Most regions expected to see strong demand for medium & heavy CVs

The outlook for global truck production in the class 4-8 looks very promising for 2018 as it continues a strong growth pattern set in 2017. Even previously struggling countries such as Russia, Brazil and Turkey saw very positive signs in 2017 and are looking for continued growth this year. North America and Europe also are expected to fare better in 2018. With the exception of Japan, Korea and possibly China, all regions are expected to see modest to strong demand for medium and heavy commercial trucks.

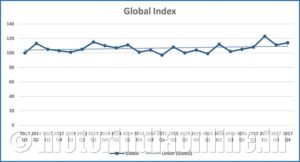

The Power Systems Research Global Truck Production Index (PSR-TPI) increased from 111 to 114, or 2.7%, for the three-month period ended December 31, 2017. The year-over-year (Q4 2016 to the Q4 2017) gain for the PSR-TPI was 8.6%, increasing from 105 to 114.

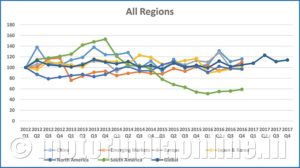

The PSR-TPI measures truck production globally and across six regions: North America, China, Europe, South America, Japan & Korea and emerging markets. This data comes from CV Link, the proprietary database maintained by Power Systems Research.

Looking at individual regions, this is what we see for 2018:

North America: When final numbers for 2017 are tabulated, production of medium and heavy commercial trucks is expected to increase by 9.3%, compared to 2016. The class 8 heavy truck segment continues to improve, and production is expected to finish approximately 11.5% higher than in 2016, driven by high order intake. The medium truck (class 4-7) segment is expected to remain strong with production increasing by 6.9% over 2016, primarily driven by a strong vocational segment. Demand for class 8 trucks declined in 2016 but stabilized in 2017, and production is expected to reach 300,000 trucks in 2018.

Europe: In Greater Europe, production of medium and heavy commercial vehicles is expected to increase by 9.7% in 2017, compared with 2016. After a relatively strong couple of years in Western Europe, demand has moderated somewhat, but production improved by 5% compared with 2016. After the past few years of political and economic strife, truck demand improved greatly in 2017 and is expected to finish the year 35.8% higher than in 2016. This is due to a combination of companies upgrading their fleets and economic expansion.

South Asia: With the exception of India, all the countries in South Asia are expected to have a good year as far as medium and heavy commercial vehicle demand is concerned. Demand has slowed in India with the strict implementation of the BS-IV emission regulations on April 1, which increased the cost of the vehicles by 6-10%. There was very little truck pre-buy during the Q1 2017, and there was a sharp decline in demand during Q2 2017. However, demand appears to have stabilized in the third quarter. For the year, medium and heavy commercial truck demand is expected to decline by 1.8% compared to 2016.

South America: Medium and heavy commercial vehicle production has finally stabilized in Brazil, albeit at historically low levels, with production expected to increase by 25% compared to 2016.

Japan/Korea: Domestic and export demand for medium and heavy commercial vehicles are expected to decline in 2017 compared with 2016. Production of medium and heavy commercial vehicles is projected to decline by 3.3% in 2017.

Greater China: Production of medium and heavy commercial vehicles is projected to increase by 28.3% in 2017. China started strictly enforcing the GB1589 regulations in 2017 to control overloading of trucks. This change will reduce freight hauling capacities by 20%, thus driving the need to increase truck capacity in the market.

The next update of the Power Systems Research TPI will be in April and will reflect changes in the TPI during Q1 2018.

Power Systems Research (PSR) is a global market research and consulting company based in St. Paul, Minnesota, USA. For more than 40 years, Power Systems Research provides data and forecasting information on engine production and applications to help companies reduce risk in product development and market expansion. It has its Indian office in Pune.

By Chris Fisher, Senior Commercial Vehicle Analyst, and Jim Downey, Vice President – Global Data Products, Power Systems Research