Air suspension has today become a common feature in buses, but not everyone is aware that the technology was introduced in the Indian market way back in the 1980s. Even then, the actual penetration started only in the 1990s, initially in inter-city buses. In those days, air suspension buses, commonly known as air buses, commanded a premium over regular buses due to the fact that very few buses came with the special feature which was considered a sophisticated one. Today, air suspension is no longer a premium feature but has become more of a standard and essential fitment.

The air suspension market as a whole has taken a huge leap forward considering the fact that it has been mandated in some segments. In terms of aggregates and components too, the air suspension system has evolved over a period of time, becoming more reliable and suitable for all kinds of roads and applications. Today, air suspension buses carry up to three tons of load on the rooftop, thanks to a combination of factors – high capacity air compressors, push-to-fit connectors, reliable levelling valves, and bellows with reasonable life – which make the overall system reliable.

The more the market shifts towards low floor buses, the more air suspensions become inevitable as mechanical suspensions are suitable only for standard floor buses. Air suspension systems have come a long way from the conventional mechanically adjustable bellows to electronically controlled ride height adjustment. Here we take a look at segment-wise growth prospects and the market size of air suspensions below.

Type I – City buses

City buses shifted to semi-low floor height on a large scale since the first phase of JnNurm in 2008. All the 900 mm floor height buses were fitted with rear air suspension which was by far the single largest move in the air suspension market that gave a major fillip for manufacturers of the product. The Urban Bus Specifications (UBS) mandated the purchase of semi-low floor buses with 900 mm, under which a total of around 15,000 buses were procured. Many State Transport Corporations bought their first air suspension buses under this scheme, which resulted in a massive change in the way passengers perceived public transportation.

The entry of premium low-floor buses, though not in very big numbers, also increased the market size of air suspensions. In the case of premium buses, air suspension systems are electronically controlled and are called ECAS – Electronically Controlled Air Suspension – which gives multiple options for the ride height. The bellow height can be independently controlled on individual sides, making the bus kneel to as low as about 60 mm to facilitate easy boarding and alighting of passengers at bus stops. This feature not only makes it convenient for passengers to enter and exit the bus but also reduces the turnaround time for the operator significantly.

The UBS II specifications which are currently being adhered to have insisted on 650 mm floor height buses for cities with a population of over a million. Though the announcement might not lead to a rise in the number of buses purchased over JnNurm I, it could almost double the air suspension market because under the new regulations, both the axles of the vehicles will be air-suspended.

Type II – Inter-urban buses

This is a segment which is yet to move to air suspensions and continues to be dominated by mechanical suspensions, the primary reason being the lack of regulation to govern the segment or mandate the adoption of air suspensions. The ticket fare in these buses is decided mostly by the government, and despite the high levels of investments made on the buses, the ticket fares are not too proportionally high. This is why basic suspensions continue to prevail. One could expect this to change once appropriate regulations fall in place, with a proportionate increase in ticket price.

Type III – inter-city buses

This is a niche segment where almost 100 per cent of the buses are with air suspension, despite not having any regulation pertaining to the feature. With a TIV of close to 5,000 numbers, all buses in this space have air suspension at least on the rear axle. The demand for air suspension in these buses is typically customer-driven and is expectedly very high considering kind of difference in comfort air suspensions offer during long distance travels. We could easily say this was the first segment to switch over to air suspensions on a mass larger scale since the 1990s. Though the TIV of the segment is yet to show significant growth over the years, it holds huge potential for growth in the coming years.

Type IV – Schools, Institutions, Tarmac and other segments

Gone are the days when used buses where mostly taken for school applications. With a plethora of branded and International schools coming up across the country, air suspensions are becoming more popular in school buses. Similarly, institutional buses are shifting towards air suspensions as they are used for moving employees who spend not less than two hours each day in bus travel. The increase in productivity as a result of shifting to air suspension buses is motivating MNCs to consider standardizing the feature in the vehicles which transport its staff. The progress is slow but is likely to pick up pace the in near future.

Tarmac coaches are almost now either semi-low floor or ultra-low floor, making it mandatory for them to be fitted with full air suspension with related bells and whistles. The tarmac segment is another small niche space which has only air-suspended buses.

