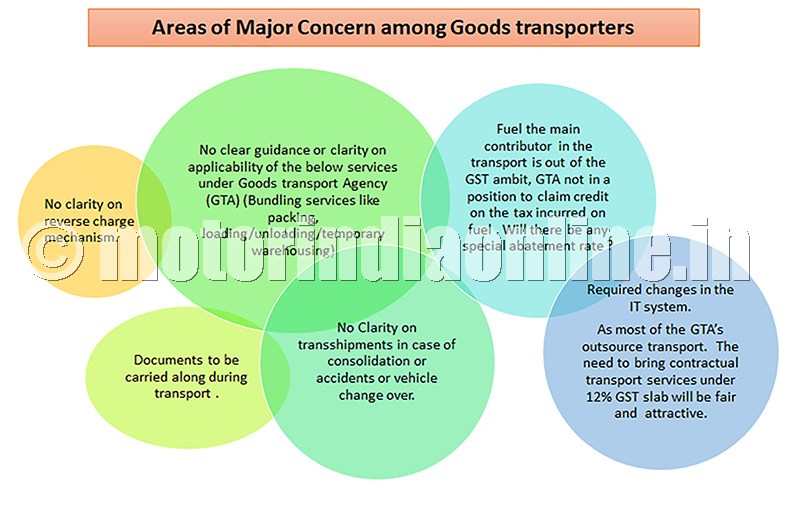

On the contrary, smaller regional logistics providers are going to face tough challenges in organising themselves in terms of registration, documentation, filing of returns to avail / pass on CENVAT credit to their end customers. The drive towards compliance may bring in some form of discipline in the so-called unorganised arena. Geographic specific transporters, clearing / forwarding agents and warehouse handlers are expected to get amalgamated with bigger players or driven to a leaner and disciplined outfit.

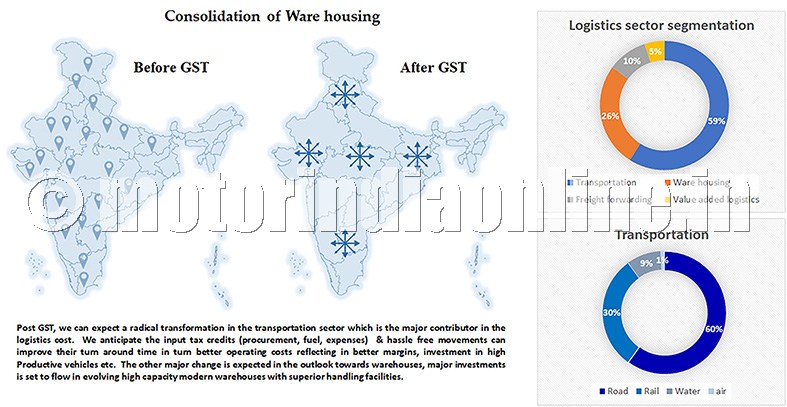

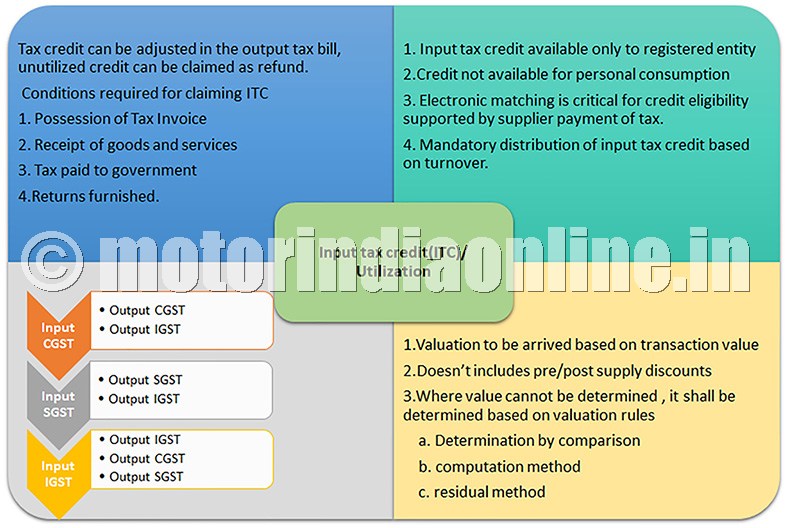

Major supply chain rejig expected in some the critical industries like pharma, white goods, e-commerce pertaining to warehouse, redesign of routes and adoption of new technologies. Post GST implementation the supply chain will be totally rejigged, suppliers will be screened on their ability to pass on CENVAT credits, contract manufacturing getting attractive, remodelling of inbound/outbound logistics flow paths, 3PL/4PL/5PL gaining traction with clarity to offer hassle-free cliental services, comprehensive change in inventory planning in the total chain starting from the raw material supplier, manufacturer, stockist, distributor, retail chain till it reaches the end consumer. Another interesting development anticipated will be the leasing equipment industry will become more attractive on account of CENVAT credits, formidably supporting the logistics sector with high productive equipments, specifically in the area of road transport and warehouse handling.

Classification of logistics service provider as a goods transport agency (GTA) or courier service agency is a main debated discussion in the pre-GST regime, the reason being the complicated procedures applicable on GTA services drives all operators to declare them as courier service agency. Post-GST, there is expected to have a clear understanding, bifurcation of services, classification / application of appropriate taxes enabling a seamless flow of credit in the entire chain.

The future of the Indian logistics industry is projected to be driven by customer-centric values, service excellence and reliability. Levels of excellence / reliability will be assured only if the complex elements in the supply chain are synchronised and work seamlessly. Until now the Indian logistics players have never been given the right platform; neither have they been appreciated and supported for their initiatives by the cost conscious Indian market. With GST in place we expect more investments flowing in supporting new initiatives, further industries collaborating with logistics service providers (LSPs) in setting the right platform to arrive at leverage economics of scale, LSPs removing deficiencies in the channel to arrive at a most competent value based logistics service.

Footnotes

11PL – A first-party logistics provider is a firm or an individual that needs to have cargo, freight, goods, produce or merchandise transported from a point A to a point B. The term first-party logistics provider stands both for the cargo sender and the cargo receiver.

2PL – A second-party logistics provider is an asset-based carrier, which actually owns the means of transportation. Typical 2PLs would be shipping lines which own, lease or charter their ships; airlines which own, lease or charter their planes and truck companies which own or lease their truck.

3PL – A third-party logistics provider provides outsourced or ‘third party’ logistics services to companies for part or sometimes all of their supply chain management functions.

4PL – A fourth-party logistics provider is an independent, singularly accountable, non-asset based integrator who will assemble the resources, capabilities and technology of its own organization and other organizations, including 3PLs, to design, build and run comprehensive supply chain solutions for clients

5PL – A fifth party logistics provider will aggregate the demands of the 3PL and others into bulk volume for negotiating more favorable rates with airlines and shipping companies. Non-asset based, it will work seamlessly across all disciplines.

By Rajesh Khanna, Chief Executive Officer, RACE Innovations Pvt. Ltd.