It was in 2005 that JOST India, the 100 per cent subsidiary of JOST Werke GmbH, kicked off operations in the Indian market. Entering the country backed by orders from the largest commercial vehicle maker Tata Motors, JOST India started local production in 2008 with a facility at Jamshedpur and has established itself as an outright leader in fifth wheel couplings ever since. Globally, the JOST Group has three other brands in its fold, namely, Rockinger, Tridec and the most recent addition Edbro, making it one of the most versatile components and systems suppliers in the truck and trailer segments worldwide and also in India.

Helming JOST India at present as Managing Director is Mr. G.S. Pradeep who joined the JOST family as Senior Manager – Sales & Marketing, JOST India in 2007. We caught up with Mr. Pradeep, who spends half his working hours at Bangalore and the rest at Jamshedpur, for some business and market updates and to also find out about JOST India’s future plans.

Mr. Pradeep made his entry into JOST India seven years ago, a switch from a German component maker which was well-established in the Indian automotive market to a comparatively very new German company with huge ambitions for India. “It was a huge transition for me in 2007 when I moved from working with a well-settled team of 10 to 12 members at my former company to a setup at JOST where almost everything had to be set up from the beginning, though we had already bagged our breakthrough business from Tata Motors by then”, Mr. Pradeep begins the conversation.

When Tata Motors initially started manufacturing tractors (prime-movers) in India, around 2001, the fifth wheel couplings were supplied to them by one of JOST’s competitors. Tata turned to JOST with an offer of maximum share of business for fifth wheel couplings, asking the German company to establish local presence in the country in return, primarily for better viability and to bring down the cost.

Asked as to how the Tata business came on board, Mr. Pradeep replies: “Tata Motors approached us around a decade back for supplying fifth wheel couplings and assured us a major share of business which is when we started off in India. We started supplying the couplings from our China facility at first and had delivered around 60,000 units in nearly three years. Our local production facility at Jamshedpur was up and running by 2008, after which all our couplings supplied to Tata Motors were made locally. We value our association with Tata Motors a lot and are proud to work with them. We also supply our couplings to Ashok Leyland and our global customers who are in India, including Daimler (BharatBenz), MAN and Scania.”

Asked as to how the Tata business came on board, Mr. Pradeep replies: “Tata Motors approached us around a decade back for supplying fifth wheel couplings and assured us a major share of business which is when we started off in India. We started supplying the couplings from our China facility at first and had delivered around 60,000 units in nearly three years. Our local production facility at Jamshedpur was up and running by 2008, after which all our couplings supplied to Tata Motors were made locally. We value our association with Tata Motors a lot and are proud to work with them. We also supply our couplings to Ashok Leyland and our global customers who are in India, including Daimler (BharatBenz), MAN and Scania.”

Measured approach

Though the volume of fifth wheel couplings sold in the Indian market have traditionally been very low when compared to other developed markets like Europe, the slow-growing segment has taken a reverse turn of sorts in recent years. The sales numbers of JOST, the market leader in the segment, reveal that around 25,000 couplings were delivered to Tata Motors in 2005 while the number has fallen to a low 8,000 in 2013, a decline which is proportional to a sharp fall in the overall tractor-trailer market.

Despite the highly challenging market conditions at present, JOST India is ready to go through the tough grind, as it remains focused on taking sensible and practically meaningful steps in India, a market which is considered a very important one by its parent company. “We have a capacity of 70,000 fifth wheel couplings at our facility, so our fixed costs are quite high. We have been exporting our couplings since a year and half ago and are working on striking a good balance between local volumes and export supplies. We would be very happy to see a day when the tractor-trailer segment grows to a level when we run our plant at full capacity. JOST being a forward-looking company, we are open for new investments, but only as long as there is a market need and it is justified from a revenue point of view”, he says.

Since February this year, the tractor-trailer market has apparently taken a positive turn with trailer makers, at least those who are working with JOST, placing orders for components and systems. The most obvious reason for the positive development are the encouraging election results which have sparked talks of a revival in the economy and growth of industries, giving way to some much-needed optimism across the country.

The tractor-trailer segment is likely to get better towards the end of the calendar year and could probably see good growth in 2015, though it all boils down to a handful of crucial policies and legislations. Mr. Pradeep points out: “The main problem in India is the legislation for tractor-trailer registration wherein the tractor-trailer combination is registered together. The articulated tractor-trailer configuration is used like a rigid vehicle, which defeats the very purpose of the design of such trailers. We will see an increase in the usage of trailers only when the homologation of the trailer is made independent.”

The tractor-trailer segment is likely to get better towards the end of the calendar year and could probably see good growth in 2015, though it all boils down to a handful of crucial policies and legislations. Mr. Pradeep points out: “The main problem in India is the legislation for tractor-trailer registration wherein the tractor-trailer combination is registered together. The articulated tractor-trailer configuration is used like a rigid vehicle, which defeats the very purpose of the design of such trailers. We will see an increase in the usage of trailers only when the homologation of the trailer is made independent.”