Another area which has good potential for air suspensions is ICV buses, which largely come with only mechanical suspensions at present. With some air suspension systems for ICV buses already available in the market, including retro kit versions, this segment can grow rapidly to become an important one as far as the technology is concerned.

*****************************

WHEELS INDIA

When it comes to bus air suspensions in the Indian market, Wheels India is probably the first name that comes to one’s mind. The home-grown firm has established a stronghold in the country’s bus air suspension market with its perfect-fit products and solutions that meet the customer and market requirements better than any others. Mr. Srivats Ram, Managing Director, Wheels India Ltd., talks to us on the current scenario in the segment and the factors that would drive its future growth.

Excerpts:

Market Presence

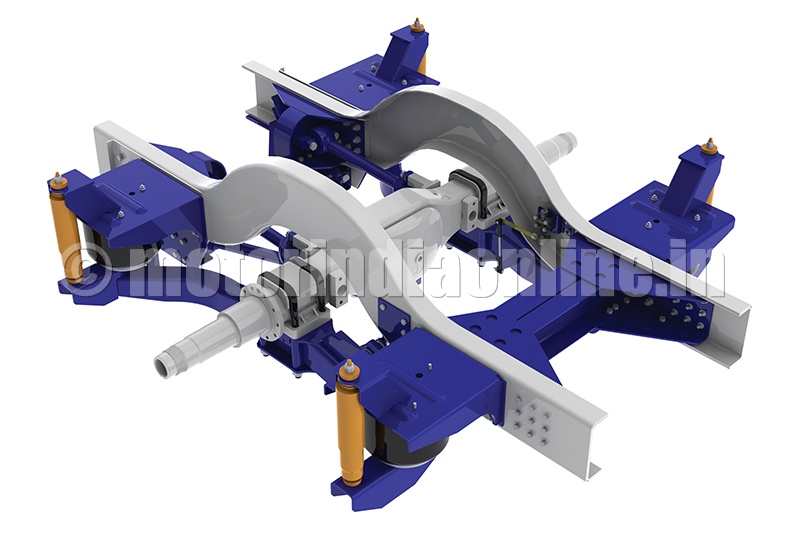

Wheels India offers a combination of front and rear suspensions to meet various segments of the bus industry. Additionally, we offer suspension systems for trucks and trailers, and lift axle suspensions for the multi-axle truck segment. In addition, we have started offering electronic air suspension for van-based applications.

Outlook on bus air suspension market

The volumes in the bus segment have been stagnant as it has been very dependent on government packages that have been irregular and infrequent in coming. There is a private operator segment that is relatively small and the larger orders come from state transport undertakings who work their volumes based on central government schemes. It is expected that with the government’s AMRUT and Smart City initiatives, there could be some growth in this segment in the coming years.

There are around 65,000-70,000 buses that we have fitted our air suspension systems on, out of which there are approximately 50,000 buses on the road at present. The growth of the segment is very dependent on the implementation of government schemes.

The air suspension division currently contributes to five per cent of Wheels India’s sales and this could grow to seven per cent over the next few years if the government schemes proceed as planned.

Technology roadmap

We expect some growth in the ICV segment, in the form of the Small Bus and adoption of suspension for this segment. In terms of technology, we have offered electronic kneeling and electronic air suspension. In India, it is important to provide economic value to the end-customer and thus the adoption of new technologies are linked to their economic viability for the operator. While we remain behind the west, it is mainly due to the economic feasibility of the technology for the operator. In the west, statutory regulations that have been put in force have enhanced the adoption of air suspension technology.

JnNurm impact

In JnNurm phase I, approximately 15,000 buses were fitted and in phase II about 3,000 buses were equipped with air suspensions. The central government funding definitely helped improve adoption of technology by state transport undertakings. It is expected that in the next few years, the government’s AMRUT and Smart City schemes will drive volumes in the segment.After three years of no growth, we are hopeful of some volume increase in the latter part of this year as the AMRUT program rolls out.