In 2013, JOST delivered around 11,000 fifth wheel couplings in the Indian market and exported another 4,000 odd couplings to its overseas customers. The company expects to reach at least 18,000 to 20,000 couplings this year with an aim of touching an annual mark of 30,000 couplings in the near future and maintain its lead in the segment.

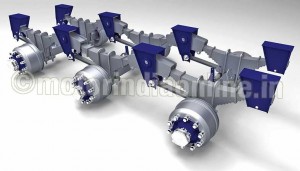

JOST-Gigant JV

At Auto Expo in 2012, JOST had announced a joint venture with Gigant to manufacture and supply tailor-made axles and suspensions for the Indian trailer market. The partnership brought together two of Europe’s biggest names, but the subsequent slowdown in the Indian CV market did not give way for progress as expected. “We had launched our trailer axles and suspensions as well, but due to the recession, we could not reach our volume targets. But the revival has already started, with fifth wheel coupling orders from OEMs starting to pick up, which will lead to a similar number of trailers in the market, if not more. In trailer axles, we are targeting a market share of 5 to 10% and become the third largest player by the end of 2014. Moving on, over a period of time, we will be quite happy if we manage to take one-third share (33%) of the trailer axle market”, says Mr. Pradeep.

Rockinger

Under the Rockinger brand, JOST makes towing hitches and drawbar eyes for transporters and trucks. In India, with the RO*56 and the RO*50 flex, Rockinger offers two towing hitches that by the nature of their construction are particularly well suited for Indian use. Both are configured for towing eyes with a 50 millimetre diameter and feature a safe, easily manageable automatic bolt locking. Over 200 Rockinger towing hitches have already been delivered to customers in the Indian market.

Under the Rockinger brand, JOST makes towing hitches and drawbar eyes for transporters and trucks. In India, with the RO*56 and the RO*50 flex, Rockinger offers two towing hitches that by the nature of their construction are particularly well suited for Indian use. Both are configured for towing eyes with a 50 millimetre diameter and feature a safe, easily manageable automatic bolt locking. Over 200 Rockinger towing hitches have already been delivered to customers in the Indian market.

Tridec

In 2008, JOST took over Tridec which specializes in the development and production of mechanically controlled steering systems for trailers and also hydraulic and electronically controlled steering systems. Tridec’s product range also features wheel suspension systems for single wheel axles or swinging axles as well as hydraulic suspension. Its systems can be found in all application areas, from single axle city trailers all the way to hydraulically steered transport platforms of up to 250 tonnes. Tridec trailer axle steering systems improve not only manoeuvrability but also enhance the vehicle safety. They significantly reduce wear and tear on tyres as well as operating costs.

JOST has been offering the Tridec systems in the Indian market since three years and has recently supplied three systems to the Indian Defence through a trailer builder. It is in talks with a leading transporter in the over dimensional cargo (ODC) segment for the supply of 10 Tridec systems. Buoyed by the growing interest to Tridec systems, JOST is currently working on localizing the products which would further add to the customer interest.

Edbro

In late 2012, JOST made a global acquisition of Edbro cylinders. As far as the Indian market is concerned, Edbro’s presence runs to as early as around the year 2000, with its cylinder kits being sold in the country until 2007, over 1,500 of which are operating successfully even today. The main challenge for Edbro in India was the cost factor since the cylinders were imported from its facility at Bolton in the UK, while another hurdle was the kind of abuse the cylinders went through in the Indian market which was often way too much.

In late 2012, JOST made a global acquisition of Edbro cylinders. As far as the Indian market is concerned, Edbro’s presence runs to as early as around the year 2000, with its cylinder kits being sold in the country until 2007, over 1,500 of which are operating successfully even today. The main challenge for Edbro in India was the cost factor since the cylinders were imported from its facility at Bolton in the UK, while another hurdle was the kind of abuse the cylinders went through in the Indian market which was often way too much.

Talking about JOST’s plans for the Edbro range, Mr. Pradeep shares: “Fit and forget is what customers say about Edbro cylinders. We are focusing on profitable markets for offering the Edbro range and in markets where downtime plays a very important role, customers will come looking for us because they want highly reliable cylinders with exclusive features such as ours. We have had many enquiries for Edbro in India but we will not put up a factory just because there are a lot of enquiries. We will have to wait for the right time for that to happen.”

JOST’s acquisition of Edbro has expanded the market reach of the latter’s products, making them available across different countries, thanks to JOST’s global presence, along with the added advantage of the new parent company’s local understanding of different markets worldwide.

JOST’s acquisition of Edbro has expanded the market reach of the latter’s products, making them available across different countries, thanks to JOST’s global presence, along with the added advantage of the new parent company’s local understanding of different markets worldwide.