***********************************

GIBRALTAR

Gibraltar has emerged one of the fastest growing air spring brands in the country. The company which has its state-of-the-art manufacturing facility near Kolkata relies on its deep market understanding and domain expertise to deliver competitive solutions for customers. Mr. Arpan Basu, Director – Marketing & Product Development, Gibraltar Airsprings Pvt. Ltd., shares his views on the market for bus air suspensions in India and how his company plans to make the most of the potential in store.

Excerpts:

Market Presence

Gibraltar is very strong in the air spring aftermarket in India. We have started selling to few global OEMs and are in the process of developing products for some Indian OEMs based on specific orders received from them.

Gibraltar entered the business of air-springs in 1993 while we used to be the exclusive distributor for a global brand in the Indian market. Our distribution channel for the aftermarket has been established since then. Our new state-of-the-art production facility near Kolkata, operational since 2013, has helped in boosting our sales volume tremendously, with Gibraltar air springs now available across India. We started with the production of snap-fitted bus air springs and air springs for railways and gradually added the convoluted air springs for trucks and trailers to our range to ensure better market coverage.

Outlook on bus air suspension market

The use of air suspension in buses is almost mandatory in India. However, it is good to understand that nowadays, fleet-owners prefer to use air suspension on their buses with the awareness of the advantages air suspension going up substantially. The segment is expected to experience a very high growth in the coming years with many new suspension manufacturers gearing up for the Indian market.

Technology for local market

As we are aware, many new global bus manufactures have already come to India and are trying to create various new segments in the market where use of air suspension is always a part of the package.

Most of the global air spring brands are offering the same product quality as in Europe or America for the Indian market. However, considering the Indian loading pattern, usage, driving pattern, maintenance practices and road conditions, we have tailor-made our air springs to perfectly suit the Indian requirements. Being active in the domestic market for the last 22 years, we use our rich experience while designing the product and parallely focus on continuous improvement.

JnNurm impact

JnNurm phase I was almost the first initiative from the Government of India towards bringing air-suspension technology for public transportation. Before this, air suspensions were fitted mostly in luxury fleets for long-distance travel. However, JnNurm phase I helped introduce air suspension technology in city buses for rapid transit system for the mass while JnNurm phase II reinforced the success of the technology in the Indian market.

**************************************

HENDRICKSON

Hendrickson is a global pioneer and frontrunner when it comes to air suspension technology for buses, truck and related applications, while it also offers a range of other products as well. The company is actively working towards providing tailor-made solutions based on its unmatched technology know-how and sound understanding of the specific market requirements of the Indian bus industry.

Mr. J.V. Narasimha Rao, Senior General Manager – Business Development, Tata Autocomp Hendrickson Suspensions Pvt. Ltd., shares details with us.

Excerpts:

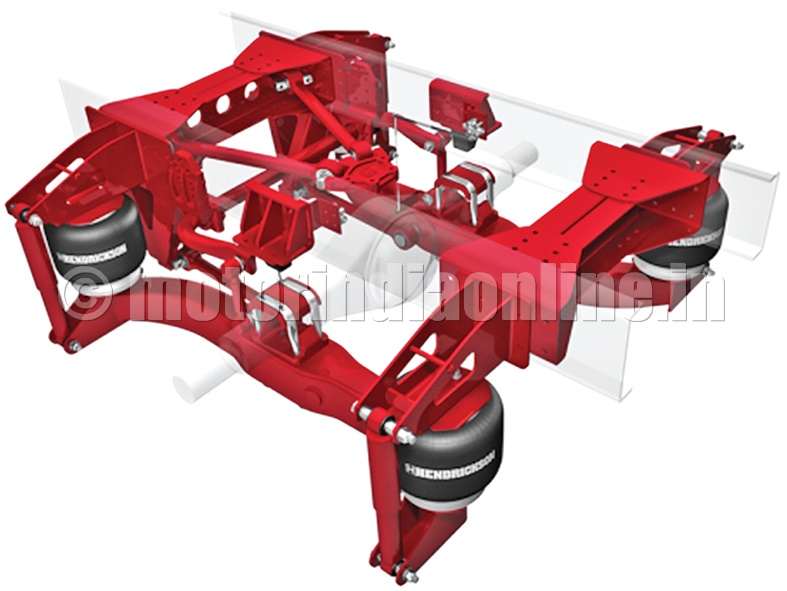

Market Presence

Hendrickson is a leading manufacturer and supplier of premium bus chassis components to global bus markets. We are presently working with OEM’s in India to bring our air suspension technology to Indian buses. Our legacy embodies over 100 years as the leading innovator and manufacturer of suspension systems and components for the global transportation industry. Utilizing world class design, testing and validation capabilities, Hendrickson provides robust solutions that feature the ride quality, vehicle handling and stability required for bus applications around the world. Our product lines include:

• Air Suspensions

• Steer Axles

• Steel Leaf Springs

• Bumpers

• Brakes & Wheel-Ends

Outlook on bus air suspension market

Air suspension in buses is predominantly promoted by State Transport Undertakings (STUs) run by government. Many of these systems are converted in the aftermarket from steel spring suspensions to air suspensions. While the volumes reached a peak of about 15,000 units in FY2010 and hit a bottom of about 7,000 units in FY13, the situation is improving partially due to government support in releasing tenders for air suspension buses. Certain OEMs are offering buses 100 per cent with air suspension while others are offering them as FBV buses and in chassis form as well. Growth in this segment is driven by implementation of government regulation on JnNurm buses.

Technology roadmap

• Hendrickson is bringing purpose-built bus suspension solutions to India. Oftentimes ‘truck’ air suspensions are used on bus chassis which results in poor ride and handling. Our knowledge of the application, ride and handling expertise and our advanced design & manufacturing methods position Hendrickson well to support the growing air ride requirements in India.

• Bus air suspensions in India are still driven by government regulations and not by the market needs. Hence it continues to be a price driven to fulfil the requirement. Over time, we expect customers to gain more interest in air suspensions as they experience the benefits of the product.

• We predict a sea change in the segment as more and more OEMs introduce fully-built buses with proper air suspension technology.

• The government norm for JnNurm buses in midi segment may drive the industry to introduce air suspension technology in ICV & LCV bus segments.

ECAS technology

Electronically Controlled Air Suspension (ECAS) technology is already very popular in the West. In most of the suspensions in Indian buses, the height is controlled by sensing the load and adjusting the air pressure in the air spring, such that it is capable of taking the load comfortably to ensure the chassis level is maintained. In ECAS, the control is done electronically by sensing the load through sensors located at multiple locations, thus making reaction times a lot better.

JnNurm impact

JnNurm contributed abundantly in popularizing air suspension technology in the country. With highways becoming better, the time for intercity travel is reducing. With the travel time in other modes of travel such as rail remaining constant, commuters are shifting more towards bus transportation, as seen from the rising popularity of bus travel in Maharashtra, Goa and the four southern states in particular. Going forward, air suspension buses in cities will definitely become popular thanks to schemes such as JnNurm.

**************************************

SABO HEMA

SABO Hema Automotive Ltd., a 50:50 JV between Roberto Nuti S.p.a, Italy, and Hema Engineering Industries Ltd., is aggressively building its presence in the domestic market, with its range of dampers and air springs for commercial vehicles. Mr. S.N. Ahmed, CEO, talks to us on how far his company has penetrated the market and gives the outlook for air suspension technology for buses in the country.

Excerpts:

Sabo-Hema manufactures products such as dampers and air-springs are part of suspension systems which are supplied to various domestic and overseas OEM customers. Our air springs and dampers are designed with robust construction for better performance and are available in different types, constructions and sizes. Our products cater to a wide range of applications, providing optimized suspension features to satisfy the most diverse needs of the front, rear and trailing axles as well as the leading axle of semi-trailer tractors. We have supplied over 5,000 air springs during the current and last financial years and continue to grow strong.

Outlook on bus air suspension market

At present, the number of buses with air suspension systems in India is around 60,000 units per year and is estimated to grow at a CAGR of 18 to 20 per cent.

Technology roadmap

The key technology that is coming up is the next-generation Electronically Controlled Air Suspension (ECAS) for Buses which help reduce fuel costs, boost engine efficiency and make vehicles more environmental friendly.

JnNurm impact

The JnNurm (Phase I & II) has had great impact on the market in terms of technology adoption, achieving better fuel efficiency, implementation of more stringent emission norms and higher sales volume of buses with air suspension technology.