The JOST World

JOST is the worldwide leading producer of vehicle connection systems, modules and components for truck & trailer. The JOST brand includes fifth wheel couplings, telescopic landing gears and accessories for semi-trailers, ball bearing turntables, king pins and container locks and components for alternating systems. Under the traditional brand name of Rockinger, the company produces towing hitches and drawbar eyes for both transporters and trucks, as well as for use in the agricultural industry.

Another globally-renowned brand within the JOST umbrella is Tridec which specializes in trailer rear axle steering and suspension systems. The fourth brand and also the most recent member to join the JOST family is Edbro, global leader in hydraulic systems for commercial vehicles. With these four brands, the JOST Group is unarguably the strongest and the most comprehensive solution provider in the global truck and trailer industry.

Why customers can rely on JOST any day:

• Reliability: Quality is an important parameter to gauge any product. In addition to unmatched quality, JOST fifth wheel couplings offer the highest reliability which translates into maximum confidence and trust on the JOST brand by its customers.

• Cost-to-benefit ratio: JOST products are not the cheapest in the market, but when it comes to the cost-to-benefit ratio or the overall operating cost, any customer would opt for JOST. “The truck may wear out, but our fifth wheel coupling will not, if maintained properly. That’s not arrogance but that’s the kind of confidence we have on our products and that’s what we deliver to our customer”, says Mr. Pradeep.

• Safety: JOST designs, develops and tests its products with utmost care and precision. Its fifth wheel couplings are designed for a high safety factor which will withstand the tough operating conditions prevailing in India.

• Serviceability: JOST products come with the advantage of very easy serviceability to such an extent that even a truck driver can service its fifth wheel coupling, without much of a problem, using some basic tools. Almost every single nut or washer of the coupling has a replacement part number and can be replaced individually, relegating the need to replace the entire coupling or go for a new sub-assembly to very remote cases.

• Service back-up: As a complement to the easy serviceability of its products, JOST conducts regular voluntary service campaigns for its customers apart from the routine service calls. The main aim of the service campaigns is to break the common misconceptions and myths in the minds of customers related to tractor-trailers and their usage. The company’s aftersales support team personnel are on the move to educate the drivers and fleet owners on handling and servicing its products in the best possible way.

• Technology: When it comes to technology capability, JOST is probably 15 to 20 years ahead of the Indian market. It currently offers its conventional fifth wheel coupling in India, in line with the market requirements, but can unleash an extensive range of technologically superior products including different versions of couplings such as sensoric, lubetronic, airtronic and KKS, among others.

JOST’s focus areas during the market slowdown:

• Stepped up focus on exports which has paved off quite well in the form of some regular orders from overseas markets.

• Developed capabilities to manufacture a new product range locally in India.

• JOST found the slowdown period to be a good time to look for new sources and has managed to find some good ones. The company has appointed a new Director for its axle division globally.

• The company optimized manpower at its facilities and offices, going in for some reduction to bring down the fixed cost.

• Focused extensively on the aftermarket segment with regular service campaigns. JOST India’s sales team, which had just Mr. Pradeep few years back, now has seven members and will reach 10 soon. It has representatives based at Hyderabad, Chennai, Mumbai, Jamshedpur and Bangalore, all of which are of close proximity to its existing and targeted OEM customers.

• Lastly, the company went in for a number of alternative vendors with a view of improving quality and reducing cost. As Mr. Pradeep puts it: “In the last six to eight months, we could perhaps say ‘we have taken it one notch up’ in the Indian market. We could have thought about more investments and bringing other new products but the situation did not warrant it. We had to gear up for a revival in the market which we have done and were focused on cutting our flab. We are now perfectly placed to do well when the market picks up.”

When asked about the changes needed to drive growth in the tractor-trailer segment, Pradeep replies:

• First and foremost, the country’s infrastructure has to improve. The average speed of trucks has to increase to at least 30 kmph, if not to 40-50 kmph. Currently the average speed is not even 25 kmph which is far too low.

• We need vehicles with powerful engines for which we need good roads. The Government should take the initiative and improve the road infrastructure which would push fleets to go for better-powered and modern vehicles.

• Currently, the ratio between rigid trucks and tractor-trailers is nearly 90:10 in India. Ideally, this should reverse to somewhere around 80 to 90 per cent tractor-trailers which will mean maximum efficiency of transportation, like in developed markets such as Europe. For this to happen, GST will be the main growth-driver.

• We have close to 700 to 800 unorganized trailer builders across the country who operate without proper equipment, without any design, just by seeing and copying. ARAI is compiling a trailer code with a team of key stakeholders in the segment, of which JOST is also an invitee participant. Will this really see the light of the day and get enforced? Unless this happens this segment may not grow.

• We need to educate the fleet owners about the dangers of using road-side trailers so that they can contribute in making the country’s trailer market better organized and also much more safer than what it is today.